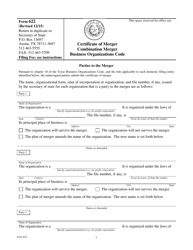

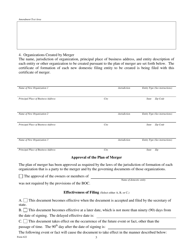

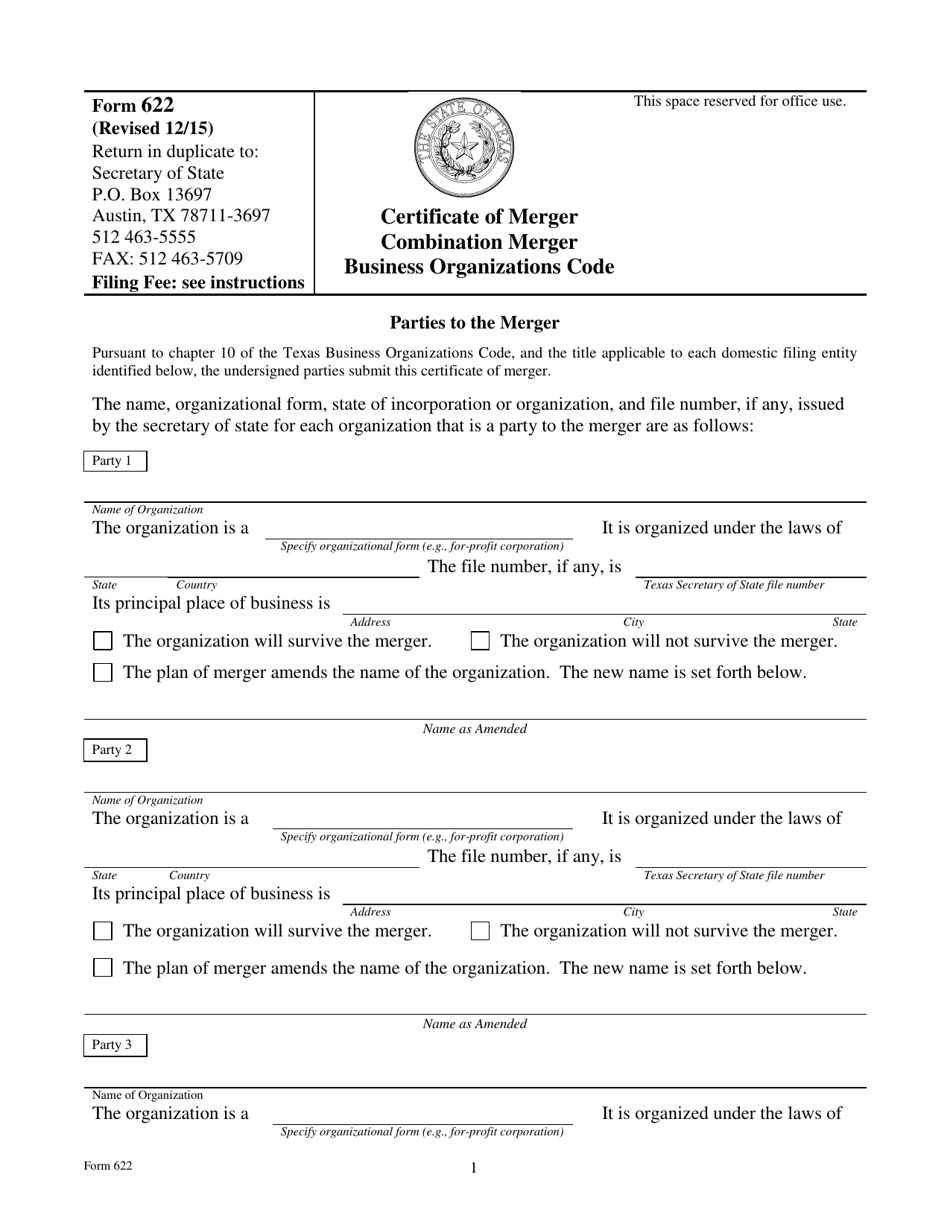

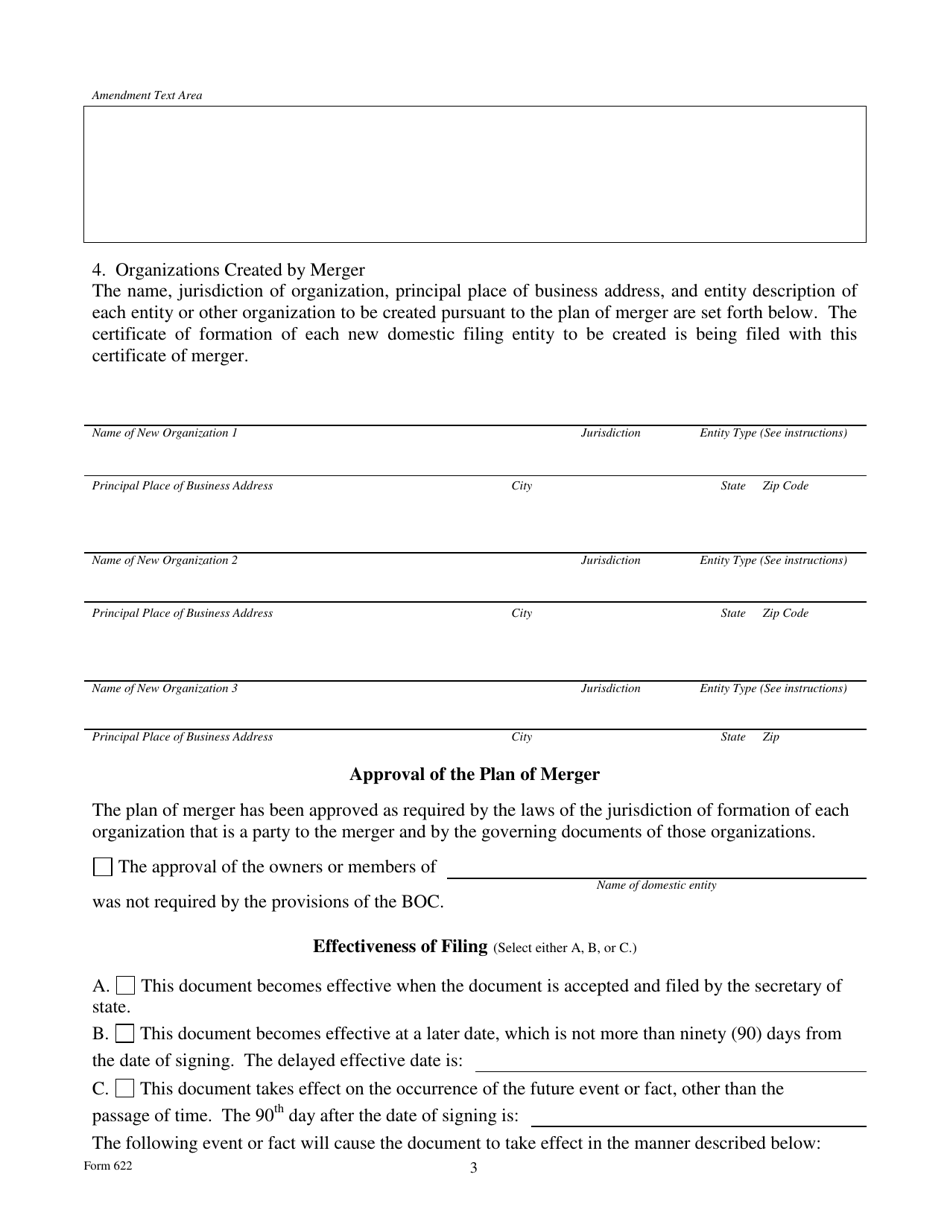

