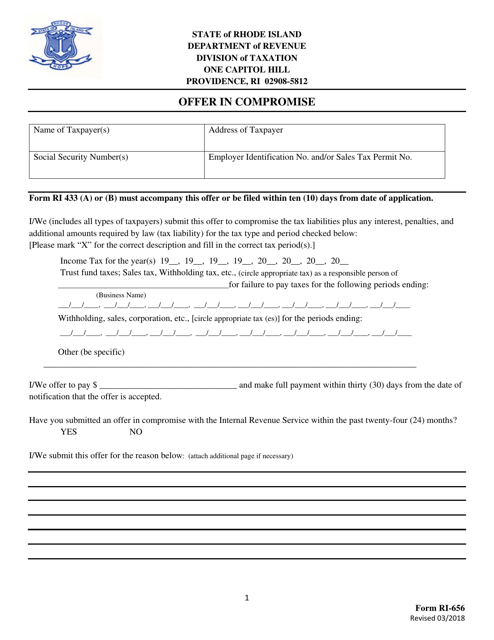

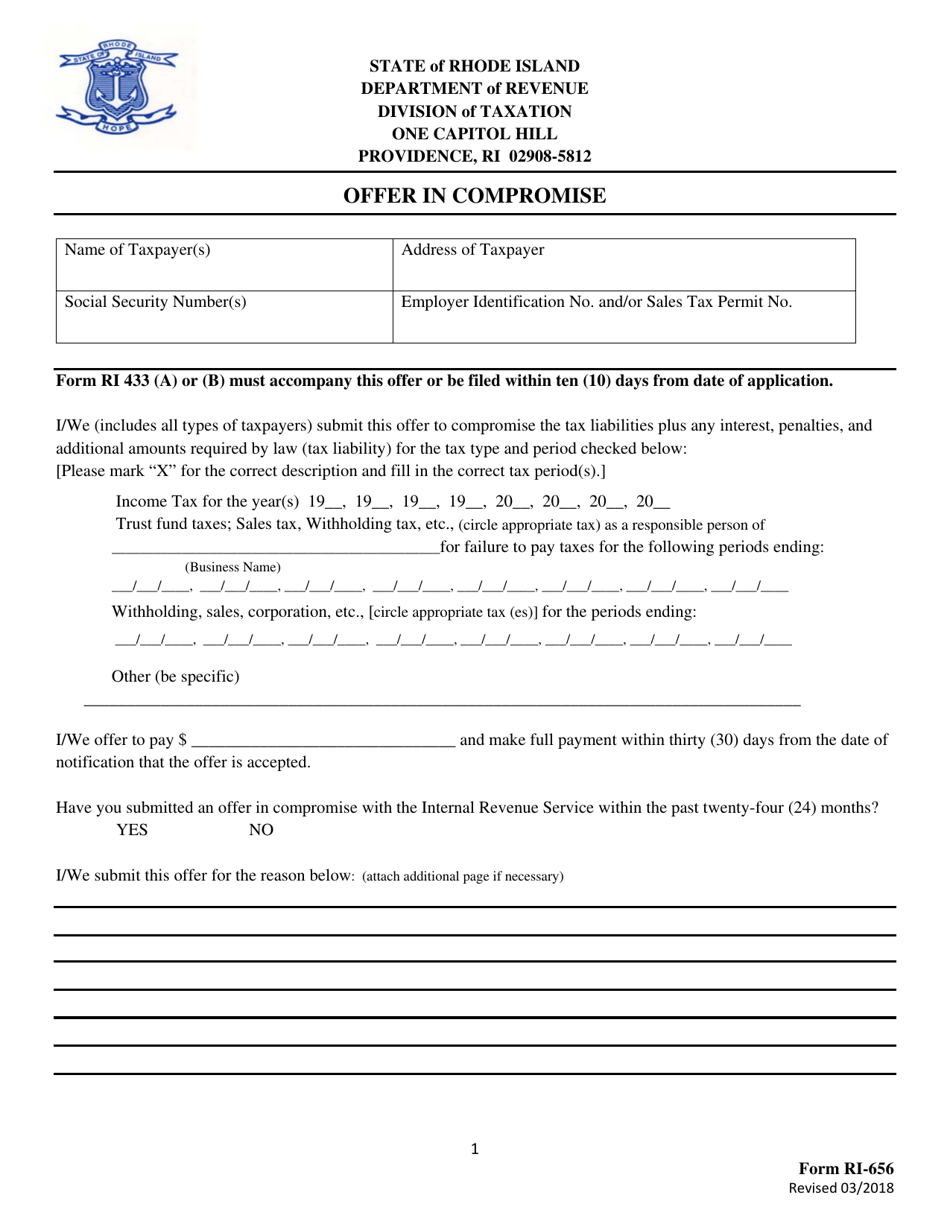

Form RI-656 Offer in Compromise - Rhode Island

What Is Form RI-656?

