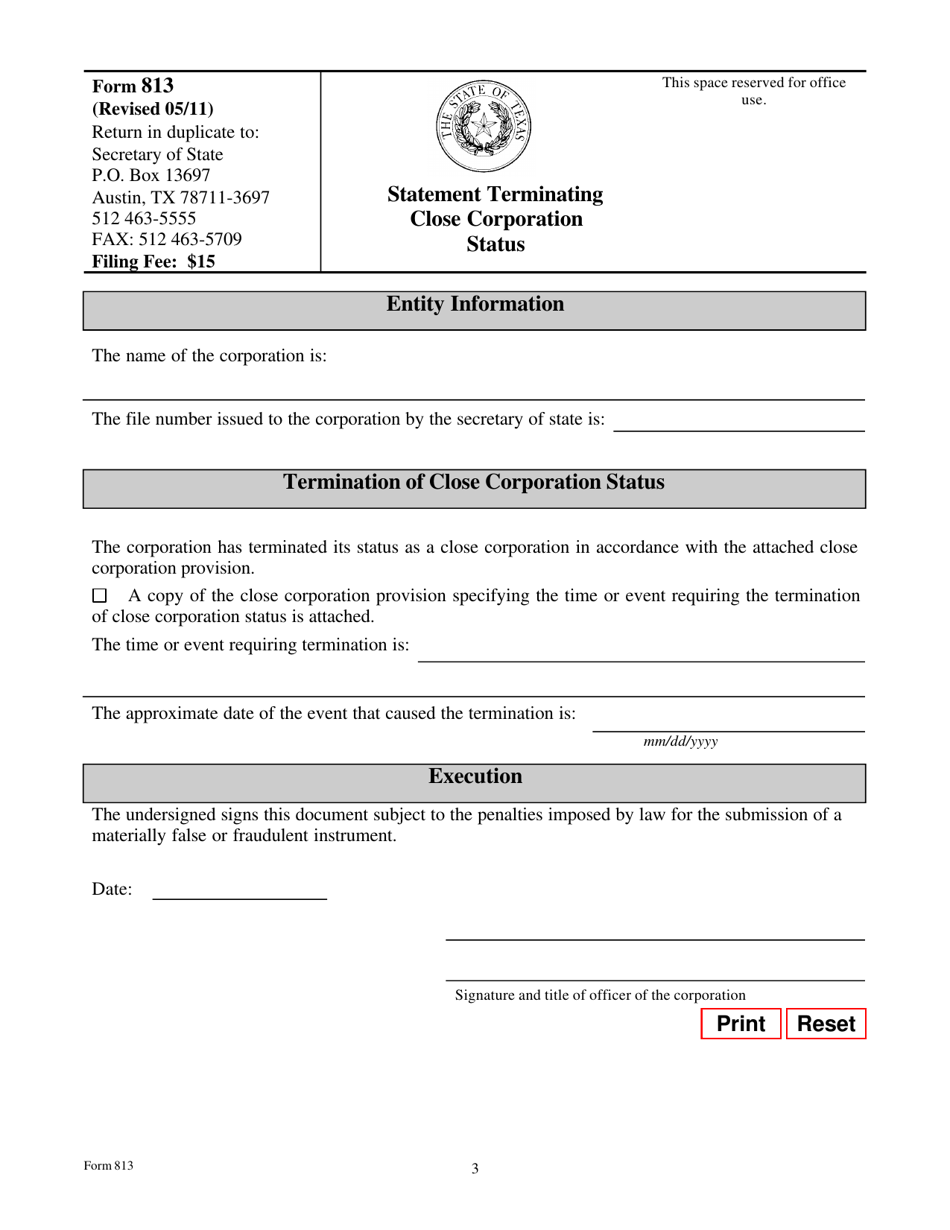

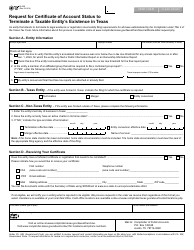

Form 813 Statement Terminating Close Corporation Status - Texas

What Is Form 813?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 813?

A: Form 813 is a statement used to terminate close corporation status in Texas.

Q: What is close corporation status?

A: Close corporation status is a special type of legal status for corporations with a limited number of shareholders.

Q: Who can use Form 813?

