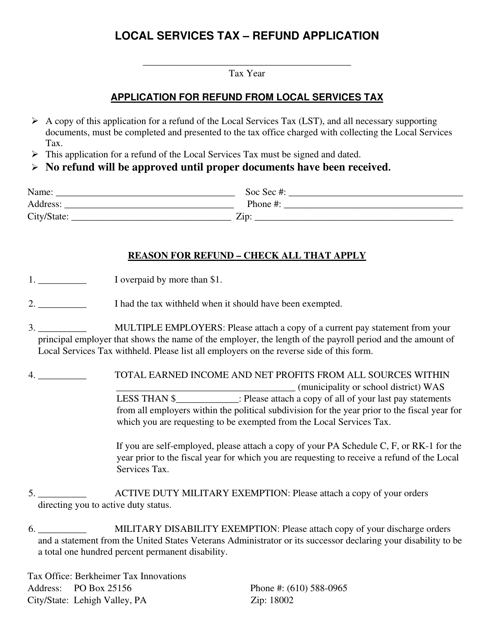

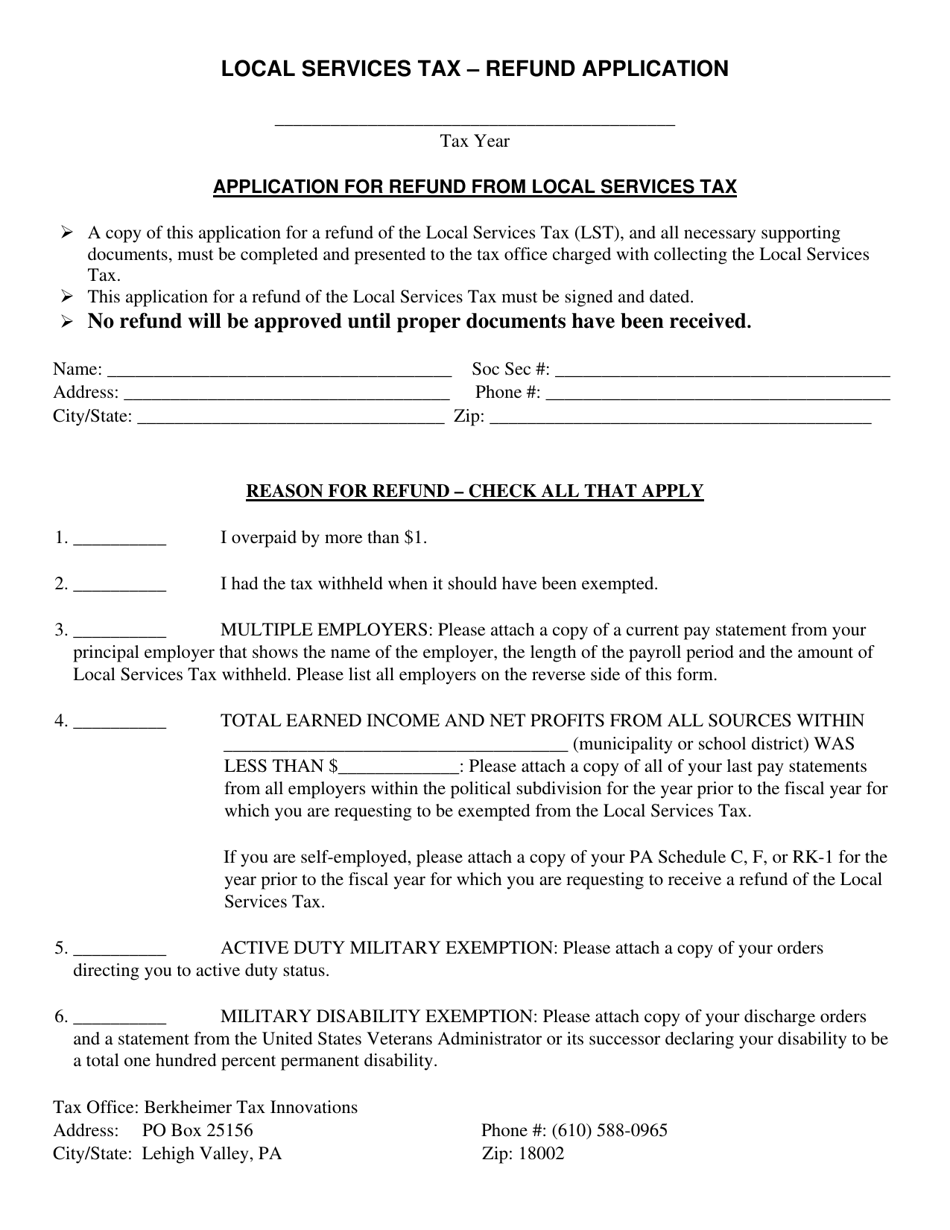

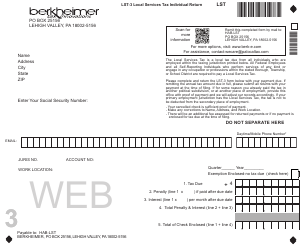

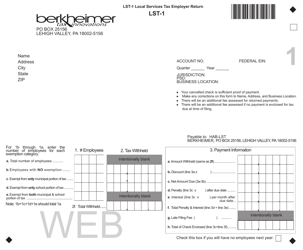

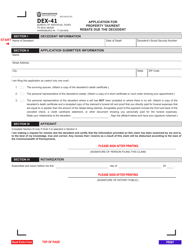

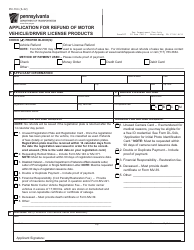

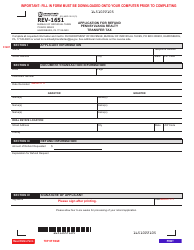

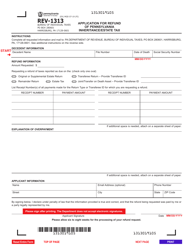

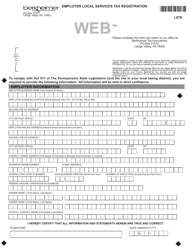

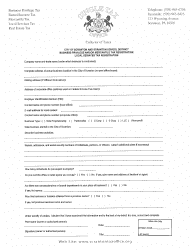

Application for Refund From Local Services Tax - Pennsylvania

Application for Refund From Local Services Tax is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is the Local Services Tax in Pennsylvania?

A: The Local Services Tax is a tax levied by certain Pennsylvania municipalities on individuals who work within their jurisdiction.

Q: Who is required to pay the Local Services Tax?

A: Anyone who works within a municipality that imposes the tax is required to pay it.

Q: How much is the Local Services Tax?

A: The amount of the tax varies by municipality, but it is typically around $52 per year.

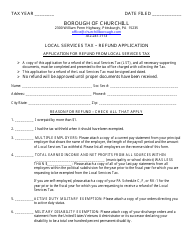

Q: Can I get a refund of the Local Services Tax?

A: Yes, you can apply for a refund if you meet certain eligibility criteria.

Q: What are the eligibility criteria for a refund?

A: To be eligible for a refund, you must have earned less than a certain threshold and have not worked in the municipality for the entire year.

