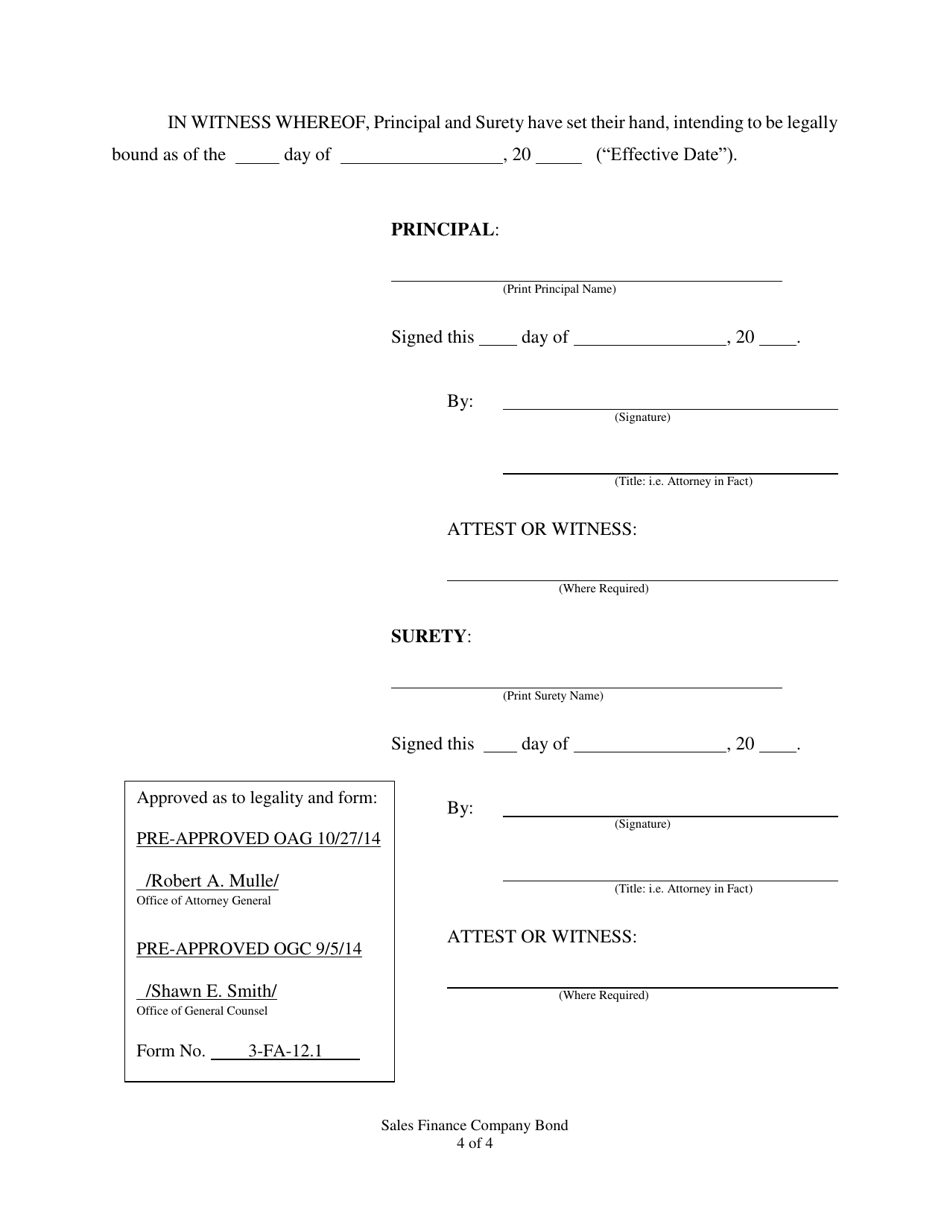

Sales Finance Company Bond - Pennsylvania

Sales Finance Company Bond is a legal document that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania.

FAQ

Q: What is a Sales Finance Company Bond?

A: A Sales Finance Company Bond is a type of surety bond that is required for businesses operating as sales finance companies in Pennsylvania.

Q: What is a sales finance company?

A: A sales finance company is a company that provides loans to consumers for the purpose of purchasing goods or services.

Q: Why is a Sales Finance Company Bond required?

A: A Sales Finance Company Bond is required to ensure that the sales finance company operates in compliance with state regulations and protects consumers from any potential financial harm.

Q: How does a Sales Finance Company Bond work?

A: If a sales finance company fails to comply with the regulations or causes financial harm to a consumer, a claim can be filed against the bond to provide financial compensation to the affected party.

Q: Who needs to obtain a Sales Finance Company Bond in Pennsylvania?

A: Any business that operates as a sales finance company in Pennsylvania is required to obtain a Sales Finance Company Bond.

Q: How can I obtain a Sales Finance Company Bond?

A: You can obtain a Sales Finance Company Bond by contacting a surety bond company or an insurance agent that specializes in surety bonds.

Q: How much does a Sales Finance Company Bond cost?

A: The cost of a Sales Finance Company Bond can vary depending on factors such as the bond amount required, the applicant's credit history, and other underwriting considerations.

Q: How long does a Sales Finance Company Bond remain in effect?

A: A Sales Finance Company Bond remains in effect as long as the sales finance company remains in business and maintains compliance with the state regulations.

Q: Are there any alternatives to a Sales Finance Company Bond?

A: In some cases, an alternative form of financial security, such as a letter of credit, may be accepted instead of a Sales Finance Company Bond.

Q: What happens if a claim is filed against a Sales Finance Company Bond?

A: If a valid claim is filed against a Sales Finance Company Bond, the surety bond company will investigate the claim and provide compensation to the affected party if the claim is found to be valid.

Form Details:

- The latest edition currently provided by the Pennsylvania Department of Banking and Securities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.