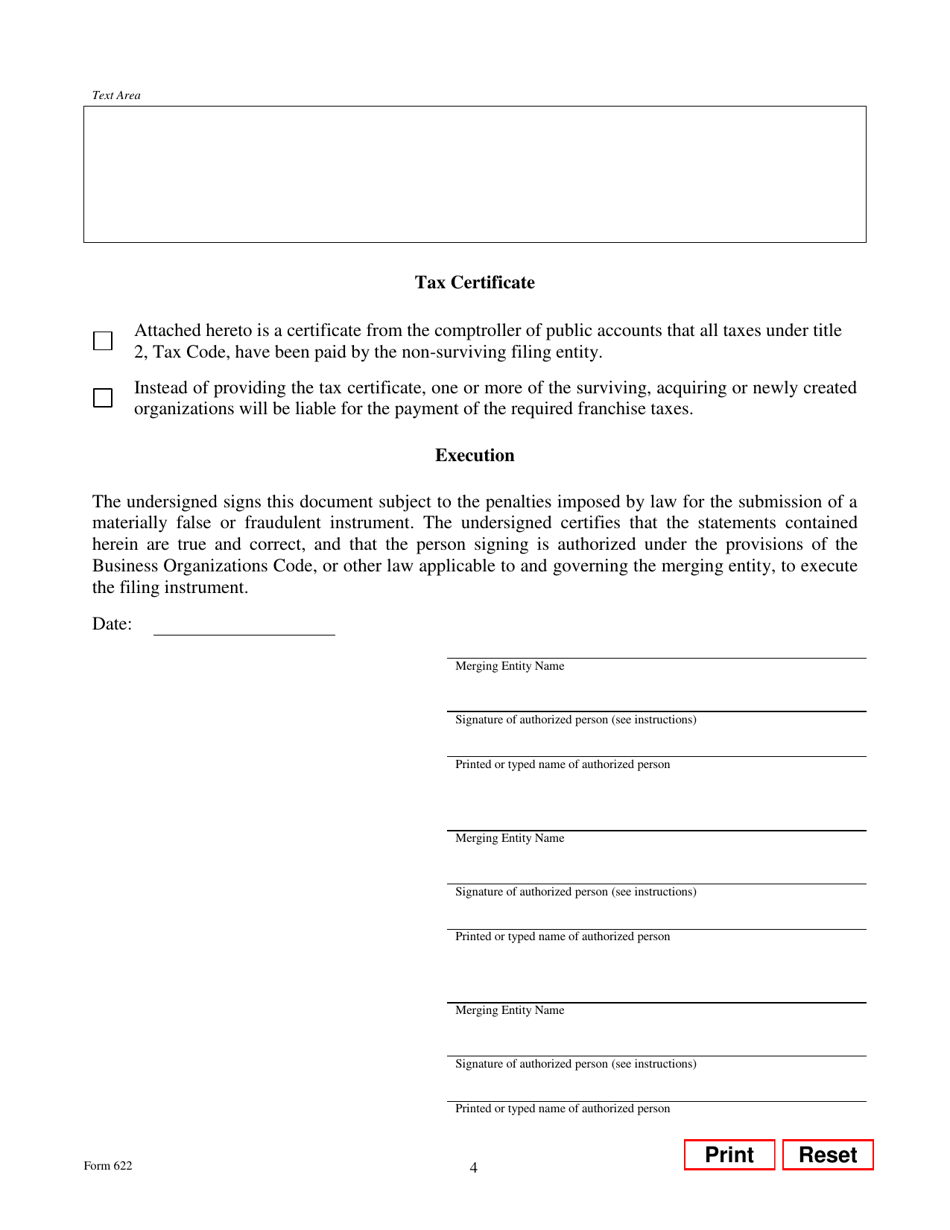

Form 622 Certificate of Merger Combination Merger Business Organizations Code - Texas

What Is Form 622?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

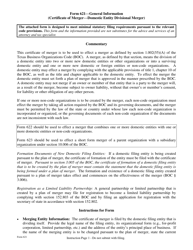

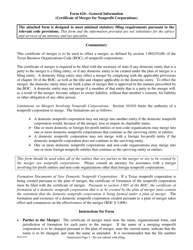

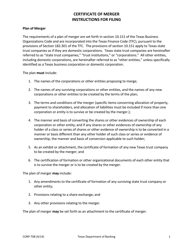

Q: What is Form 622?

