This version of the form is not currently in use and is provided for reference only. Download this version of

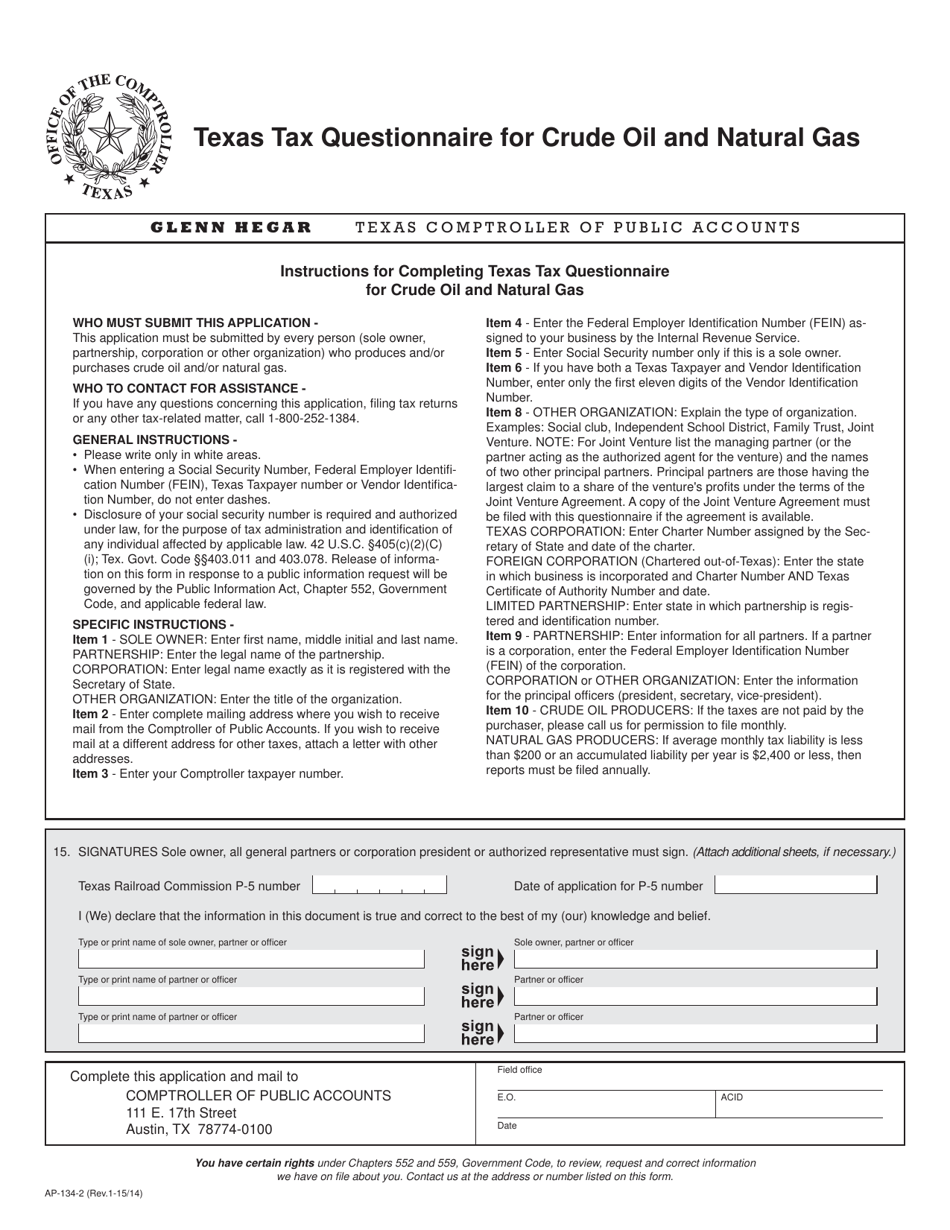

Form AP-134

for the current year.

