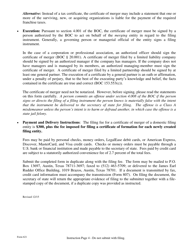

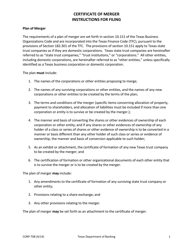

Form 621 Certificate of Merger Domestic Entity Divisional Merger Business Organizations Code - Texas

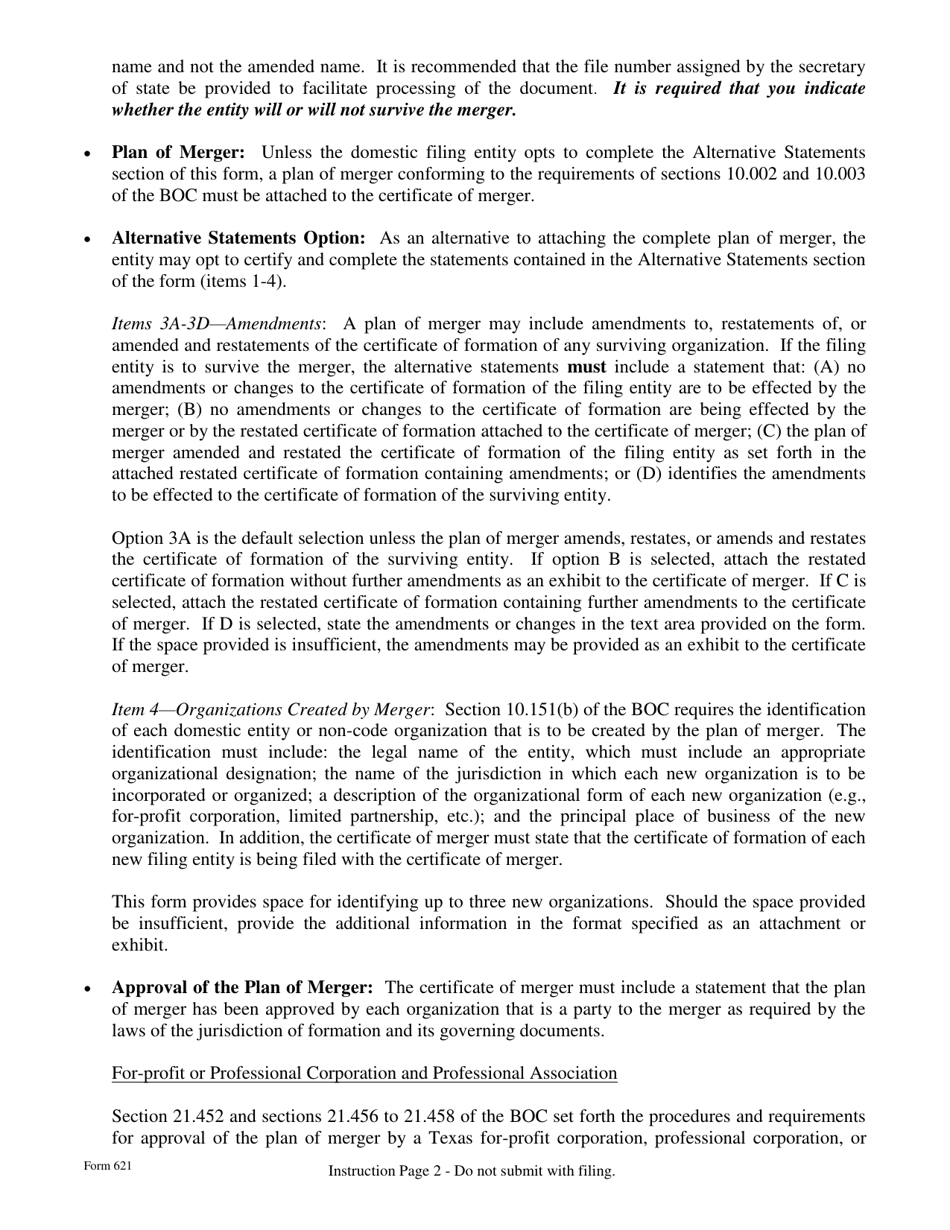

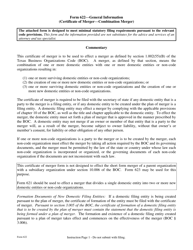

What Is Form 621?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 621?

A: Form 621 is the Certificate of Merger for a Domestic Entity Divisional Merger under the Business Organizations Code in Texas.

