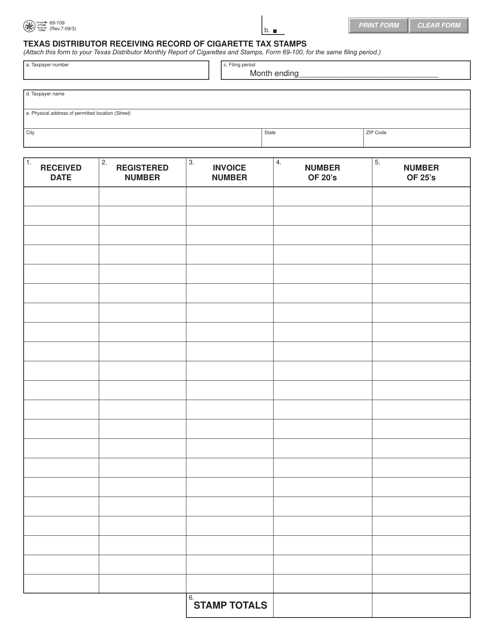

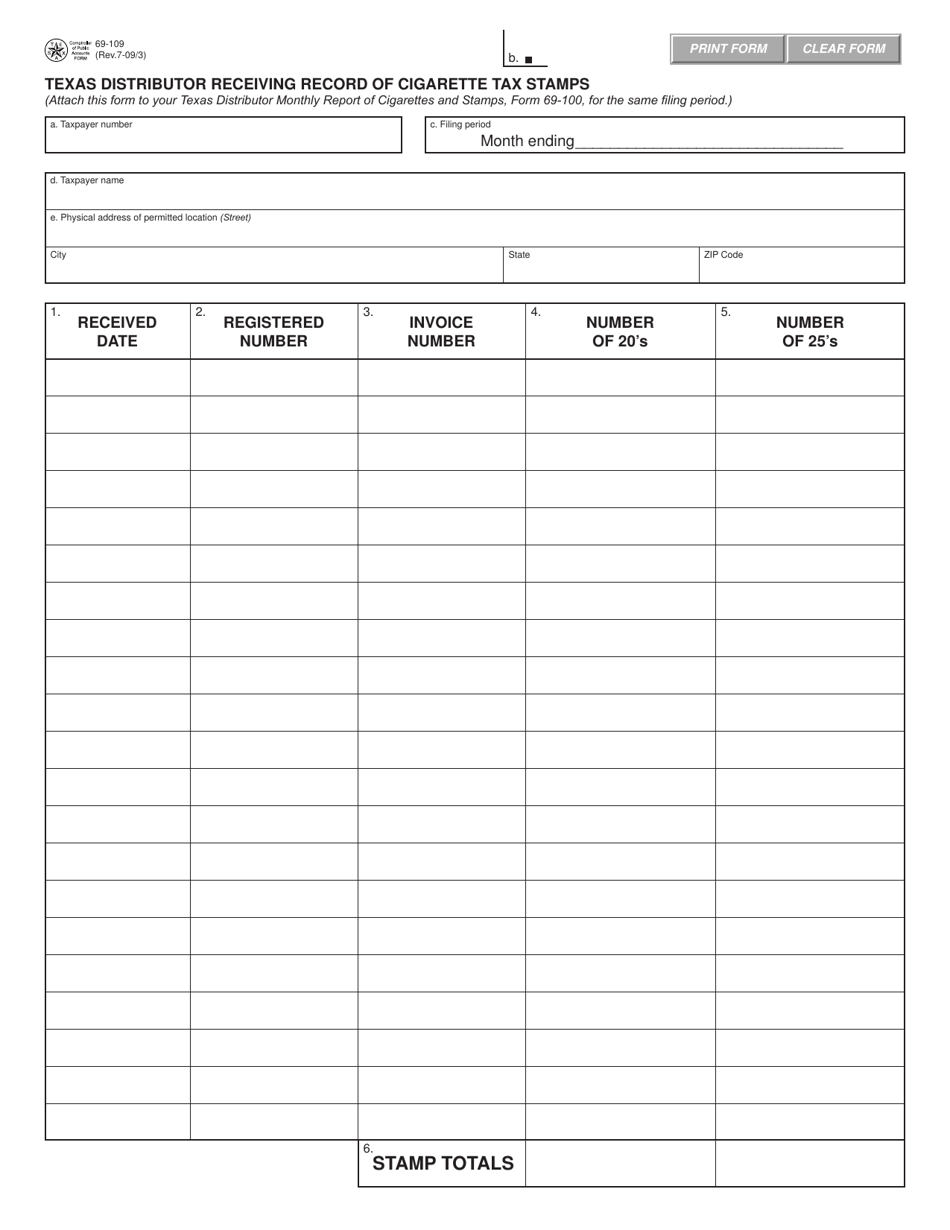

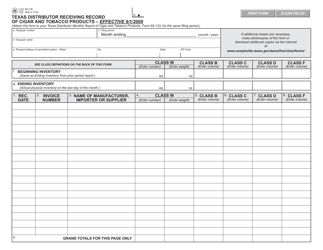

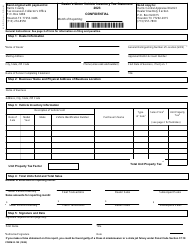

Form 69-109 Texas Distributor Receiving Record of Cigarette Tax Stamps - Texas

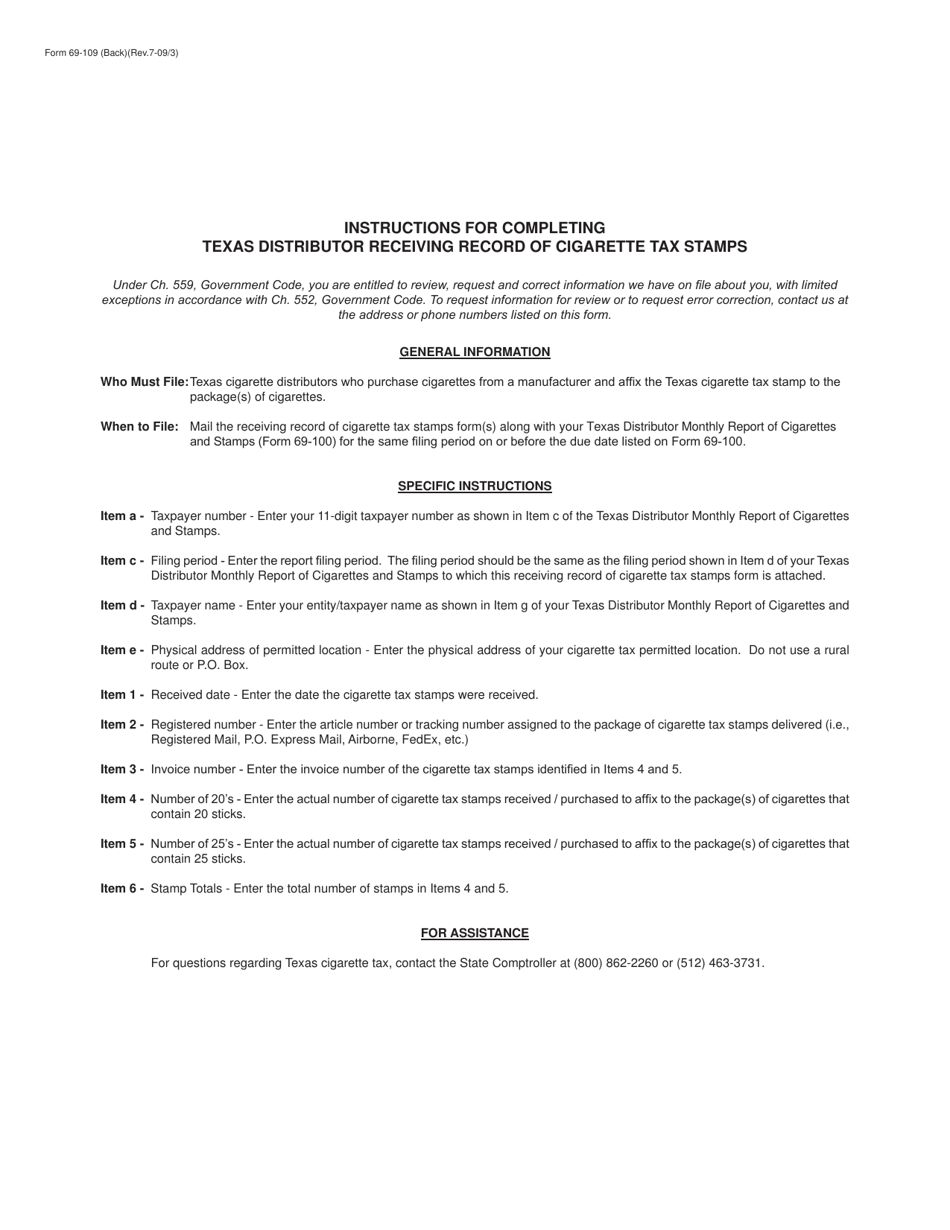

What Is Form 69-109?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-109?

A: Form 69-109 is the Texas Distributor Receiving Record of Cigarette Tax Stamps.

Q: What is the purpose of Form 69-109?

A: The purpose of Form 69-109 is to record the receipt of cigarette tax stamps by distributors in Texas.

Q: Who needs to fill out Form 69-109?

A: Distributors of cigarettes in Texas need to fill out Form 69-109.

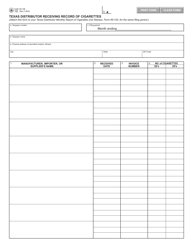

Q: What information is needed to fill out Form 69-109?

A: When filling out Form 69-109, distributors need to provide information such as their name, address, permit number, and the quantity of cigarette tax stamps received.

Q: When is Form 69-109 due?

A: Form 69-109 is due on or before the 10th day of the month following the month in which the cigarette tax stamps were received.

Q: Are there any penalties for not filing Form 69-109?

A: Yes, failure to timely file Form 69-109 may result in penalties and interest.

Q: Is there a fee to file Form 69-109?

A: No, there is no fee to file Form 69-109.

Q: Can Form 69-109 be amended if there are errors?

A: Yes, distributors can file an amended Form 69-109 if they discover errors or omissions in their original filing.

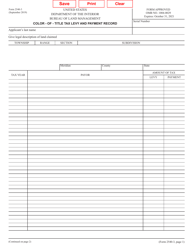

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-109 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.