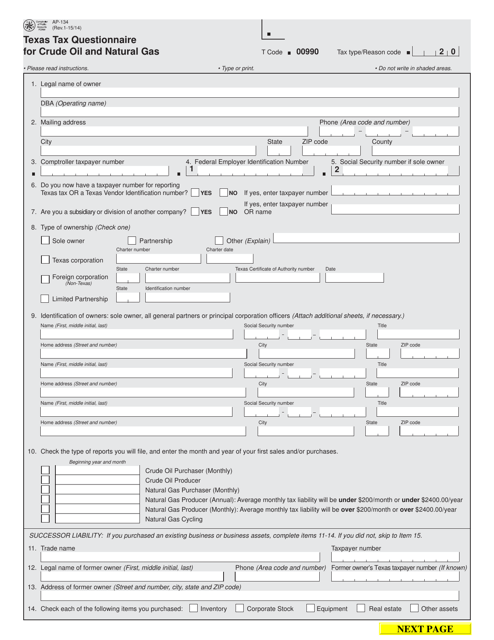

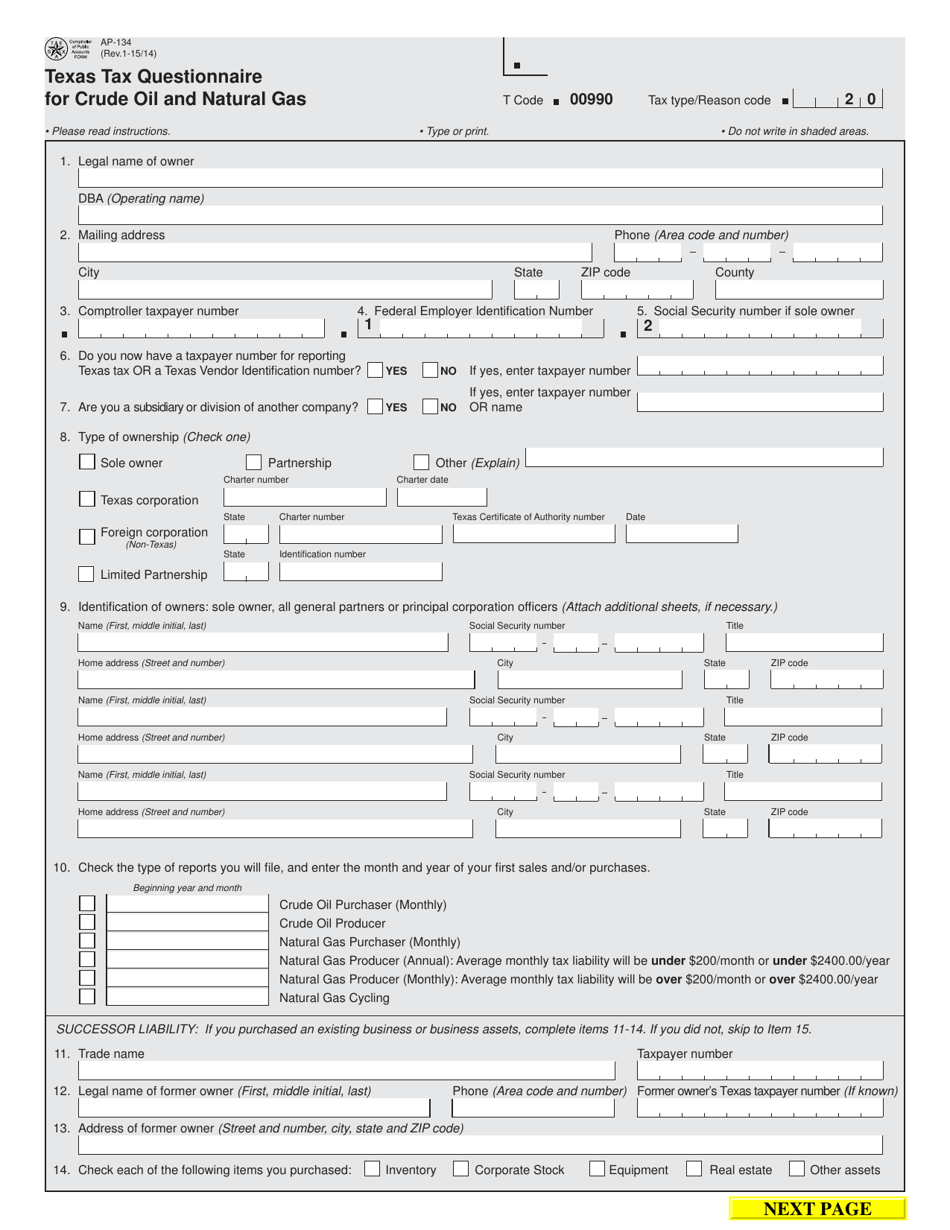

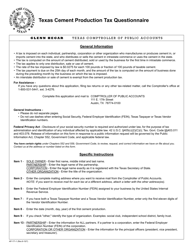

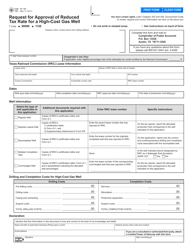

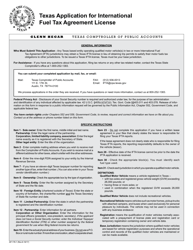

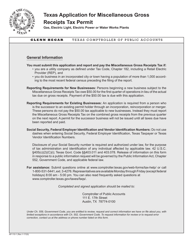

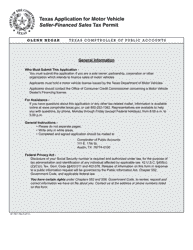

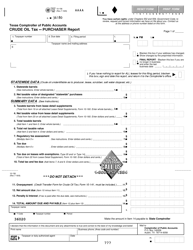

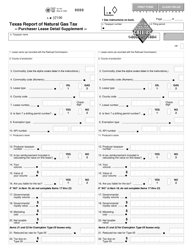

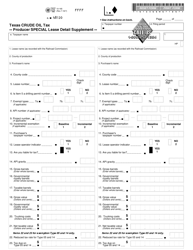

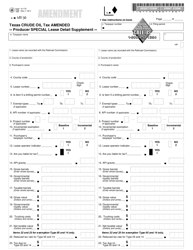

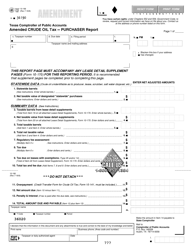

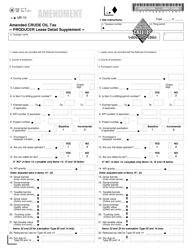

Form AP-134 Texas Tax Questionnaire for Crude Oil and Natural Gas - Texas

What Is Form AP-134?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-134?

A: Form AP-134 is a Texas Tax Questionnaire for Crude Oil and Natural Gas.

Q: Who needs to file Form AP-134?

A: Entities involved in the production or processing of crude oil and natural gas in Texas need to file Form AP-134.

Q: What information is required on Form AP-134?

A: Form AP-134 requires the entity's name, address, owner/operator information, production and processing details, and other related information.

Q: When is Form AP-134 due?

A: Form AP-134 is due by the last day of the month following the end of the calendar quarter.

Q: Are there any penalties for not filing Form AP-134?

A: Yes, there are penalties for failure to file or for filing false or incomplete information on Form AP-134. It is important to file the form accurately and on time.

Q: Do I need to attach any other documents with Form AP-134?

A: Depending on your specific situation, you may need to attach supporting documentation, such as production reports or lease agreements, with Form AP-134. Consult the instructions provided with the form for more details.

Q: Is Form AP-134 only for entities in Texas?

A: Yes, Form AP-134 is specific to entities involved in the production or processing of crude oil and natural gas in Texas.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-134 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.