This version of the form is not currently in use and is provided for reference only. Download this version of

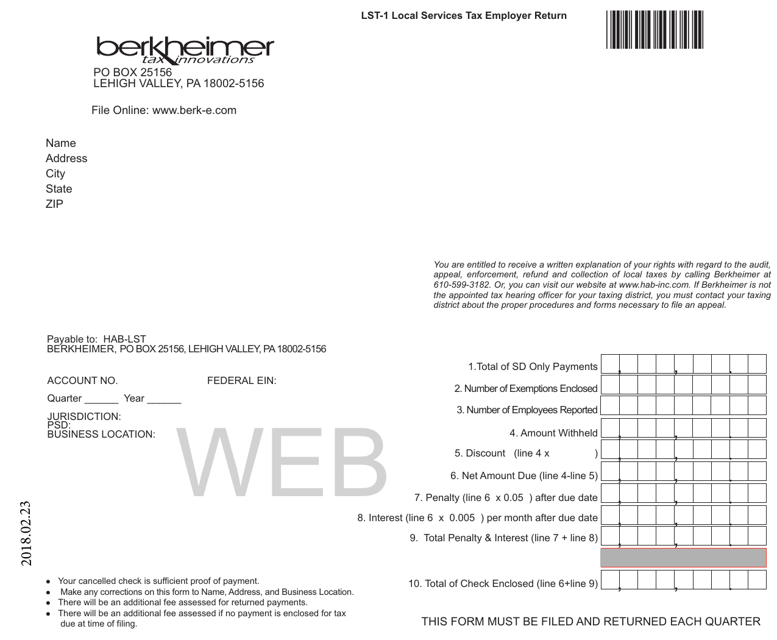

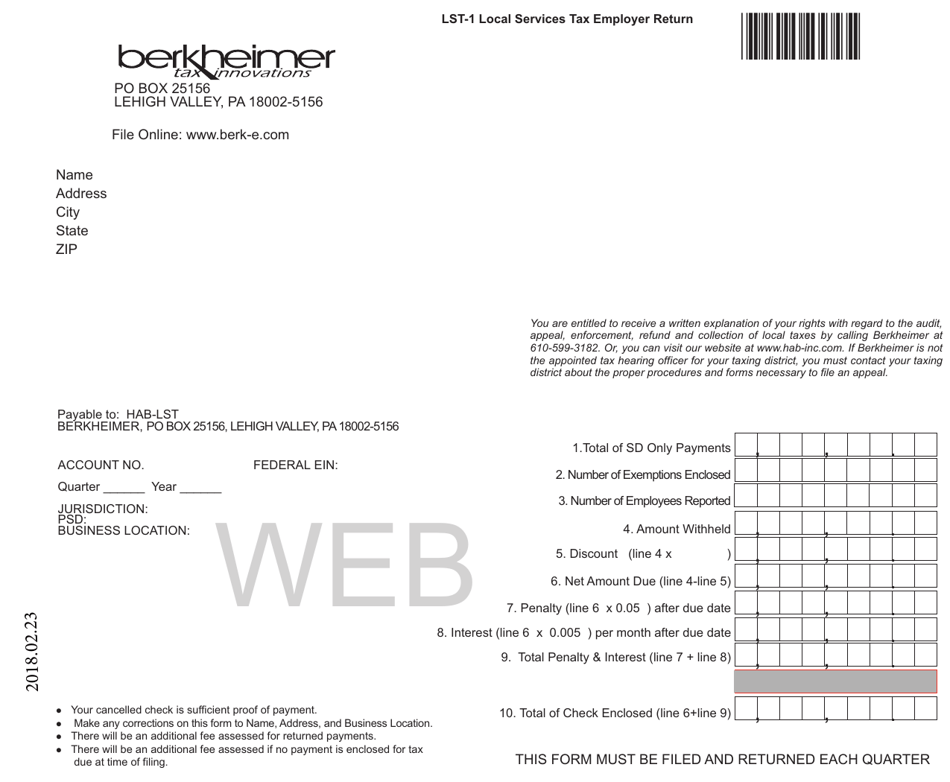

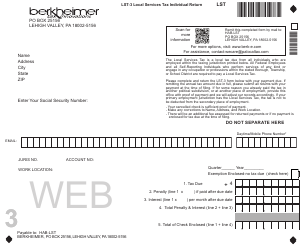

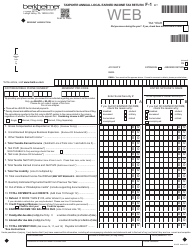

Form LST-1

for the current year.

