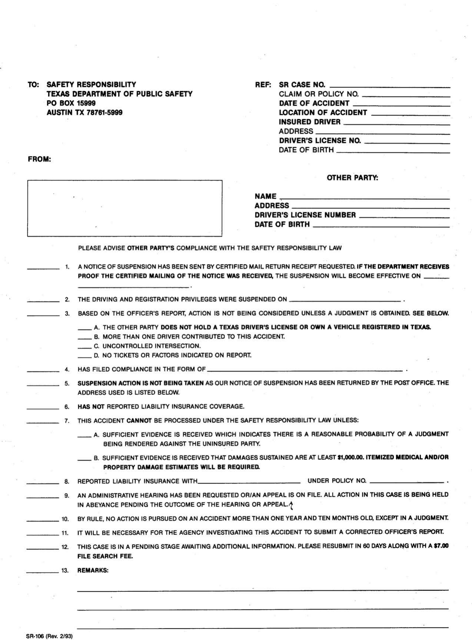

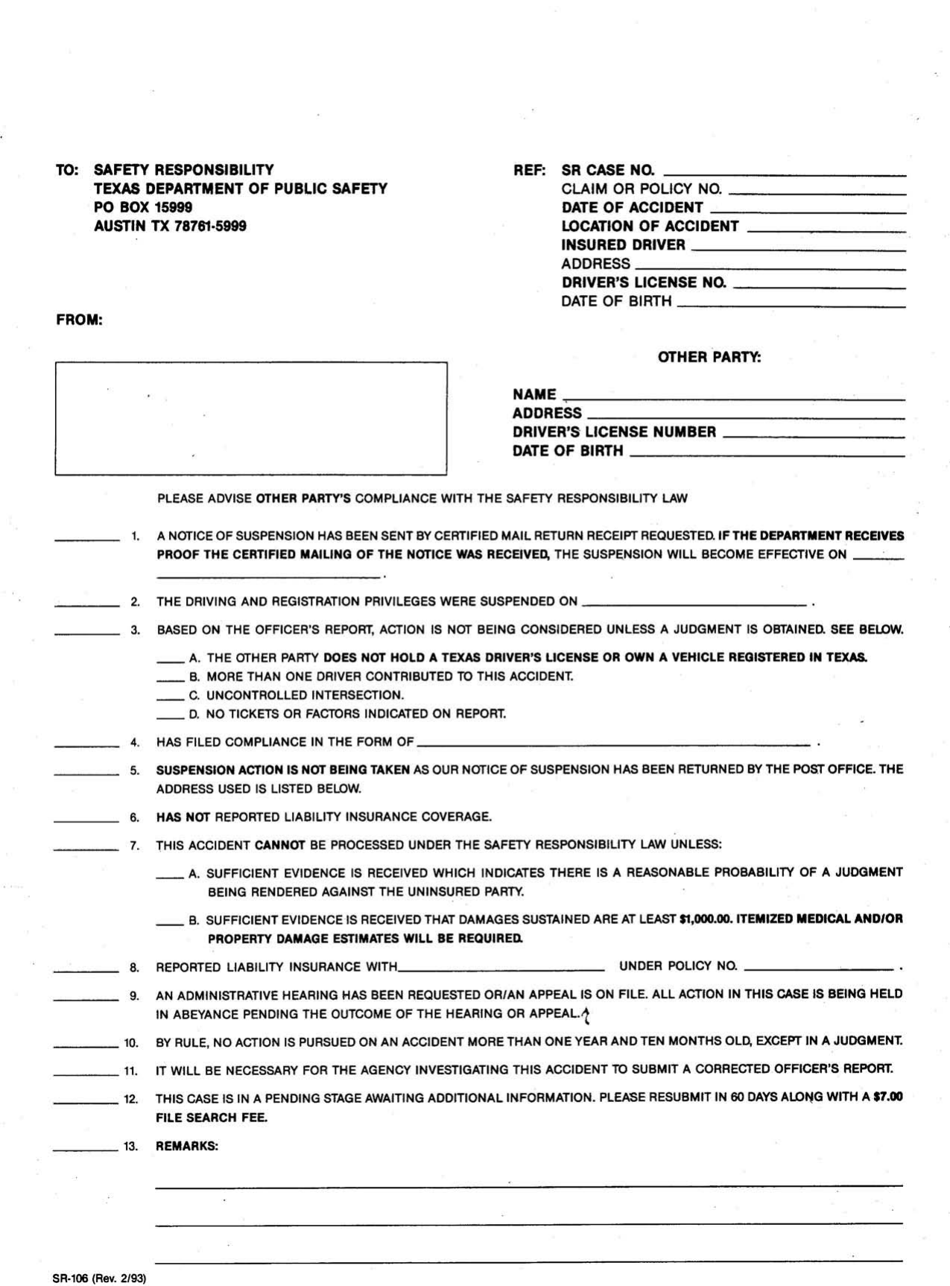

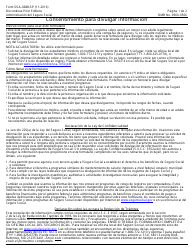

Form SR-106 Dollar Information Letter - Texas

What Is Form SR-106?

This is a legal form that was released by the Texas Department of Public Safety - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SR-106?

A: Form SR-106 is a Dollar Information Letter used in Texas.

Q: What is the purpose of Form SR-106?

A: The purpose of Form SR-106 is to provide dollar information to the Texas Comptroller.

Q: Who needs to file Form SR-106?

A: Certain businesses in Texas are required to file Form SR-106.

Q: What information is required on Form SR-106?

A: Form SR-106 requires businesses to provide dollar amounts for specific categories, such as total revenue and taxable sales.

Q: When is Form SR-106 due?

A: Form SR-106 is due annually by January 31st.

Q: Are there any penalties for not filing Form SR-106?

A: Yes, there can be penalties for not filing Form SR-106, such as late filing fees and interest charges.

Q: Do I need to submit any supporting documents with Form SR-106?

A: No, supporting documents are not required to be submitted with Form SR-106, but they should be kept for record-keeping purposes.

Q: Who can I contact for assistance with Form SR-106?

A: For assistance with Form SR-106, you can contact the Texas Comptroller's office.

Form Details:

- Released on February 1, 1993;

- The latest edition provided by the Texas Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SR-106 by clicking the link below or browse more documents and templates provided by the Texas Department of Public Safety.