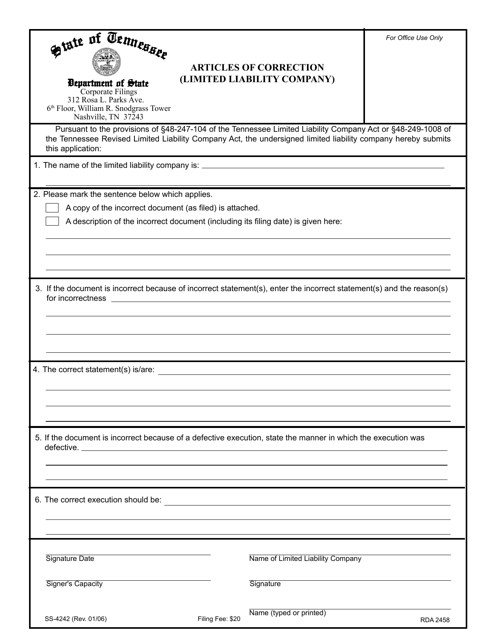

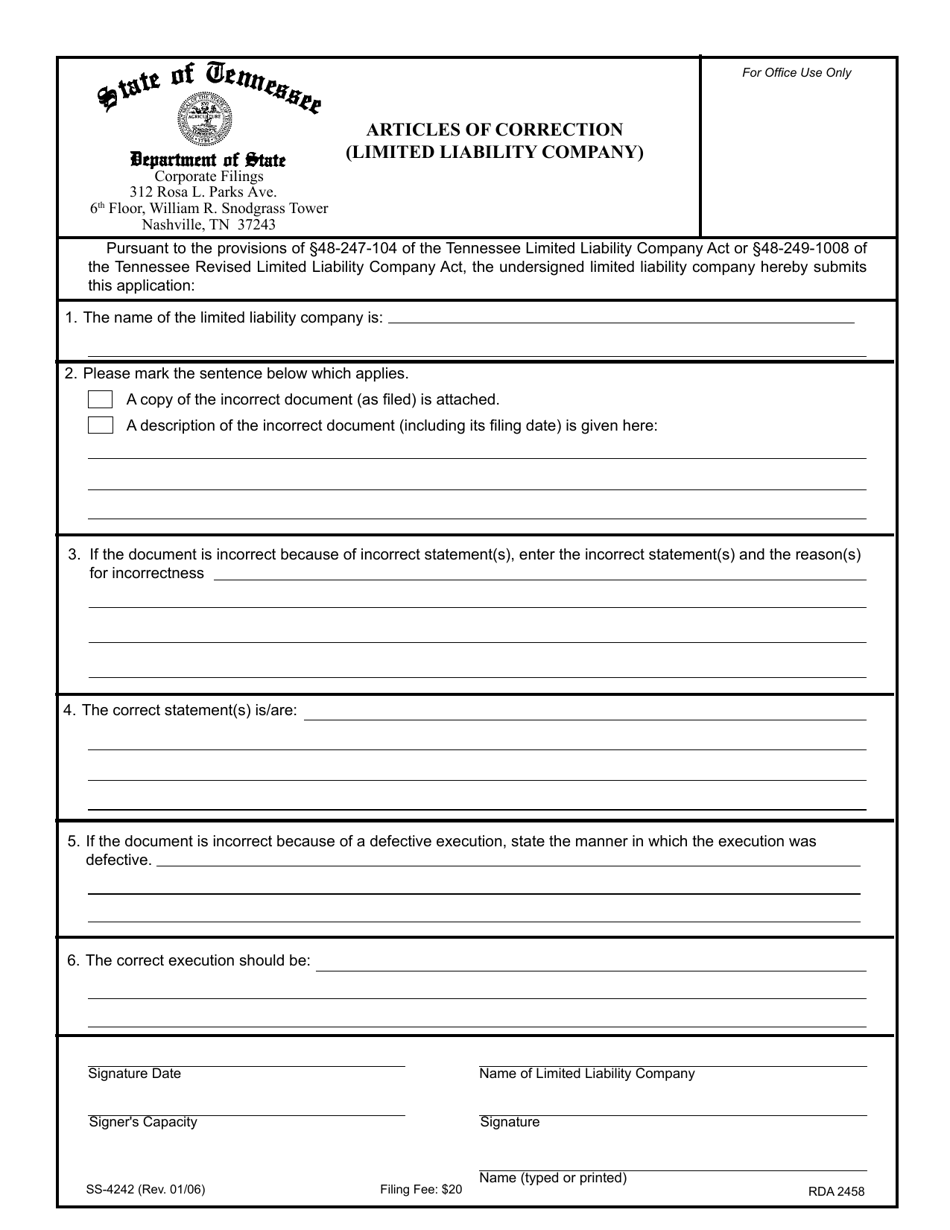

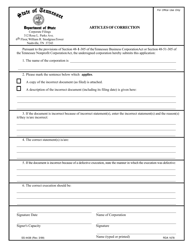

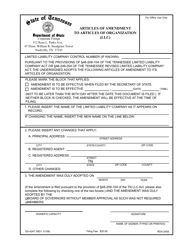

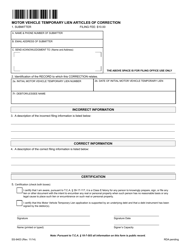

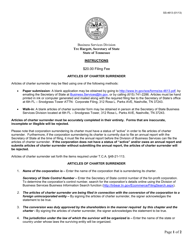

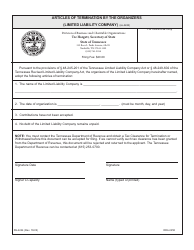

Form SS-4242 Articles of Correction (Limited Liability Company) - Tennessee

What Is Form SS-4242?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-4242?

A: Form SS-4242 is the Articles of Correction for Limited Liability Companies in Tennessee.

Q: What is the purpose of Form SS-4242?

A: Form SS-4242 is used to correct errors or provide additional information in the original Articles of Organization for a Tennessee LLC.

Q: Who must file Form SS-4242?

A: The members or authorized representatives of the LLC must file Form SS-4242.

Q: What information is required on Form SS-4242?

A: The form requires the LLC's name, the date of the original filing, the correction or additional information being provided, and the signature of the member or authorized representative.

Q: When should Form SS-4242 be filed?

A: Form SS-4242 should be filed as soon as possible after discovering the error or need for additional information.

Q: Are there any penalties for not filing Form SS-4242?

A: Failure to file Form SS-4242 can result in legal consequences and may affect the LLC's standing with the state.

Q: Can I make multiple corrections on one Form SS-4242?

A: Yes, multiple corrections or additional information can be included on one Form SS-4242.

Form Details:

- Released on January 1, 2006;

- The latest edition provided by the Tennessee Secretary of State;

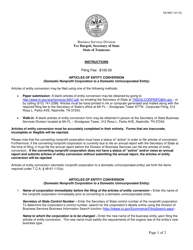

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SS-4242 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.