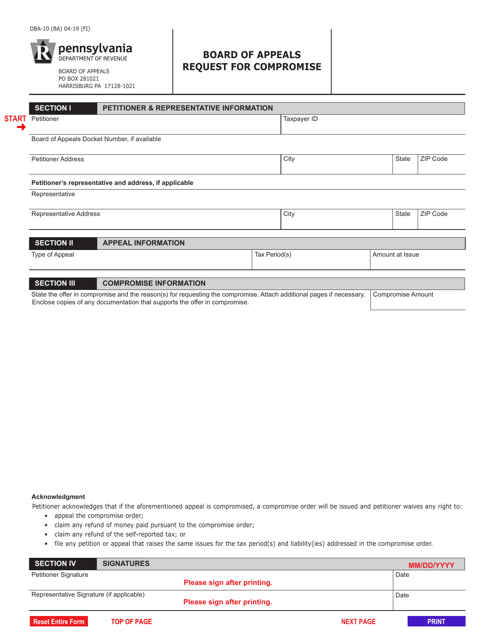

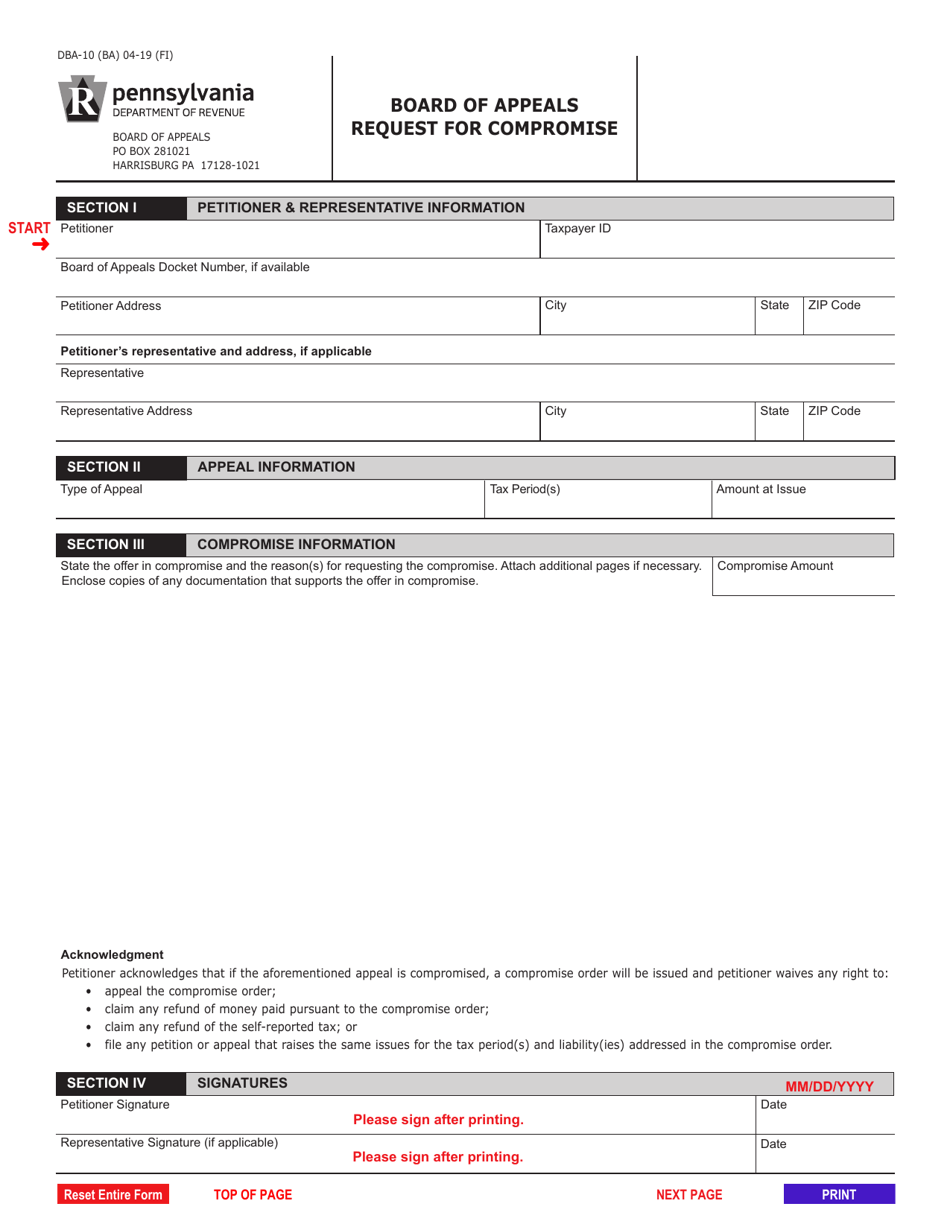

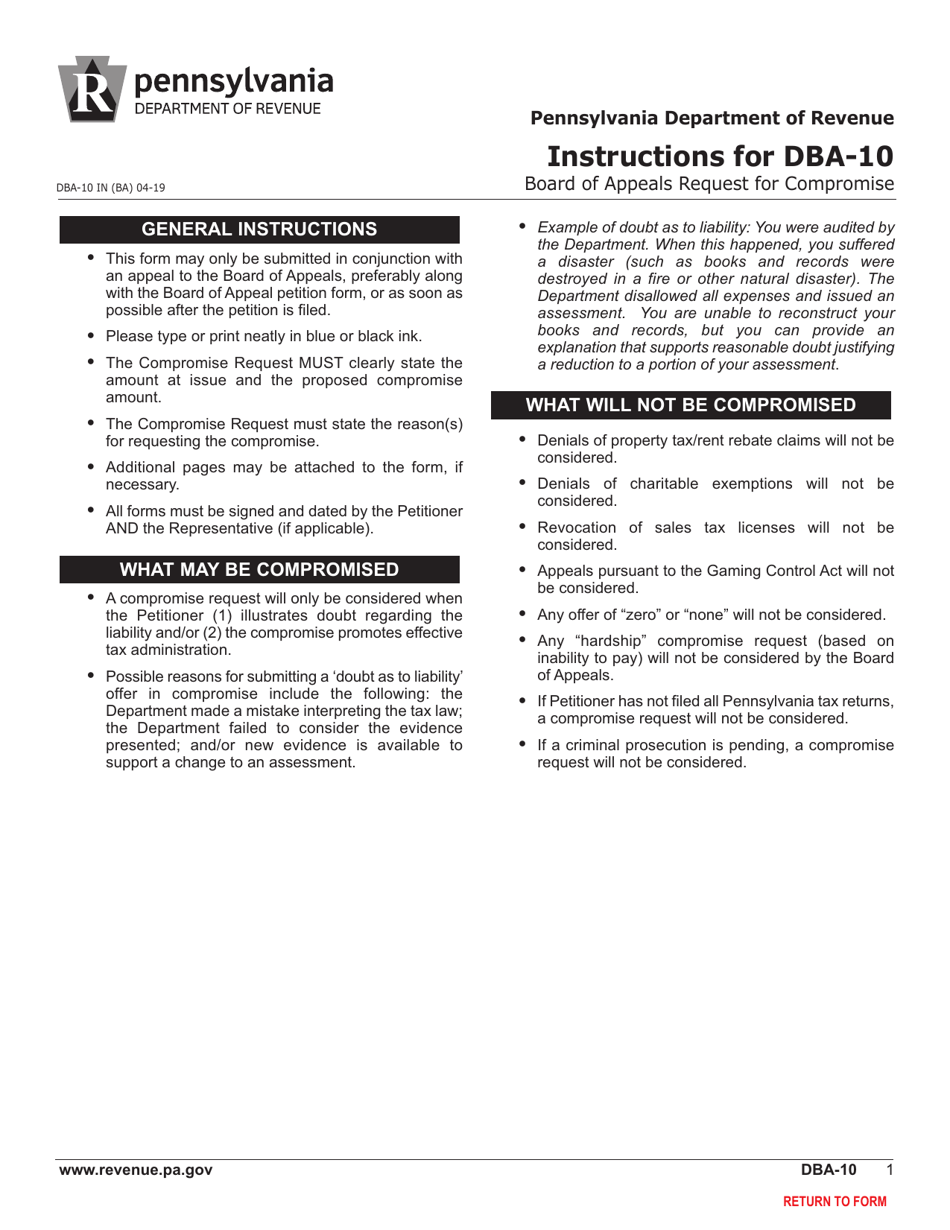

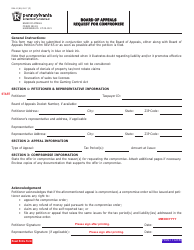

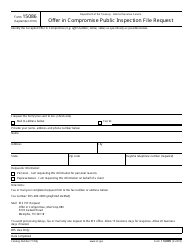

Form DBA-10 Request for Compromise - Pennsylvania

What Is Form DBA-10?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBA-10?

A: Form DBA-10 is the Request for Compromise form in Pennsylvania.

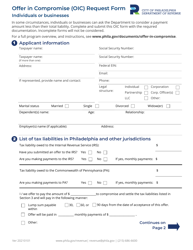

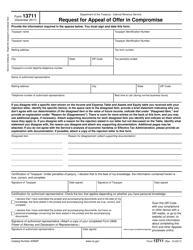

Q: What is the purpose of Form DBA-10?

A: The purpose of Form DBA-10 is to request a compromise on a debt owed to the state of Pennsylvania.

Q: Who can use Form DBA-10?

A: Any individual or business who owes a debt to the state of Pennsylvania can use Form DBA-10.

Q: What information is required on Form DBA-10?

A: Form DBA-10 requires information such as the taxpayer identification number, amount owed, reasons for the compromise request, and financial information.

Q: Is there a fee to submit Form DBA-10?

A: No, there is no fee to submit Form DBA-10.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBA-10 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.