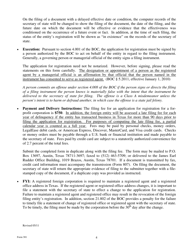

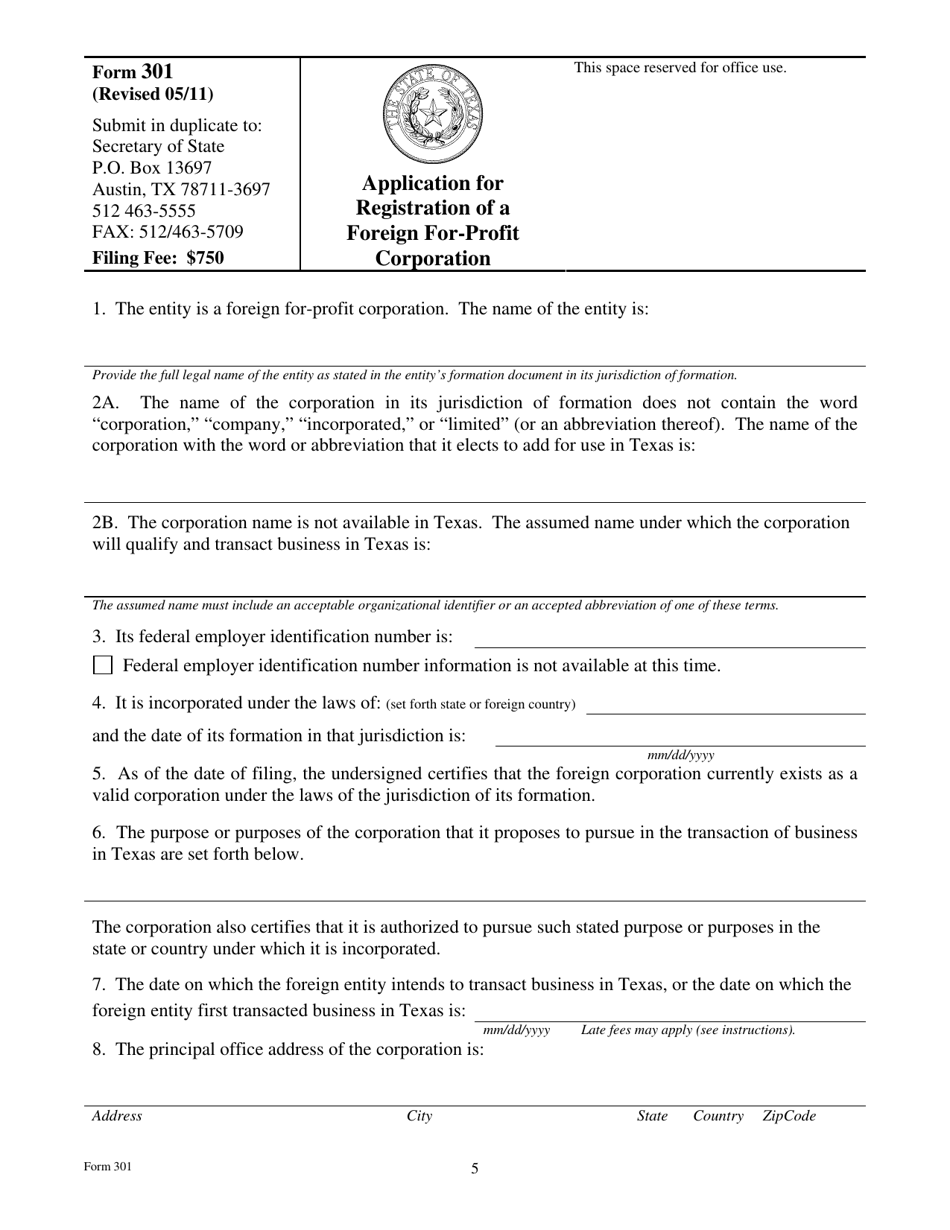

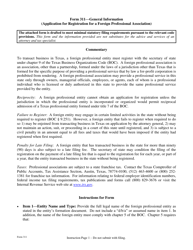

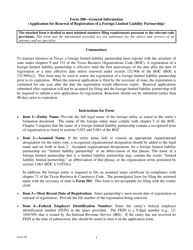

Form 301 Application for Registration of a Foreign for-Profit Corporation - Texas

What Is Form 301?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 301?

A: Form 301 is the application for registration of a foreign for-profit corporation in the state of Texas.

Q: Who needs to file Form 301?

A: Foreign for-profit corporations that wish to do business in Texas need to file Form 301.