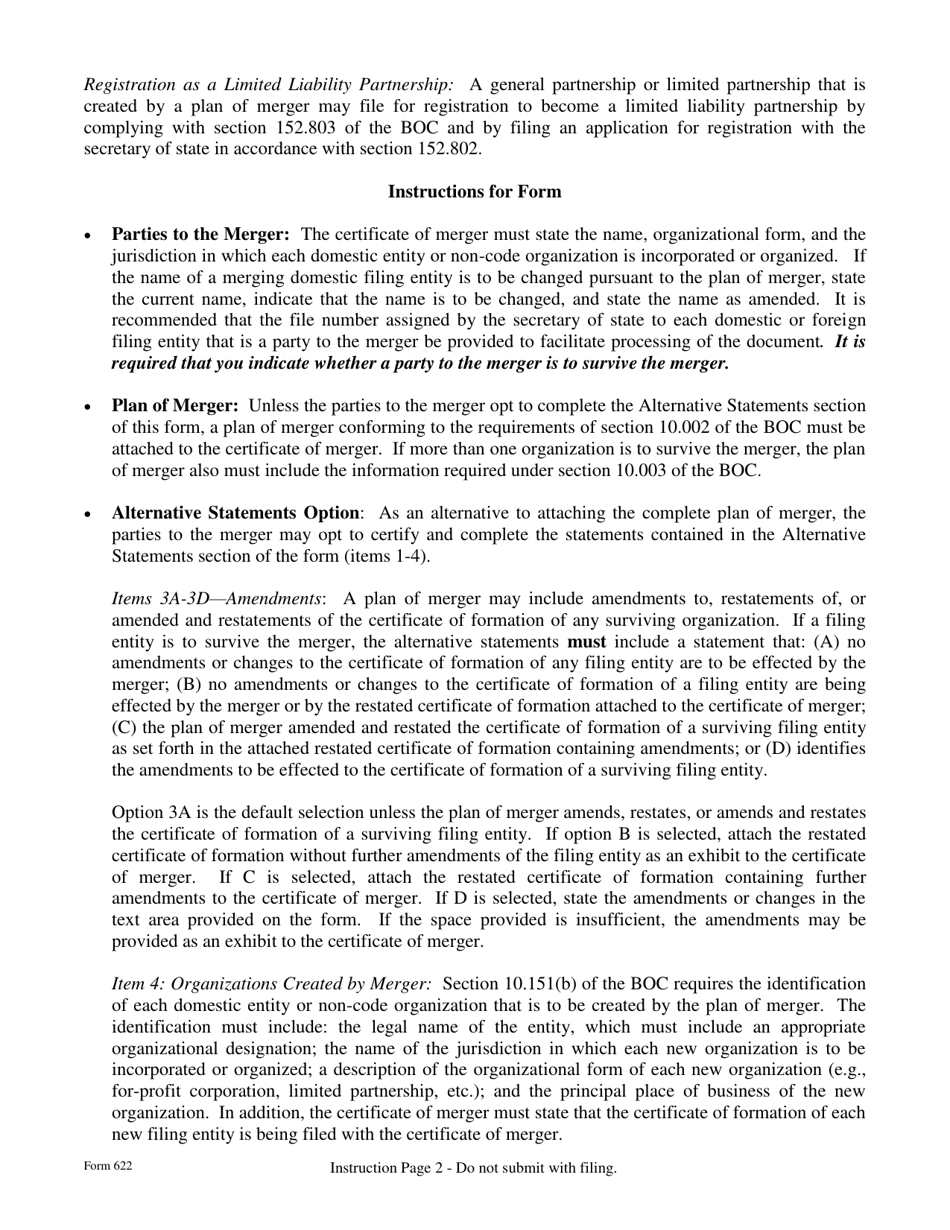

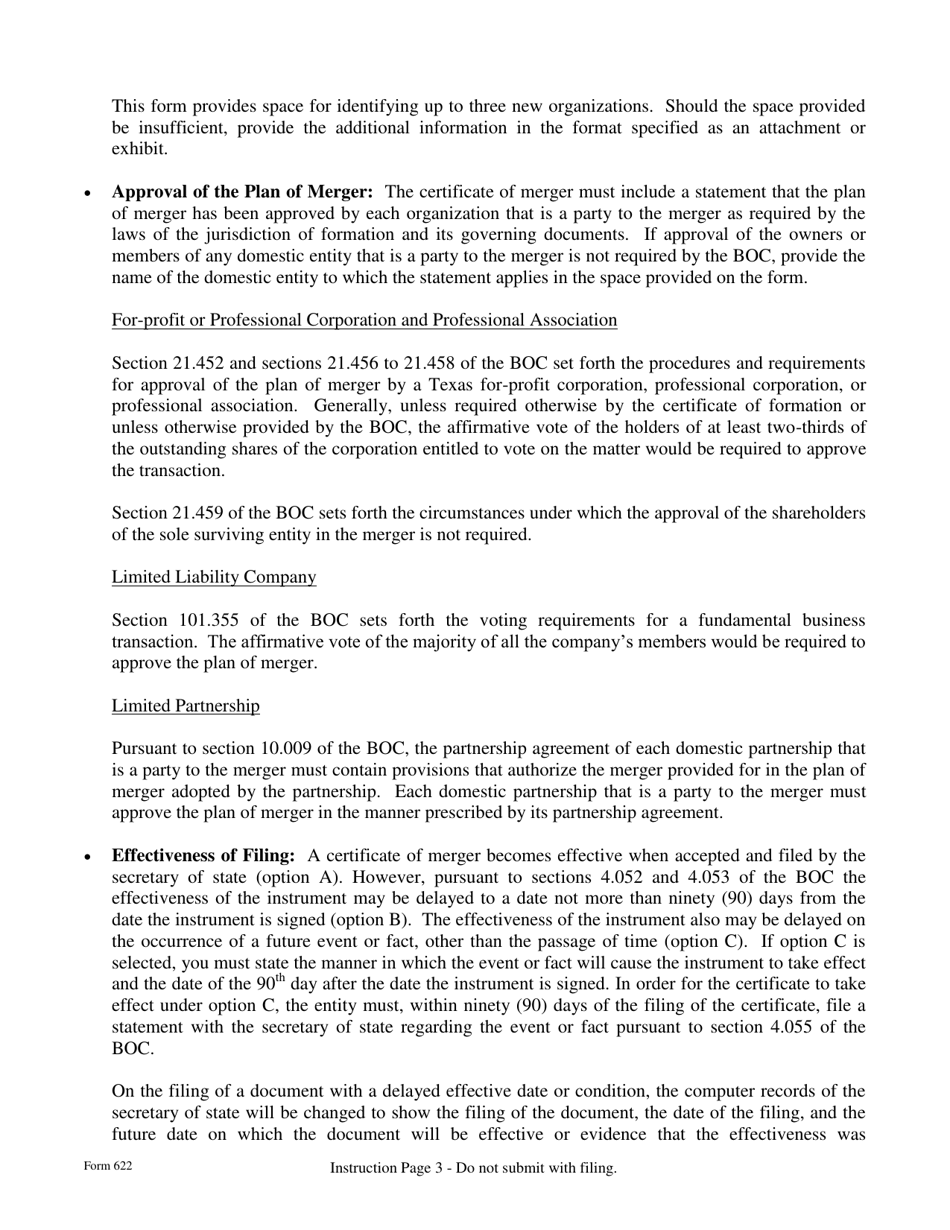

A: Form 622 is the Certificate of Merger for a combination merger under the Business Organizations Code in Texas.

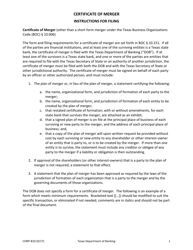

Q: What is a combination merger?

A: A combination merger is a type of merger where two or more entities combine to form a single entity.

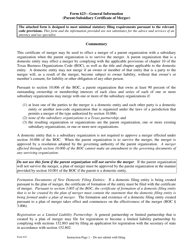

Q: What is the Business Organizations Code in Texas?

A: The Business Organizations Code is a set of laws and regulations that govern the formation and operation of business entities in Texas.

Q: What is the purpose of Form 622?

A: The purpose of Form 622 is to provide a legal document that records the details of a combination merger.

Q: Who is required to file Form 622?

A: Entities that are undergoing a combination merger in Texas are required to file Form 622.

