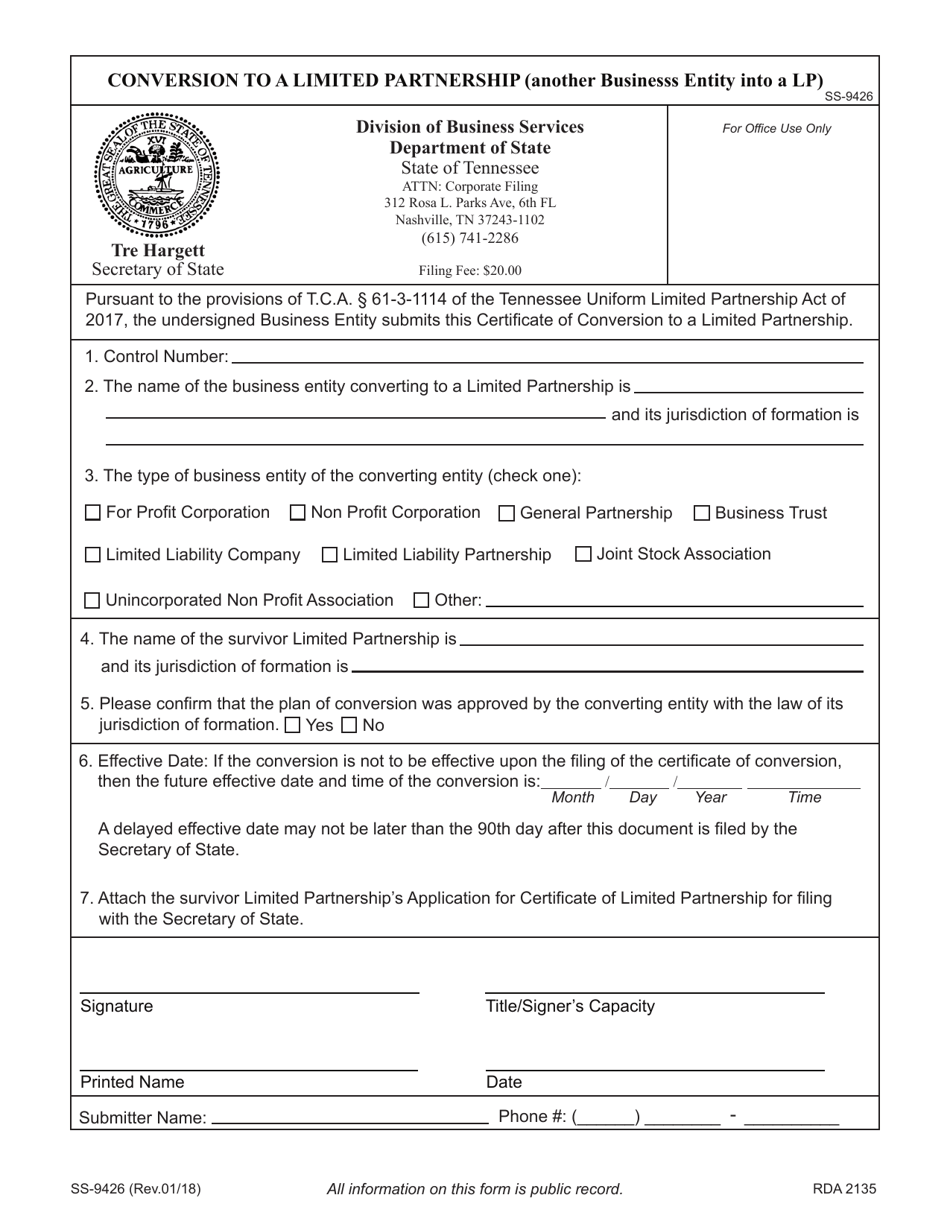

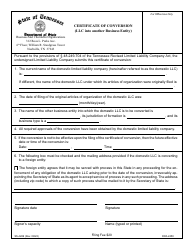

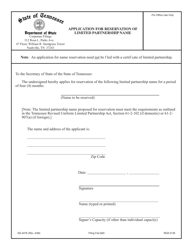

Form SS-9426 Conversion to a Limited Partnership (Another Business Entity Into a Lp) - Tennessee

What Is Form SS-9426?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

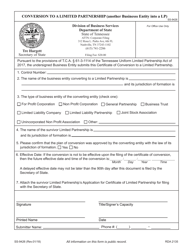

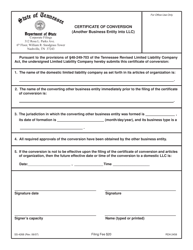

Q: What is a Form SS-9426?

A: Form SS-9426 is used to convert another business entity into a Limited Partnership (LP) in Tennessee.

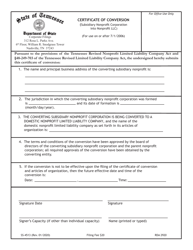

Q: What is a Limited Partnership (LP)?

A: A Limited Partnership (LP) is a partnership where there are one or more general partners who manage the business and have unlimited personal liability, and one or more limited partners who invest capital but do not participate in management and have limited liability.

Q: What type of business entity can be converted into a Limited Partnership (LP)?

A: Any other business entity, such as a corporation or a limited liability company (LLC), can be converted into a Limited Partnership (LP) using Form SS-9426.

Q: What is the purpose of converting a business entity into a Limited Partnership (LP)?

A: The purpose of converting a business entity into a Limited Partnership (LP) is to change the structure of the business and provide limited liability protection for the limited partners.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-9426 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.