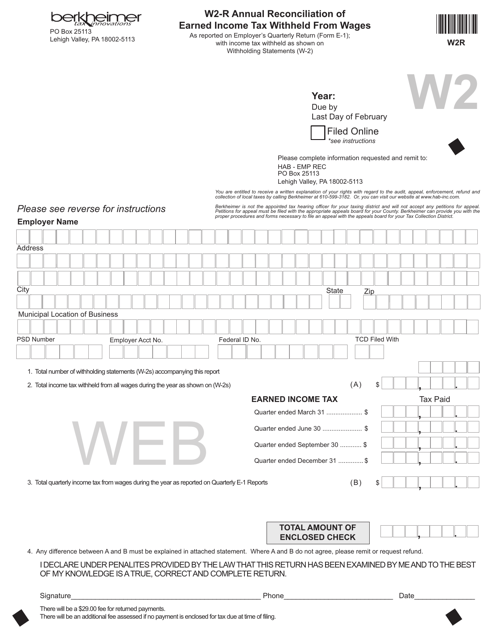

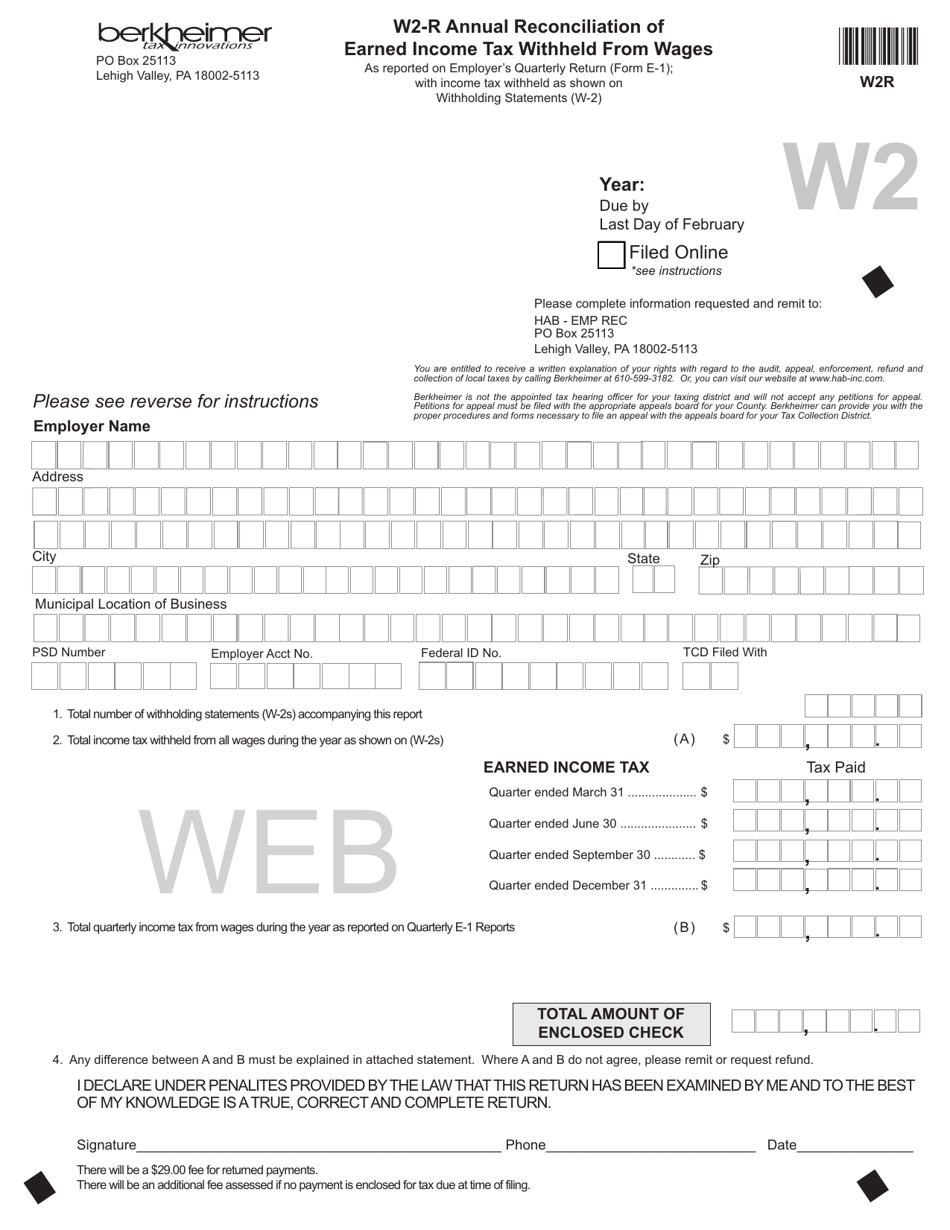

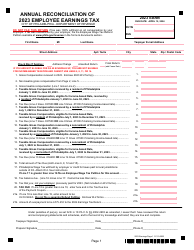

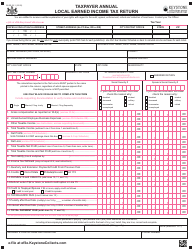

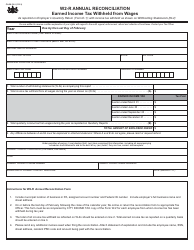

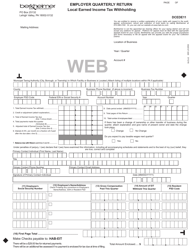

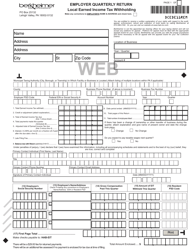

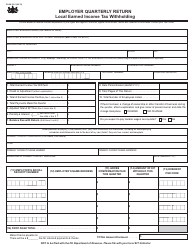

Form W2-R Annual Reconciliation of Earned Income Tax Withheld From Wages - Pennsylvania

What Is Form W2-R?

