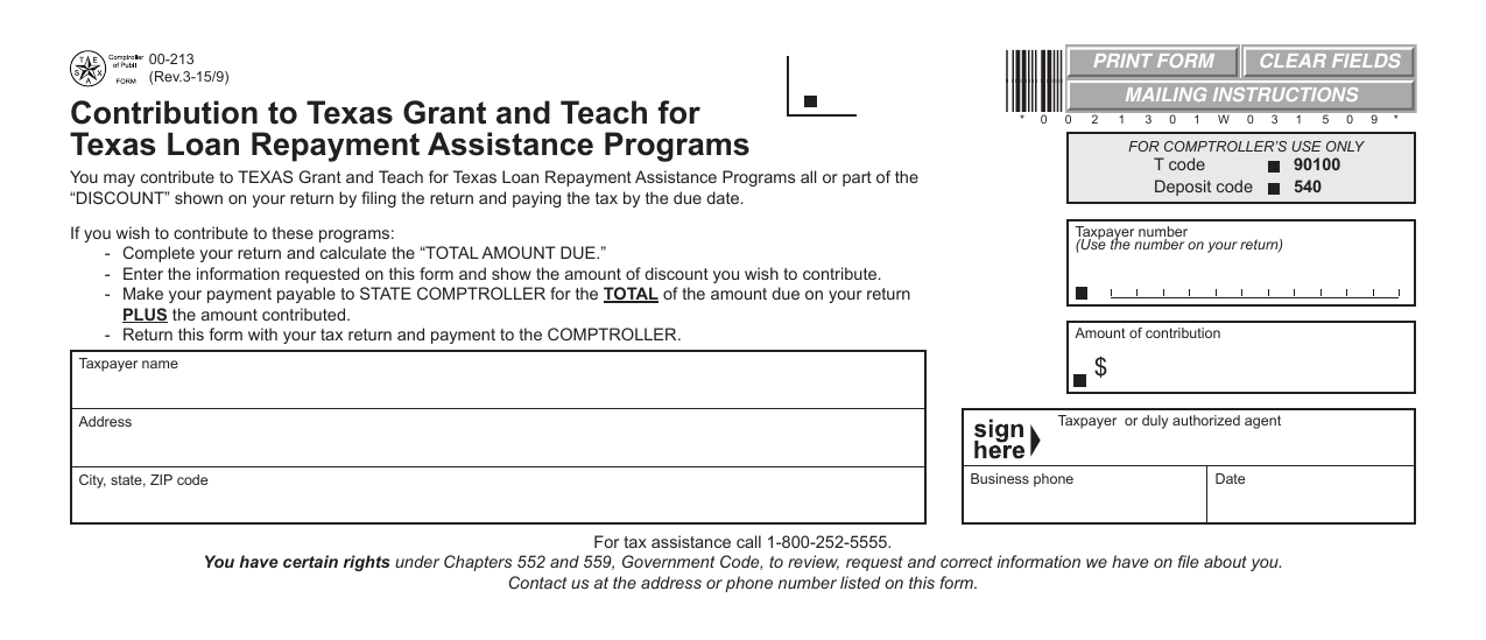

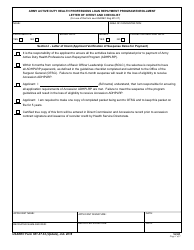

Form 00-213 Contribution to Texas Grant and Teach for Texas Loan Repayment Assistance Programs - Texas

What Is Form 00-213?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 00-213?

A: Form 00-213 is a document for making contributions to the Texas Grant and Teach for Texas Loan Repayment Assistance Programs.

Q: What are the Texas Grant and Teach for Texas Loan Repayment Assistance Programs?

A: The Texas Grant program provides financial aid to eligible Texas undergraduates to attend public colleges and universities in the state. The Teach for Texas Loan Repayment Assistance Program provides loan repayment assistance to eligible teachers who work in low-income schools.

Q: Who can make contributions using this form?

A: Anyone can make contributions using Form 00-213, including individuals, organizations, and businesses.

Q: How can contributions be made?

A: Contributions can be made through cash, check, or electronic funds transfer.

Q: Is there a minimum contribution amount?

A: No, there is no minimum contribution amount.

Q: Are contributions tax-deductible?

A: Yes, contributions to the Texas Grant and Teach for Texas Loan Repayment Assistance Programs are tax-deductible.

Q: Is this form only for residents of Texas?

A: No, anyone can make contributions to the Texas Grant and Teach for Texas Loan Repayment Assistance Programs, regardless of their residency.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 00-213 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.