A: Form 813 is used by shareholders of a close corporation in Texas who want to terminate the close corporation status.

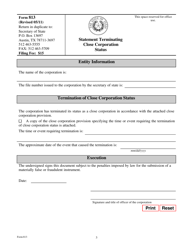

Q: What information is required on Form 813?

A: Form 813 requires certain information about the corporation, its shareholders, and the reason for terminating close corporation status.

Q: Are there any fees associated with filing Form 813?

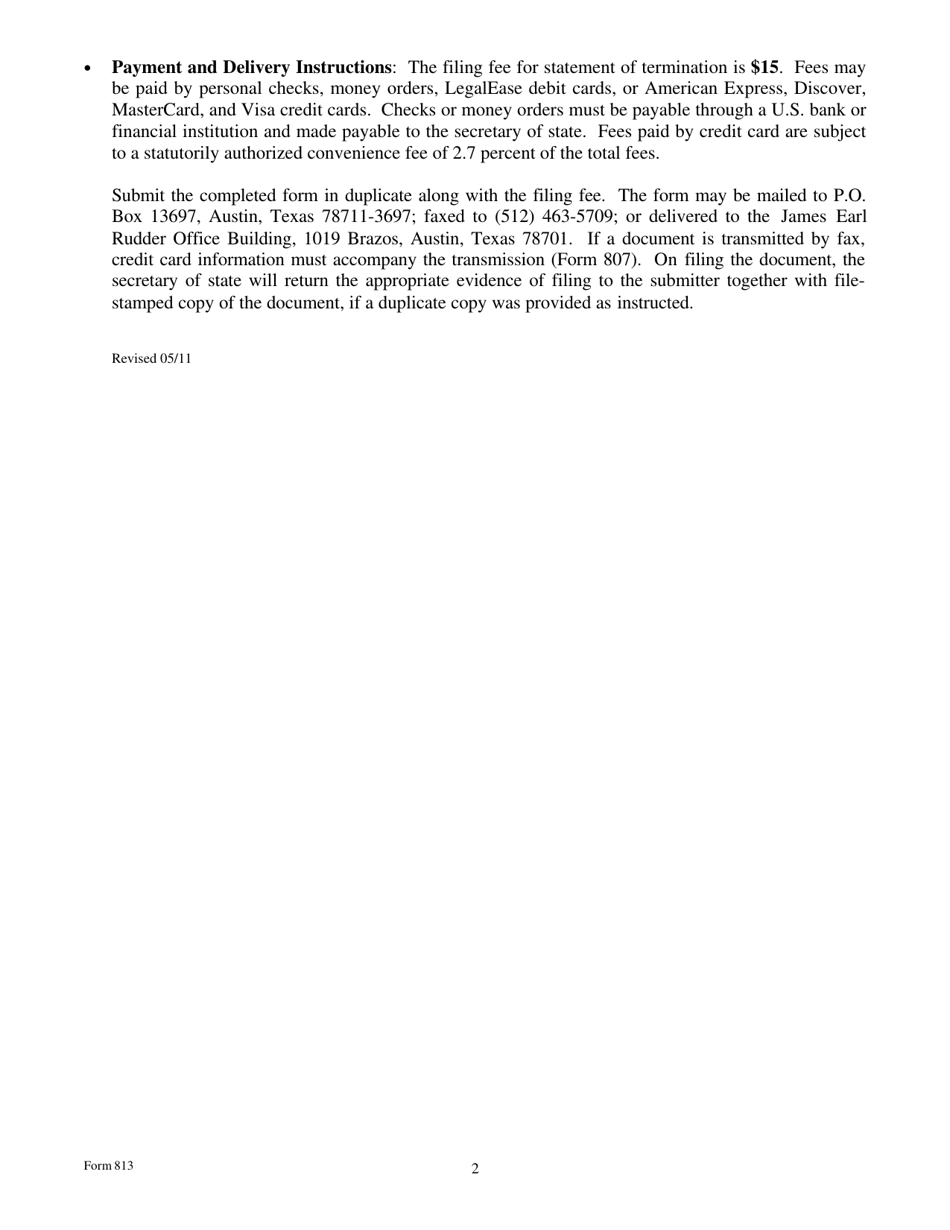

A: Yes, there is a filing fee that must be paid when submitting Form 813.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 813 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.