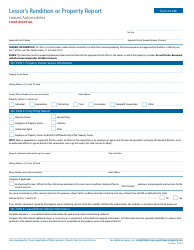

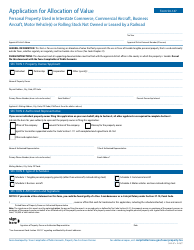

This version of the form is not currently in use and is provided for reference only. Download this version of

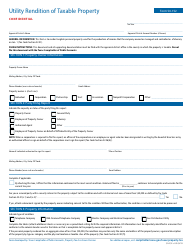

Form 50-145

for the current year.

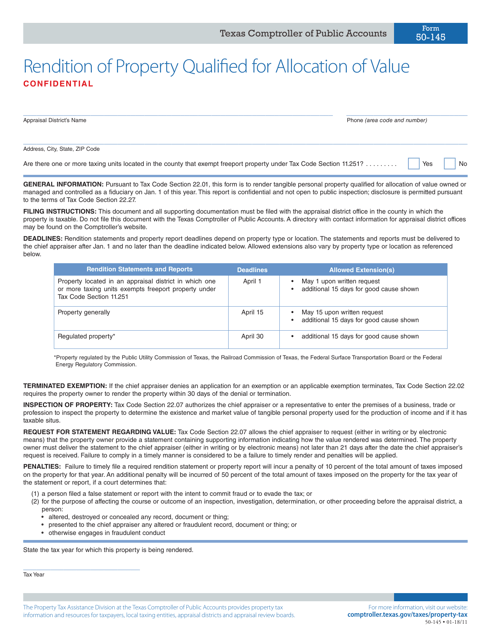

