This version of the form is not currently in use and is provided for reference only. Download this version of

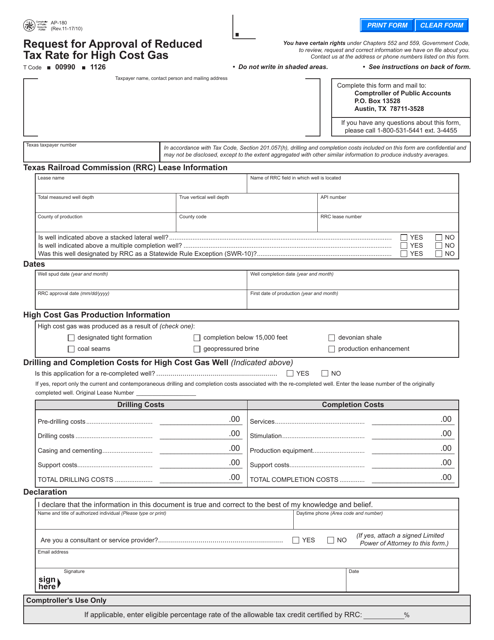

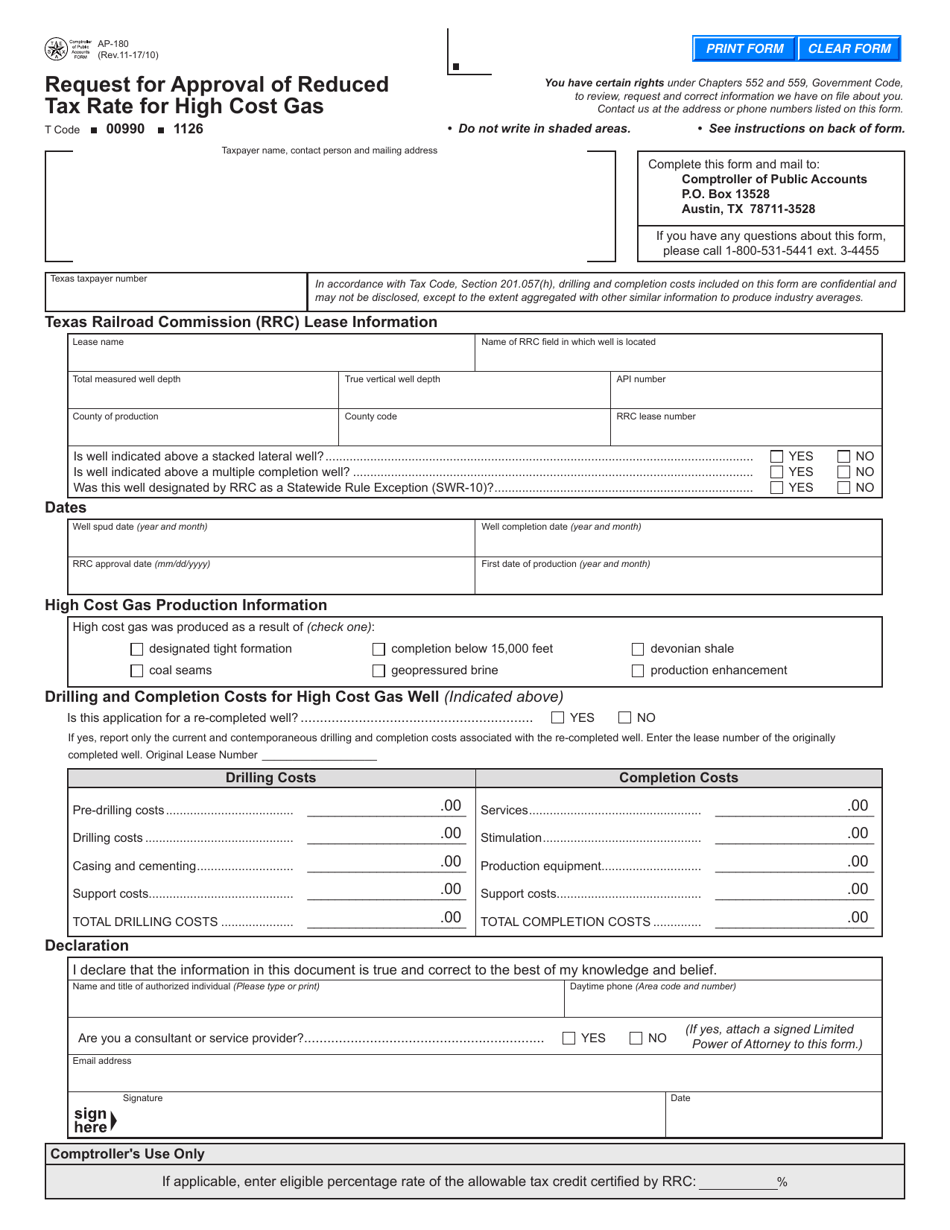

Form AP-180

for the current year.

Form AP-180 Request for Approval of Reduced Tax Rate for High Cost Gas - Texas

What Is Form AP-180?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AP-180?

A: Form AP-180 is a request for approval of reduced tax rate for high cost gas in Texas.

Q: What is the purpose of Form AP-180?

A: The purpose of Form AP-180 is to request approval for a reduced tax rate for high cost gas.

Q: Who needs to file Form AP-180?

A: Anyone who wants to apply for a reduced tax rate for high cost gas in Texas needs to file Form AP-180.

Q: What is high cost gas?

A: High cost gas refers to natural gas that has a high production cost due to factors such as deep drilling or difficult extraction.

Q: Are there any fees associated with filing Form AP-180?

A: No, there are no fees associated with filing Form AP-180.

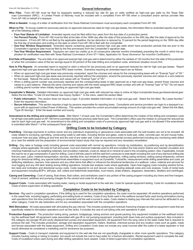

Q: What information is required on Form AP-180?

A: Form AP-180 requires information such as the taxpayer's name and address, the amount of gas produced, and the estimated production cost.

Q: What is the deadline for filing Form AP-180?

A: The deadline for filing Form AP-180 is the 25th day of the month following the reporting period.

Q: Is a reduced tax rate guaranteed upon filing Form AP-180?

A: No, the approval of a reduced tax rate is subject to review and approval by the Texas Comptroller of Public Accounts.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-180 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.