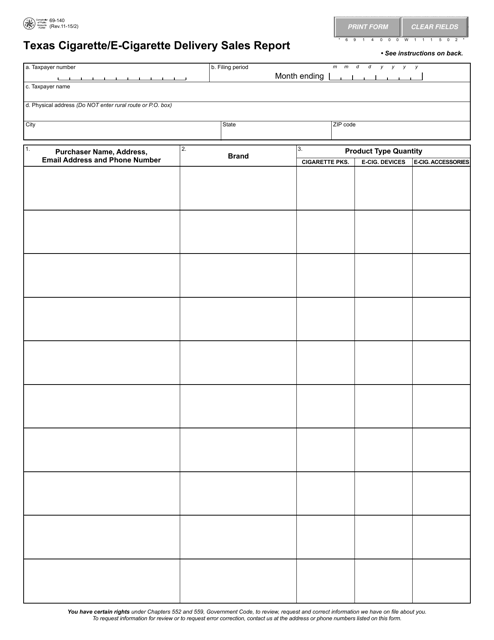

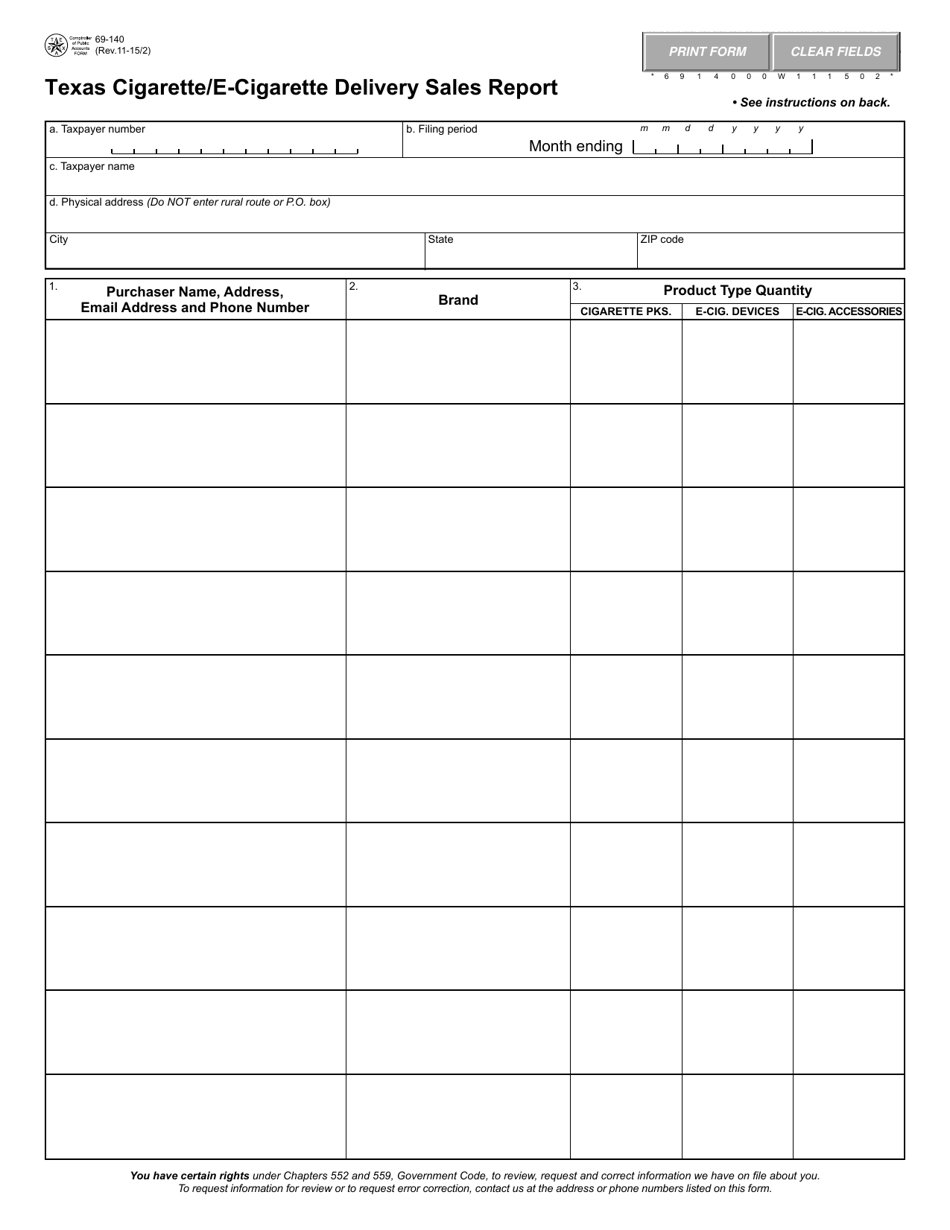

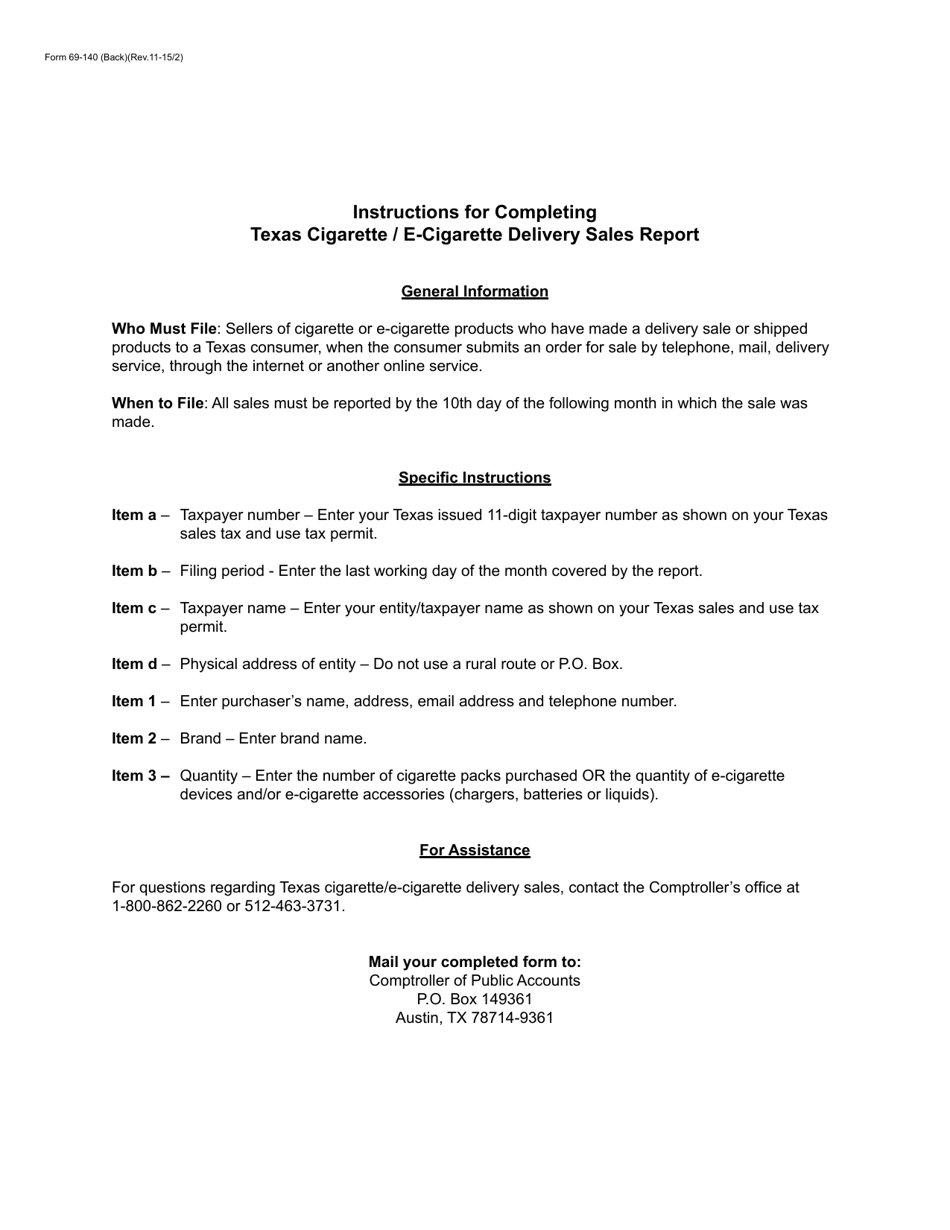

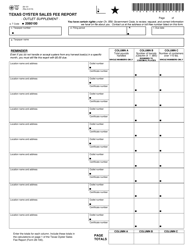

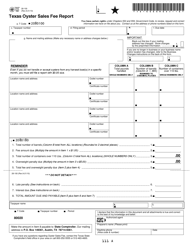

Form 69-140 Texas Cigarette / E-Cigarette Delivery Sales Report - Texas

What Is Form 69-140?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 69-140?

A: Form 69-140 is the Texas Cigarette/E-Cigarette Delivery Sales Report.

Q: What is the purpose of form 69-140?

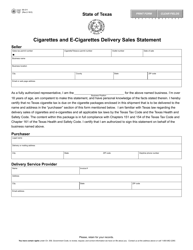

A: The purpose of form 69-140 is to report cigarette and e-cigarette delivery sales in Texas.

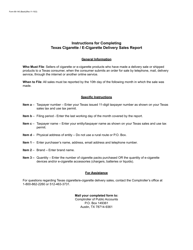

Q: Who needs to file form 69-140?

A: Any business that sells cigarettes or e-cigarettes for delivery in Texas needs to file form 69-140.

Q: What information is required on form 69-140?

A: Form 69-140 requires details about the quantity and sales data of cigarettes and e-cigarettes.

Q: How often does form 69-140 need to be filed?

A: Form 69-140 needs to be filed on a monthly basis.

Q: Is there a deadline for filing form 69-140?

A: Yes, form 69-140 must be filed by the 20th day of the following month.

Q: Are there any penalties for not filing form 69-140?

A: Yes, failure to file form 69-140 can result in penalties and interest.

Q: Is there a fee for filing form 69-140?

A: No, there is no fee for filing form 69-140.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-140 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.