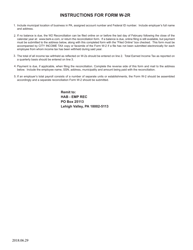

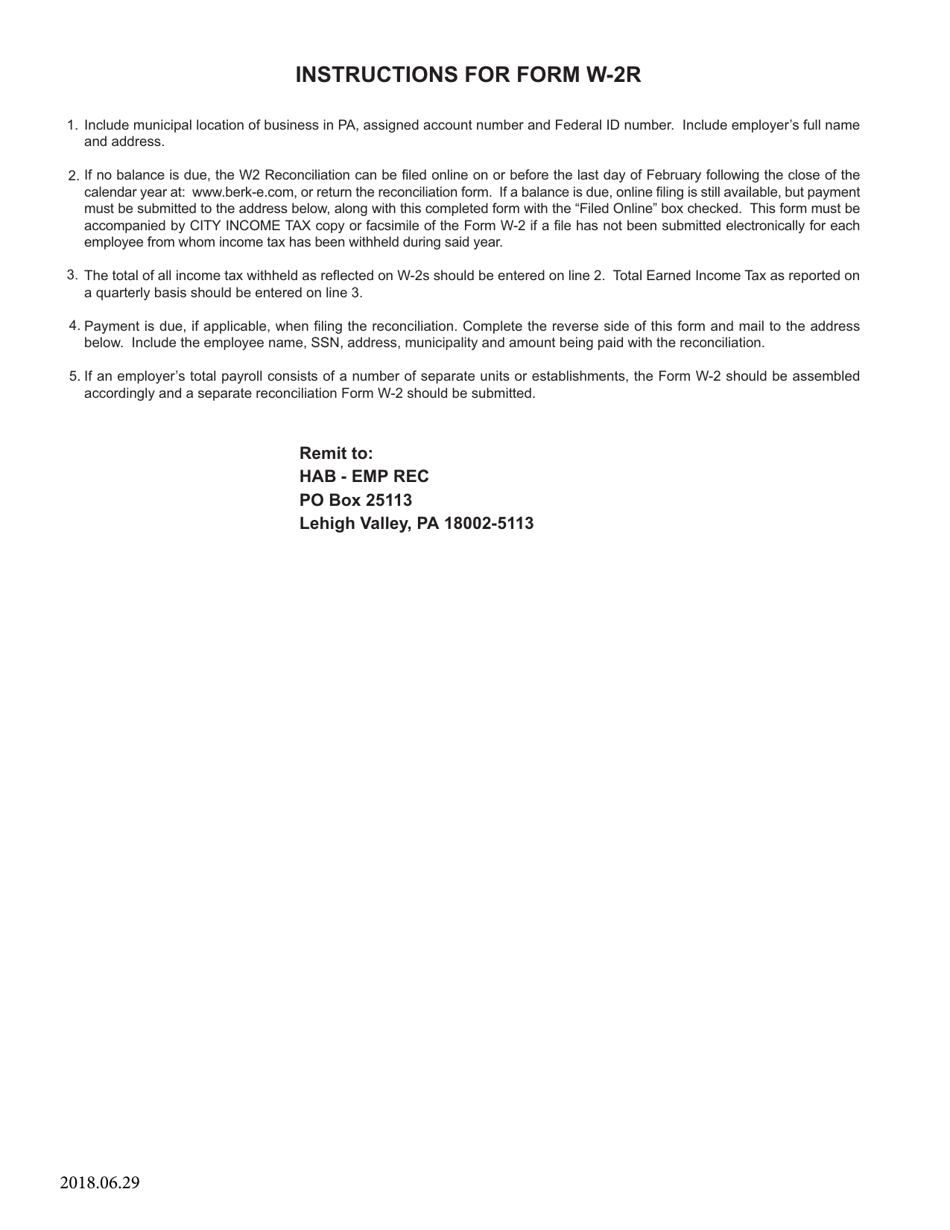

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W2-R?

A: Form W2-R is the Annual Reconciliation of Earned Income Tax Withheld From Wages.

Q: Who needs to file Form W2-R?

A: Employers in Pennsylvania who withhold earned income tax from their employees' wages need to file Form W2-R.

Q: What is the purpose of Form W2-R?

A: The purpose of Form W2-R is to report the total amount of earned incometax withheld by the employer during the year.

Q: When is the deadline to file Form W2-R?

A: Form W2-R must be filed by February 28th of the following year.

Form Details:

- Released on June 29, 2018;

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W2-R by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.