Form 908 Foreign Corporate Fiduciary Estates Code Filing - Texas

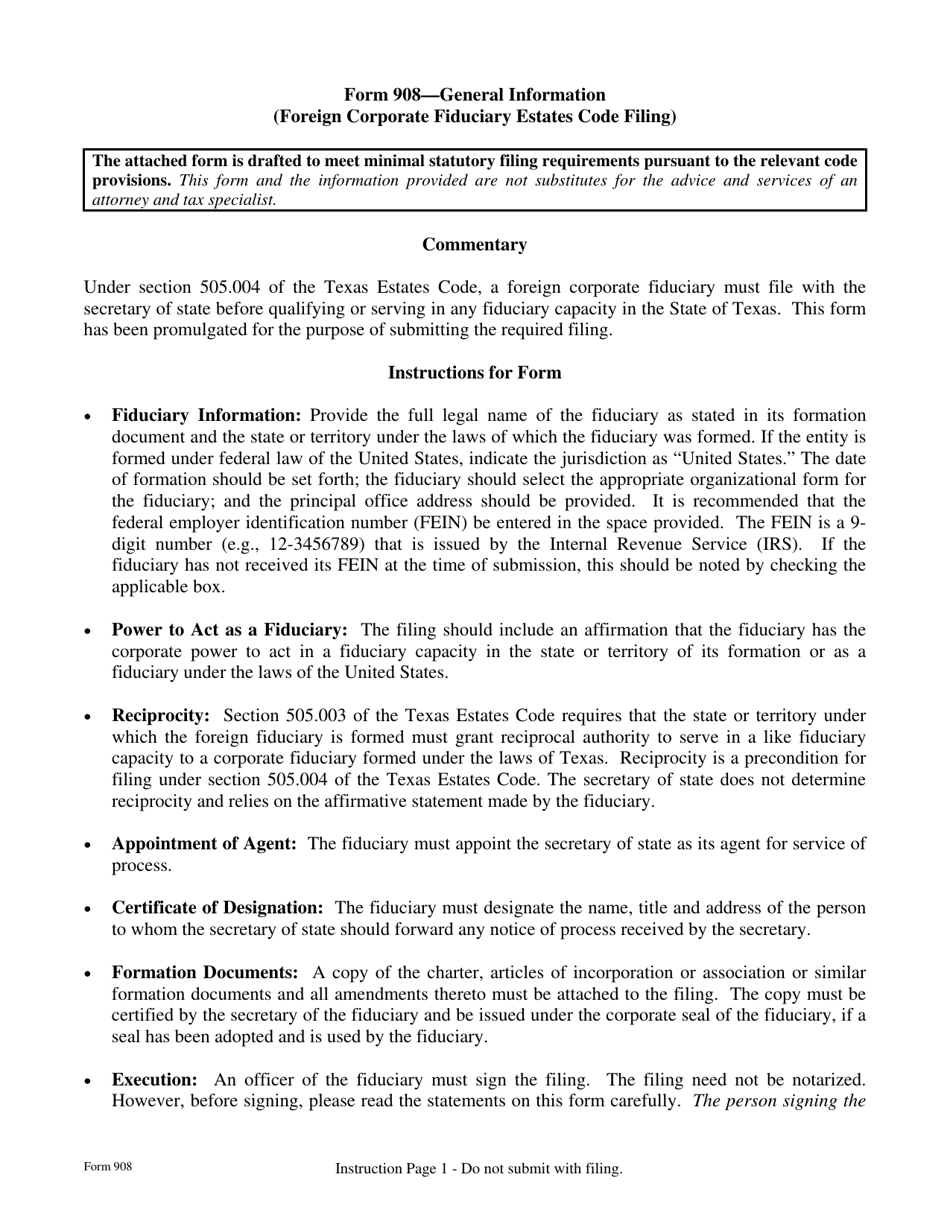

What Is Form 908?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

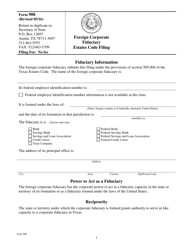

Q: What is Form 908?

