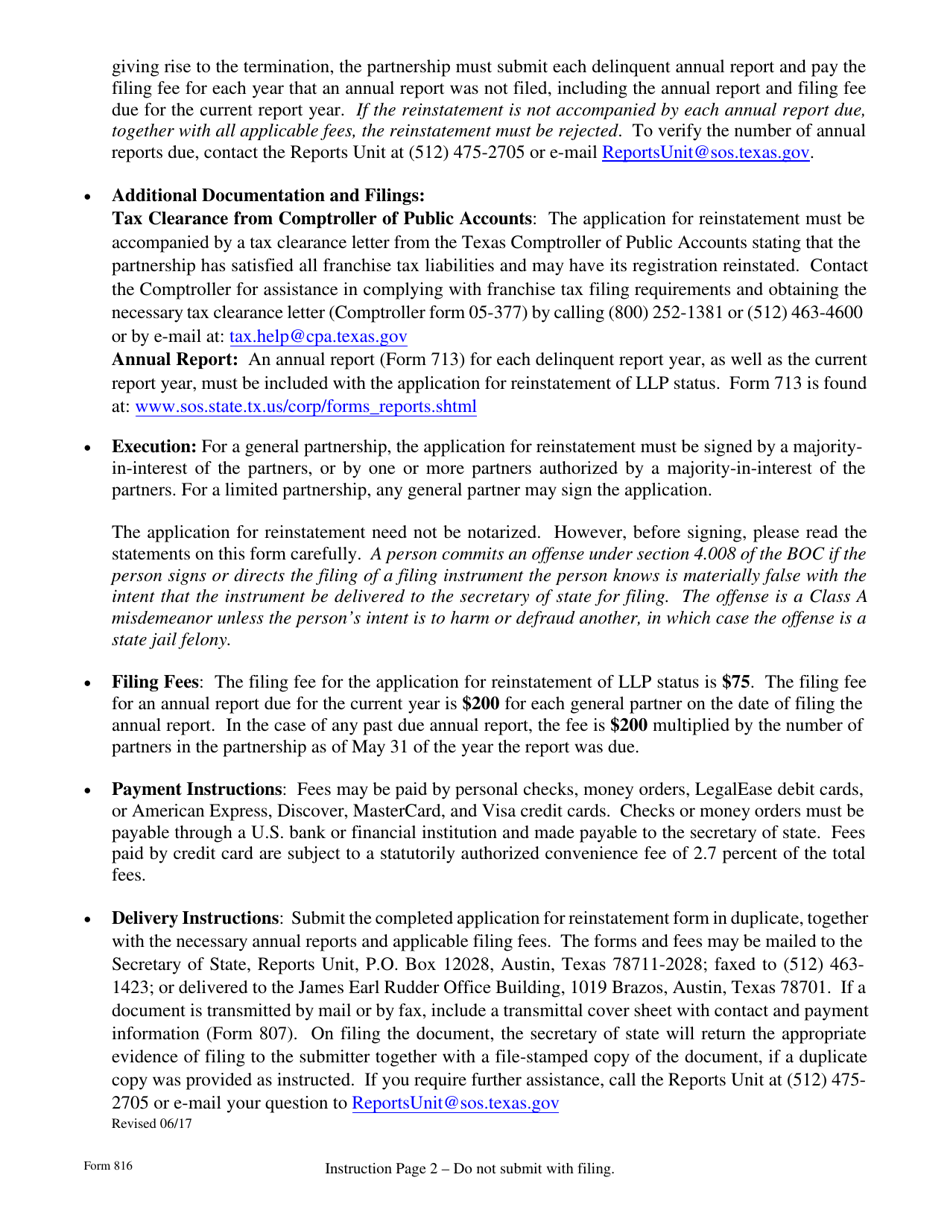

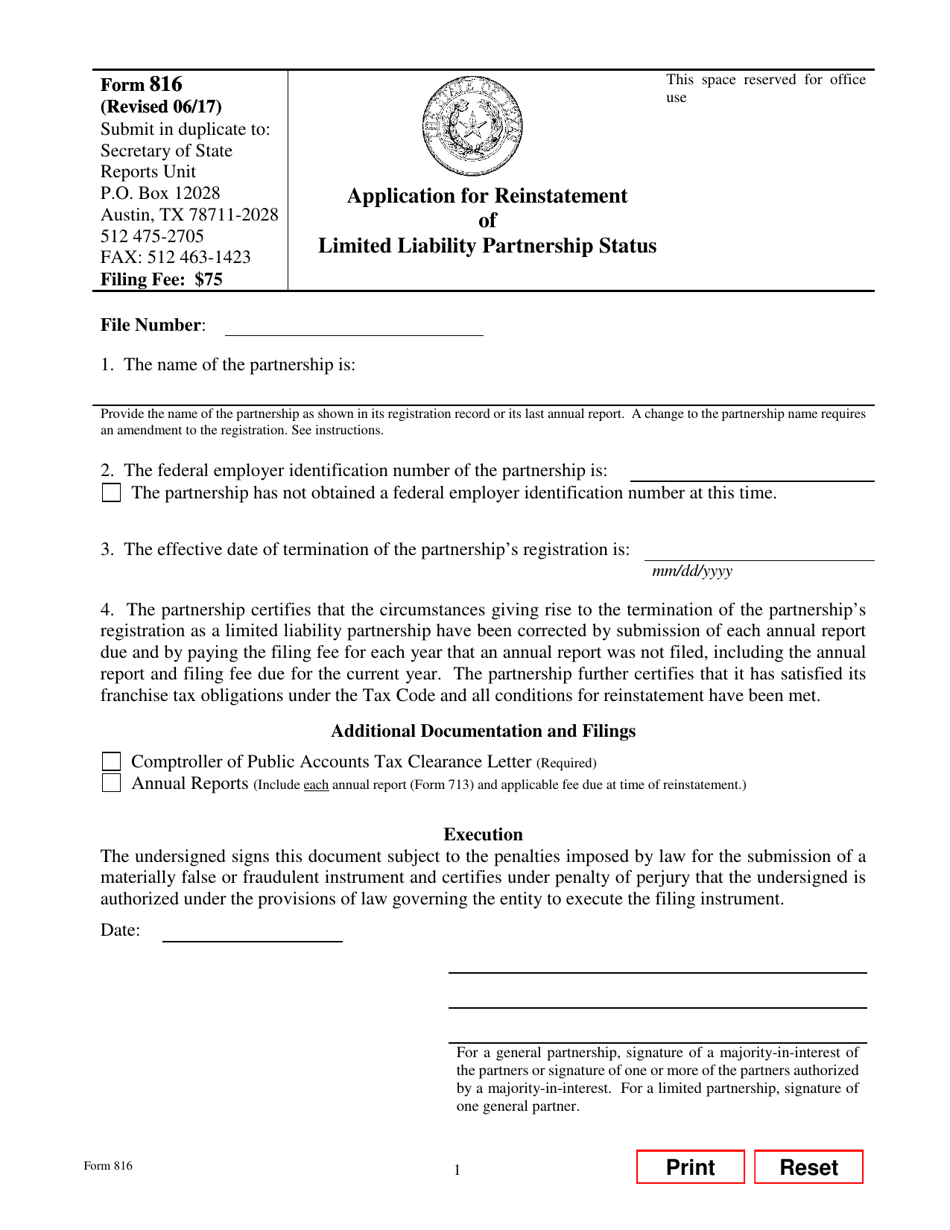

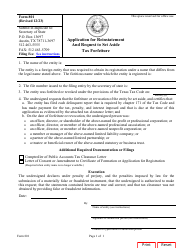

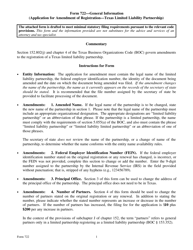

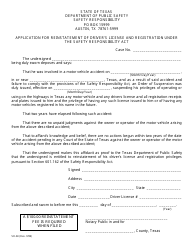

Form 816 Application for Reinstatement of Limited Liability Partnership Status - Texas

What Is Form 816?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

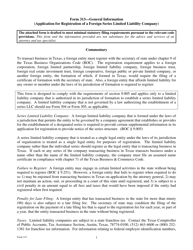

Q: What is Form 816?

A: Form 816 is the Application for Reinstatement of Limited Liability Partnership Status in Texas.

Q: What is the purpose of Form 816?

A: The purpose of Form 816 is to apply for the reinstatement of the limited liability partnership status in Texas.

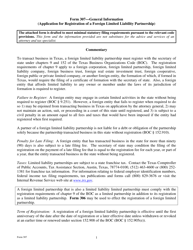

Q: Who needs to file Form 816?

A: Limited liability partnerships in Texas that have been administratively terminated or revoked need to file Form 816 to apply for reinstatement.

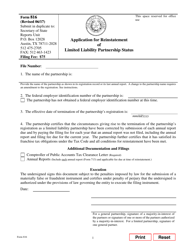

Q: What information is required on Form 816?

A: Form 816 requires information such as the name of the limited liability partnership, the reason for termination or revocation, and the date of termination or revocation.

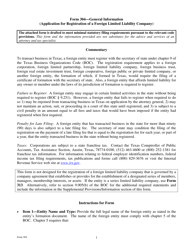

Q: Are there any fees associated with filing Form 816?

A: Yes, there is a fee of $25 to file Form 816.

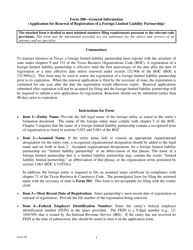

Q: What is the deadline for filing Form 816?

A: There is no specific deadline for filing Form 816, but it is recommended to file as soon as possible after the termination or revocation of the limited liability partnership status.

Q: What happens after filing Form 816?

A: After filing Form 816 and paying the required fee, the Texas Secretary of State will review the application and determine whether to reinstate the limited liability partnership status.

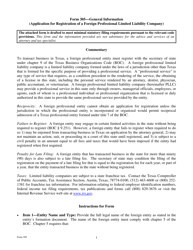

Q: How long does it take to process Form 816?

A: The processing time for Form 816 can vary, but it usually takes a few weeks to receive a response from the Texas Secretary of State.

Q: Can I expedite the processing of Form 816?

A: No, there is no option to expedite the processing of Form 816.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 816 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.