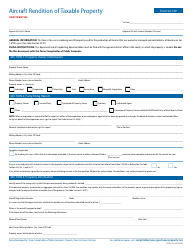

This version of the form is not currently in use and is provided for reference only. Download this version of

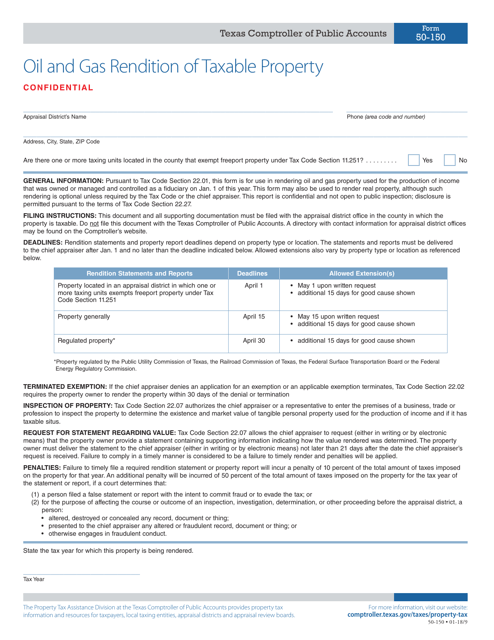

Form 50-150

for the current year.

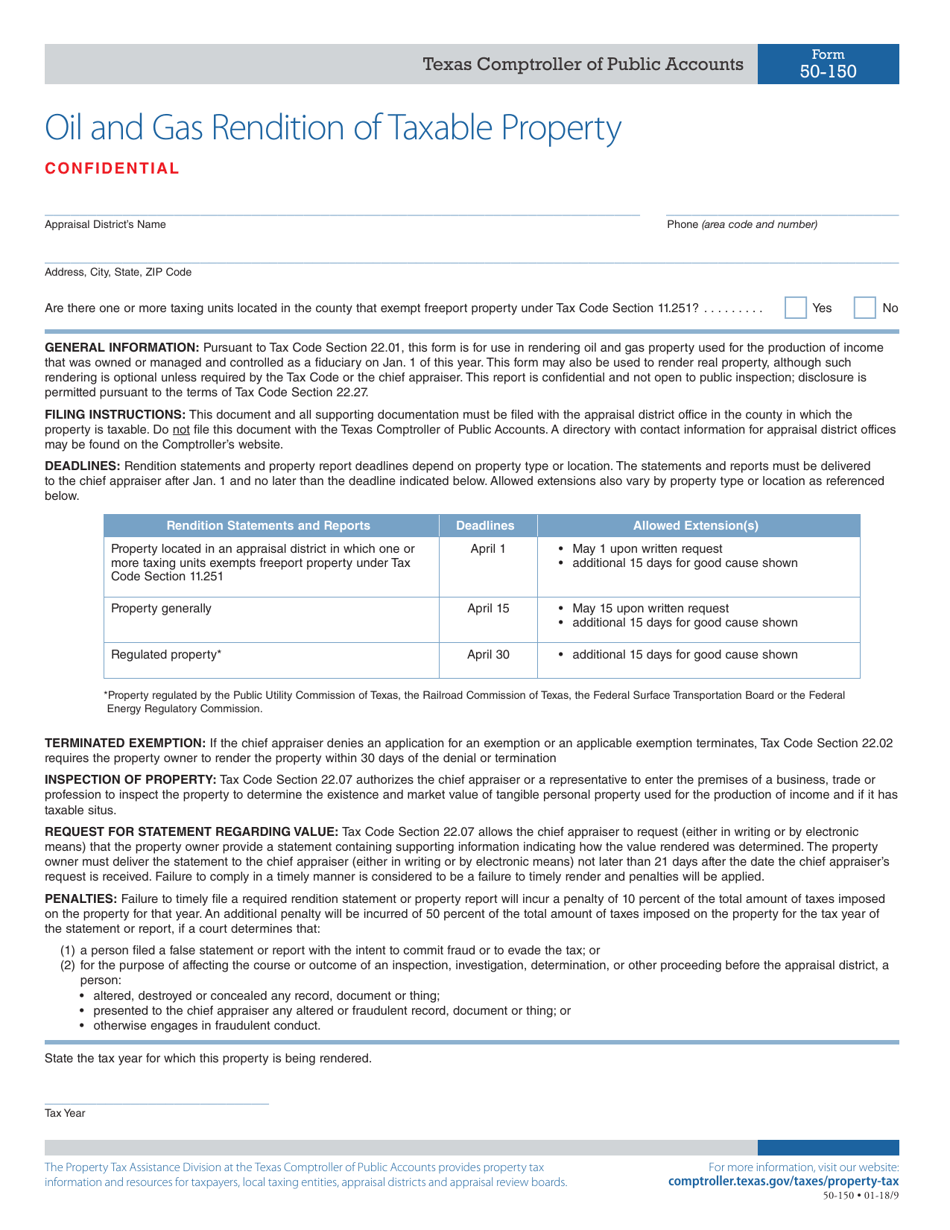

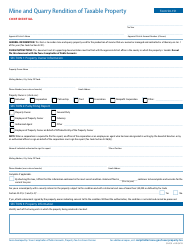

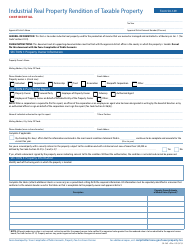

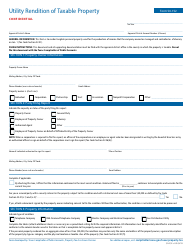

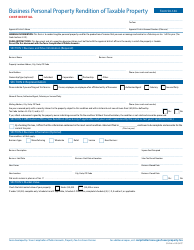

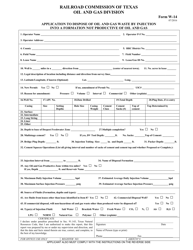

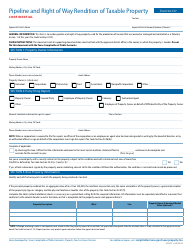

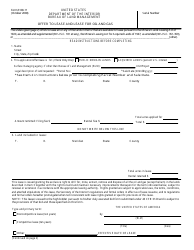

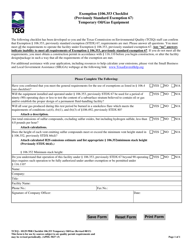

Form 50-150 Oil and Gas Rendition of Taxable Property - Texas

What Is Form 50-150?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-150?

A: Form 50-150 is the Oil and Gas Rendition of Taxable Property form used in Texas.

Q: Who needs to file Form 50-150?

A: Owners of oil and gas properties in Texas need to file Form 50-150.

Q: What is the purpose of Form 50-150?

A: The purpose of Form 50-150 is to report the value of oil and gas properties for tax assessment in Texas.

Q: When is Form 50-150 due?

A: Form 50-150 is typically due by April 15th of each year.

Q: Are there any penalties for not filing Form 50-150?

A: Yes, failure to file Form 50-150 may result in penalties.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-150 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.