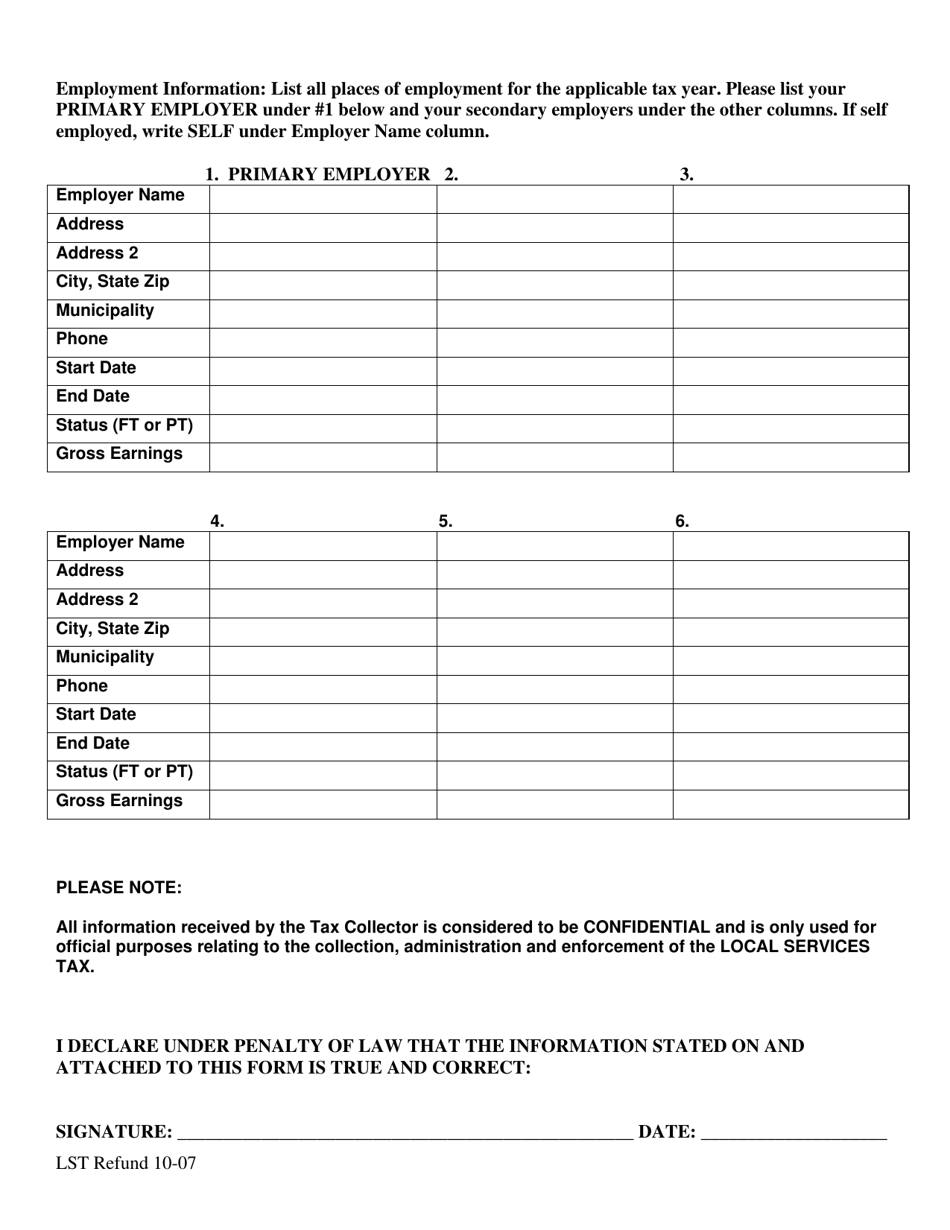

Q: How do I apply for a refund of the Local Services Tax?

A: You can apply for a refund by completing and submitting an Application for Refund From Local Services Tax to the appropriate municipality.

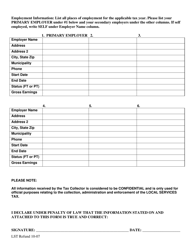

Q: What documents do I need to include with my refund application?

A: You will typically need to include proof of your income, such as a copy of your W-2 or pay stubs.

Q: When can I apply for a refund?

A: You can apply for a refund no earlier than January 1 of the year following the tax year in which you are seeking a refund.

Q: Is there a deadline to apply for a refund?

A: Yes, you must typically apply for a refund within three years of the end of the tax year for which you are seeking a refund.

Q: How long does it take to receive a refund?

A: The processing time for a refund can vary, but it is typically within a few weeks to a couple of months.

Form Details:

- Released on October 1, 2007;

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.