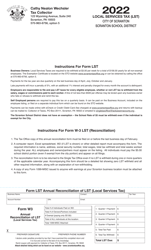

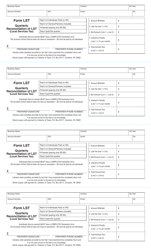

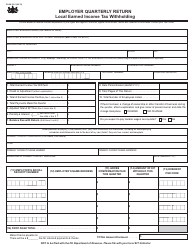

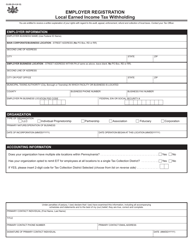

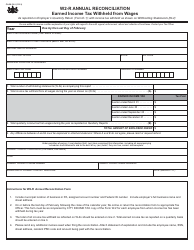

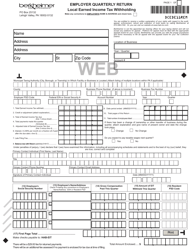

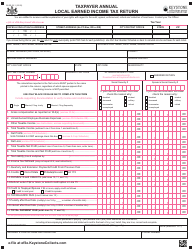

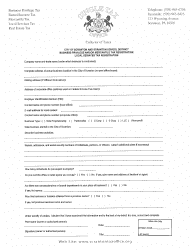

Form LST-1 Local Services Tax Employer Return - Pennsylvania

What Is Form LST-1?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LST-1?

A: Form LST-1 is the Local Services TaxEmployer Return in Pennsylvania.

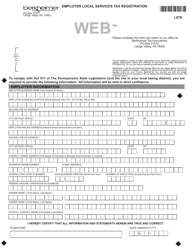

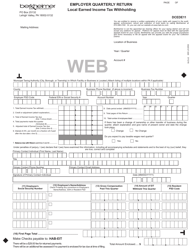

Q: Who needs to file Form LST-1?

A: Employers in Pennsylvania who have employees subject to the Local Services Tax (LST) need to file Form LST-1.

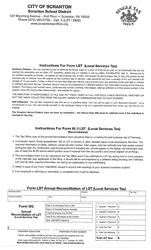

Q: What is the Local Services Tax?

A: The Local Services Tax is a tax imposed on individuals who work in Pennsylvania, with the amount varying by municipality.

Q: What information is needed to complete Form LST-1?

A: To complete Form LST-1, you will need to provide information about your business, such as employer identification number (EIN), number of employees subject to LST, and total amount of LST withheld.

Q: When is the deadline to file Form LST-1?

A: The deadline to file Form LST-1 is typically on or before April 30th of each year.

Q: Is there a penalty for failing to file Form LST-1?

A: Yes, there may be penalties for failing to file Form LST-1 or for filing it late. It is important to file on time to avoid penalties.

Q: Can I file Form LST-1 electronically?

A: Yes, you can file Form LST-1 electronically using the PA e-TIDES system.

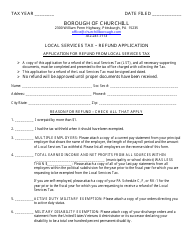

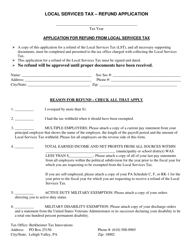

Q: Are there any exemptions from the Local Services Tax?

A: Yes, there are certain exemptions from the Local Services Tax, such as active duty military personnel and individuals earning less than a certain amount.

Form Details:

- Released on February 23, 2018;

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LST-1 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.