Q: What is a foreign for-profit corporation?

A: A foreign for-profit corporation is a corporation that was formed outside of Texas.

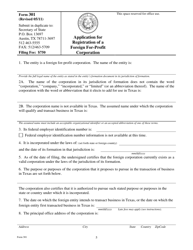

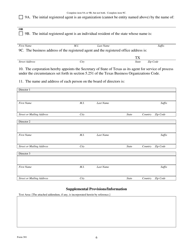

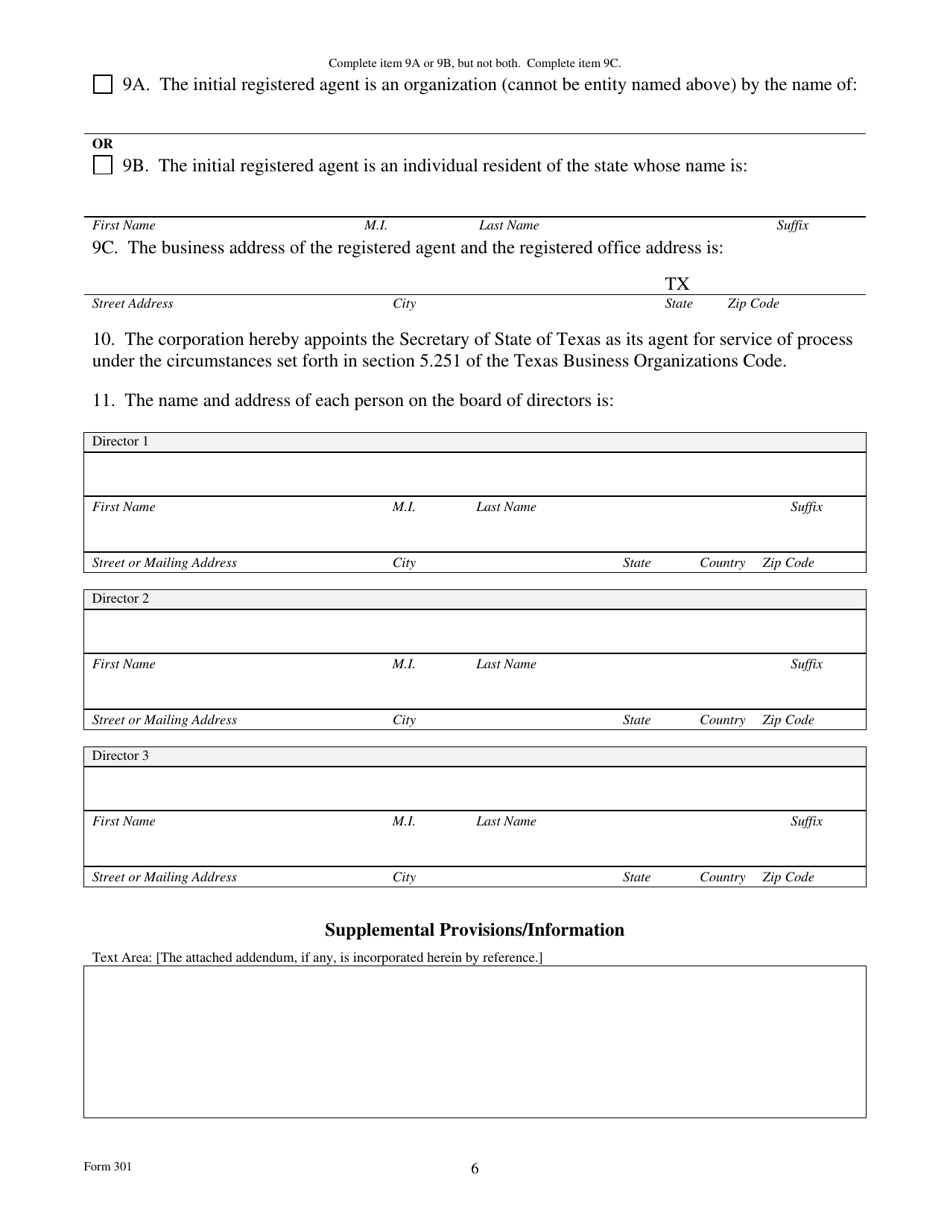

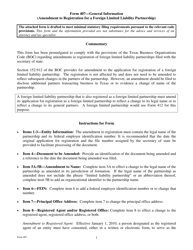

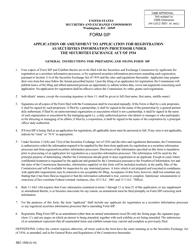

Q: What information is required on Form 301?

