This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-40

for the current year.

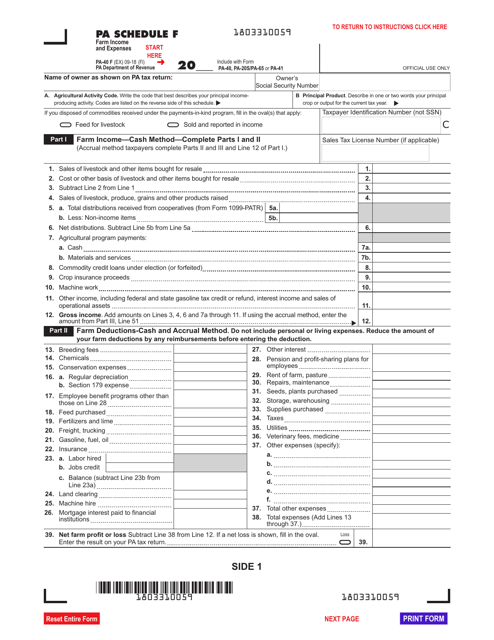

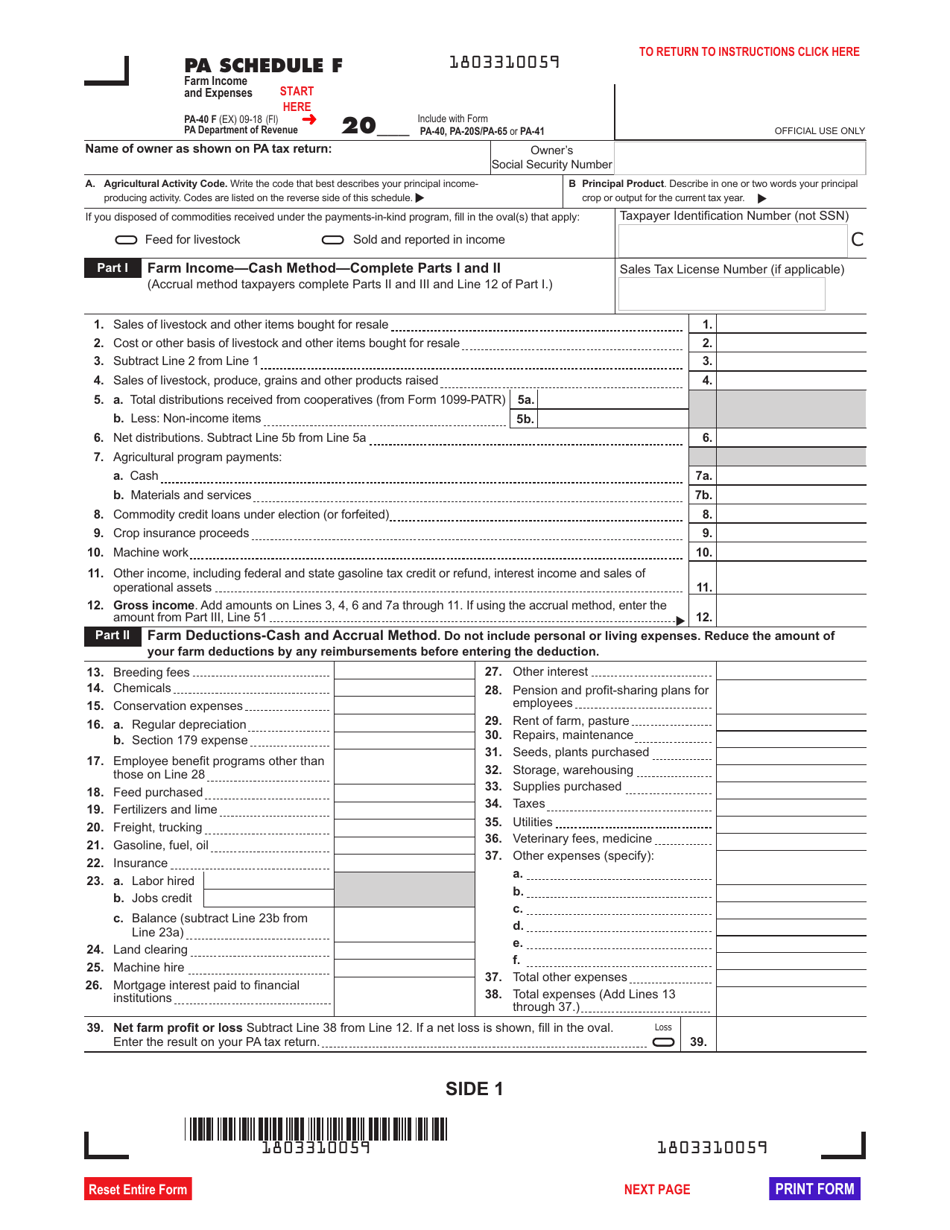

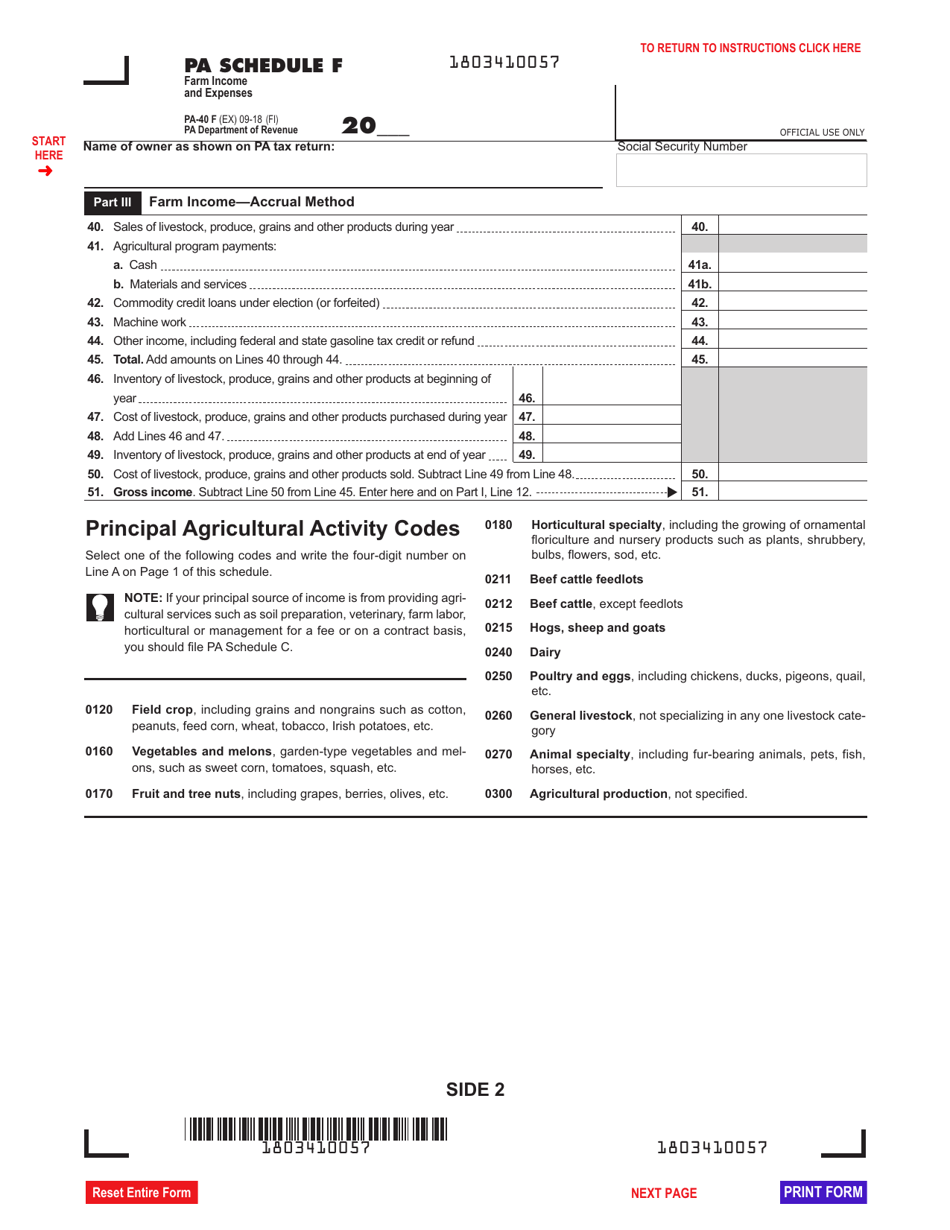

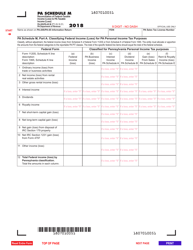

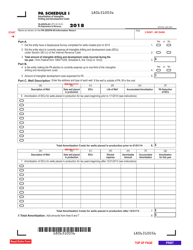

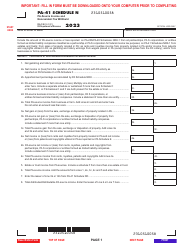

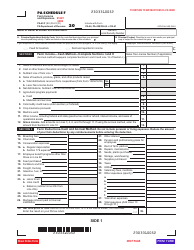

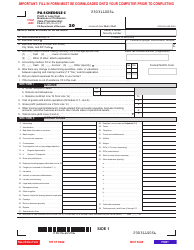

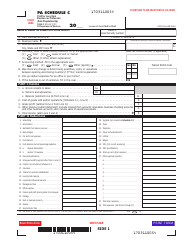

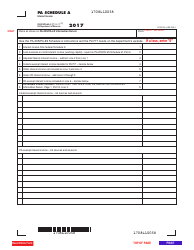

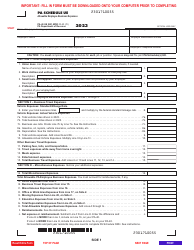

Form PA-40 Pa Schedule F - Farm Income and Expenses - Pennsylvania

What Is Form PA-40?