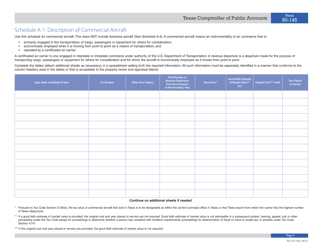

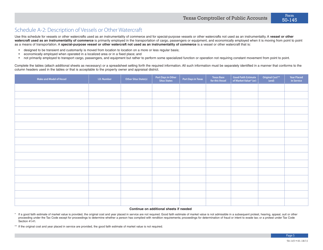

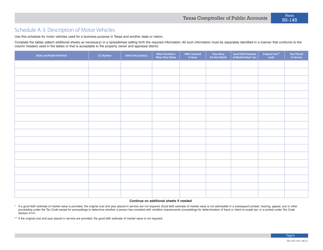

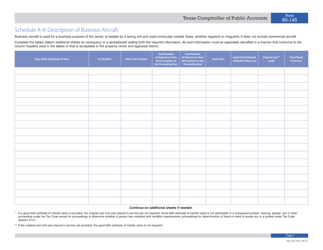

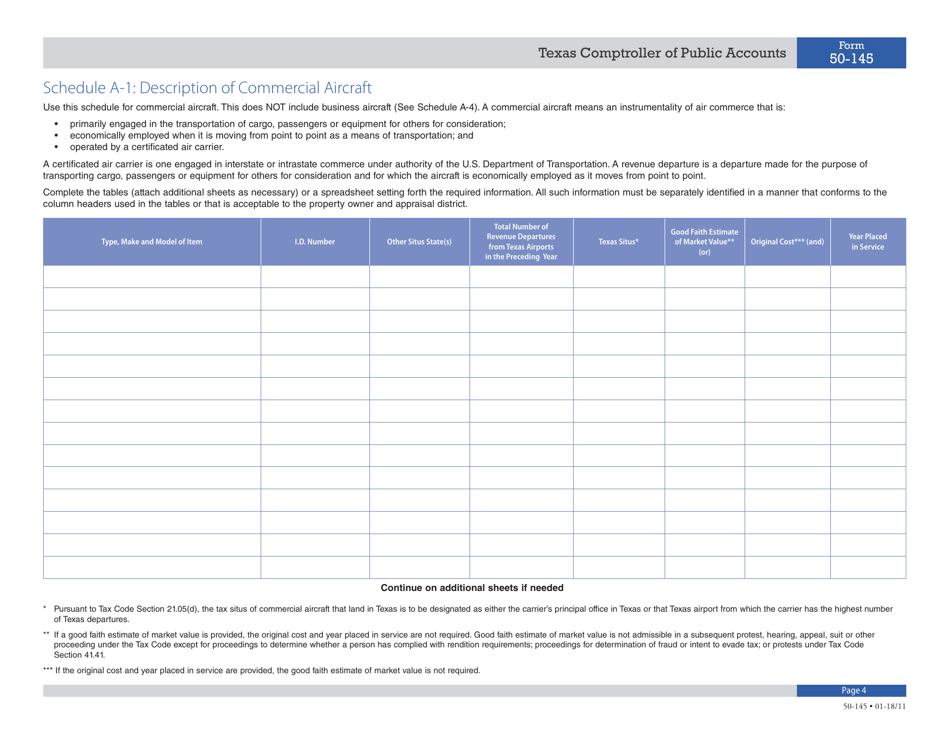

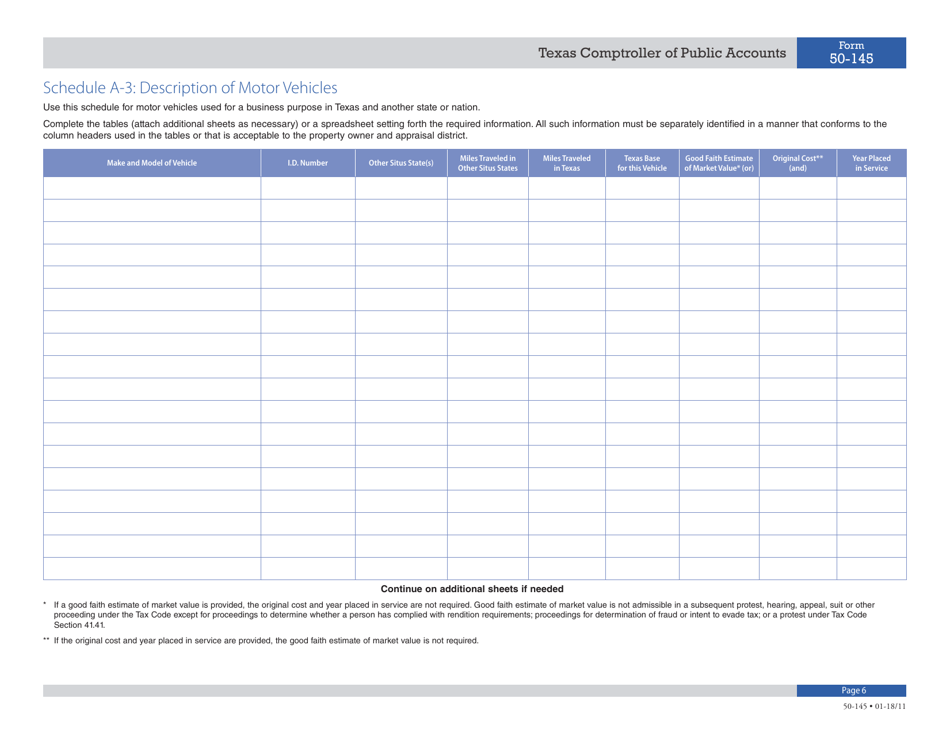

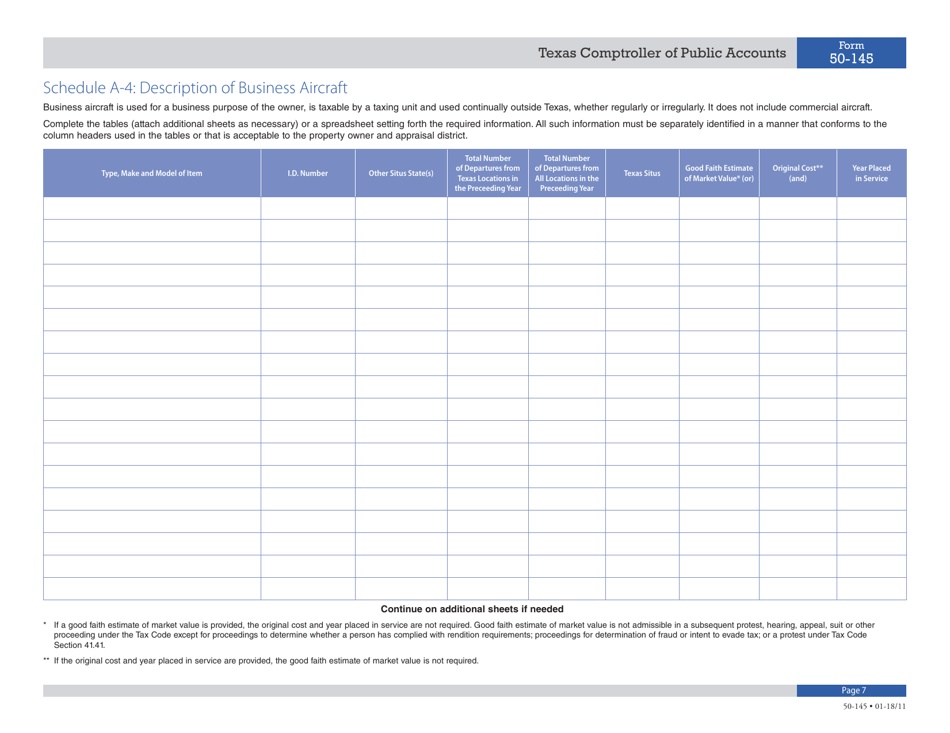

