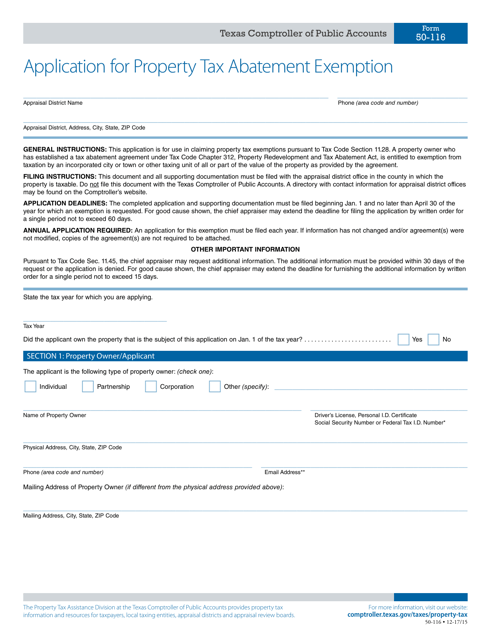

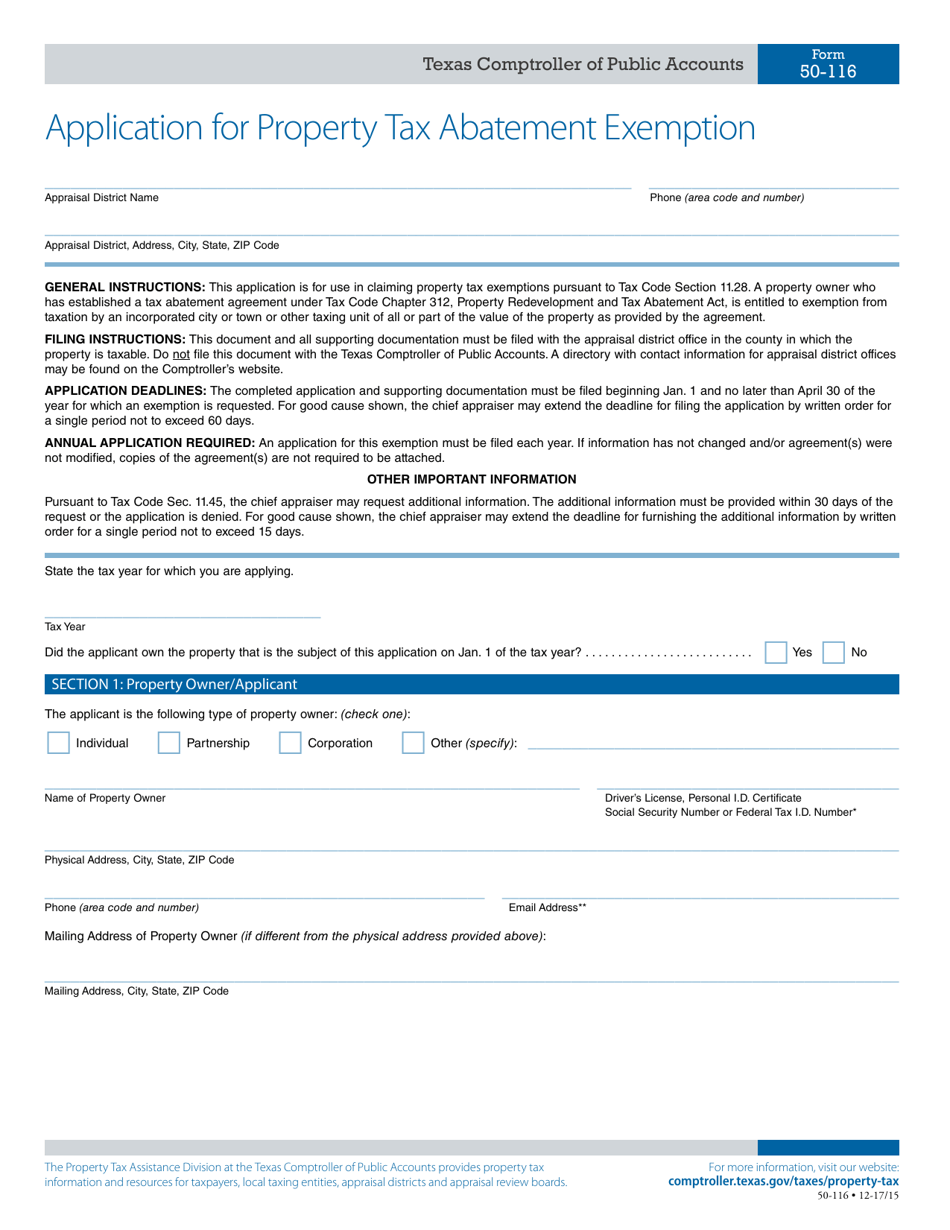

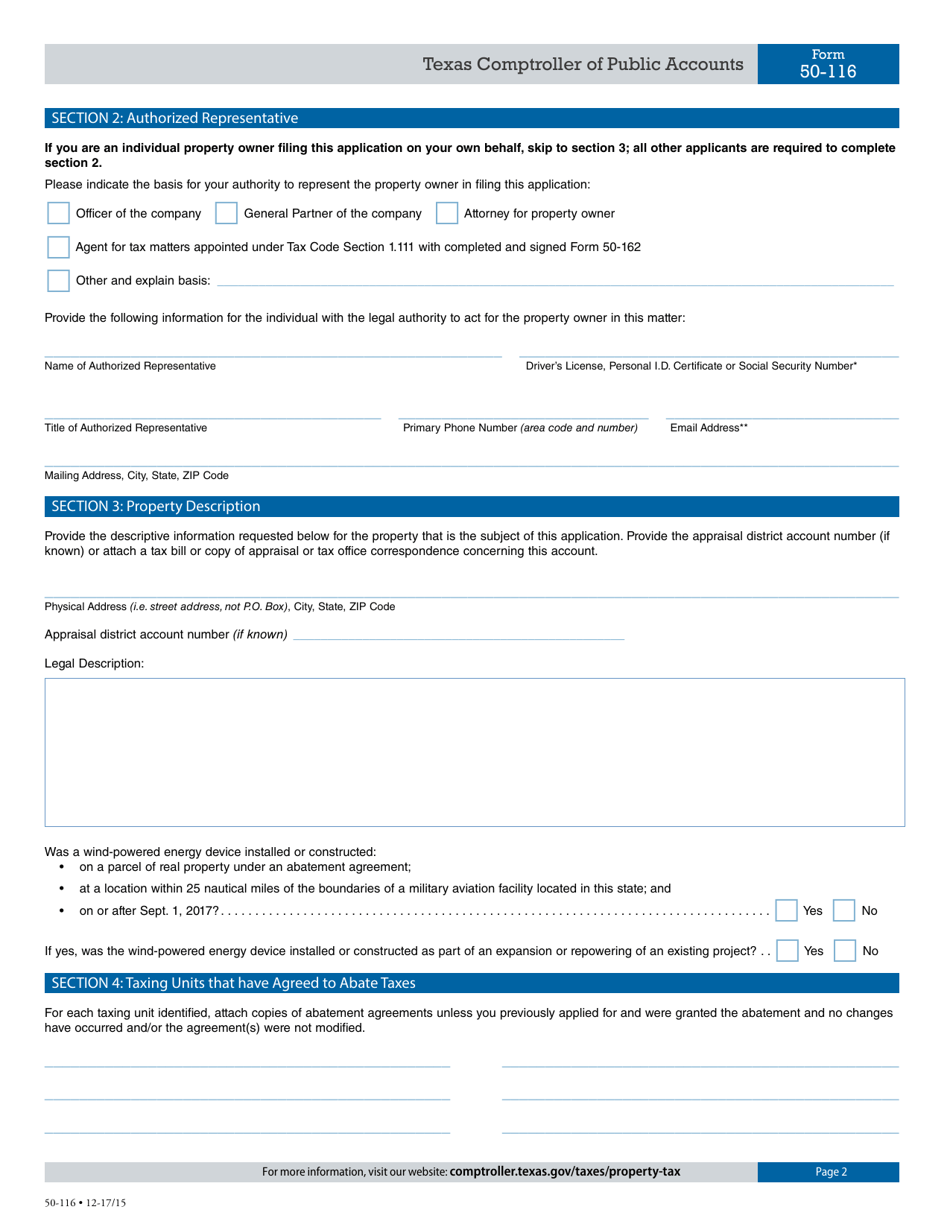

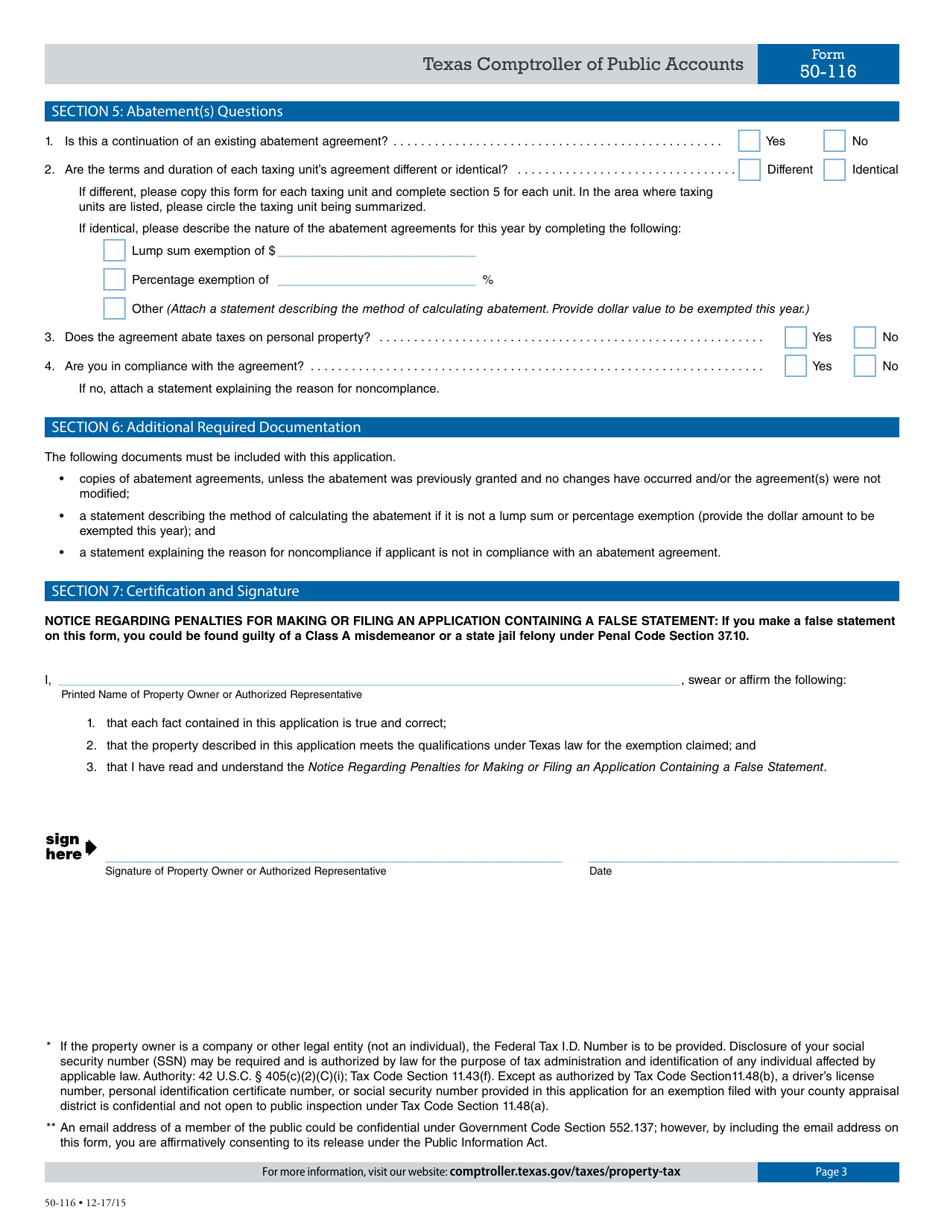

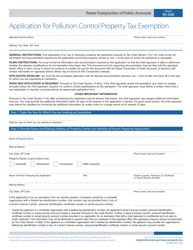

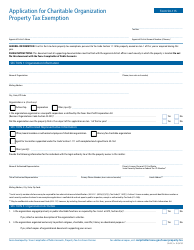

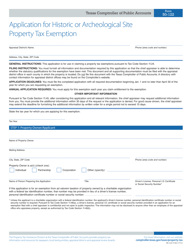

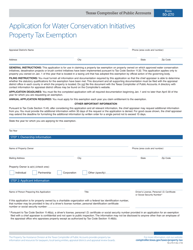

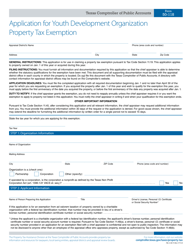

Form 50-116 Application for Property Tax Abatement Exemption - Texas

What Is Form 50-116?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-116?

A: Form 50-116 is the Application for Property Tax Abatement Exemption in Texas.

Q: What is a property tax abatement exemption?

A: A property tax abatement exemption is a reduction or exemption from property taxes for certain types of properties in Texas.

Q: Who is eligible to file Form 50-116?

A: Property owners who meet the eligibility requirements specified by the Texas Comptroller's office may file Form 50-116.

Q: What types of properties may qualify for the abatement exemption?

A: Certain types of properties such as renewable energy facilities, pollution control property, and certain new economic development projects may qualify for the abatement exemption.

Q: What information is required to be provided on Form 50-116?

A: Form 50-116 requires information about the property, the property owner, and the type of exemption being claimed.

Q: When should Form 50-116 be filed?

A: Form 50-116 should be filed with the local appraisal district by April 30th of the tax year for which the exemption is sought.

Q: Is there a fee to file Form 50-116?

A: There is no fee to file Form 50-116.

Q: What happens after filing Form 50-116?

A: After filing Form 50-116, the local appraisal district will review the application and determine the eligibility for the abatement exemption.

Q: Can the abatement exemption be renewed?

A: In some cases, the abatement exemption may be renewed for subsequent years if the property continues to meet the eligibility requirements.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-116 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.