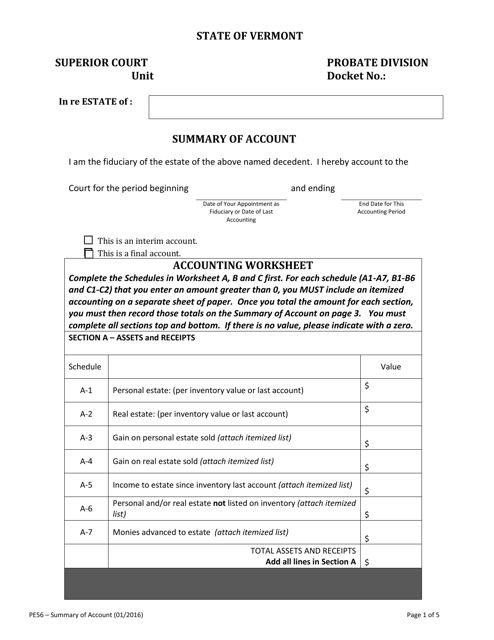

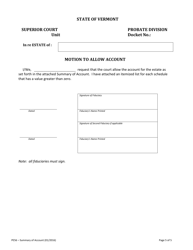

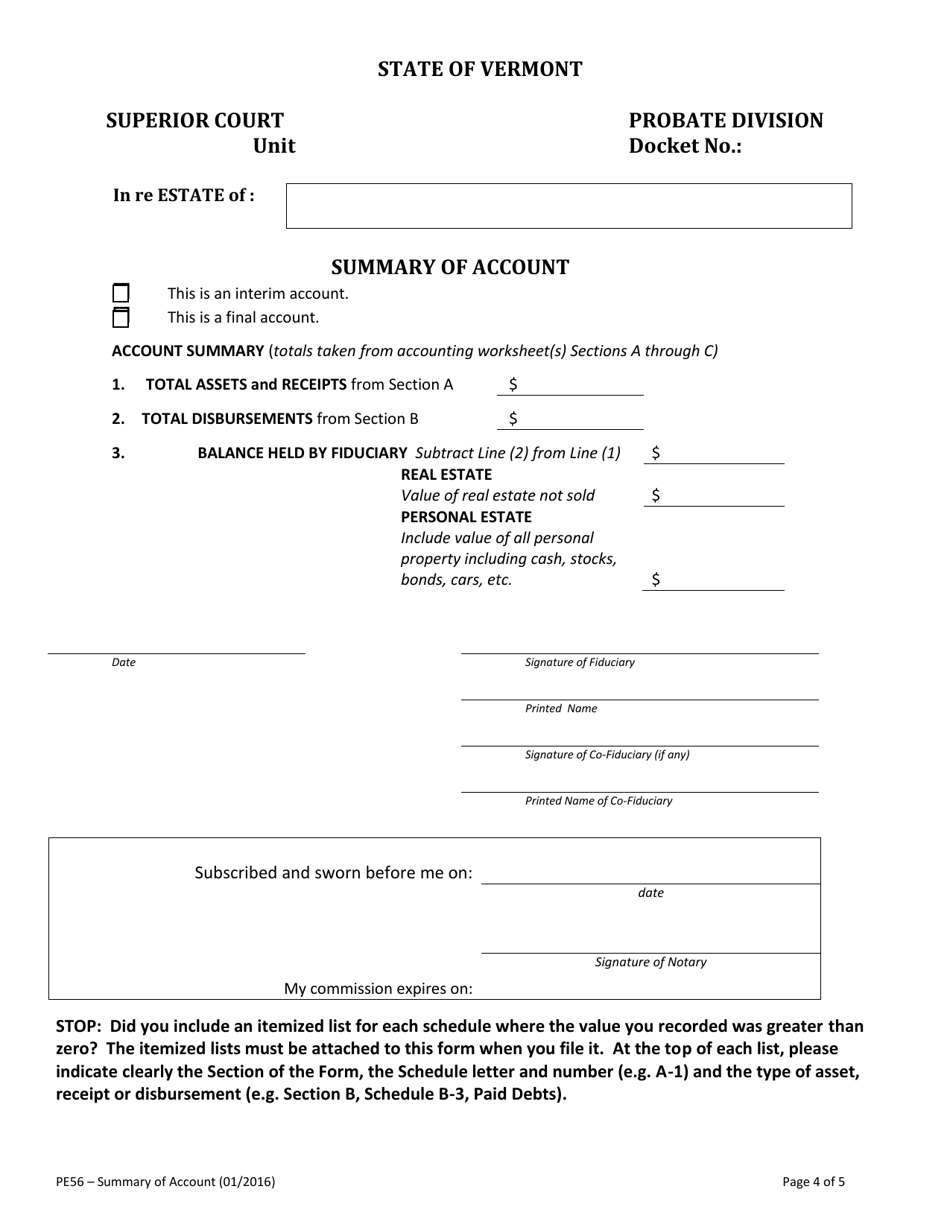

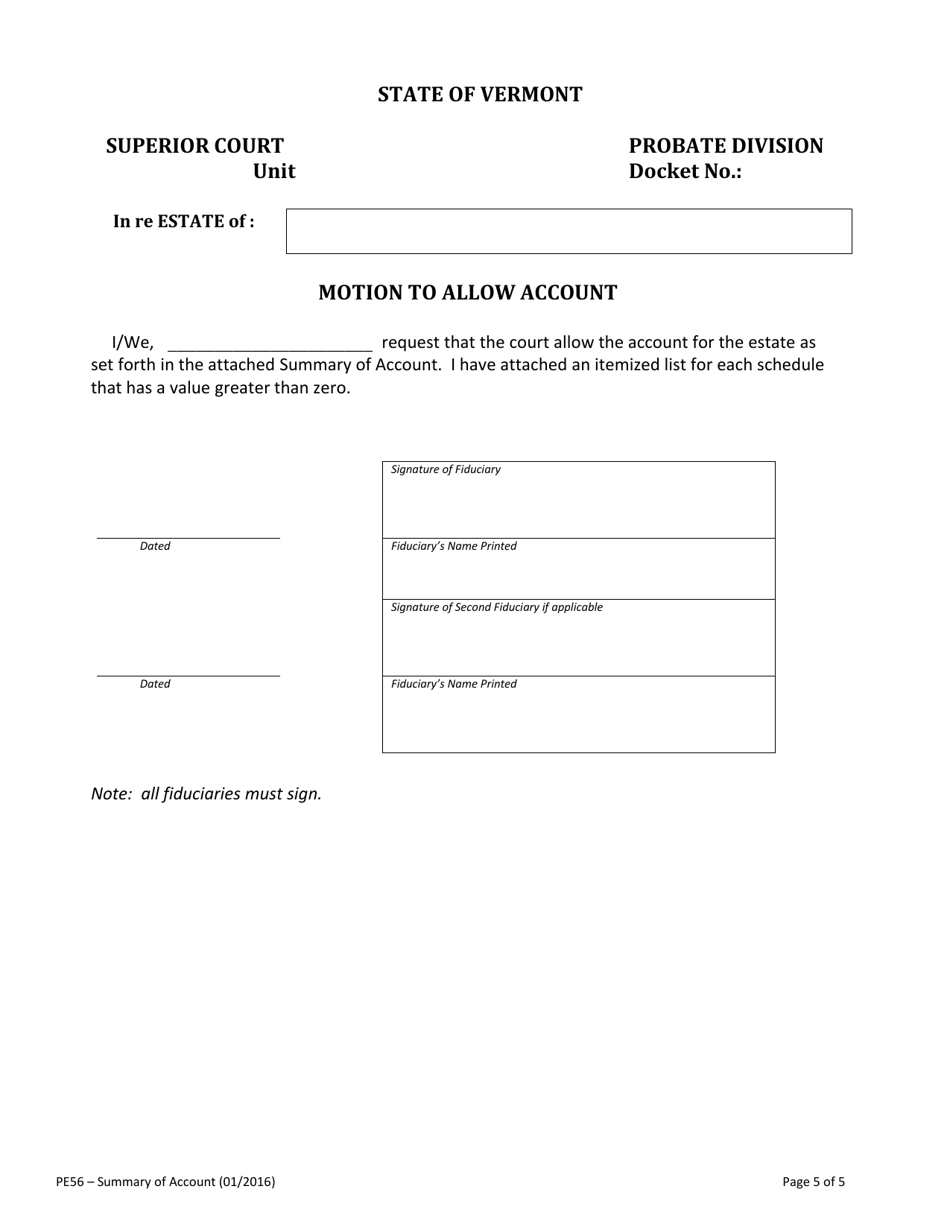

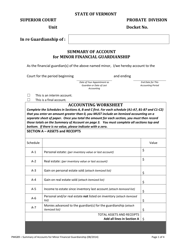

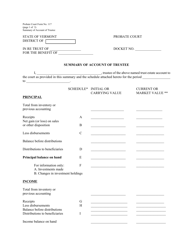

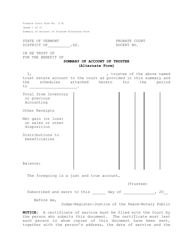

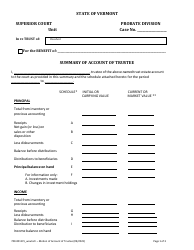

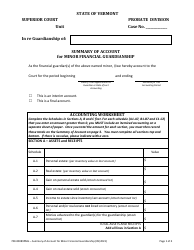

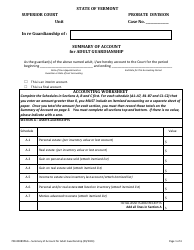

Form PE56 Summary of Account - Vermont

What Is Form PE56?

