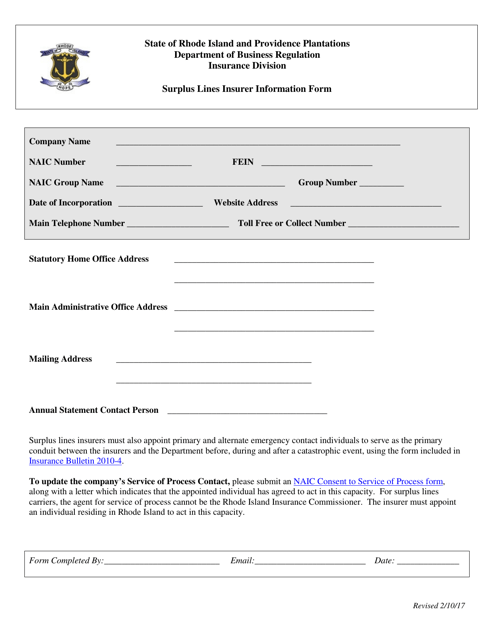

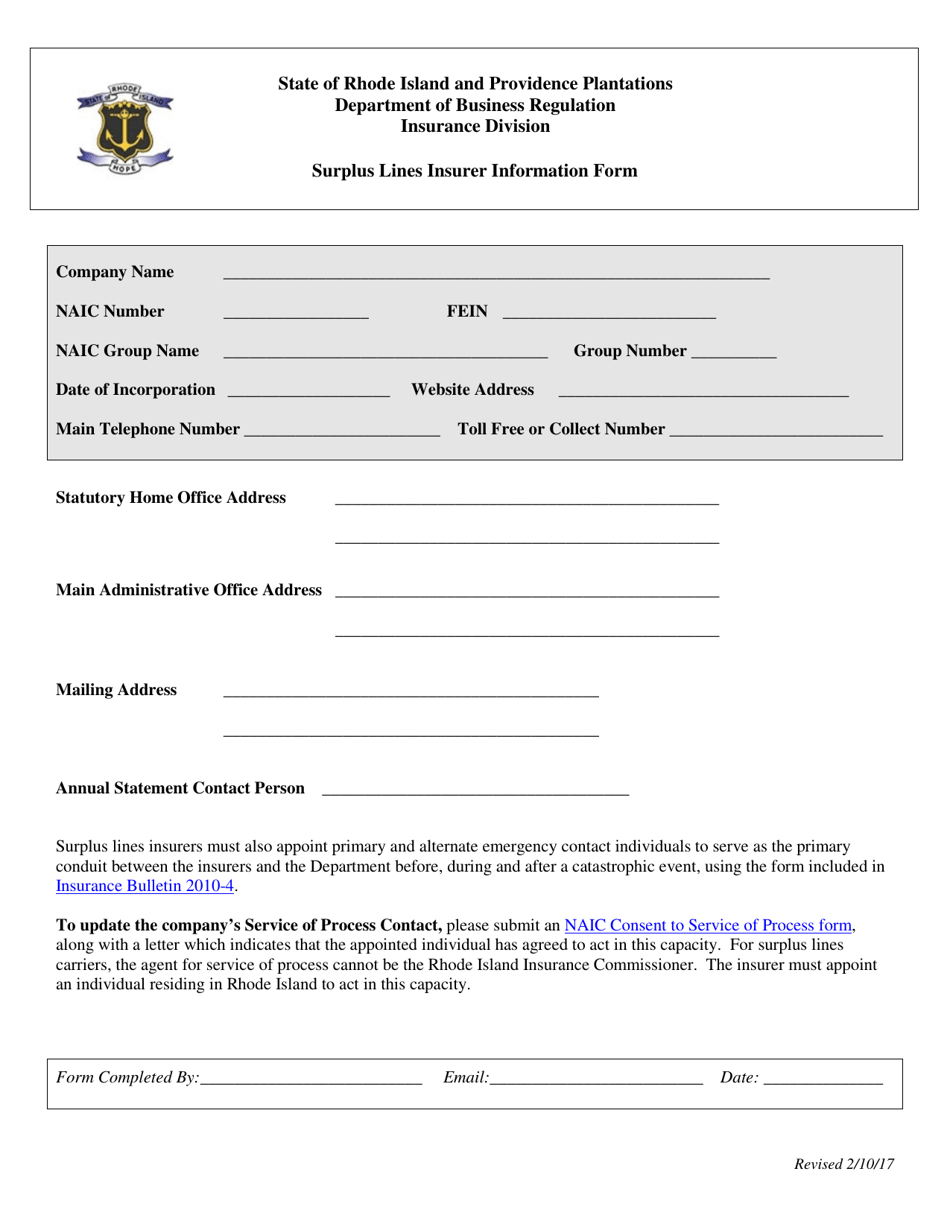

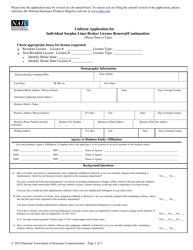

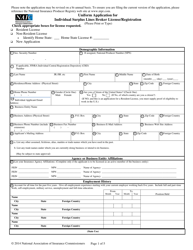

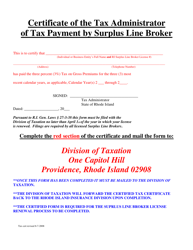

Surplus Lines Insurer Information Form - Rhode Island

Surplus Lines Insurer Information Form is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a Surplus Lines insurer?

A: A Surplus Lines insurer is an insurance company that is not licensed to operate in the state but is allowed to provide coverage for risks that are not readily available in the standard insurance market.

Q: Why would someone use a Surplus Lines insurer?

A: Someone might use a Surplus Lines insurer if they have a unique or high-risk insurance need that cannot be met by a licensed insurance company.

Q: How do I know if a Surplus Lines insurer is reliable?

A: The Rhode Island Department of Business Regulation maintains a list of approved Surplus Lines insurers, and working with a licensed insurance broker can also help ensure reliability.

Q: What types of insurance can Surplus Lines insurers provide?

A: Surplus Lines insurers can provide coverage for various risks, such as liability, property, or specialty lines of insurance.

Q: Are Surplus Lines insurers regulated?

A: Yes, Surplus Lines insurers are regulated by the Rhode Island Department of Business Regulation to ensure they meet certain financial solvency and consumer protection requirements.

Q: Do I have the same level of protection with a Surplus Lines insurer?

A: While Surplus Lines insurers may provide coverage, it's essential to understand that they may not offer the same level of protection and regulation as licensed insurance companies.

Form Details:

- Released on February 10, 2017;

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.