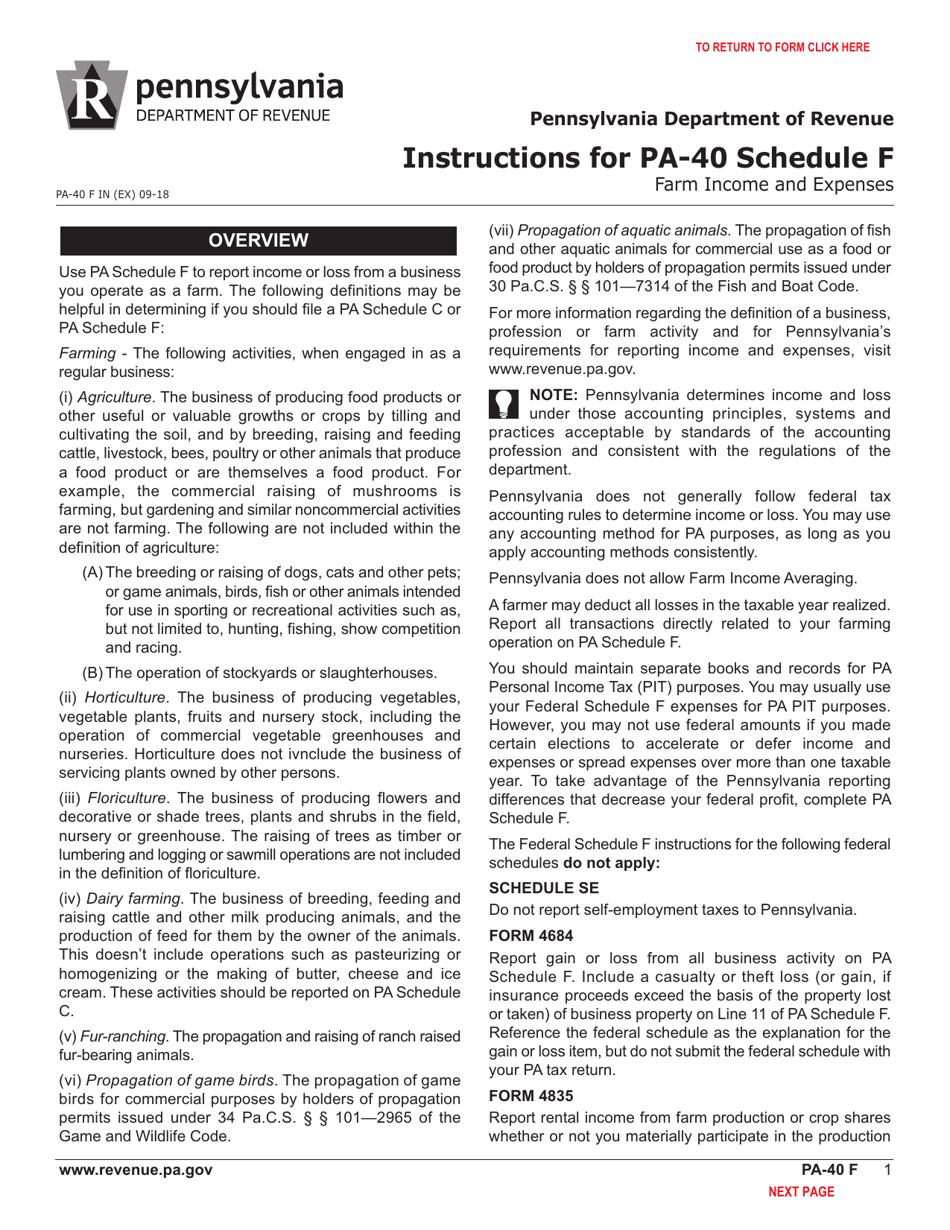

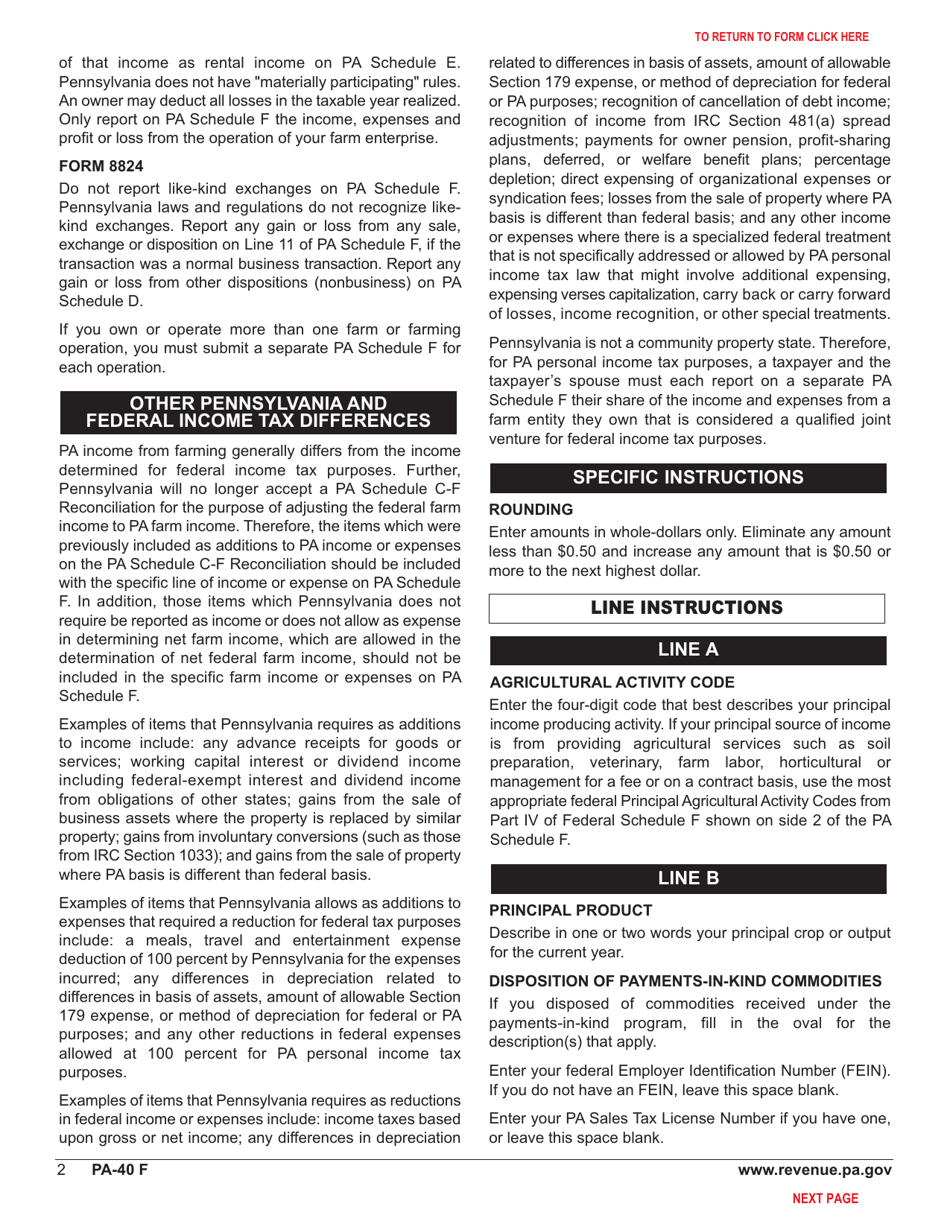

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Pa Schedule F?

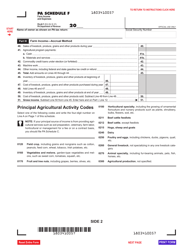

A: Form PA-40 Pa Schedule F is a tax form used in Pennsylvania to report farm income and expenses.

Q: Who needs to file Form PA-40 Pa Schedule F?

A: Farmers in Pennsylvania who have farm income and expenses need to file Form PA-40 Pa Schedule F.

Q: What is the purpose of Form PA-40 Pa Schedule F?

A: The purpose of Form PA-40 Pa Schedule F is to report farm income and expenses for tax purposes.

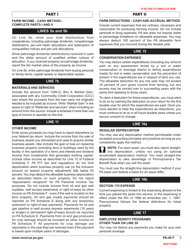

Q: What kind of income should be reported on Form PA-40 Pa Schedule F?

A: Any income derived from farming activities should be reported on Form PA-40 Pa Schedule F.

Q: What expenses can be deducted on Form PA-40 Pa Schedule F?

A: Allowable farm expenses, such as supplies, equipment, feed, and labor costs, can be deducted on Form PA-40 Pa Schedule F.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.