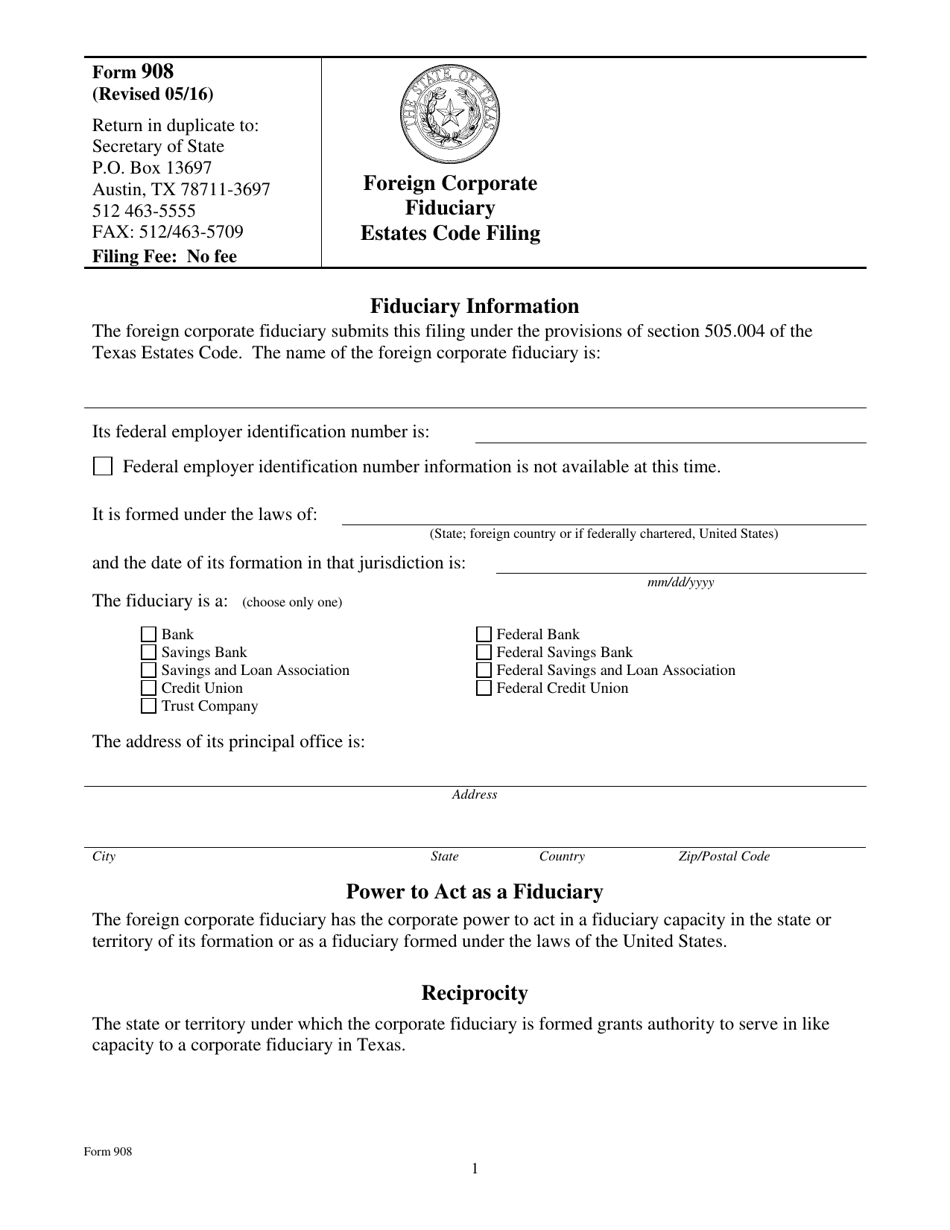

A: Form 908 is a filing form for foreign corporate fiduciary estates code in Texas.

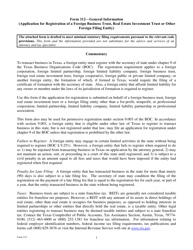

Q: What is a foreign corporate fiduciary?

A: A foreign corporate fiduciary is a corporation that acts as a trustee or fiduciary in the state of Texas, but is incorporated outside of Texas.

Q: What is the Estates Code?

A: The Estates Code is a set of laws in Texas that governs matters related to estates, trusts, and fiduciaries.

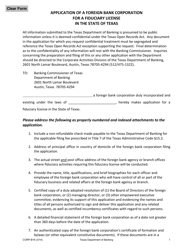

Q: Why do foreign corporate fiduciaries need to file Form 908?

A: Foreign corporate fiduciaries need to file Form 908 in order to comply with the requirements of the Estates Code in Texas.