A: Form 301 requires information such as the corporation's name, address, registered agent, and the state or country of incorporation.

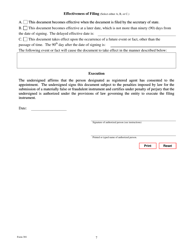

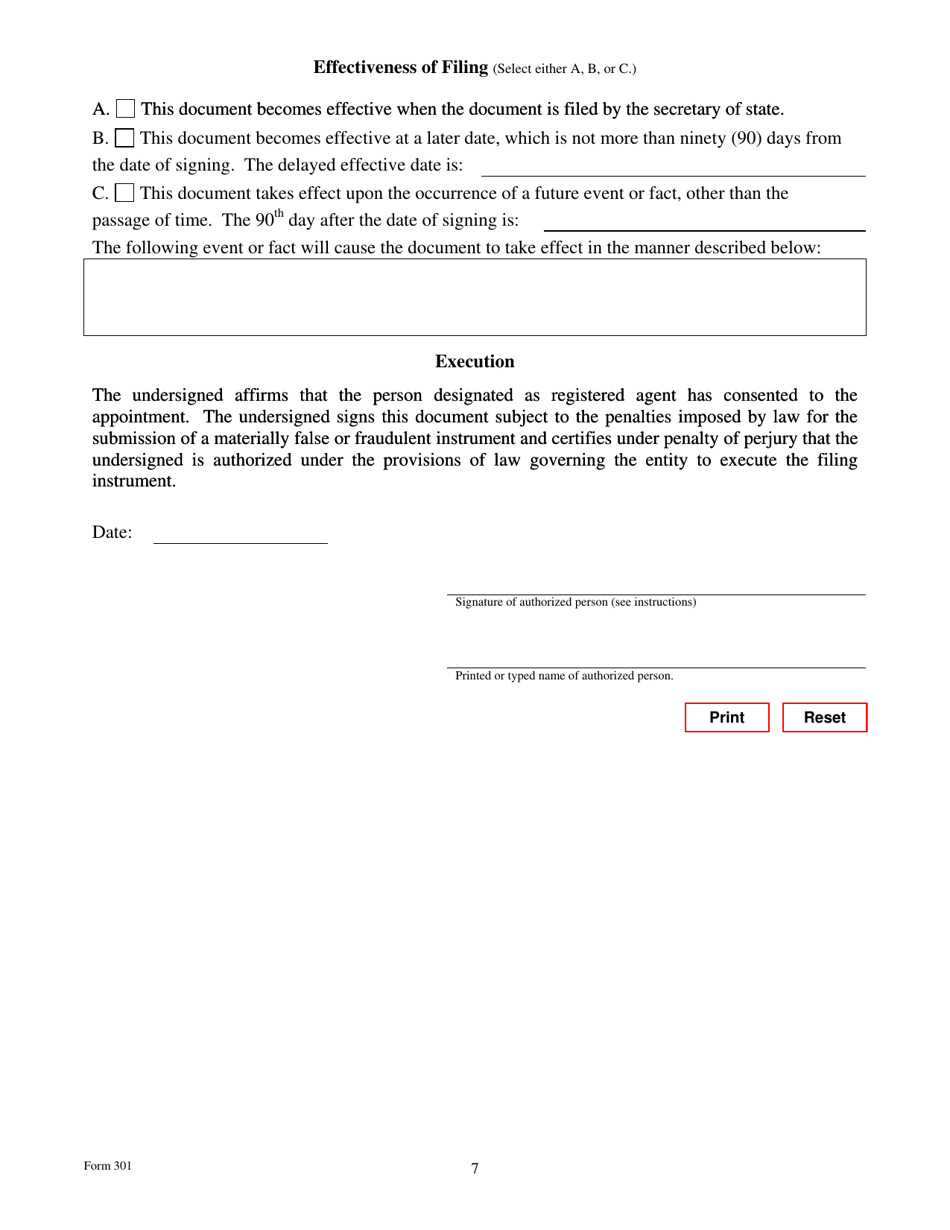

Q: What happens after Form 301 is filed?

A: After Form 301 is filed and the fee is paid, the Texas Secretary of State will review the application and, if approved, issue a certificate of authority to do business in Texas.

Q: Is it mandatory to file Form 301?

A: Yes, it is mandatory for foreign for-profit corporations to file Form 301 in order to legally do business in Texas.

Q: Are there any additional requirements for foreign for-profit corporations in Texas?

A: Foreign for-profit corporations may be required to appoint and maintain a registered agent in Texas and may also be subject to certain taxes and reporting obligations.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 301 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.