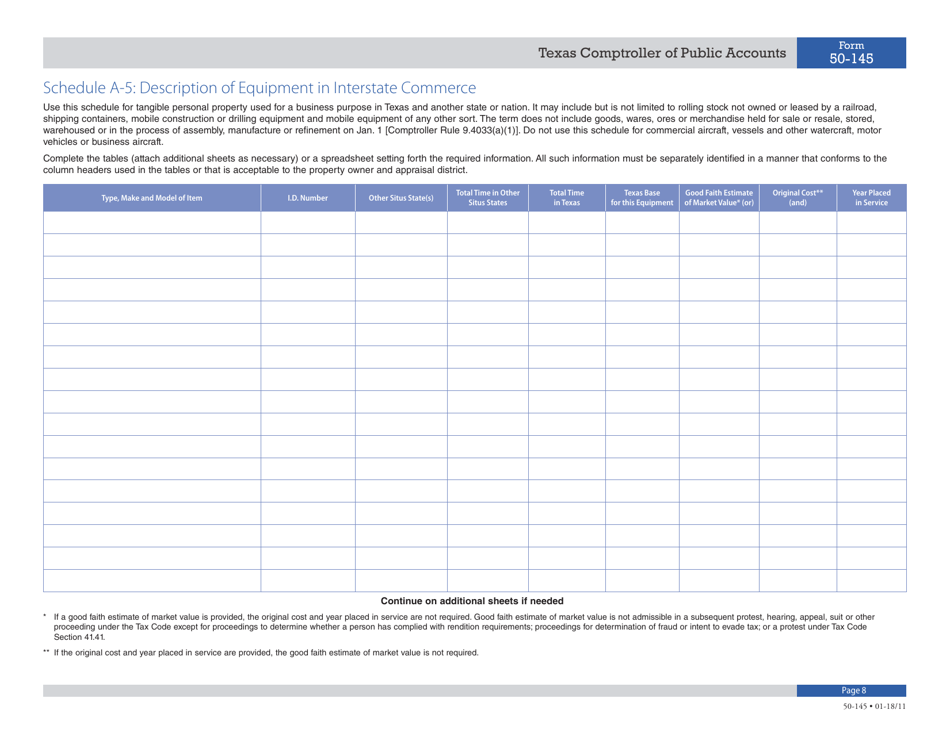

Form 50-145 Rendition of Property Qualified for Allocation of Value - Texas

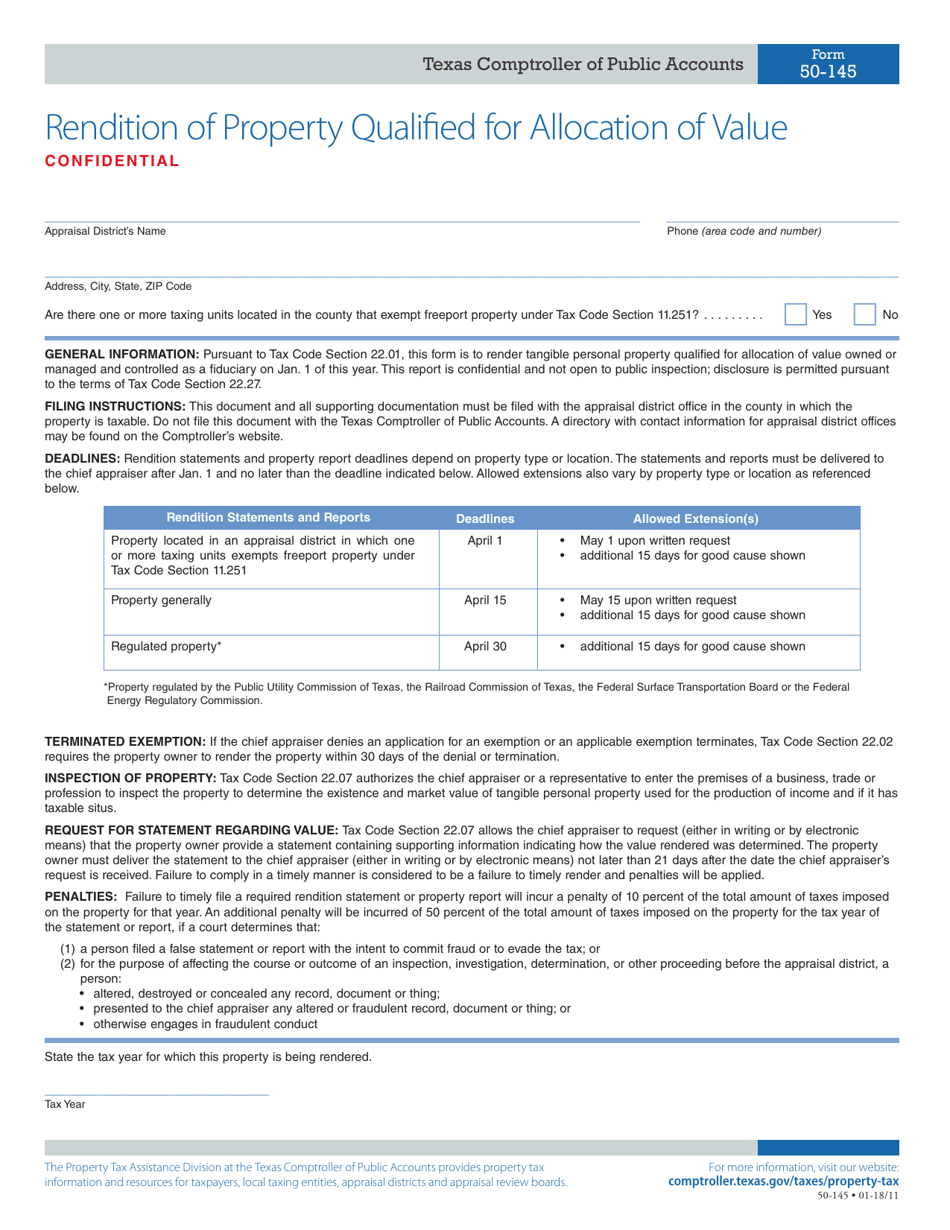

What Is Form 50-145?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

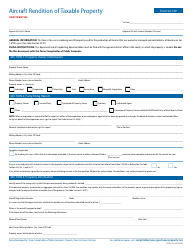

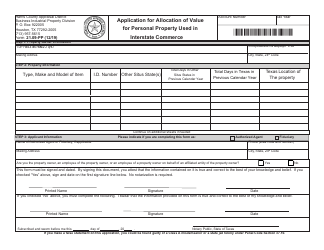

Q: What is Form 50-145?

A: Form 50-145 is the Rendition of Property Qualified for Allocation of Value in Texas.

Q: What is the purpose of Form 50-145?

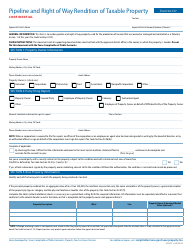

A: The purpose of Form 50-145 is to report property qualified for allocation of value for taxation in Texas.

