This version of the form is not currently in use and is provided for reference only. Download this version of

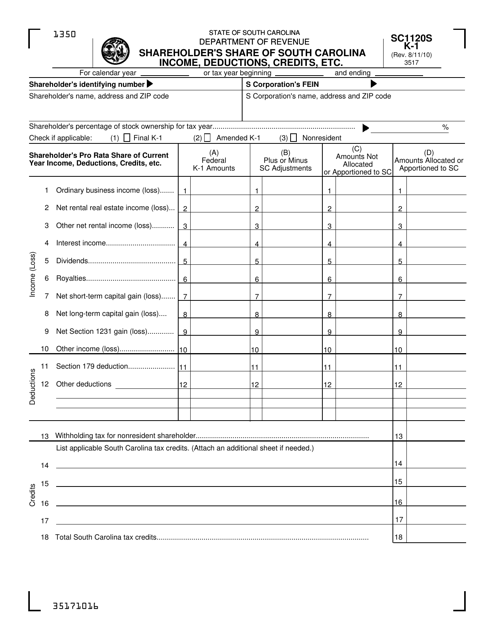

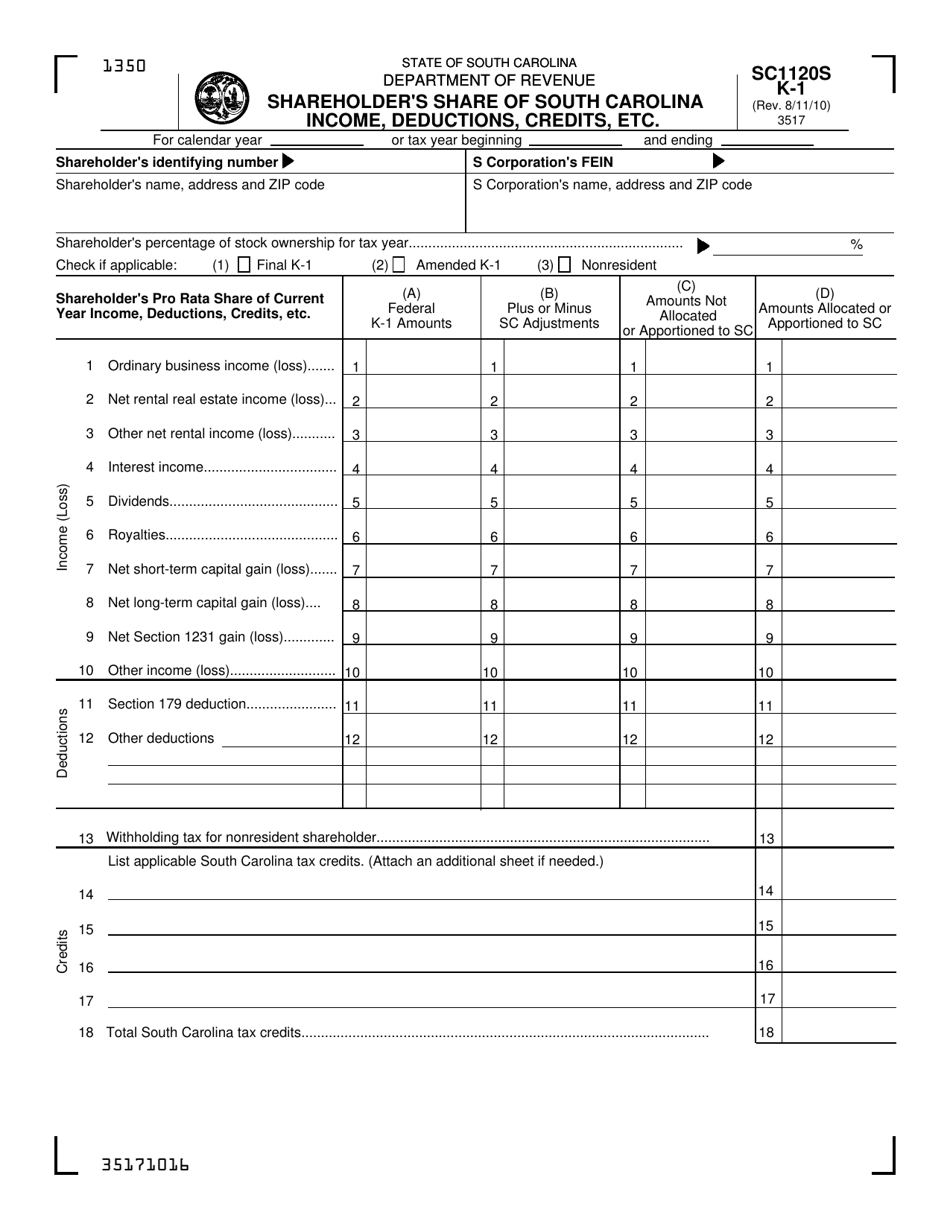

Form SC1120S K-1

for the current year.

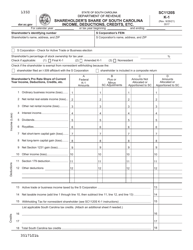

Form SC1120S K-1 Shareholder's Share of South Carolina Income, Deductions, Credits, Etc. - South Carolina

What Is Form SC1120S K-1?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC1120S K-1?

