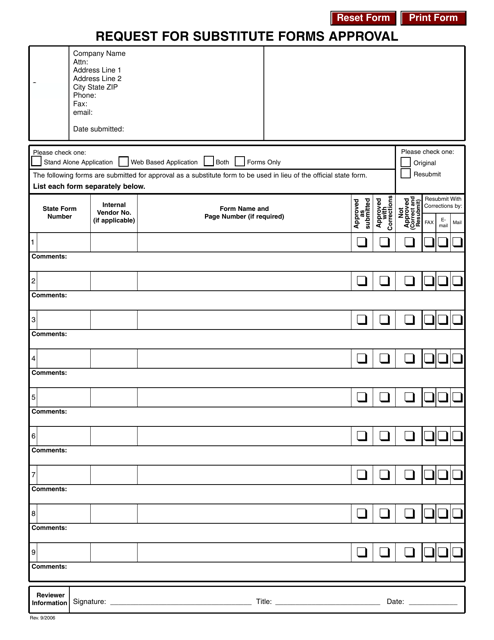

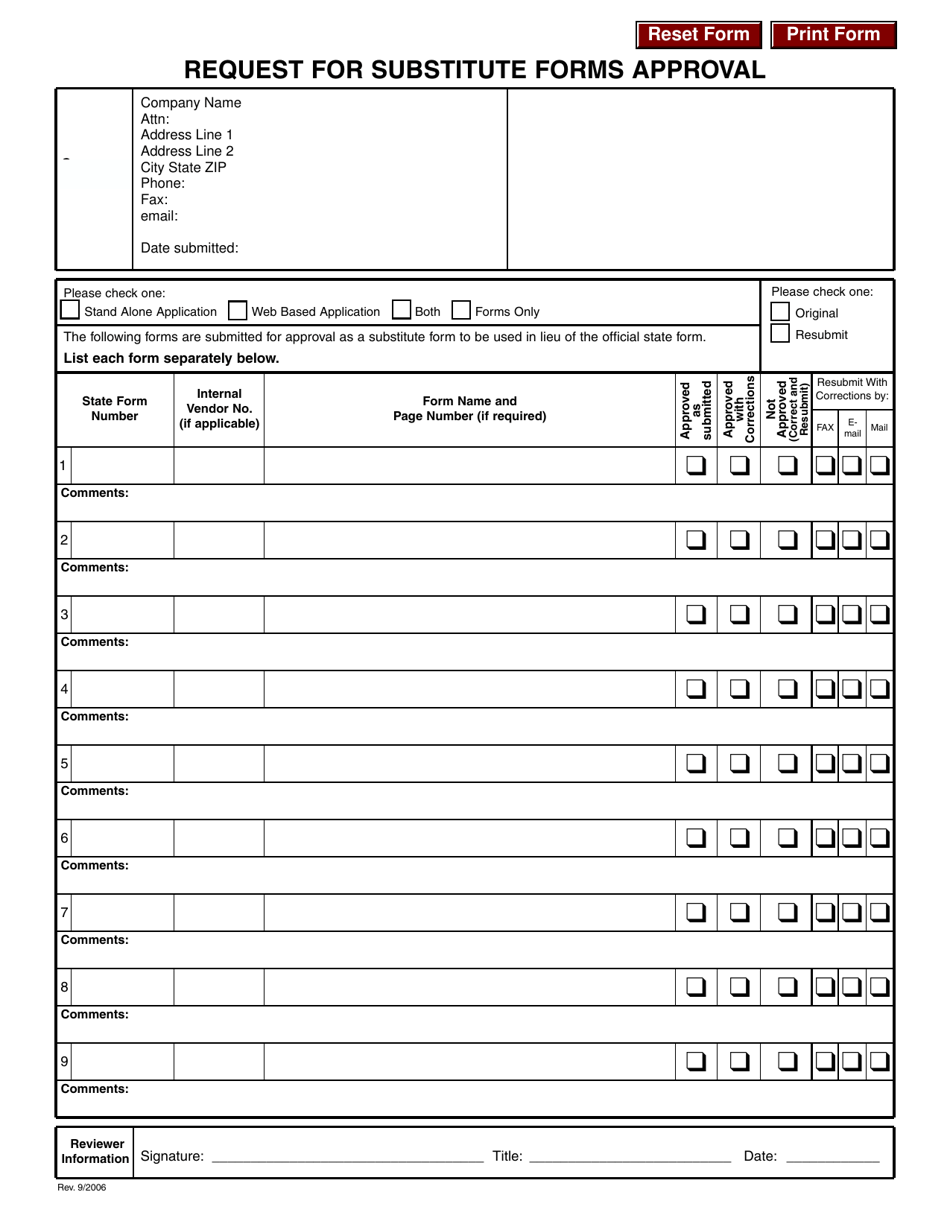

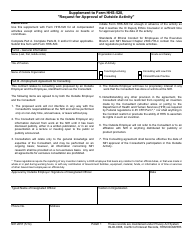

Request for Substitute Forms Approval - Rhode Island

Request for Substitute Forms Approval is a legal document that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island.

FAQ

Q: What is a substitute form?

A: A substitute form is an alternate version of a standard tax form.

Q: Why would I need a substitute form?

A: You may need a substitute form if the standard form provided by the government does not meet your specific needs.

Q: What is a Request for Substitute Forms Approval?

A: A Request for Substitute Forms Approval is a formal submission to the government to request approval for using a substitute form.

Q: Who can submit a Request for Substitute Forms Approval?

A: Any individual or organization that wants to use a substitute form can submit a Request for Substitute Forms Approval.

Q: How do I submit a Request for Substitute Forms Approval in Rhode Island?

A: You can submit a Request for Substitute Forms Approval in Rhode Island by following the instructions provided by the Rhode Island Department of Revenue.

Form Details:

- Released on September 1, 2006;

- The latest edition currently provided by the Rhode Island Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.