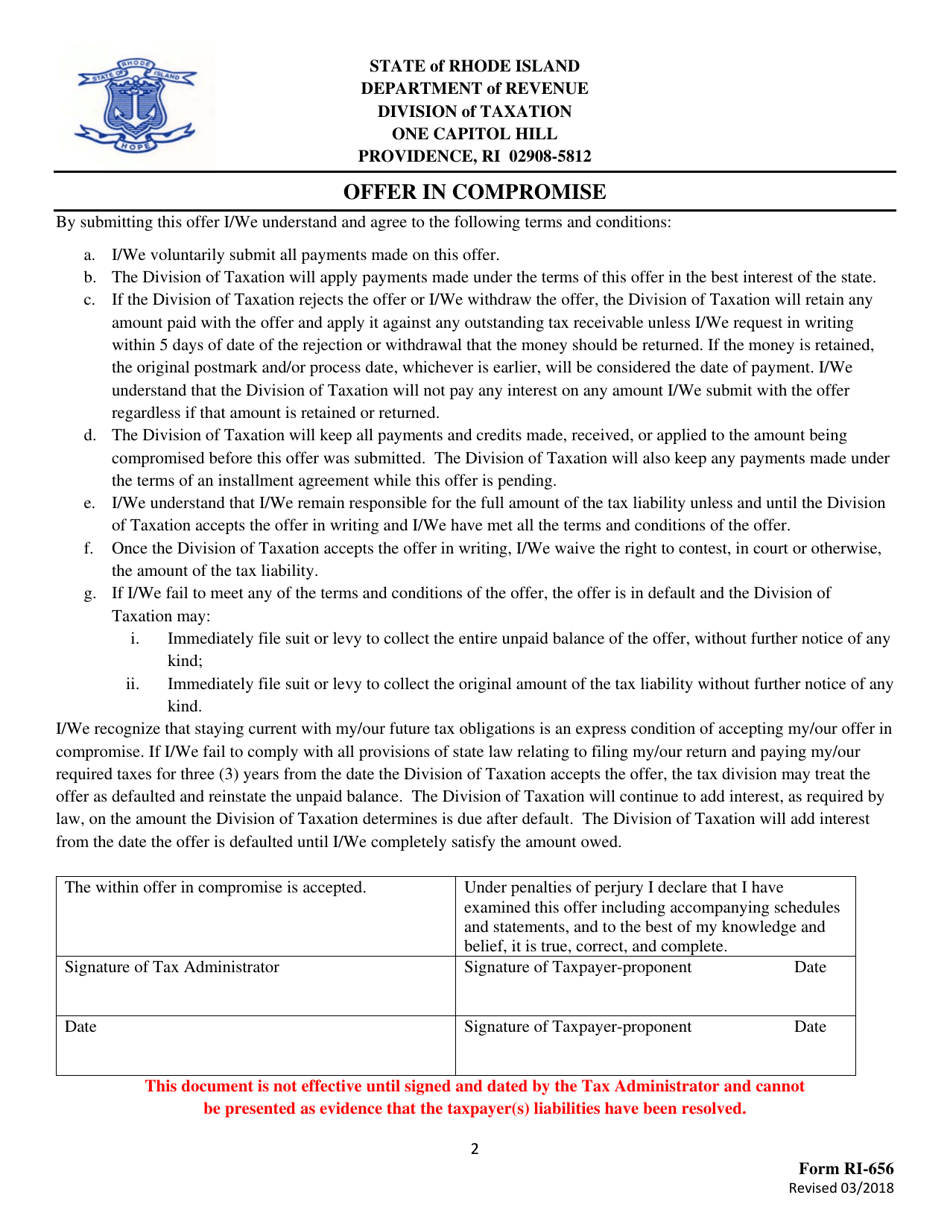

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-656 Offer in Compromise?

A: Form RI-656 Offer in Compromise is a document in the state of Rhode Island that allows taxpayers to propose a settlement to resolve their outstanding tax debt for less than the full amount owed.

Q: Who can use Form RI-656 Offer in Compromise?

A: Any individual or business who owes taxes to the state of Rhode Island can use Form RI-656 Offer in Compromise to propose a settlement.

Q: What is the purpose of Form RI-656 Offer in Compromise?

A: The purpose of Form RI-656 Offer in Compromise is to provide taxpayers with a way to settle their tax debt with the state of Rhode Island for less than the full amount owed.

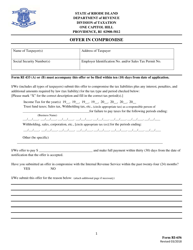

Q: How do I fill out Form RI-656 Offer in Compromise?

A: You must provide detailed information about your financial situation, including your income, expenses, assets, and liabilities. You must also propose a settlement amount and provide supporting documentation.

Q: Is there a fee for submitting Form RI-656 Offer in Compromise?

A: Yes, there is a non-refundable application fee of $100 for submitting Form RI-656 Offer in Compromise.

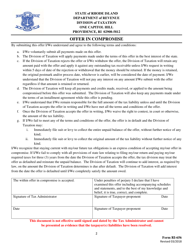

Q: What happens after I submit Form RI-656 Offer in Compromise?

A: The Rhode Island Division of Taxation will review your proposal and supporting documentation. They will then decide whether to accept or reject your offer.

Q: Can I appeal if my Form RI-656 Offer in Compromise is rejected?

A: Yes, you have the right to appeal the decision if your Form RI-656 Offer in Compromise is rejected. You must request an appeal within 30 days of receiving the rejection notice.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-656 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.