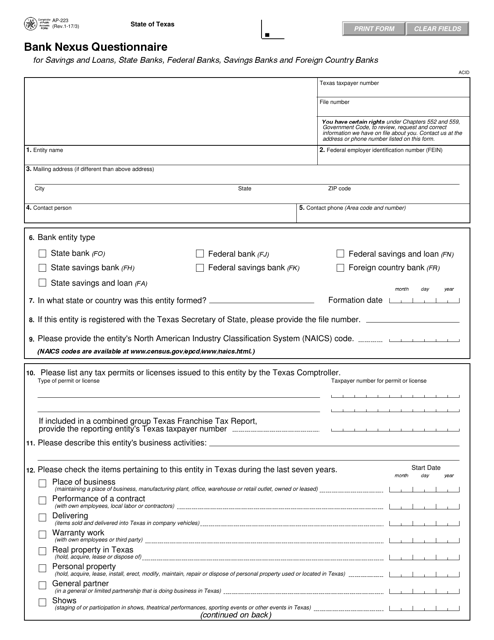

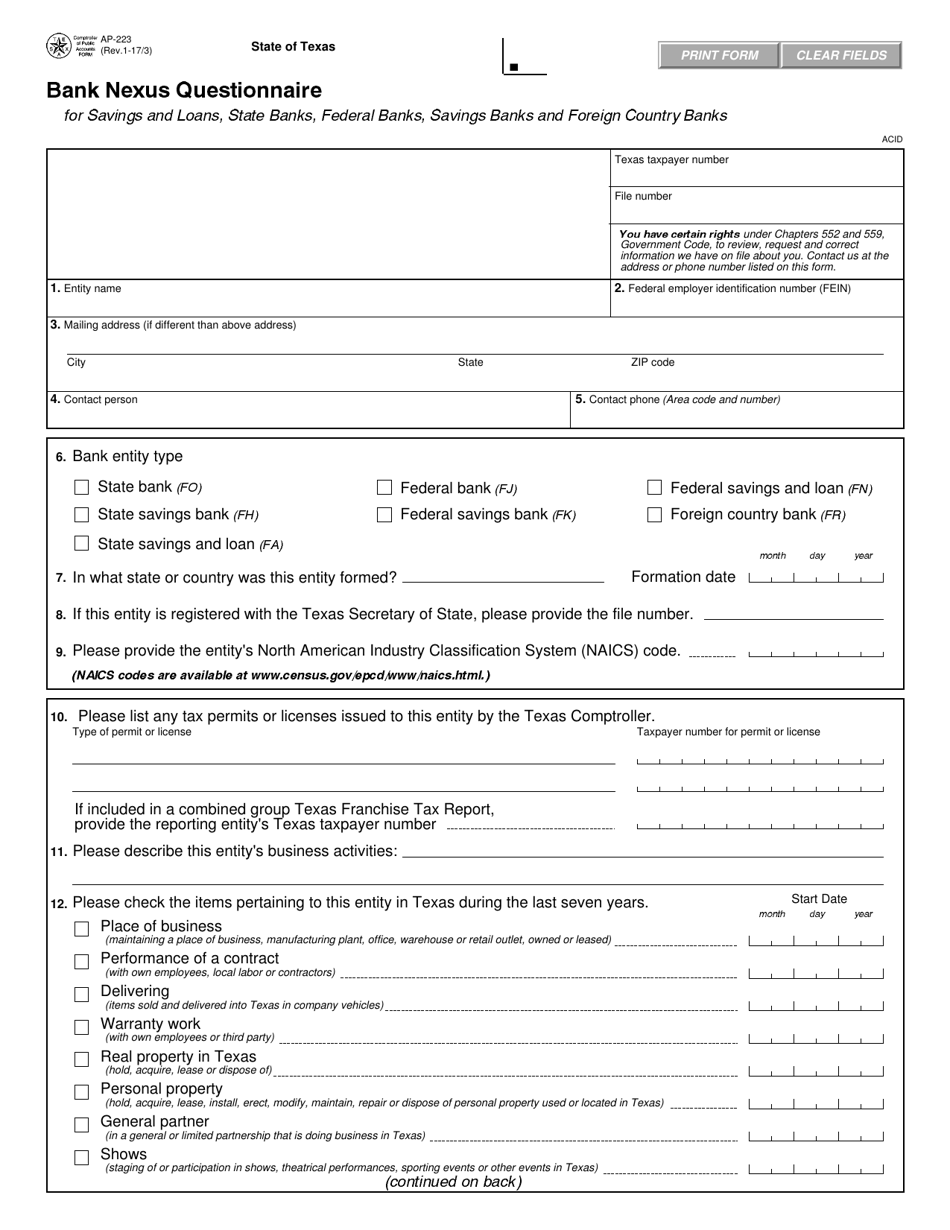

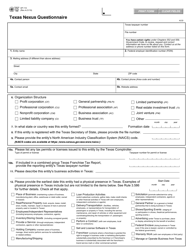

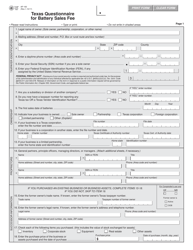

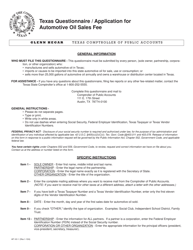

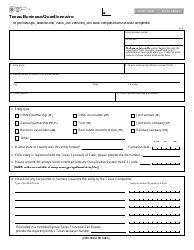

Form AP-223 Bank Nexus Questionnaire - Texas

What Is Form AP-223?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-223?