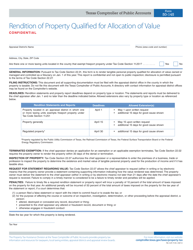

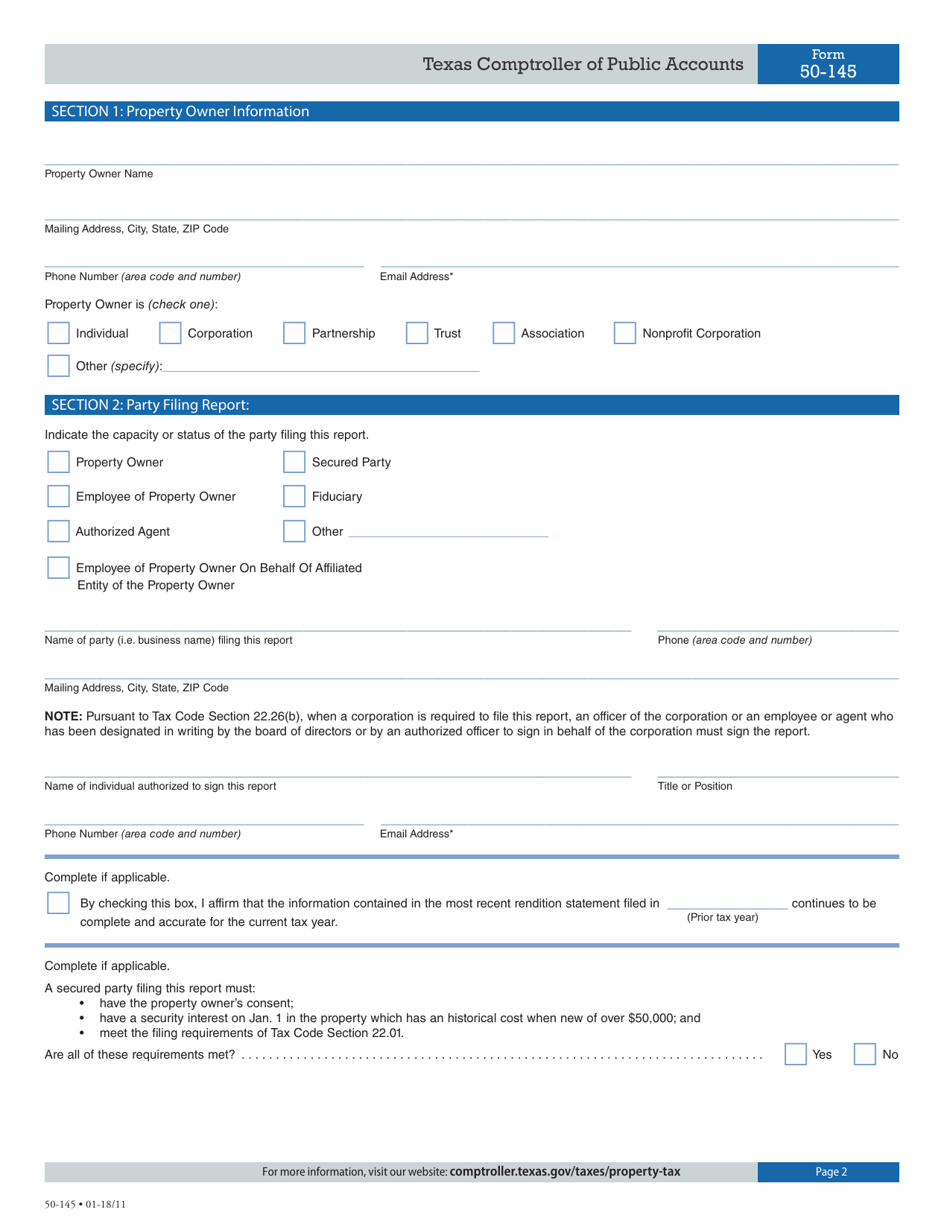

Q: Who needs to file Form 50-145?

A: Property owners in Texas who have property qualified for allocation of value need to file Form 50-145.

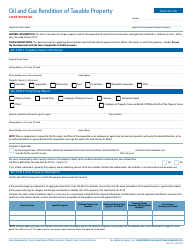

Q: When is Form 50-145 due?

A: Form 50-145 is due on April 15th of each year.

