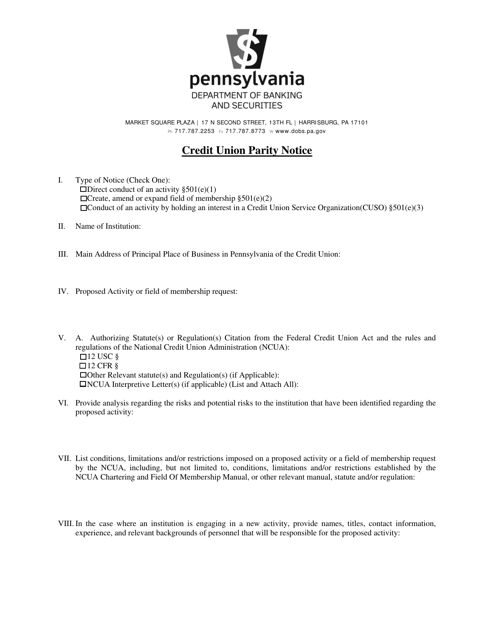

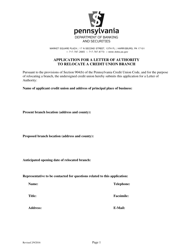

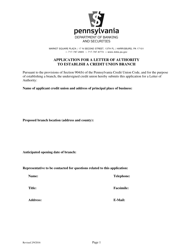

Credit Union Parity Notice - Pennsylvania

Credit Union Parity Notice is a legal document that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania.

FAQ

Q: What is a Credit Union Parity Notice?

A: A Credit Union Parity Notice is a requirement in Pennsylvania that is intended to provide equal disclosure of important information to credit union members.

Q: What information does the Credit Union Parity Notice provide?

A: The Credit Union Parity Notice provides information about the financial condition and services available at the credit union, as well as contact information for regulatory authorities.

Q: Why is the Credit Union Parity Notice important?

A: The Credit Union Parity Notice is important because it helps credit union members make informed decisions about their financial services and allows them to compare different credit unions.

Q: Who is required to provide a Credit Union Parity Notice?

A: All credit unions that are chartered or licensed in Pennsylvania are required to provide a Credit Union Parity Notice.

Q: How often is the Credit Union Parity Notice required to be provided?

A: The Credit Union Parity Notice is required to be provided at least annually to credit union members.

Q: What are the consequences for not providing a Credit Union Parity Notice?

A: Failure to provide a Credit Union Parity Notice may result in penalties and the credit union may be subject to other enforcement actions by regulatory authorities.

Form Details:

- The latest edition currently provided by the Pennsylvania Department of Banking and Securities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.