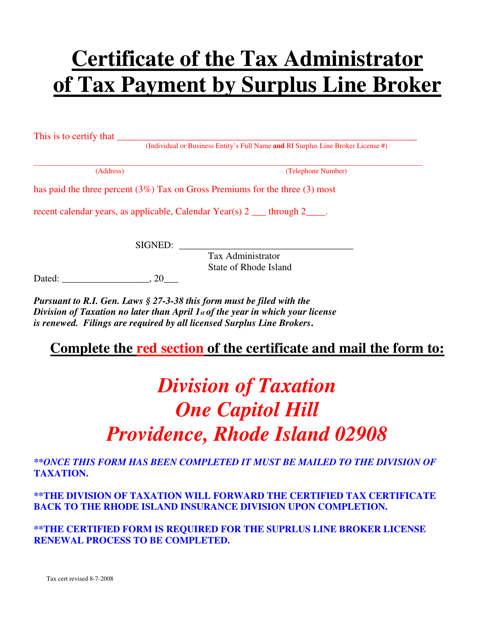

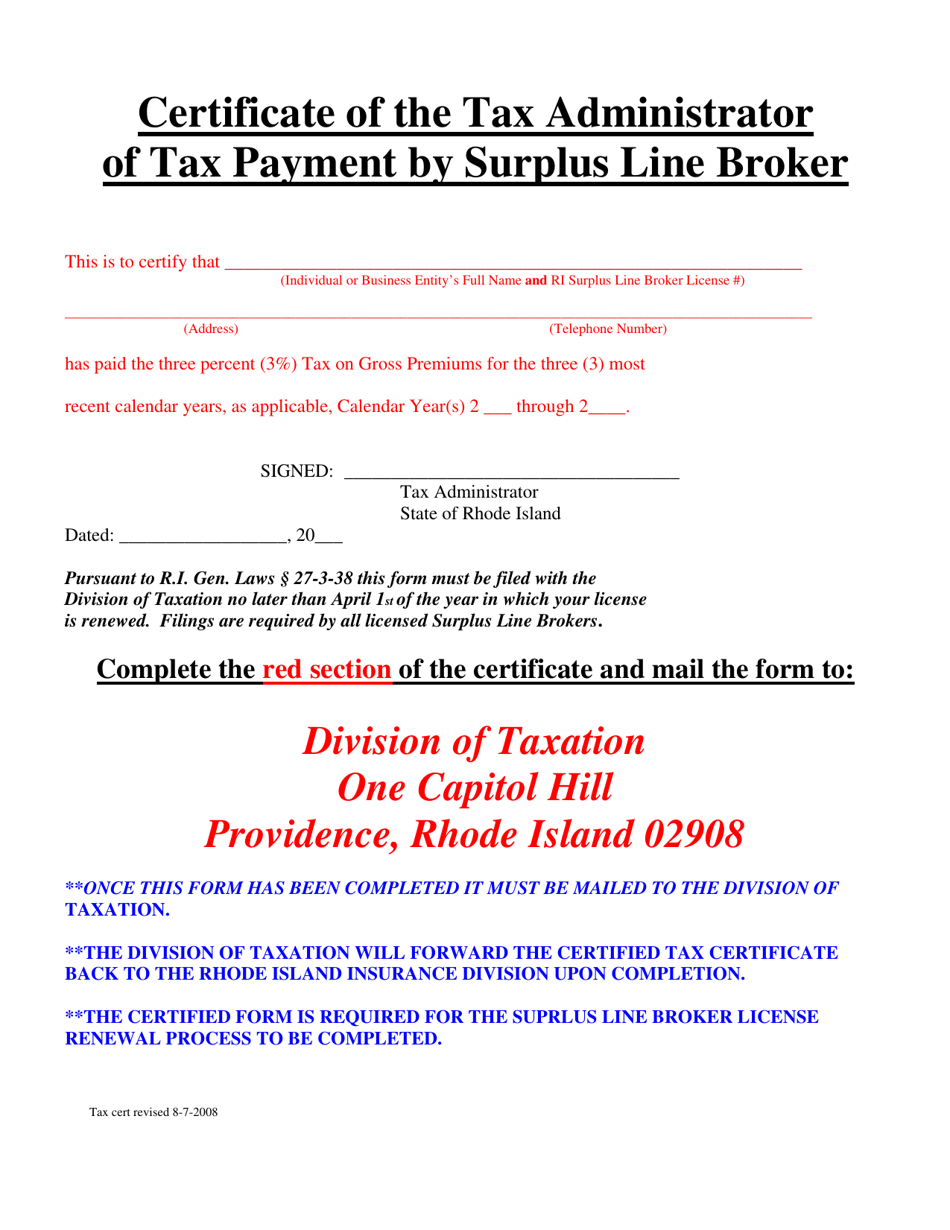

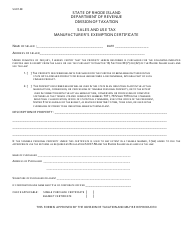

Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker - Rhode Island

Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker?

A: The Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker is a document related to tax payment by a surplus line broker in Rhode Island.

Q: Who issues the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker?

A: The Tax Administrator of Rhode Island issues the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker.

Q: What is the purpose of the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker?

A: The purpose of the Certificate is to certify that a surplus line broker has fulfilled their tax payment obligations in Rhode Island.

Q: What does a surplus line broker do?

A: A surplus line broker is an insurance intermediary who helps to arrange insurance coverage for risks that cannot be easily placed with authorized insurance companies.

Q: Why is tax payment important for a surplus line broker?

A: Tax payment is important for a surplus line broker to comply with state regulations and contribute to the state's revenue.

Q: Are all insurance brokers required to obtain a Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker?

A: No, only surplus line brokers who operate in Rhode Island and have tax payment obligations need to obtain this certificate.

Q: How can a surplus line broker obtain the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker?

A: A surplus line broker can obtain the certificate by fulfilling their tax payment obligations and requesting it from the Tax Administrator of Rhode Island.

Q: Is the Certificate of the Tax Administrator of Tax Payment by Surplus Line Broker valid in other states?

A: No, the certificate is specific to tax payment obligations in Rhode Island and may not be recognized in other states.

Form Details:

- Released on August 7, 2008;

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.