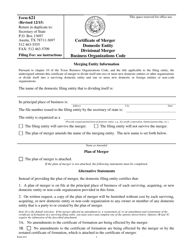

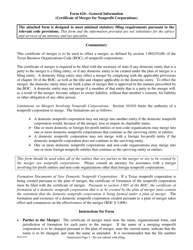

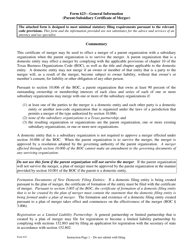

Q: What is a Domestic Entity Divisional Merger?

A: A Domestic Entity Divisional Merger is a type of merger under which one or more divisions of a domestic entity are merged into another domestic entity.

Q: What is the Business Organizations Code in Texas?

A: The Business Organizations Code in Texas is a set of laws that governs various types of business entities and transactions in the state.

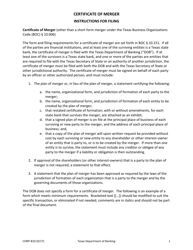

Q: Who needs to file Form 621?

A: Any domestic entity that is undergoing a divisional merger in Texas needs to file Form 621.

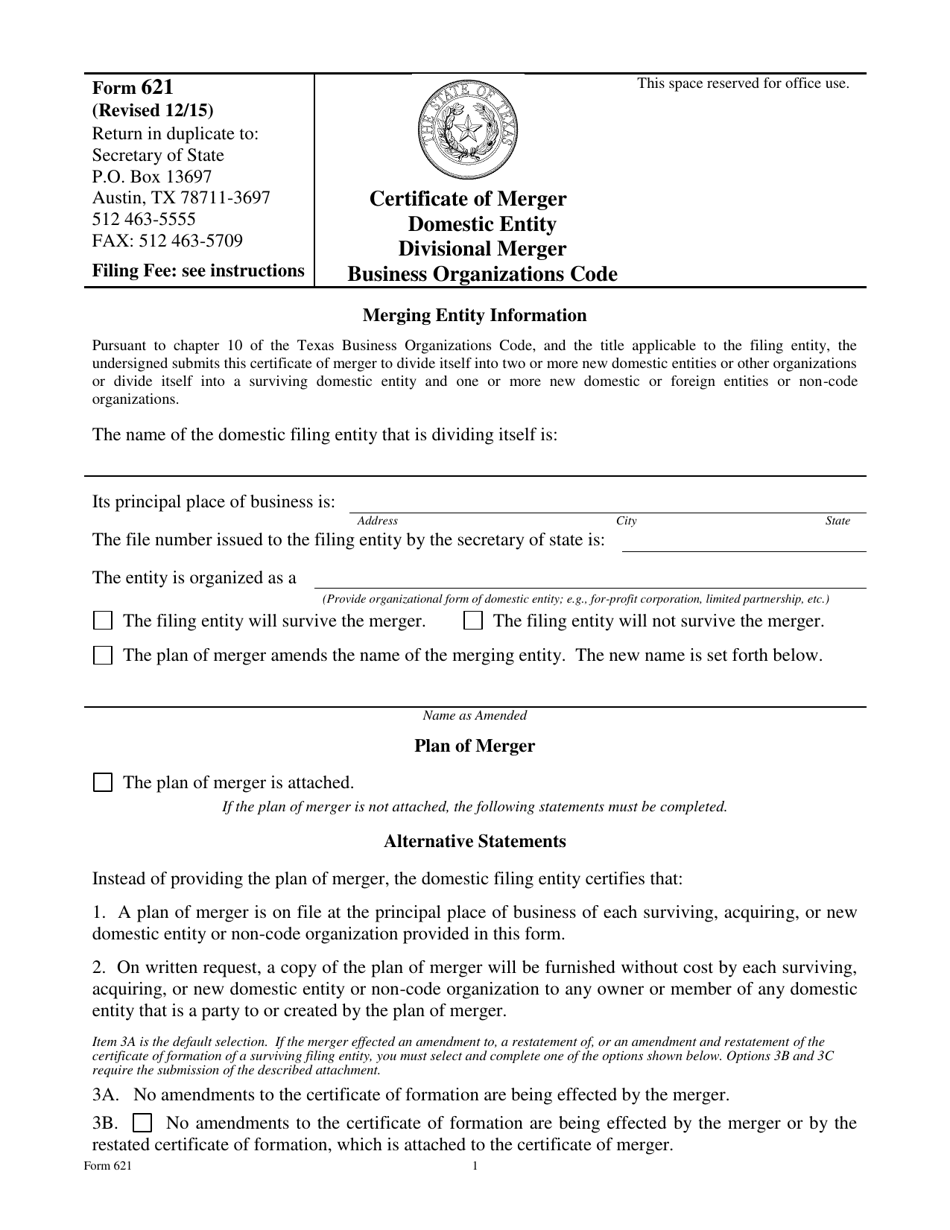

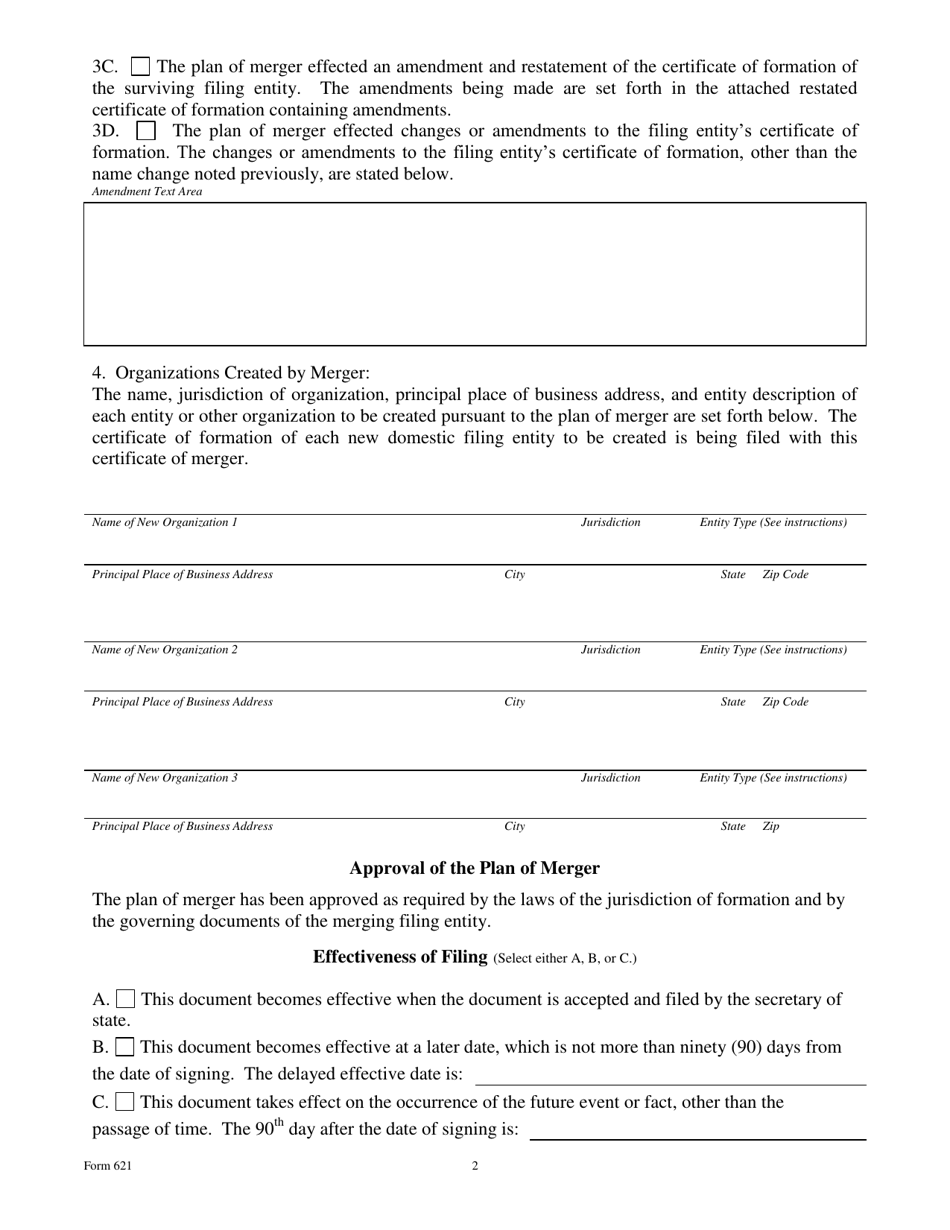

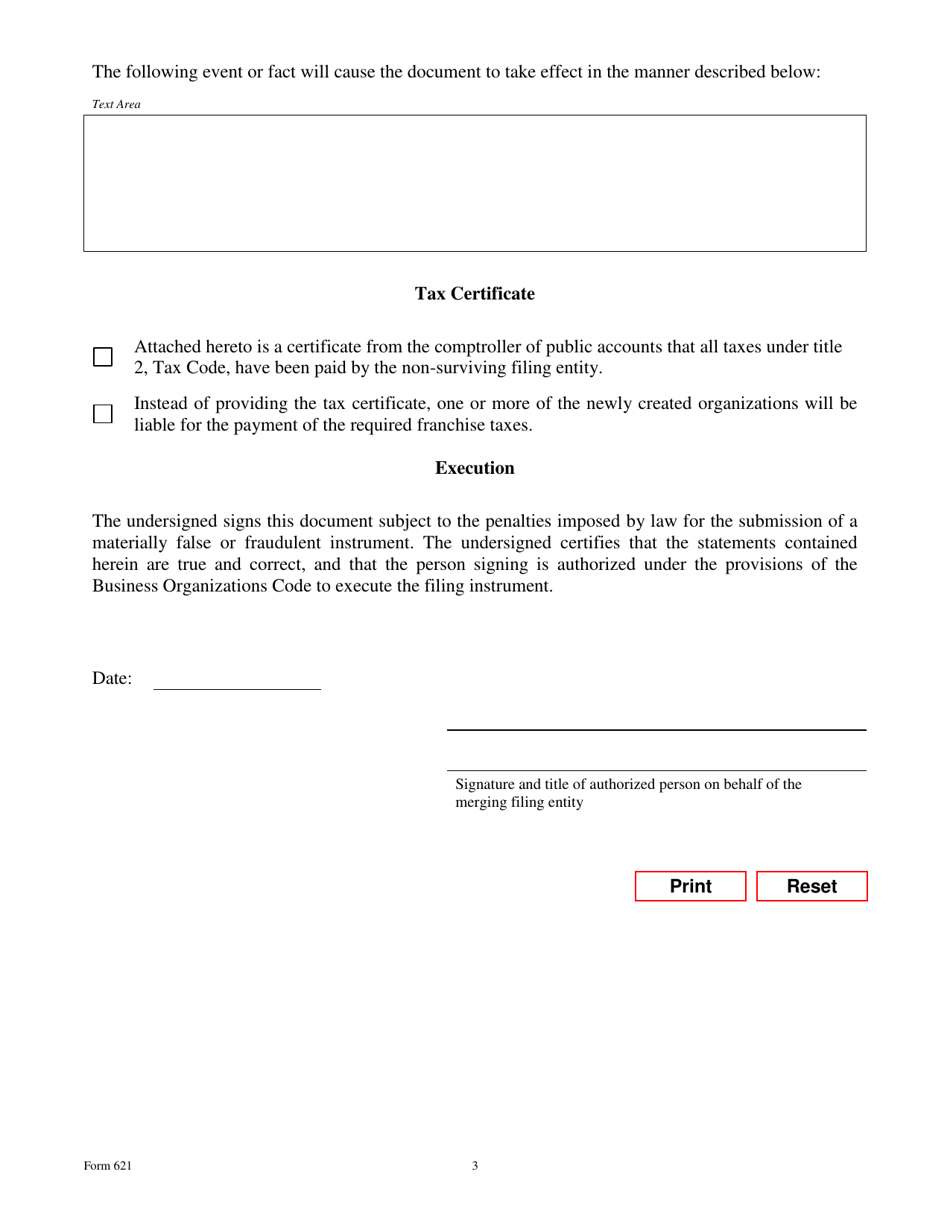

Q: What information is required on Form 621?

A: Form 621 requires information about the merging entities, the terms of the merger, and the effect of the merger on the domestic entity.

Q: Is legal advice necessary for filling out Form 621?

A: While legal advice is not required, it is recommended to consult with an attorney or business professional familiar with the merger process to ensure compliance with applicable laws and regulations.

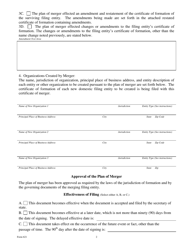

Q: What is the purpose of filing Form 621?

A: The purpose of filing Form 621 is to officially document and authorize the divisional merger of domestic entities in Texas.

Q: What is the timeline for filing Form 621?

A: Form 621 should be filed with the Texas Secretary of State within a reasonable period of time before the effective date of the divisional merger, as specified by the Business Organizations Code.

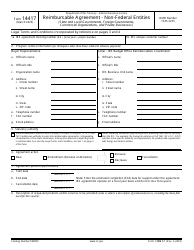

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

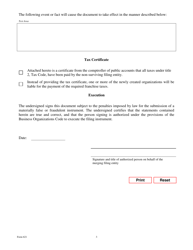

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 621 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.