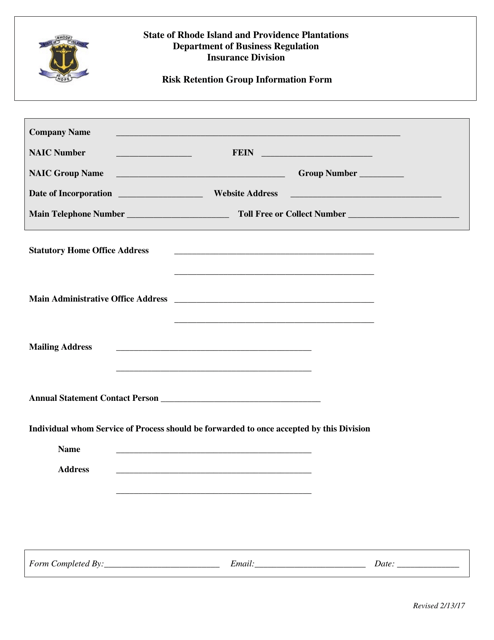

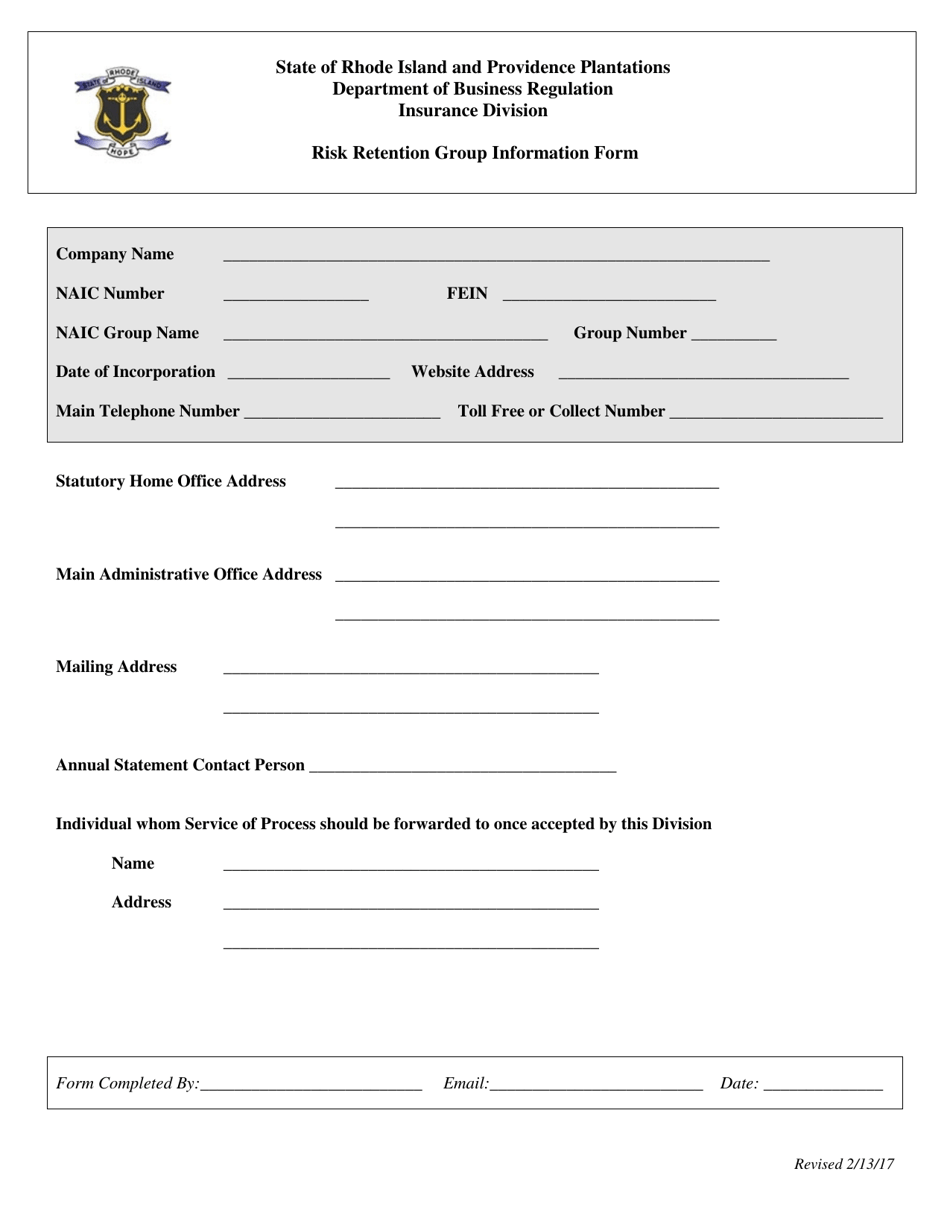

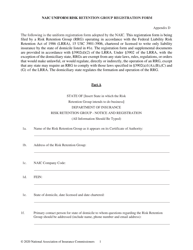

Risk Retention Group Information Form - Rhode Island

Risk Retention Group Information Form is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a Risk Retention Group?

A: A Risk Retention Group is an insurance company that is owned by its policyholders and is licensed to provide liability insurance coverage.

Q: How is a Risk Retention Group different from a traditional insurance company?

A: A Risk Retention Group is owned by its policyholders and typically provides coverage for a specific type of liability risk, whereas a traditional insurance company is owned by shareholders and offers a broader range of insurance products.

Q: What types of liability risks can a Risk Retention Group provide coverage for?

A: Depending on its license and the needs of its policyholders, a Risk Retention Group can provide coverage for a variety of liability risks, such as professional liability, product liability, and general liability.

Q: Is a Risk Retention Group regulated?

A: Yes, a Risk Retention Group is regulated by the state in which it is licensed to operate. It must comply with state insurance laws and regulations.

Q: Can a Risk Retention Group operate in multiple states?

A: Yes, a Risk Retention Group can operate in multiple states as long as it is licensed in each state where it wants to do business.

Q: Do Risk Retention Groups have to meet certain financial requirements?

A: Yes, Risk Retention Groups are required to maintain adequate financial reserves to ensure they can fulfill their policyholders' claims obligations.

Q: Are Risk Retention Group policies backed by a guarantee fund?

A: No, Risk Retention Group policies are not typically backed by a state guarantee fund. Policyholders should carefully review the financial stability of the Risk Retention Group and assess the potential risks.

Q: Is purchasing insurance from a Risk Retention Group a common practice?

A: Purchasing insurance from a Risk Retention Group is less common compared to traditional insurance companies. Policyholders should carefully consider the specific risks and the financial stability of the group before purchasing coverage.

Q: Can individuals and businesses join a Risk Retention Group?

A: Yes, both individuals and businesses can join a Risk Retention Group as policyholders, depending on the group's membership requirements.

Form Details:

- Released on February 13, 2017;

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.