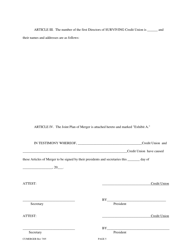

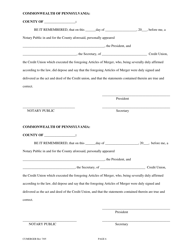

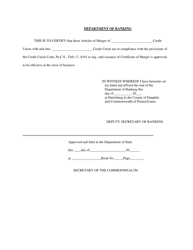

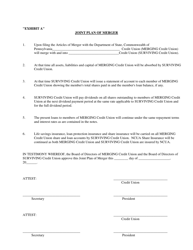

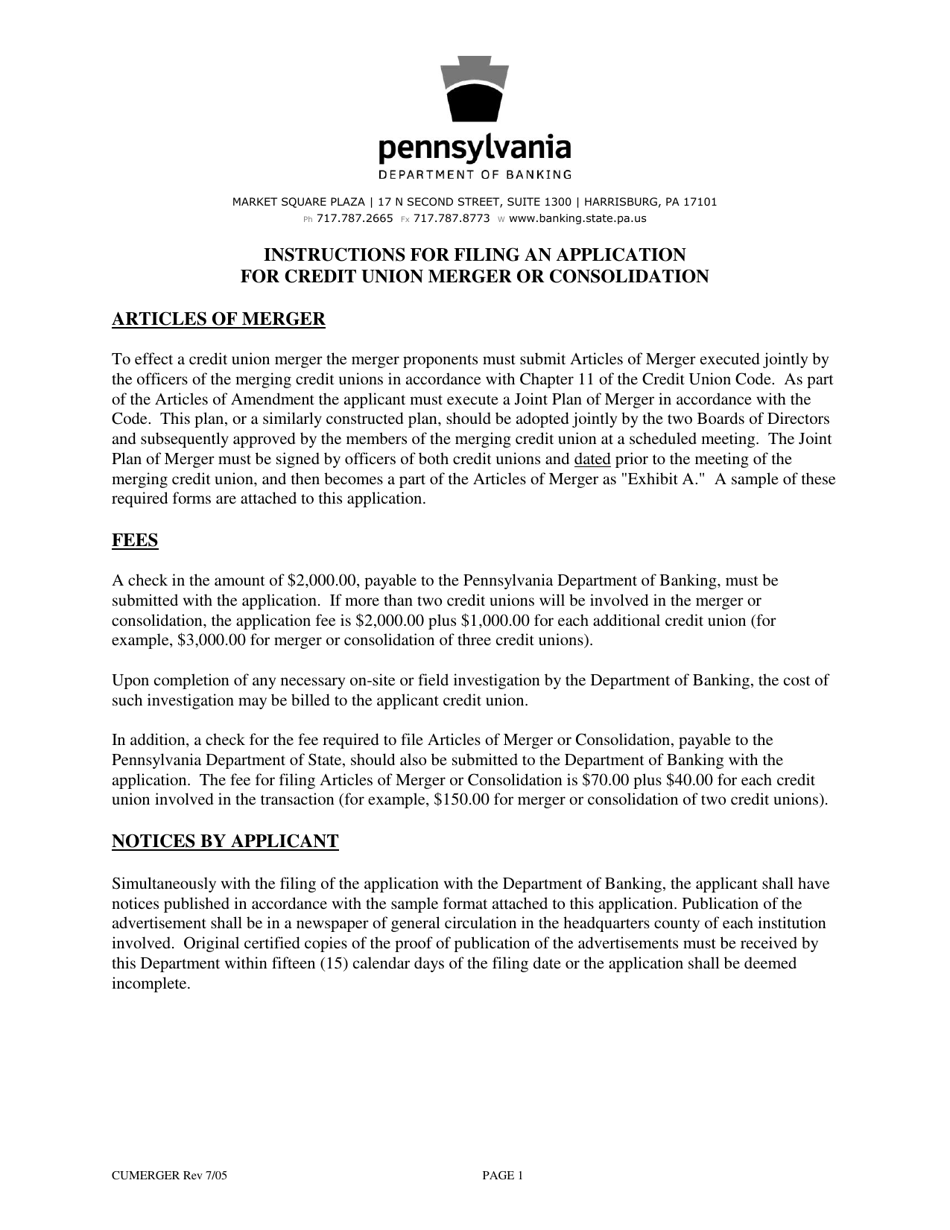

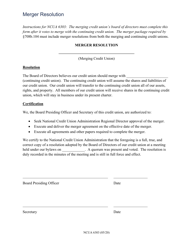

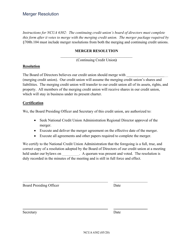

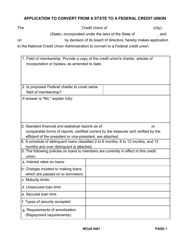

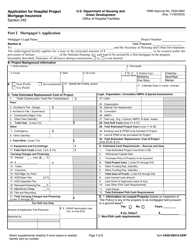

Application for Credit Union Merger or Consolidation - Pennsylvania

Application for Credit Union Merger or Consolidation is a legal document that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania.

FAQ

Q: What is a credit union merger or consolidation?

A: A credit union merger or consolidation is when two or more credit unions combine to form a single credit union.

Q: Why would credit unions choose to merge or consolidate?

A: Credit unions may choose to merge or consolidate to improve efficiency, expand services, or increase financial stability.

