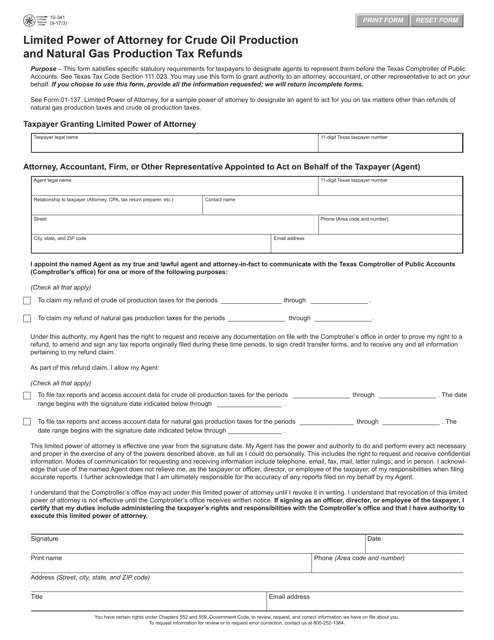

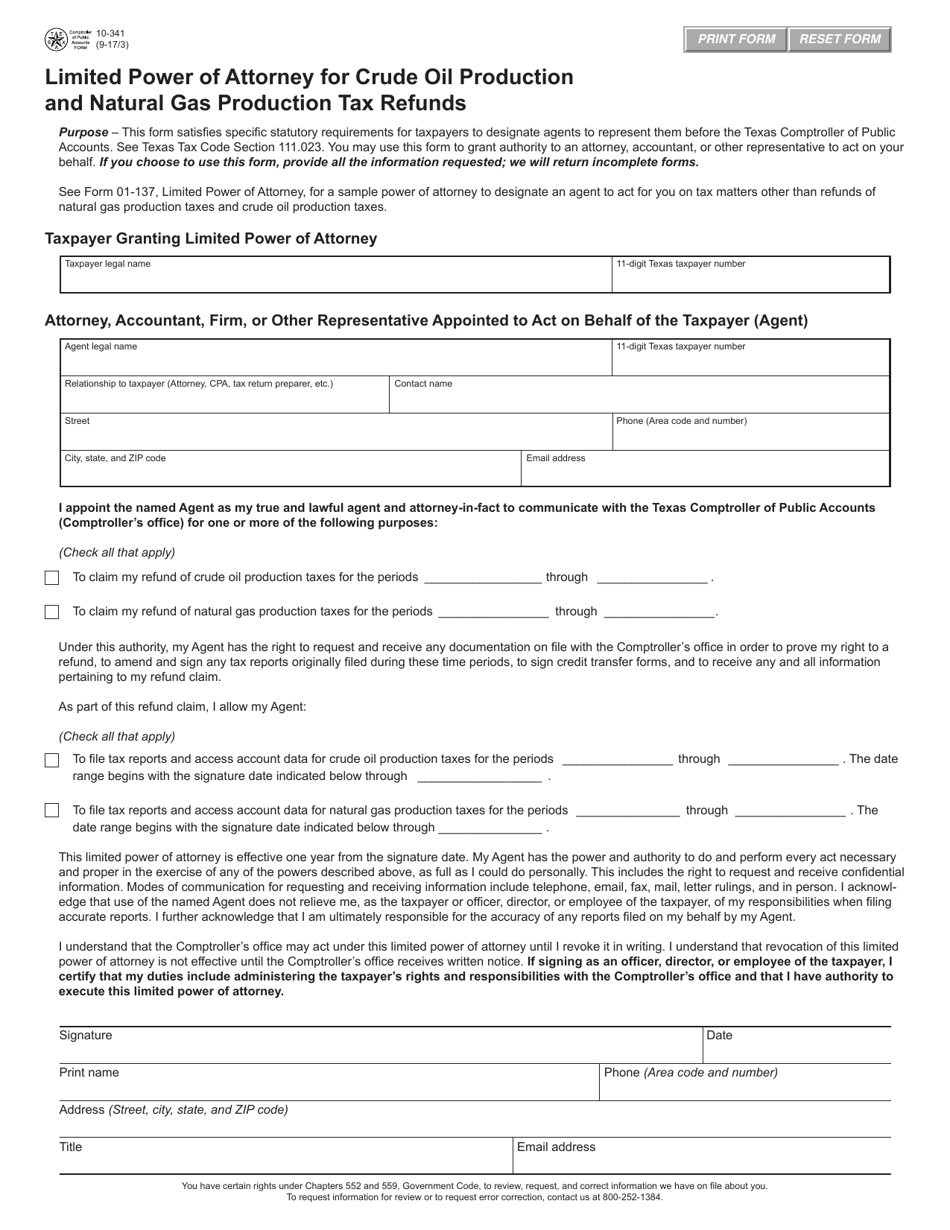

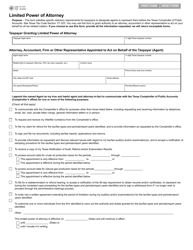

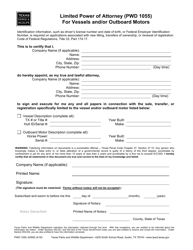

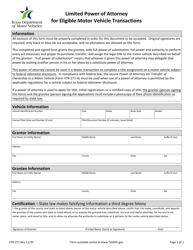

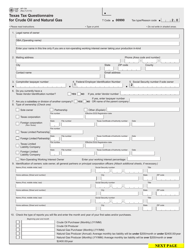

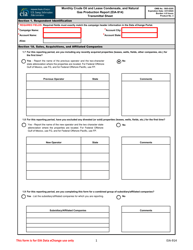

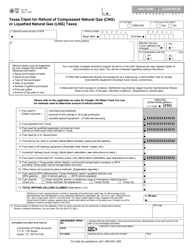

Form 10-341 Limited Power of Attorney for Crude Oil Production and Natural Gas Production Tax Refunds - Texas

What Is Form 10-341?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-341?

A: Form 10-341 is a Limited Power of Attorney for Crude Oil Production and Natural GasProduction Tax Refunds in Texas.

Q: What is the purpose of Form 10-341?

A: The purpose of Form 10-341 is to authorize someone to act as your agent and handle the refund process for crude oil and natural gas production taxes in Texas.

Q: Who can use Form 10-341?

A: Form 10-341 can be used by individuals or entities who are eligible for crude oil and natural gas production tax refunds in Texas.

Q: Do I have to pay a fee to file Form 10-341?

A: No, there is no fee required to file Form 10-341.

Q: Can I revoke a Limited Power of Attorney granted through Form 10-341?

A: Yes, you can revoke a Limited Power of Attorney by submitting a written revocation to the Texas Comptroller of Public Accounts.

Q: How long does it take to process a refund using Form 10-341?

A: Processing times may vary, but typically it takes around 30 to 60 days to process refunds.

Q: Are there any specific requirements for completing Form 10-341?

A: Yes, you must provide accurate and complete information on the form, including your name, address, taxpayer number, and the name of your authorized agent.

Q: Can I use Form 10-341 for other types of tax refunds?

A: No, Form 10-341 is specifically for crude oil and natural gas production tax refunds in Texas.

Q: What should I do if I have further questions or need assistance with Form 10-341?

A: If you have further questions or need assistance, you can contact the Texas Comptroller of Public Accounts for help.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-341 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.