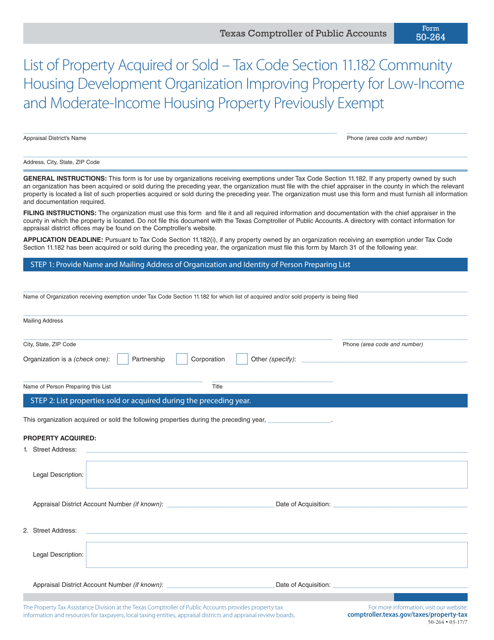

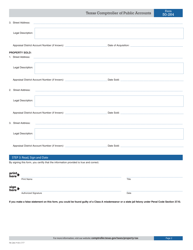

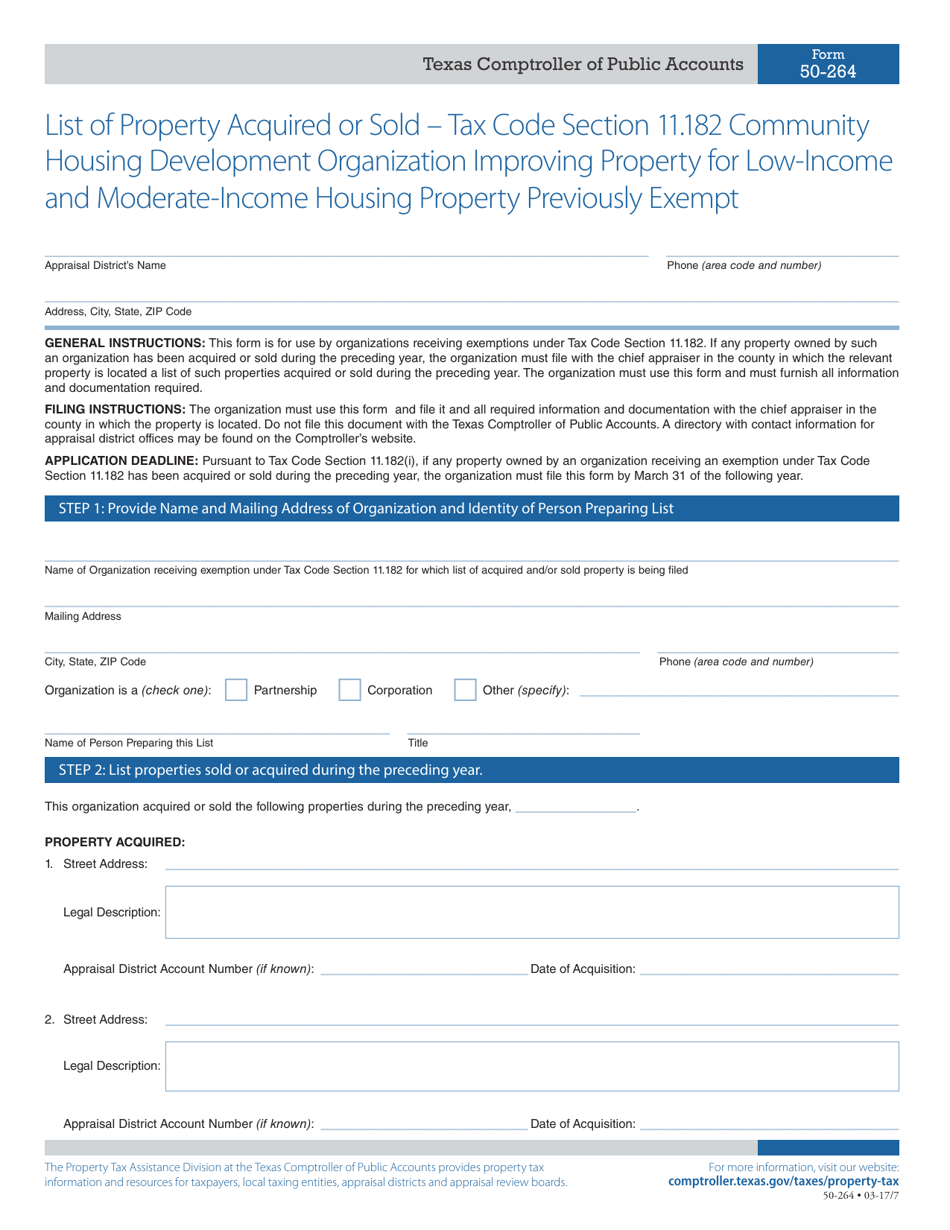

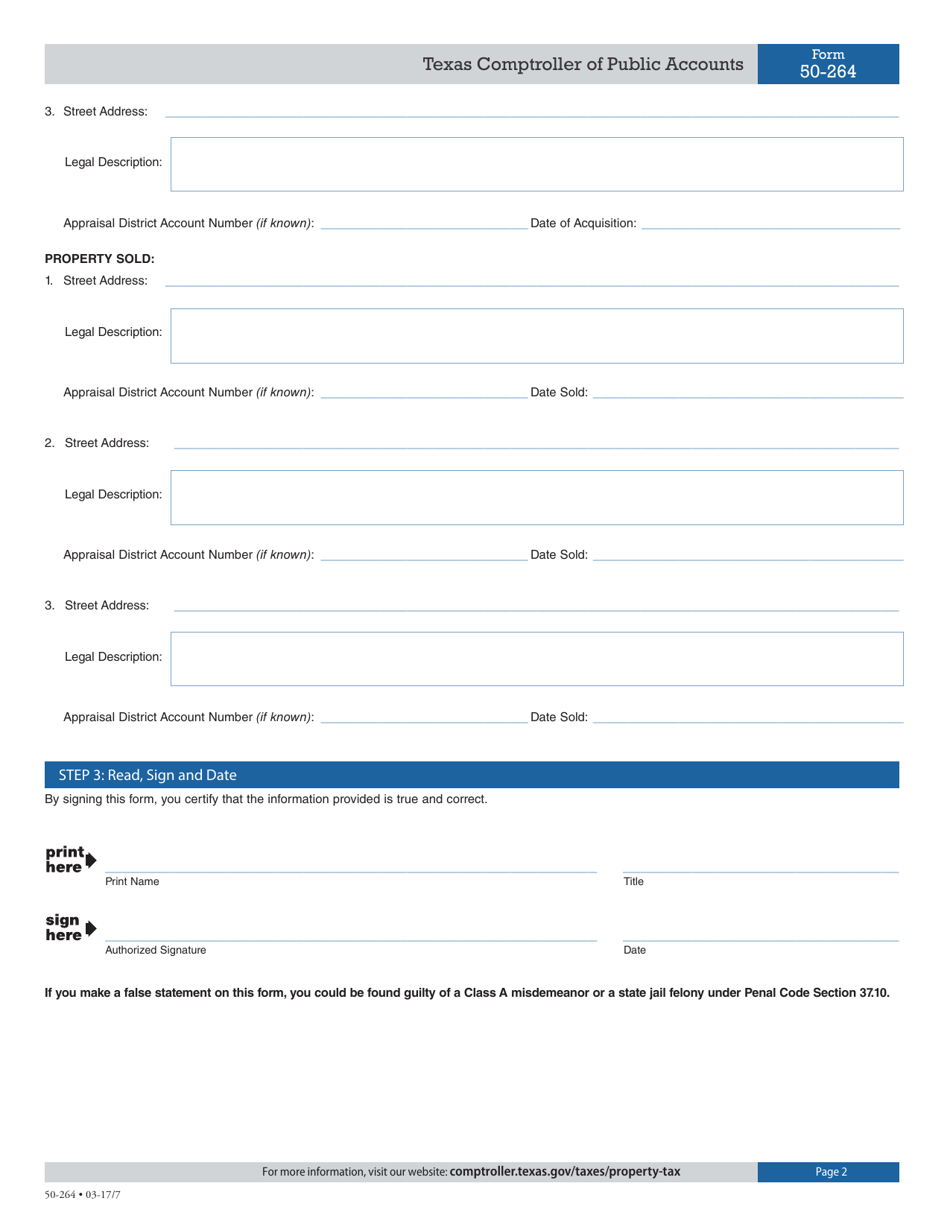

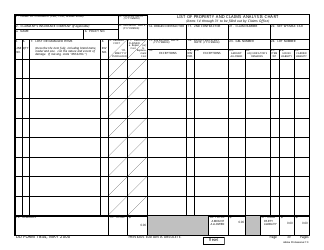

Form 50-264 List of Property Acquired or Sold " Tax Code Section 11.182 Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Previously Exempt - Texas

What Is Form 50-264?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-264?

A: Form 50-264 is a form used to list property acquired or sold.

Q: What is Tax Code Section 11.182?

A: Tax Code Section 11.182 is a section of the tax code related to community housing development organization improving property for low-income and moderate-income housing.

Q: What does the form cover?

A: The form covers property previously exempt in Texas.

Q: Who is eligible for the exemption?

A: Community housing development organizations improving property for low-income and moderate-income housing are eligible for the exemption.

Q: What is the purpose of the exemption?

A: The exemption encourages the development of affordable housing for low-income and moderate-income individuals in Texas.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-264 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.