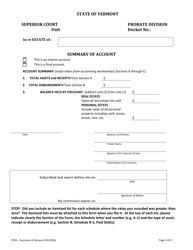

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE56?

A: Form PE56 is a Summary of Account for Vermont.

Q: What is the purpose of Form PE56?

A: The purpose of Form PE56 is to summarize account activity in Vermont.

Q: Who needs to file Form PE56?

A: Any individual or business with account activity in Vermont needs to file Form PE56.

Q: When is Form PE56 due?

A: Form PE56 is due on the 15th day of the month following the end of the reporting period.

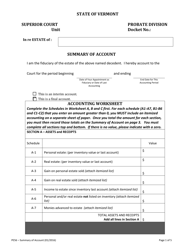

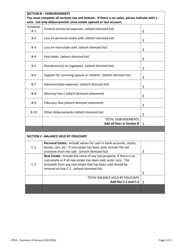

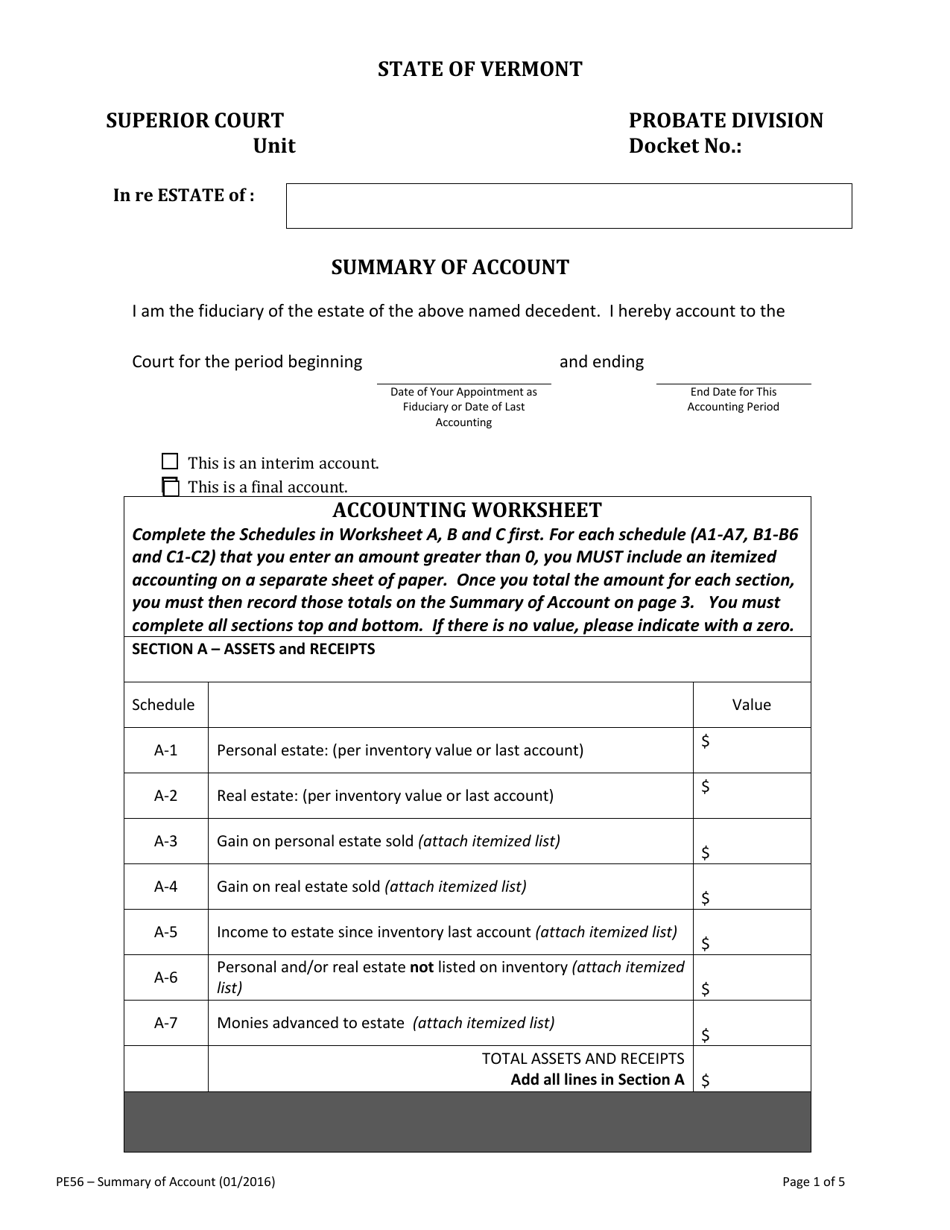

