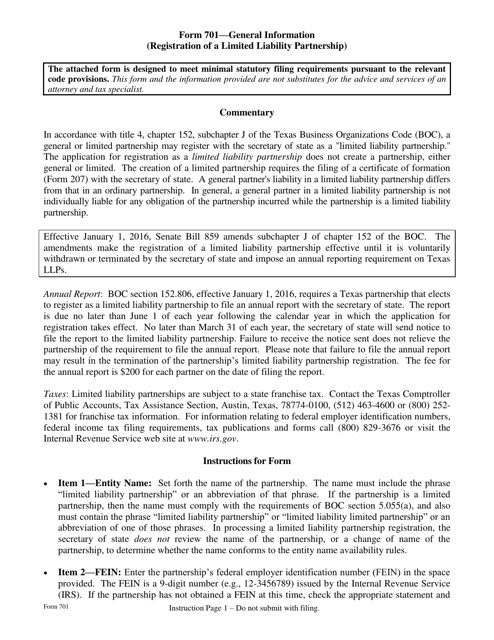

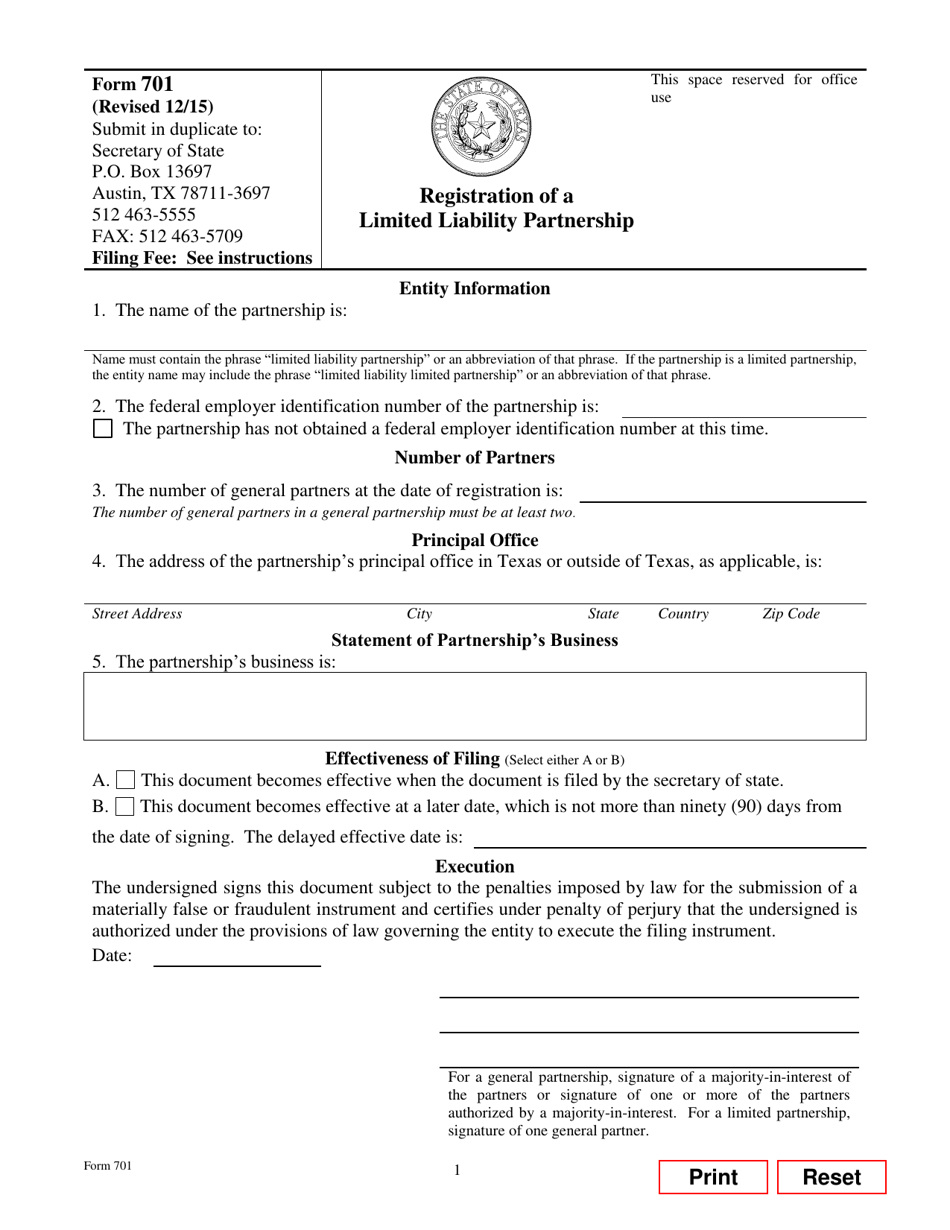

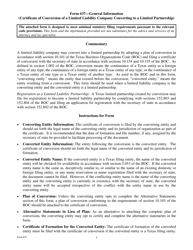

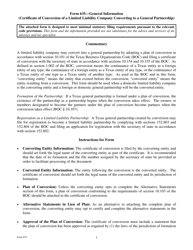

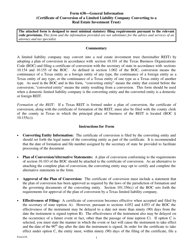

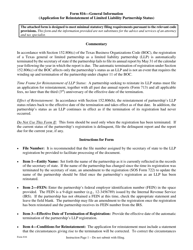

Form 701 Registration of a Limited Liability Partnership - Texas

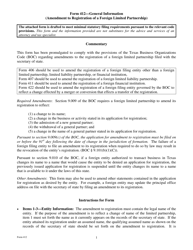

What Is Form 701?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

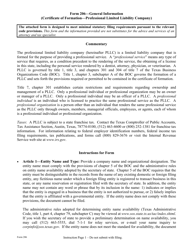

Q: What is Form 701?

A: Form 701 is the registration form for a Limited Liability Partnership (LLP) in Texas.

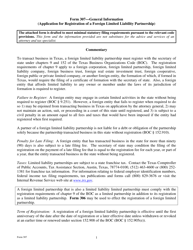

Q: What is a Limited Liability Partnership?

A: A Limited Liability Partnership (LLP) is a type of business structure that combines elements of a partnership and a corporation, providing limited liability to its partners.

Q: Who should use Form 701?

A: Form 701 should be used by individuals or entities that want to establish a Limited Liability Partnership in Texas.

Q: Why do I need to register a Limited Liability Partnership?