A: Form AP-223 is a Bank Nexus Questionnaire.

Q: What is the purpose of Form AP-223?

A: The purpose of Form AP-223 is to determine if a bank has nexus in Texas.

Q: What is nexus?

A: Nexus refers to a connection or presence that a business has in a particular jurisdiction, such as Texas.

Q: Why is bank nexus important?

A: Bank nexus is important because it determines if a bank is subject to certain state laws and regulations in Texas.

Q: Who needs to fill out Form AP-223?

A: Banks that operate or have a presence in Texas need to fill out Form AP-223.

Q: When is Form AP-223 due?

A: The due date for Form AP-223 varies and is typically specified by the Texas Comptroller of Public Accounts.

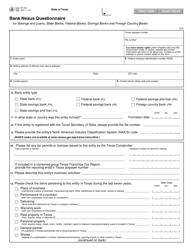

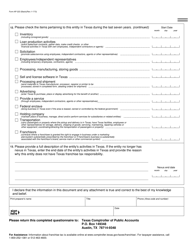

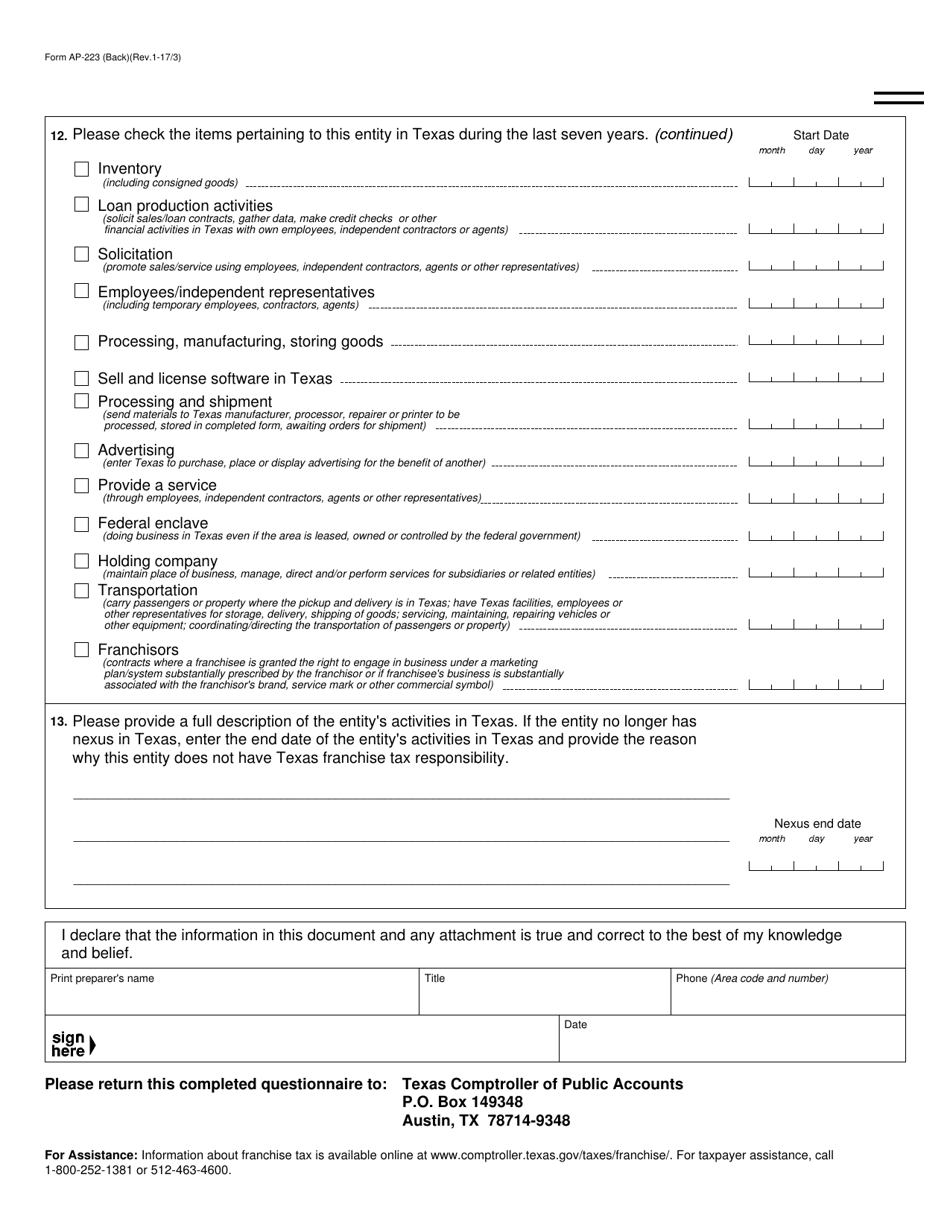

Q: What information is required on Form AP-223?

A: Form AP-223 requires information about the bank's activities, presence, and nexus in Texas.

Q: How should Form AP-223 be filed?

A: Form AP-223 should be filed electronically or by mail, as specified by the Texas Comptroller of Public Accounts.

Q: Is there a fee for filing Form AP-223?

A: There is no fee for filing Form AP-223 with the Texas Comptroller of Public Accounts.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-223 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.