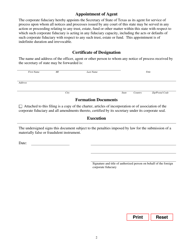

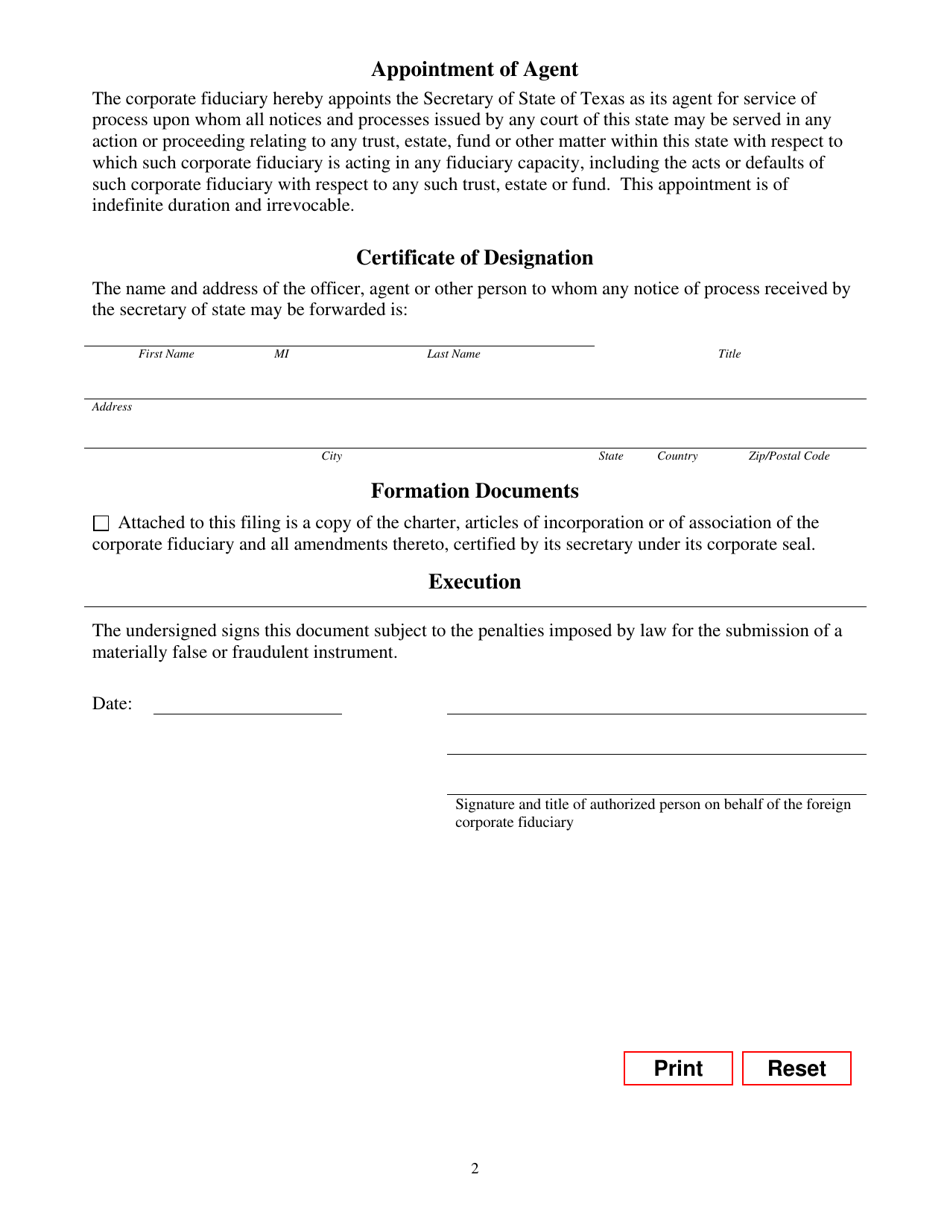

Q: What information is required on Form 908?

A: Form 908 requires information such as the name and address of the foreign corporate fiduciary, the date of qualification, and the names and addresses of its affiliated entities.

Q: What happens after Form 908 is filed?

A: After Form 908 is filed, the foreign corporate fiduciary will be in compliance with the Estates Code in Texas and will be able to legally act as a trustee or fiduciary in the state.

Q: Is Form 908 specific to Texas?

A: Yes, Form 908 is specific to Texas and is used for filing foreign corporate fiduciary estates code in the state.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 908 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.