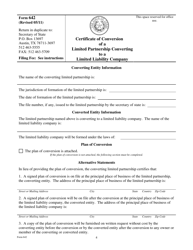

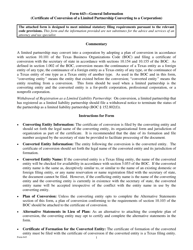

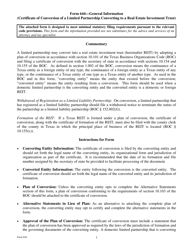

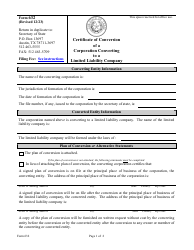

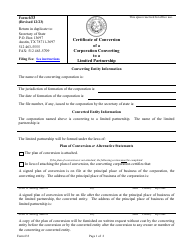

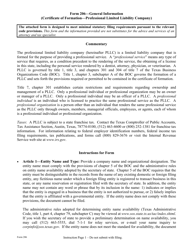

Form 642 Certificate of Conversion of a Limited Partnership Converting to a Limited Liability Company - Texas

What Is Form 642?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 642?

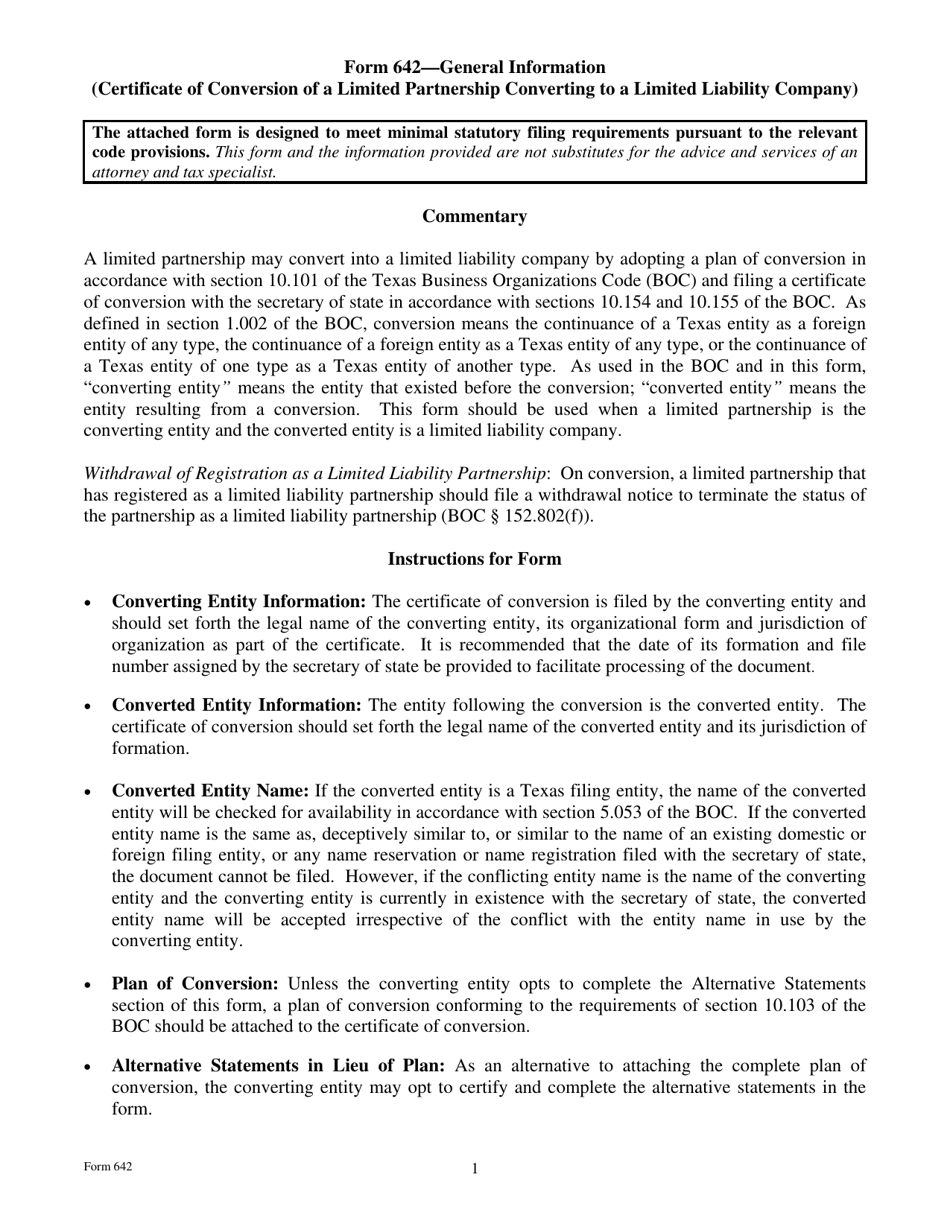

A: Form 642 is the Certificate of Conversion of a Limited Partnership Converting to a Limited Liability Company in Texas.