A: Registering a Limited Liability Partnership is important to ensure legal recognition and protection for the business, as well as to comply with state regulations.

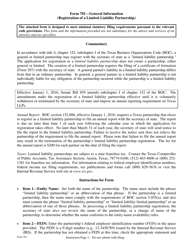

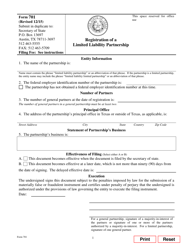

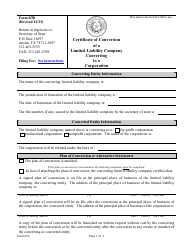

Q: What information is required on Form 701?

A: Form 701 requires information such as the LLP's name, principal place of business, duration, registered agent details, and partner information.

Q: Is Form 701 specific to Texas?

A: Yes, Form 701 is specific to the state of Texas. Other states may have their own registration forms and requirements for Limited Liability Partnerships.

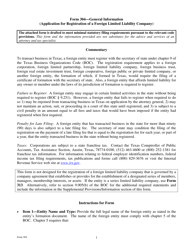

Q: What happens after submitting Form 701?

A: After submitting Form 701 and the required fees, the Texas Secretary of State will review the form and, if approved, the LLP will be officially registered.

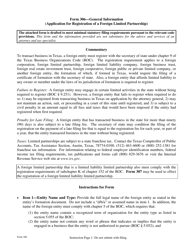

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 701 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.