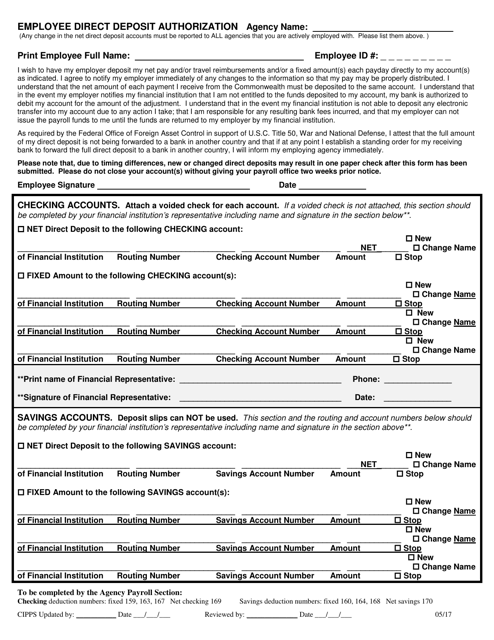

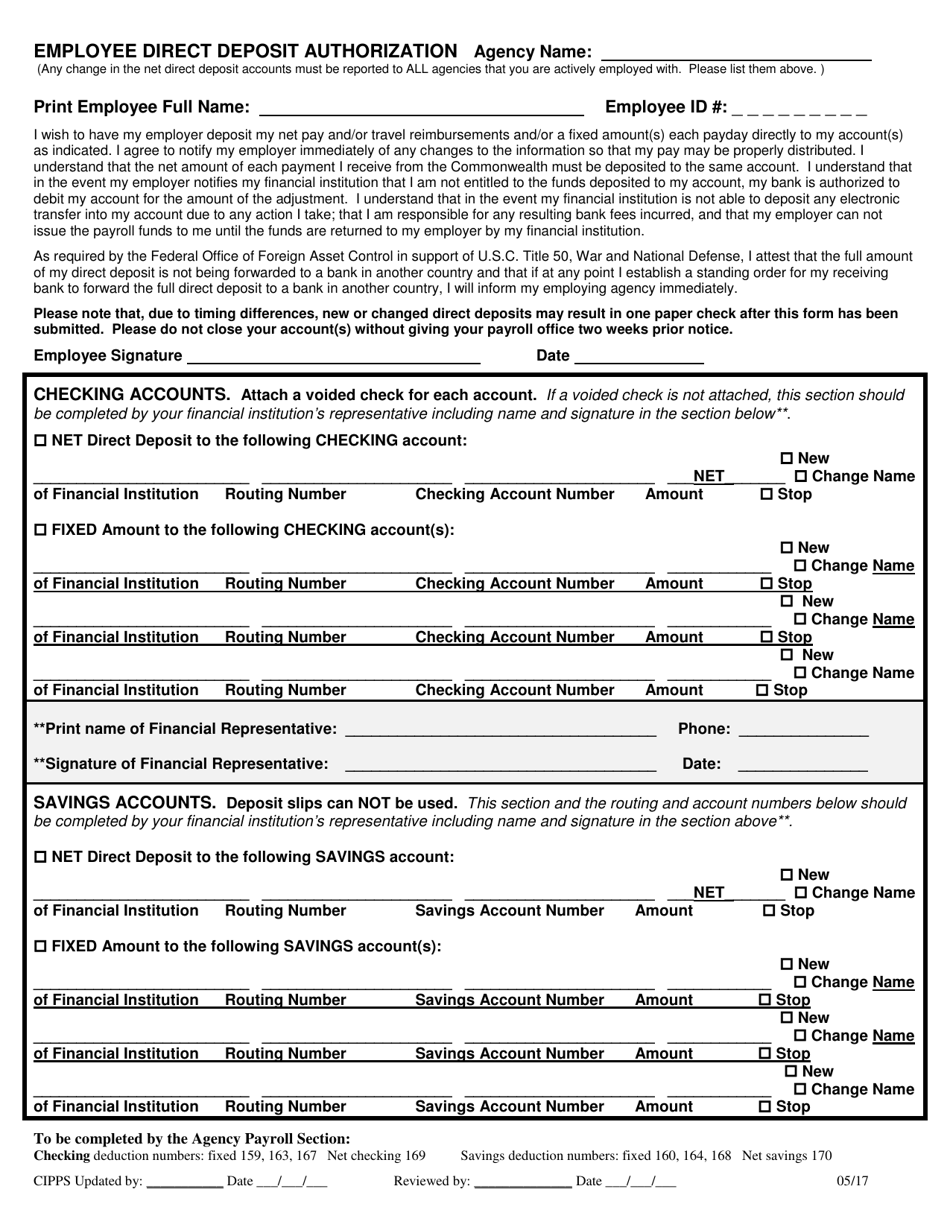

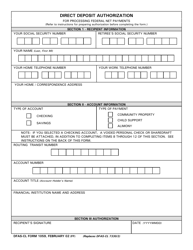

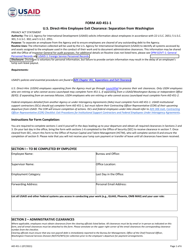

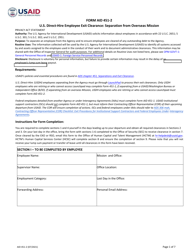

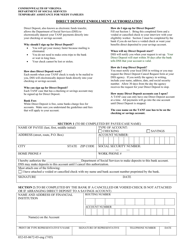

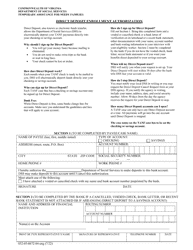

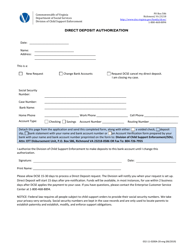

Employee Direct Deposit Authorization - Virginia

Employee Direct Deposit Authorization is a legal document that was released by the Virginia Department of Accounts - a government authority operating within Virginia.

FAQ

Q: What is an Employee Direct Deposit Authorization form?

A: An Employee Direct Deposit Authorization form is a document used by employers to obtain an employee's consent to deposit their wages directly into their bank account.

Q: Why would an employee need to fill out a Direct Deposit Authorization form?

A: Filling out a Direct Deposit Authorization form allows employees to receive their wages directly in their bank account, eliminating the need for paper checks and providing faster access to funds.

Q: Is a Direct Deposit Authorization form mandatory for employees?

A: No, employees are not required to have a direct deposit; however, many employers encourage or even require employees to use direct deposit as a more efficient method of wage payment.

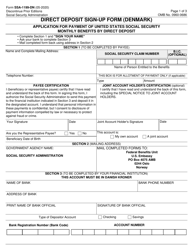

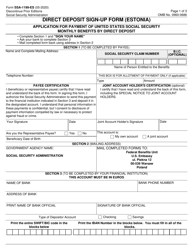

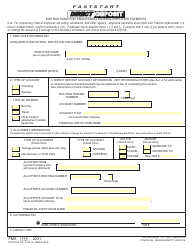

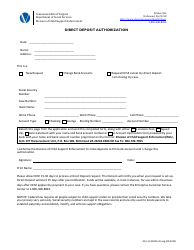

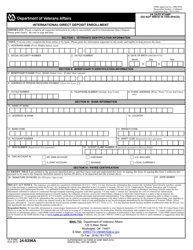

Q: What information is typically required on a Direct Deposit Authorization form?

A: Common information requested on the form includes the employee's bank account number, bank routing number, and the employee's authorization for the employer to make deposits into the designated account.