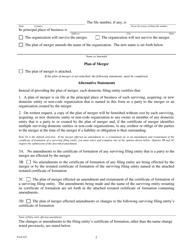

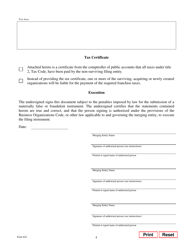

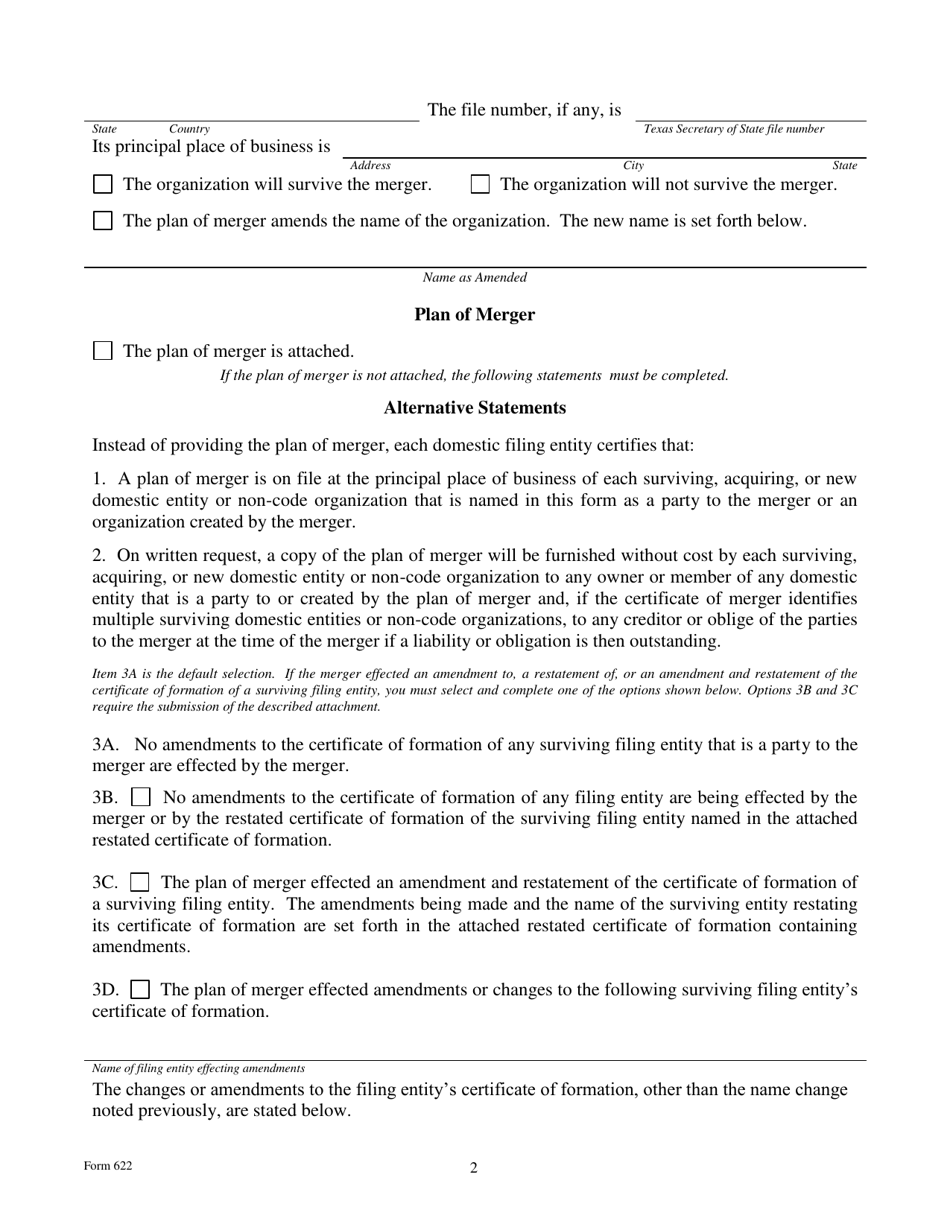

Q: What information is required on Form 622?

A: Form 622 requires information such as the names of the merging entities, the effective date of the merger, and the contact information of the person filing the form.

Q: Is legal representation required to file Form 622?

A: Legal representation is not required to file Form 622, but it is recommended to consult with an attorney for assistance.

Q: What happens after Form 622 is filed?

A: After Form 622 is filed and approved, the combination merger becomes legally effective and the entities involved become a single entity under the Business Organizations Code.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 622 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.