A: Form SC1120S K-1 is a document used to report a shareholder's share of South Carolina income, deductions, credits, and other related information.

Q: Who needs to fill out Form SC1120S K-1?

A: Shareholders of an S corporation in South Carolina need to fill out Form SC1120S K-1.

Q: What information is reported on Form SC1120S K-1?

A: Form SC1120S K-1 reports a shareholder's share of income, deductions, credits, and other relevant details from an S corporation in South Carolina.

Q: When is the deadline to file Form SC1120S K-1?

A: The deadline to file Form SC1120S K-1 is the same as the S corporation's South Carolina income tax return, which is generally due on the 15th day of the 3rd month after the end of the tax year.

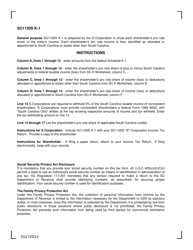

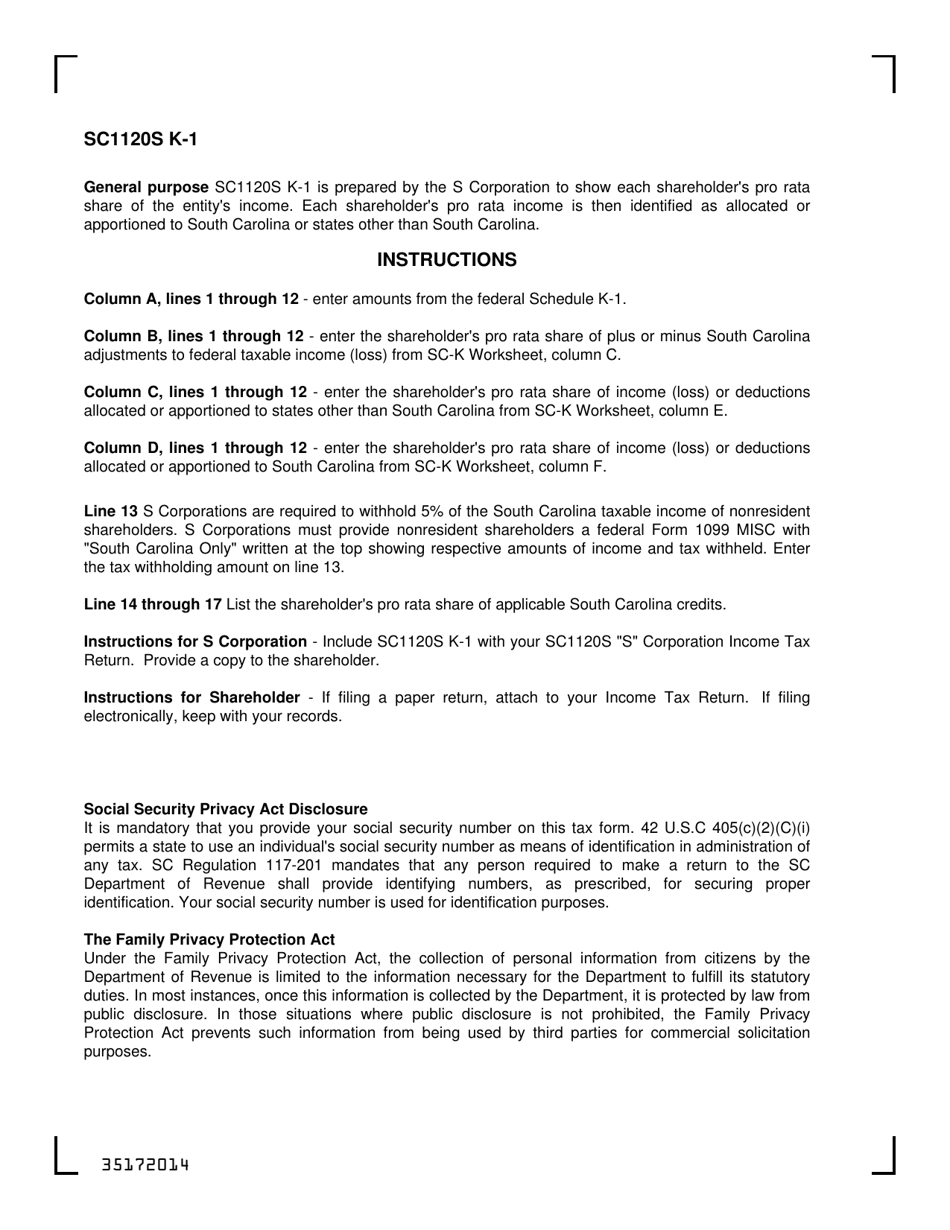

Q: Are there any specific instructions for filling out Form SC1120S K-1?

A: Yes, there are specific instructions provided by the South Carolina Department of Revenue that should be followed when filling out Form SC1120S K-1.

Q: What should I do if I have additional questions about Form SC1120S K-1?

A: If you have additional questions about Form SC1120S K-1, you can contact the South Carolina Department of Revenue for assistance.

Form Details:

- Released on August 11, 2010;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1120S K-1 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.