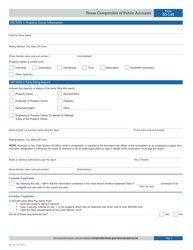

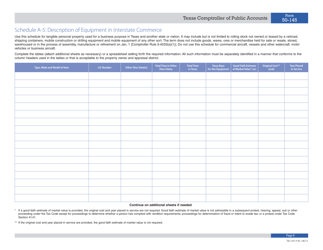

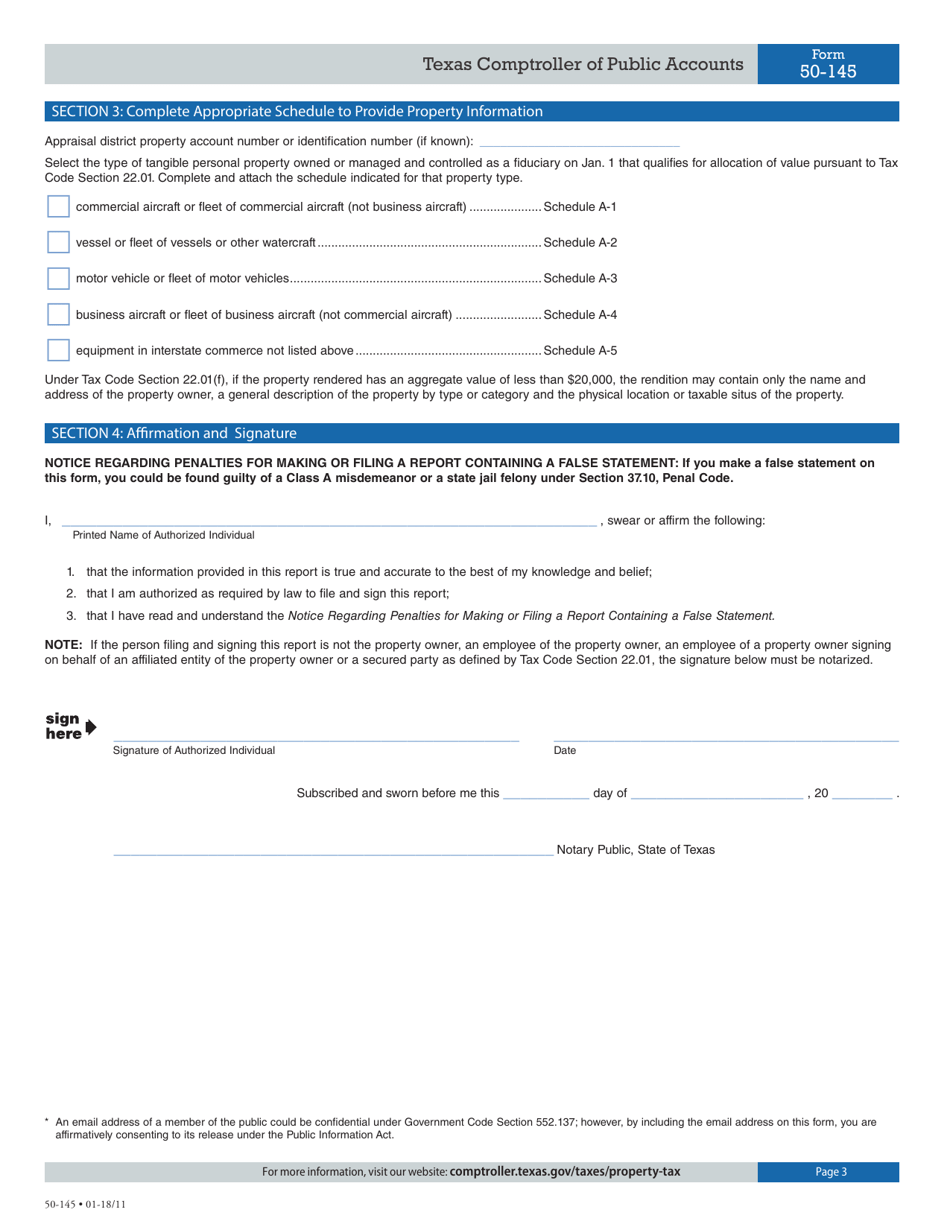

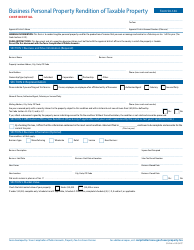

Q: What information is required on Form 50-145?

A: Form 50-145 requires information about the property owner, property description, and other details related to the qualified property.

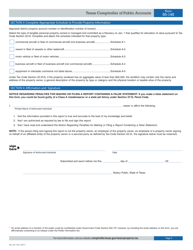

Q: Are there any penalties for late or non-filing of Form 50-145?

A: Yes, there can be penalties for late or non-filing of Form 50-145, including additional taxes and interest.

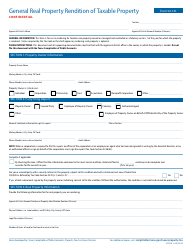

Q: What happens after I file Form 50-145?

A: After filing Form 50-145, the appraisal district will review the information and determine the value of the qualified property for taxation purposes.

Form Details:

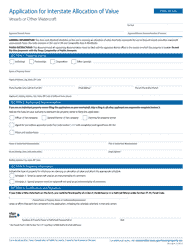

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-145 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.