Q: What is the purpose of Form 642?

A: The purpose of Form 642 is to convert a limited partnership into a limited liability company in Texas.

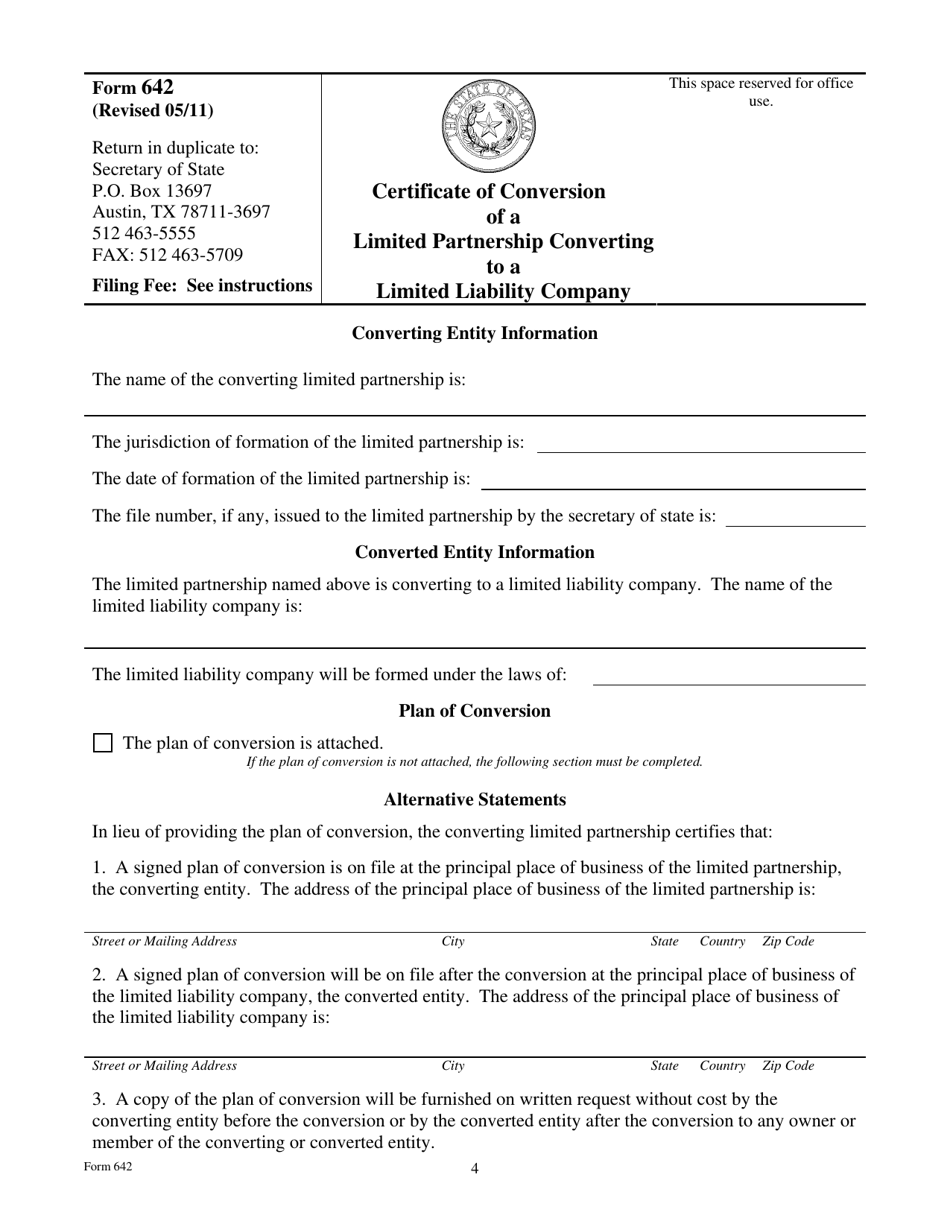

Q: Who needs to file Form 642?