Q: Can employees choose multiple bank accounts for direct deposit?

A: Yes, if the employer allows, employees may be able to choose multiple bank accounts for direct deposit, such as splitting their wages between different accounts or allocating a percentage to each account.

Q: Can an employee change their direct deposit information?

A: Yes, employees can typically change their direct deposit information by submitting a new Direct Deposit Authorization form with the updated details to their employer.

Q: How long does it take for direct deposit to take effect?

A: The time it takes for direct deposit to take effect can vary depending on the employer's payroll processing system, but it is typically within one to two payroll cycles.

Q: What happens if a direct deposit is sent to a closed or inactive bank account?

A: If a direct deposit is sent to a closed or inactive bank account, it may be rejected by the bank. In such cases, the employer will usually need to issue a paper check or arrange an alternative payment method for the affected employee.

Q: Is direct deposit a secure method of receiving wages?

A: Yes, direct deposit is generally considered a secure method of receiving wages, as it eliminates the risk of lost or stolen paper checks and reduces the need for physical handling of sensitive financial information.

Q: Are there any fees associated with receiving wages via direct deposit?

A: In most cases, there are no fees associated with receiving wages via direct deposit. However, employees should check with their bank to confirm if any fees may be applicable.

Form Details:

- Released on May 1, 2017;

- The latest edition currently provided by the Virginia Department of Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.