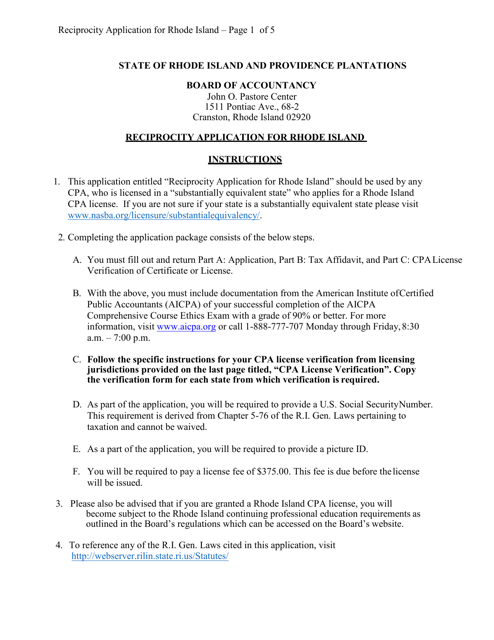

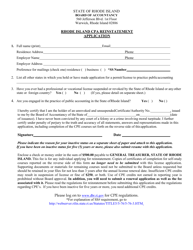

Rhode Island CPA Reciprocity Application - Rhode Island

Rhode Island CPA Reciprocity Application is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a CPA?

A: A CPA is a certified public accountant.

Q: What is reciprocity?

A: Reciprocity is an agreement between states that allows CPAs licensed in one state to obtain a license in another state without having to take the full CPA exam.

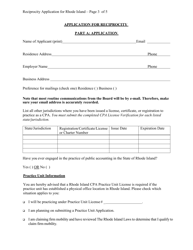

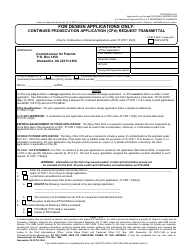

Q: How do I apply for CPA reciprocity in Rhode Island?

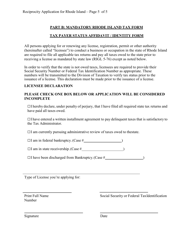

A: To apply for CPA reciprocity in Rhode Island, you must submit a completed application, the applicable fees, and the required documentation, including your original CPA license.

Q: What documentation is required for the CPA reciprocity application?

A: The documentation required for the CPA reciprocity application includes your original CPA license, official transcripts from the educational institution where you obtained your accounting degree, and completion of the Rhode Island Ethics Exam.

Q: How much does it cost to apply for CPA reciprocity in Rhode Island?

A: The fee for the CPA reciprocity application in Rhode Island is $300.

Q: How long does it take to process the CPA reciprocity application in Rhode Island?

A: The processing time for the CPA reciprocity application in Rhode Island is approximately 4-6 weeks.

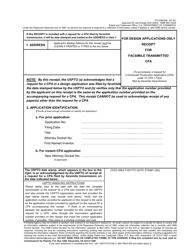

Q: Can I practice as a CPA in Rhode Island once my reciprocity application is approved?

A: Yes, once your reciprocity application is approved, you can practice as a CPA in Rhode Island.

Q: Do I need to provide proof of work experience for the CPA reciprocity application in Rhode Island?

A: Yes, you need to provide proof of at least two years of qualifying work experience as a CPA.

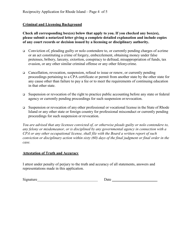

Q: Can I apply for CPA reciprocity in Rhode Island if I have disciplinary actions on my record?

A: Disciplinary actions on your record may affect your eligibility for CPA reciprocity in Rhode Island. Each case is evaluated on an individual basis.

Q: Are there any additional requirements to maintain my CPA license in Rhode Island?

A: Yes, in order to maintain your CPA license in Rhode Island, you must fulfill the continuing professional education (CPE) requirements and comply with the Rhode Island Board of Accountancy's rules and regulations.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.