A: Limited partnerships in Texas that want to convert to a limited liability company need to file Form 642.

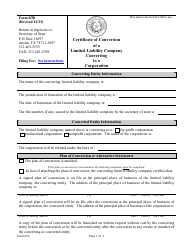

Q: What information is required on Form 642?

A: Form 642 requires information such as the name of the limited partnership, the name of the limited liability company, and the signatures of the general partners.

Q: Are there any additional documents that need to be submitted with Form 642?

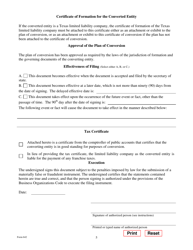

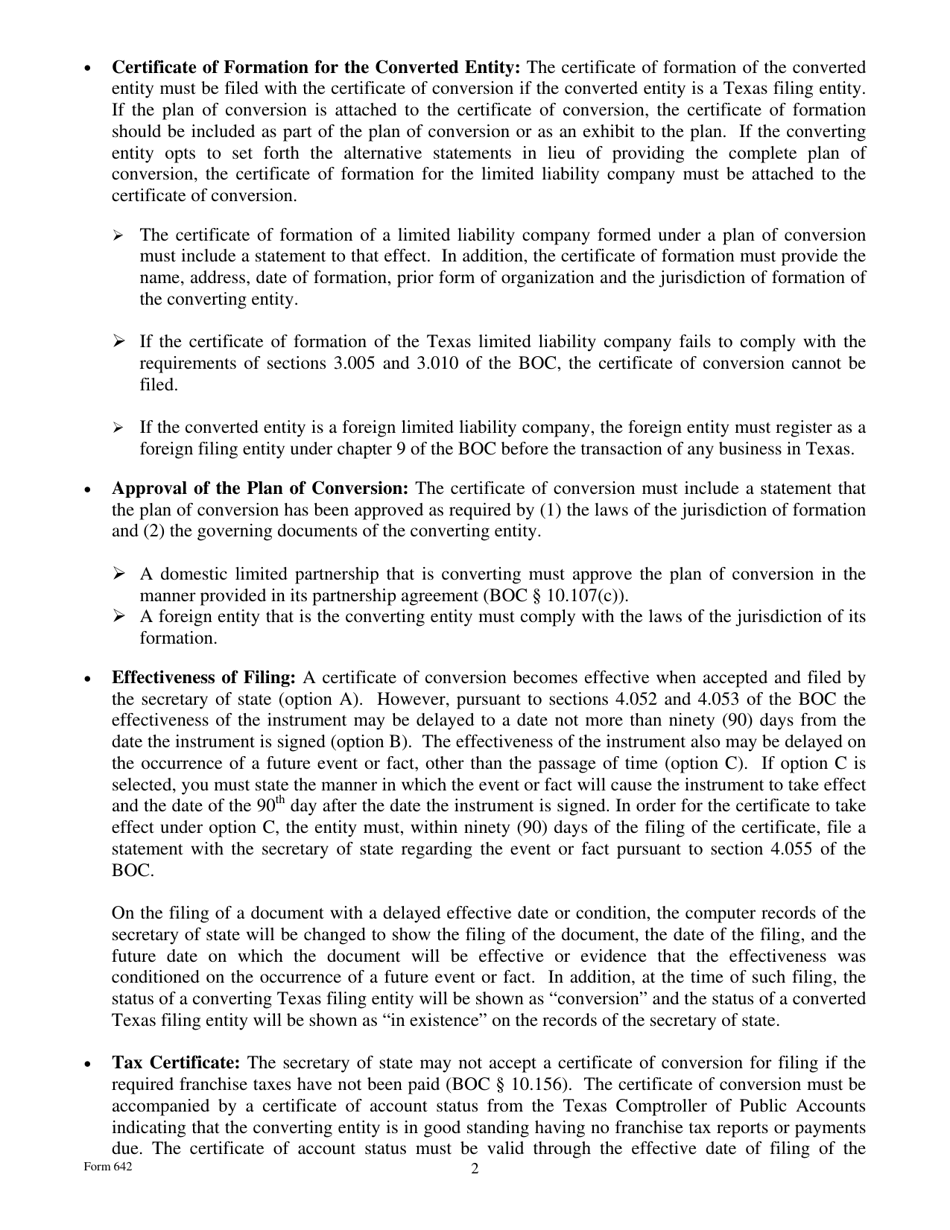

A: Yes, additional documents such as a certificate of formation for the new limited liability company and a plan of conversion may need to be submitted with Form 642.