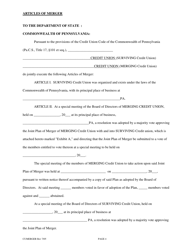

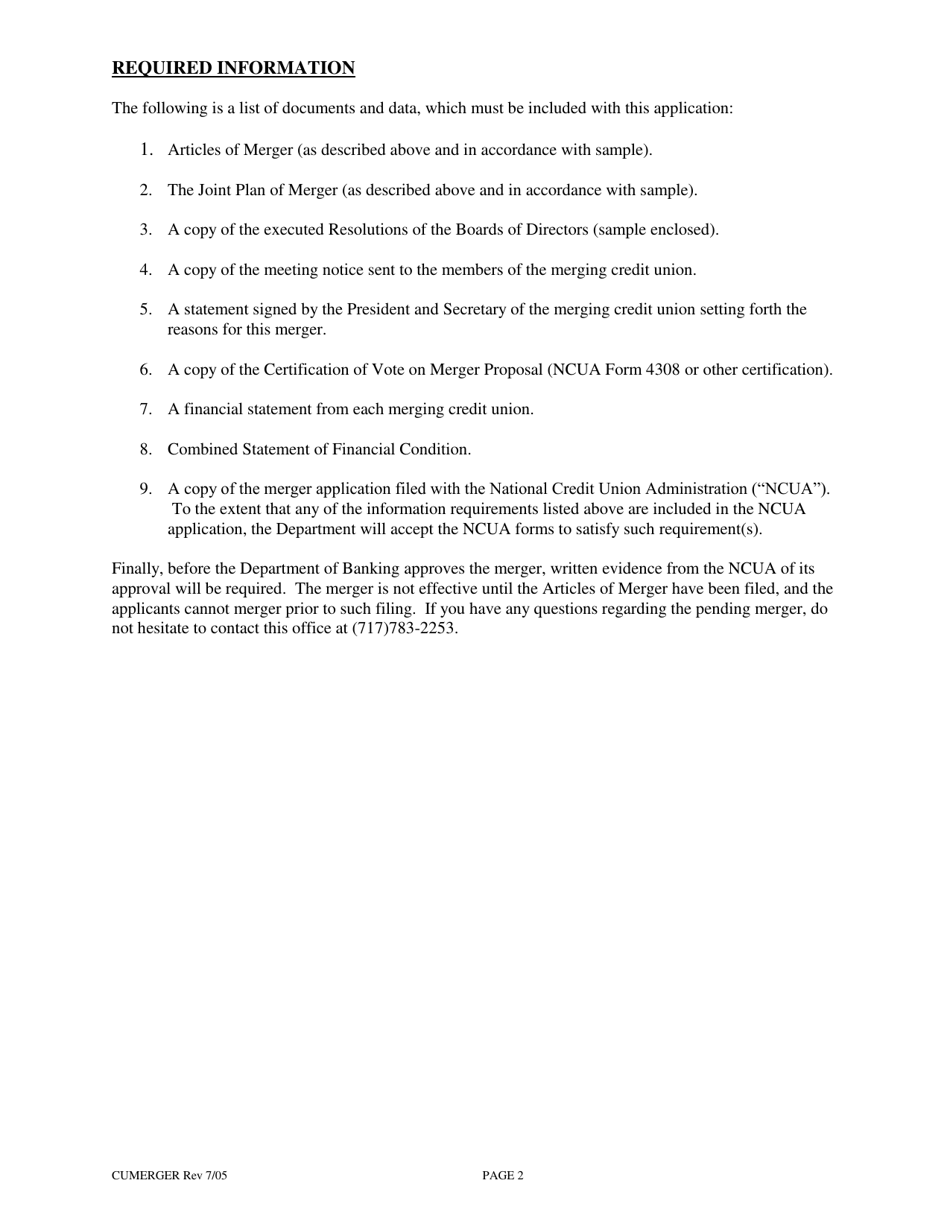

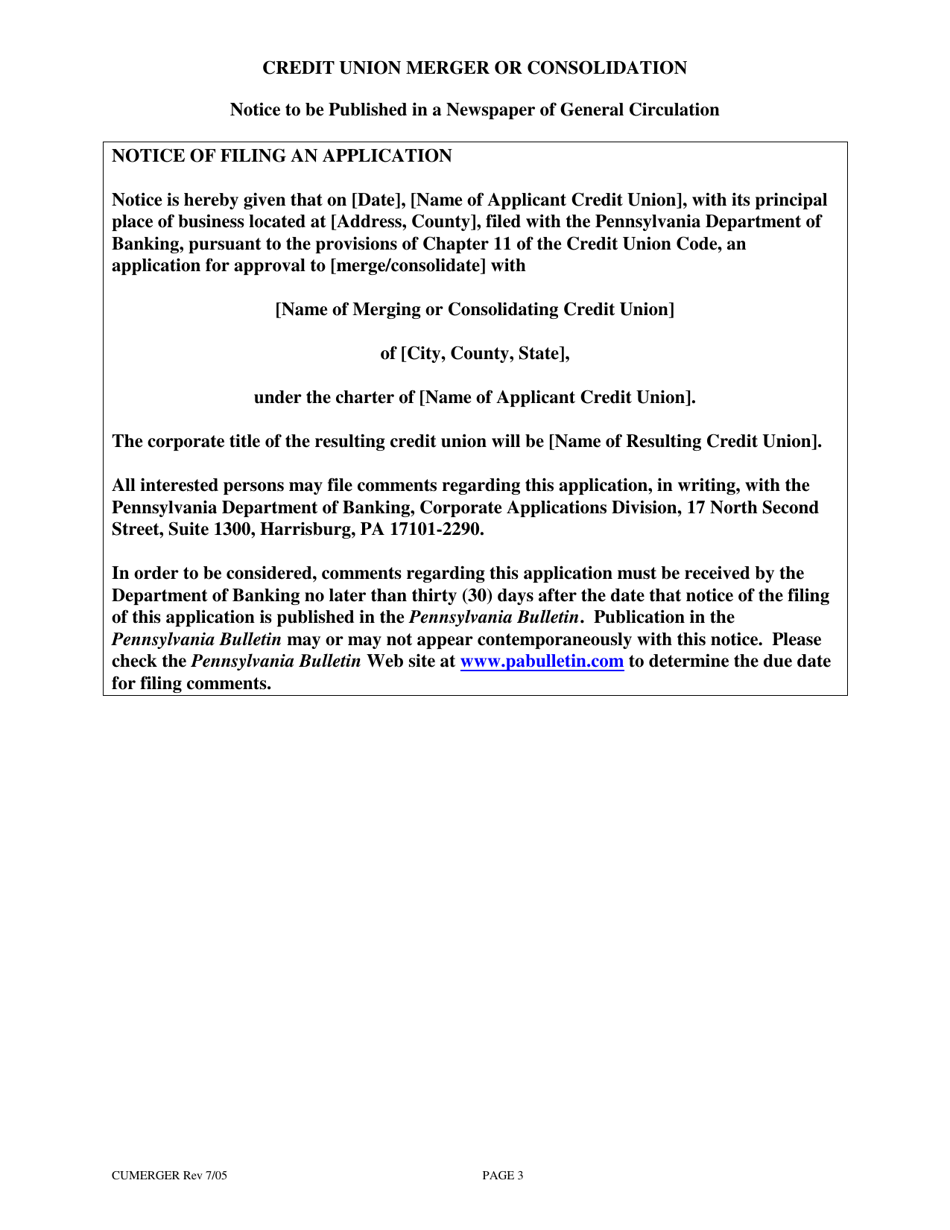

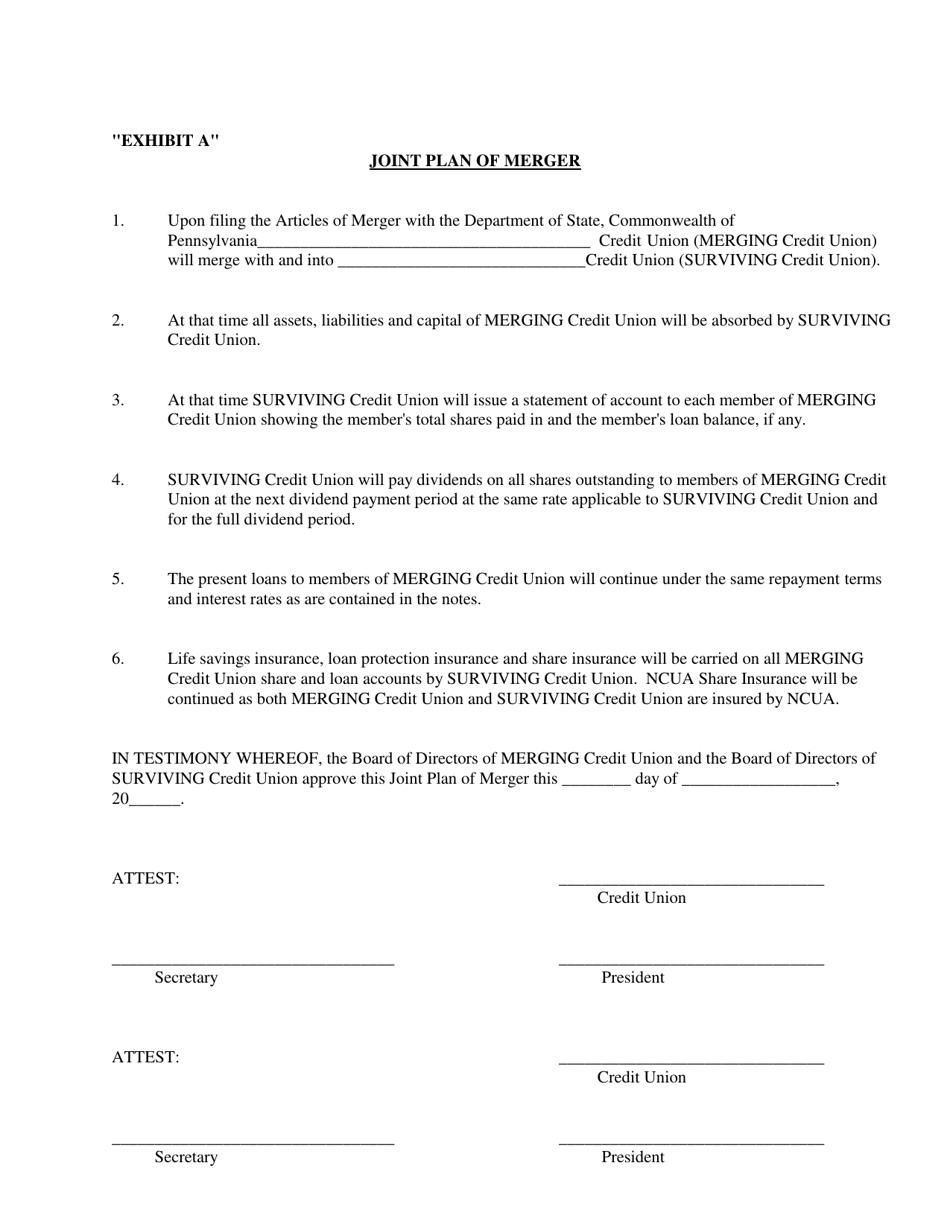

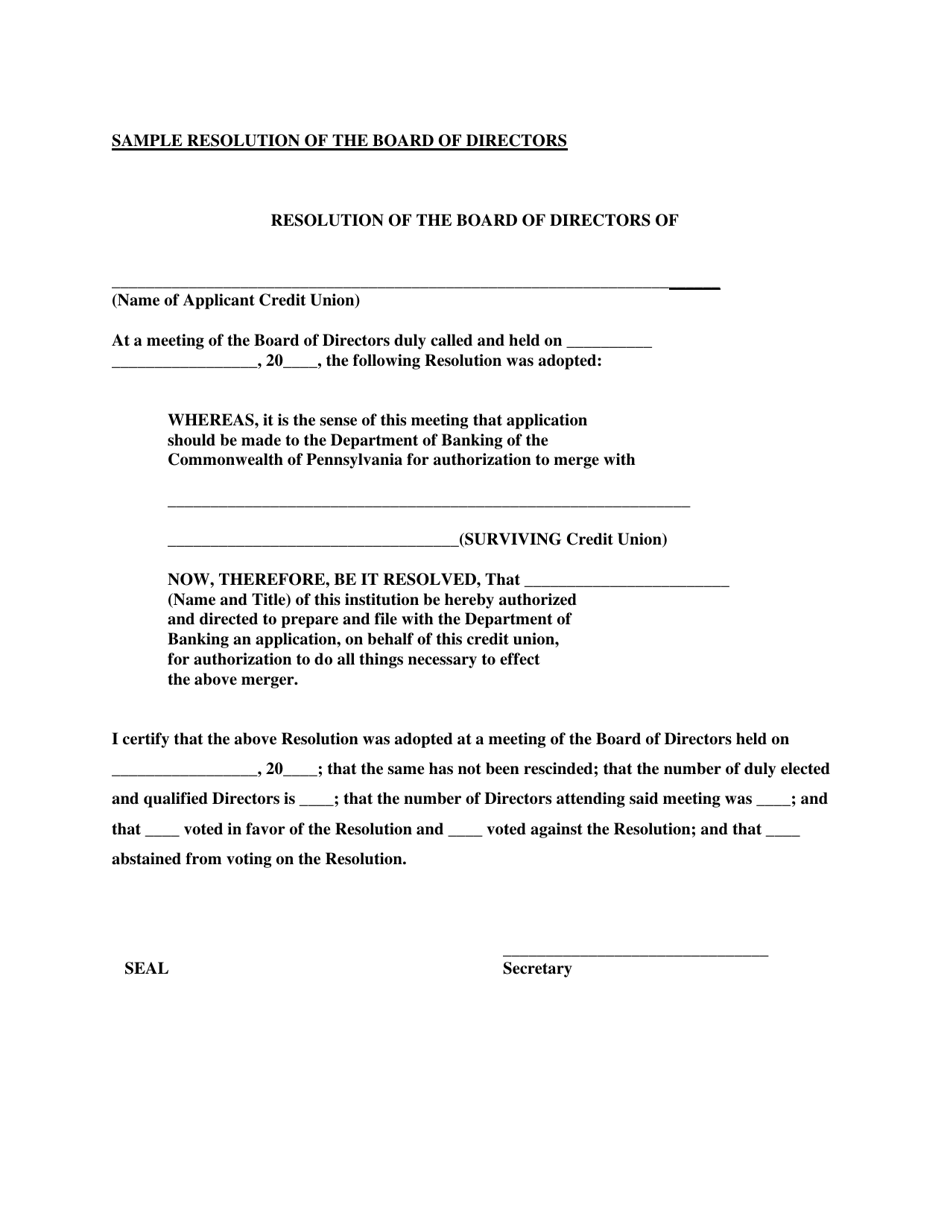

Q: What is the process for a credit union merger or consolidation in Pennsylvania?

A: The process for a credit union merger or consolidation in Pennsylvania involves obtaining approval from various regulatory bodies, notifying members, and conducting a vote.

Q: What happens to the members of the credit unions involved in a merger or consolidation?

A: The members of the credit unions involved become members of the newly formed credit union.

Q: Are credit union mergers and consolidations regulated in Pennsylvania?

A: Yes, credit union mergers and consolidations are regulated by the Pennsylvania Department of Banking and Securities.

Q: What are the potential benefits of a credit union merger or consolidation?

A: Potential benefits of a credit union merger or consolidation include increased access to services, improved technology, and greater financial strength.

Q: Can credit union members vote against a merger or consolidation?

A: Yes, credit union members have the opportunity to vote on proposed mergers or consolidations.

Q: What happens to the employees of the credit unions involved in a merger or consolidation?

A: The employees of the credit unions involved may be offered positions in the newly formed credit union.

Form Details:

- Released on July 1, 2005;

- The latest edition currently provided by the Pennsylvania Department of Banking and Securities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.