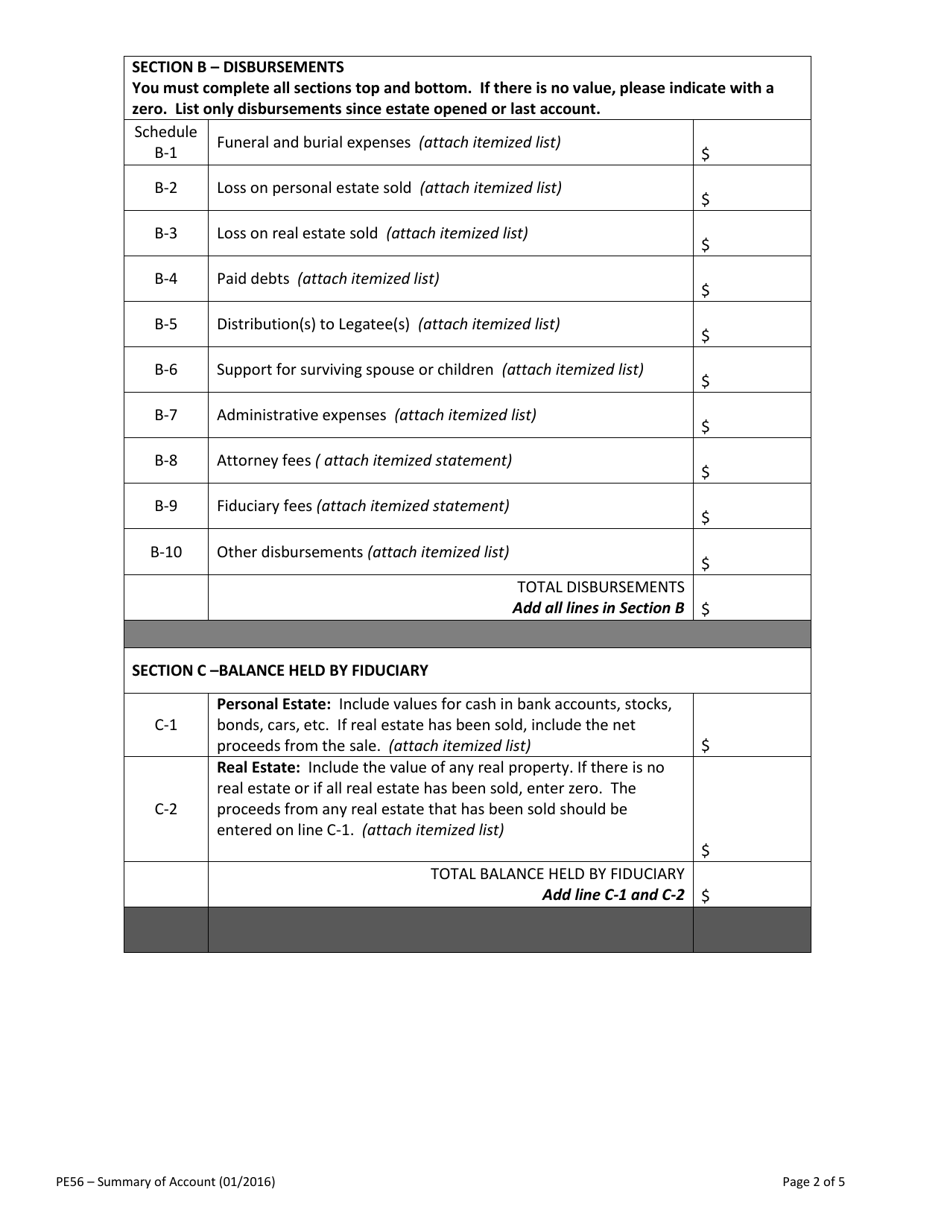

Q: What information is required on Form PE56?

A: Form PE56 requires information such as account balances, financial activity, and taxpayer information.

Q: Is there a penalty for not filing Form PE56?

A: Yes, there may be penalties for not filing Form PE56 or filing it late.

Q: Are there any exemptions to filing Form PE56?

A: Certain taxpayers may be exempt from filing Form PE56. It is best to consult the Vermont Department of Taxes for specific exemptions.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE56 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.