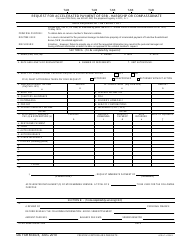

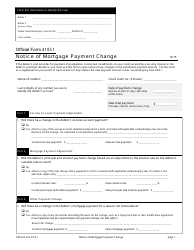

Accelerated Mortgage Payment Provider Bond - Pennsylvania

Accelerated Mortgage Payment Provider Bond is a legal document that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania.

FAQ

Q: What is an Accelerated Mortgage Payment Provider Bond?

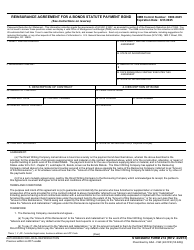

A: An Accelerated Mortgage Payment Provider Bond is a type of surety bond required by the state of Pennsylvania for companies that offer accelerated mortgage payment services.

Q: Why is an Accelerated Mortgage Payment Provider Bond required in Pennsylvania?

A: The bond is required to protect consumers from fraud or mismanagement by the mortgage payment provider.

Q: Who needs to obtain an Accelerated Mortgage Payment Provider Bond in Pennsylvania?

A: Companies that offer accelerated mortgage payment services in Pennsylvania need to obtain this bond.

Q: How much does an Accelerated Mortgage Payment Provider Bond in Pennsylvania cost?

A: The cost of the bond varies based on the company's financials and credit history, but typically ranges from 1% to 5% of the bond amount.

Form Details:

- The latest edition currently provided by the Pennsylvania Department of Banking and Securities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.