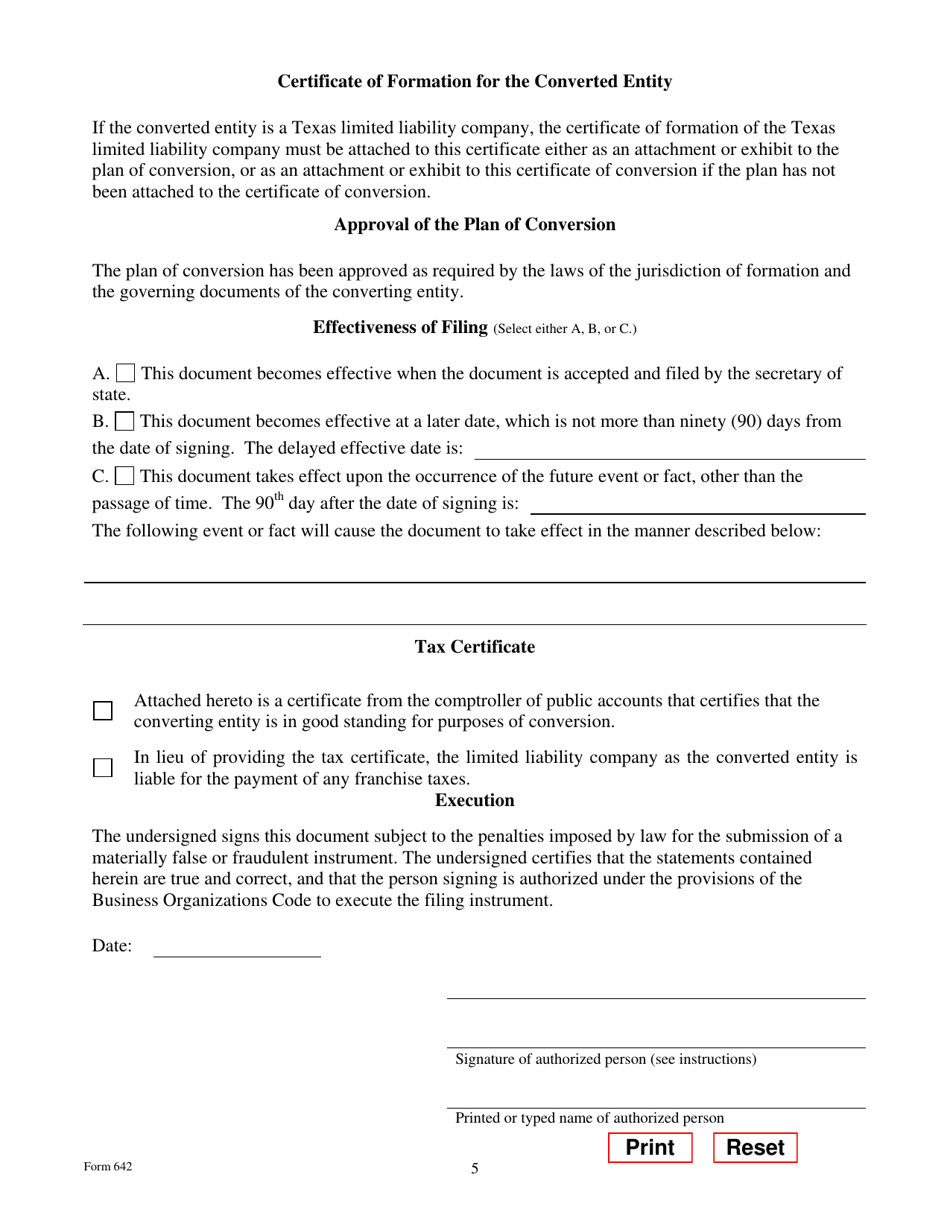

Q: How long does it take to process Form 642?

A: The processing time for Form 642 can vary. It is best to check with the Texas Secretary of State for the current processing times.

Q: What happens after Form 642 is filed?

A: After Form 642 is filed and approved, the limited partnership will be converted into a limited liability company according to the terms of the conversion plan.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 642 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.