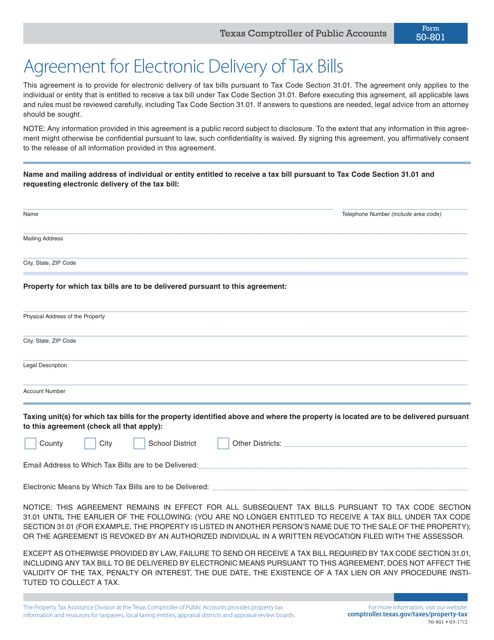

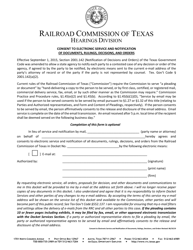

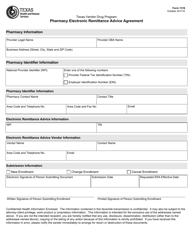

Form 50-801 Agreement for Electronic Delivery of Tax Bills - Texas

What Is Form 50-801?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-801?

A: Form 50-801 is the Agreement for Electronic Delivery of Tax Bills in Texas.

Q: What is the purpose of Form 50-801?

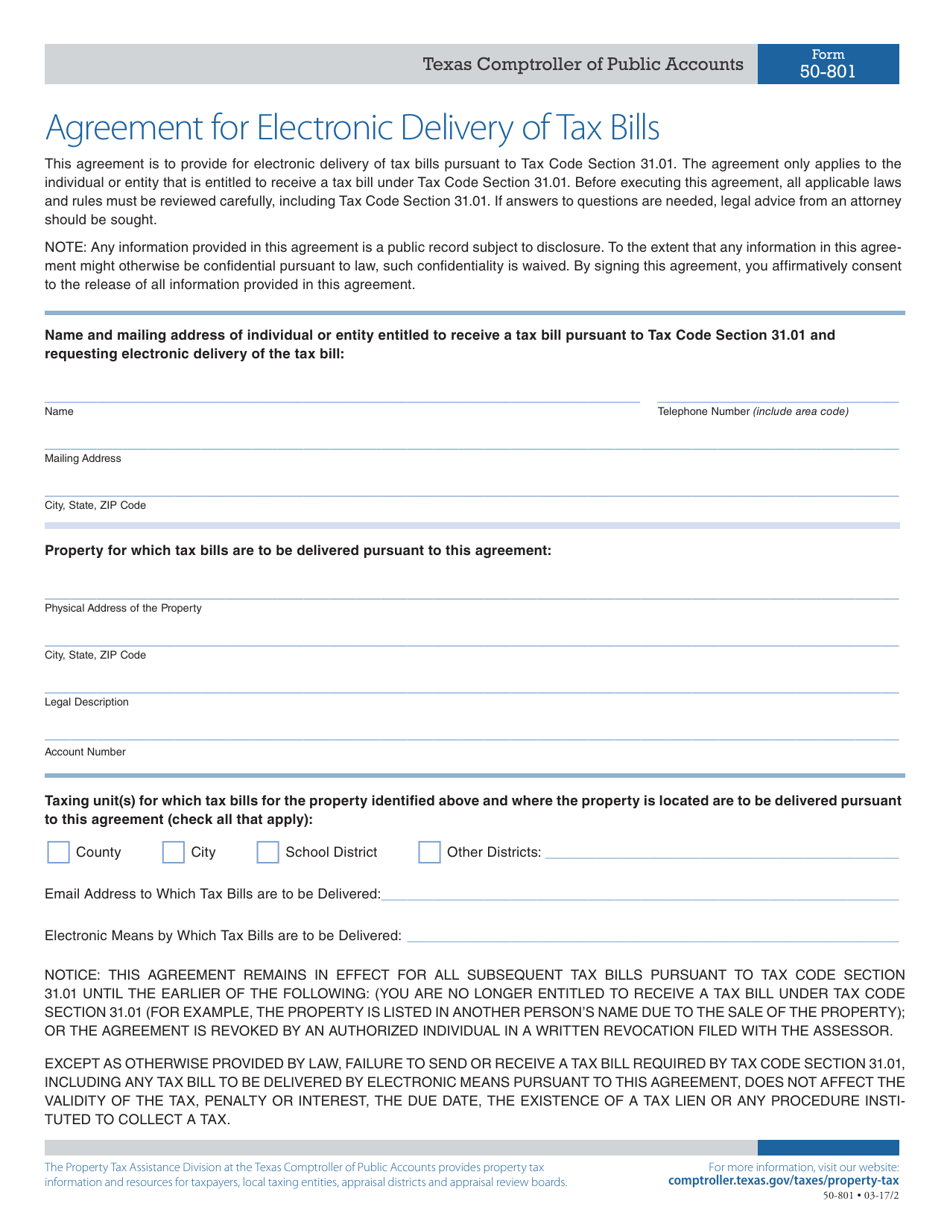

A: The purpose of Form 50-801 is to request electronic delivery of property tax bills instead of receiving them in paper form.

