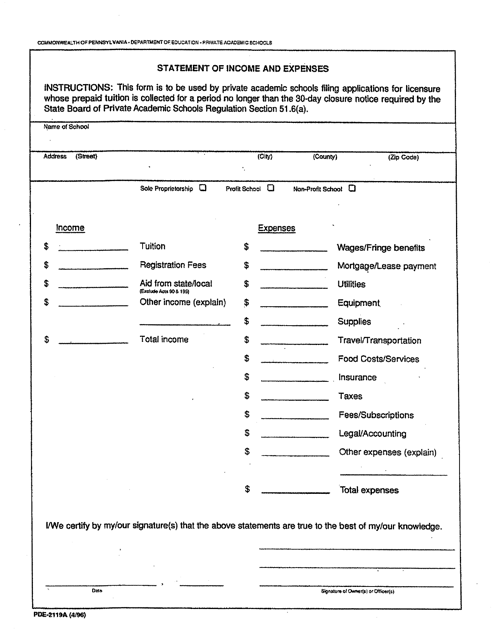

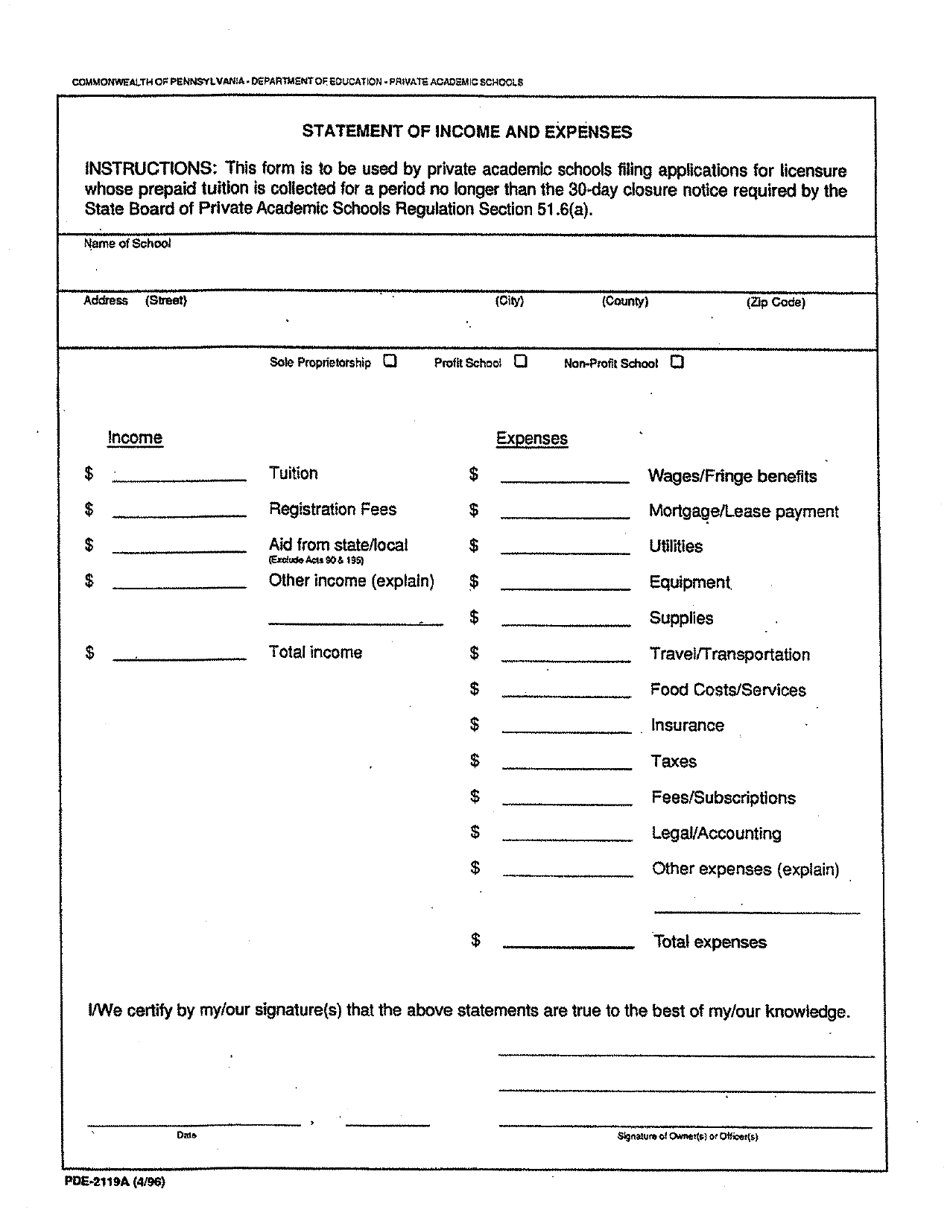

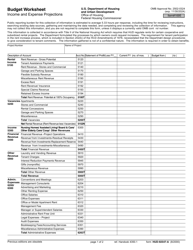

Form PDE-2119A Statement of Income and Expenses - Pennsylvania

What Is Form PDE-2119A?

This is a legal form that was released by the Pennsylvania Department of Education - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDE-2119A?

A: Form PDE-2119A is the Statement of Income and Expenses for the state of Pennsylvania.

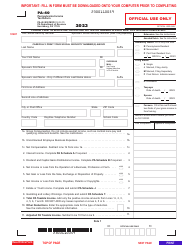

Q: Who is required to file Form PDE-2119A?

A: Individuals and businesses who have a rental or lease income from Pennsylvania real estate or property are required to file Form PDE-2119A.

Q: What is the purpose of Form PDE-2119A?

A: The purpose of Form PDE-2119A is to report the income and expenses related to rental or lease income from Pennsylvania real estate or property.

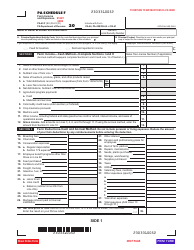

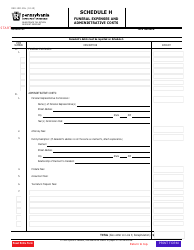

Q: What information is required on Form PDE-2119A?

A: Form PDE-2119A requires information such as rental or lease income, expenses related to the property, depreciation, and other relevant financial details.

Q: When is Form PDE-2119A due?

A: Form PDE-2119A is due on or before April 15th of each year.

Q: What happens if I don't file Form PDE-2119A?

A: If you are required to file Form PDE-2119A but fail to do so, you may face penalties and interest on any unpaid taxes.

Q: Can I e-file Form PDE-2119A?

A: Yes, you can e-file Form PDE-2119A using approved electronic filing methods.

Q: Are there any exemptions to filing Form PDE-2119A?

A: Some individuals and businesses may be exempt from filing Form PDE-2119A. Consult the instructions or the Pennsylvania Department of Revenue for more information.

Q: Can I amend my Form PDE-2119A if I made a mistake?

A: Yes, you can file an amended Form PDE-2119A if you need to correct any errors or make changes to your original filing.

Form Details:

- Released on April 1, 1996;

- The latest edition provided by the Pennsylvania Department of Education;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PDE-2119A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Education.