Q: Who should use Form 50-801?

A: Property owners in Texas who wish to receive their tax bills electronically should use Form 50-801.

Q: What information is required on Form 50-801?

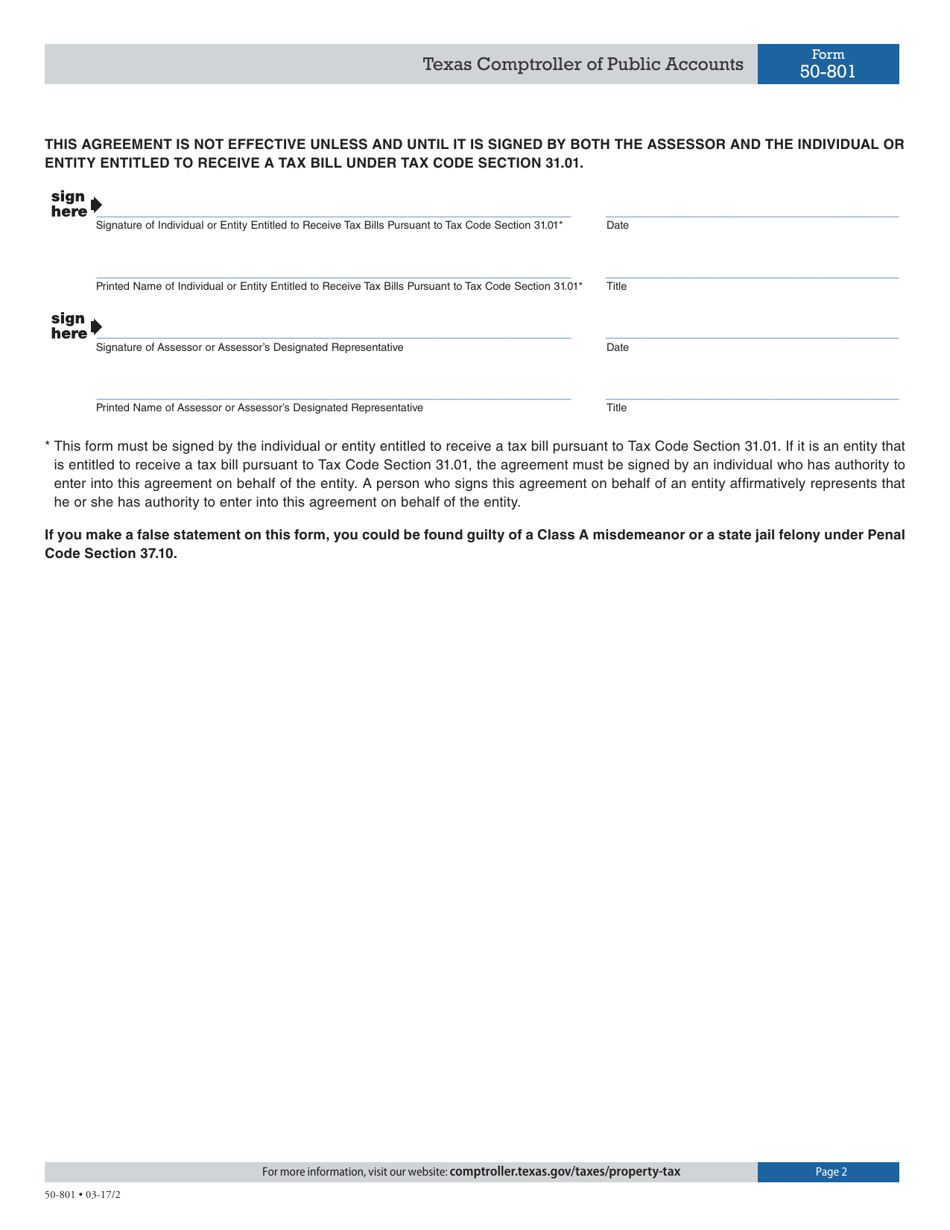

A: Form 50-801 requires information such as the property owner's name, address, contact information, property identification number, and a signature.

Form Details:

- Released on March 17, 2002;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-801 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.