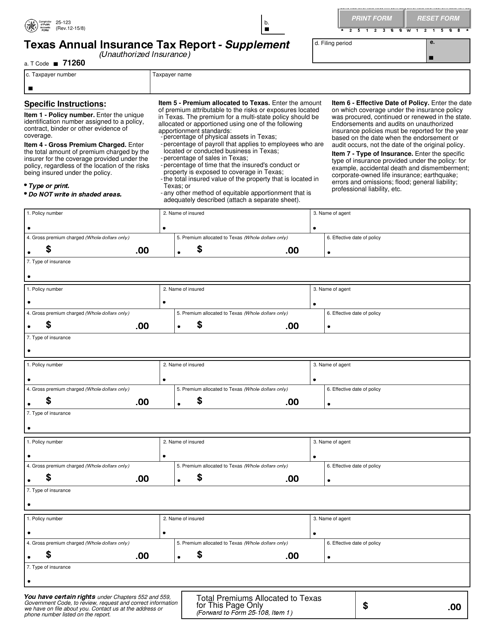

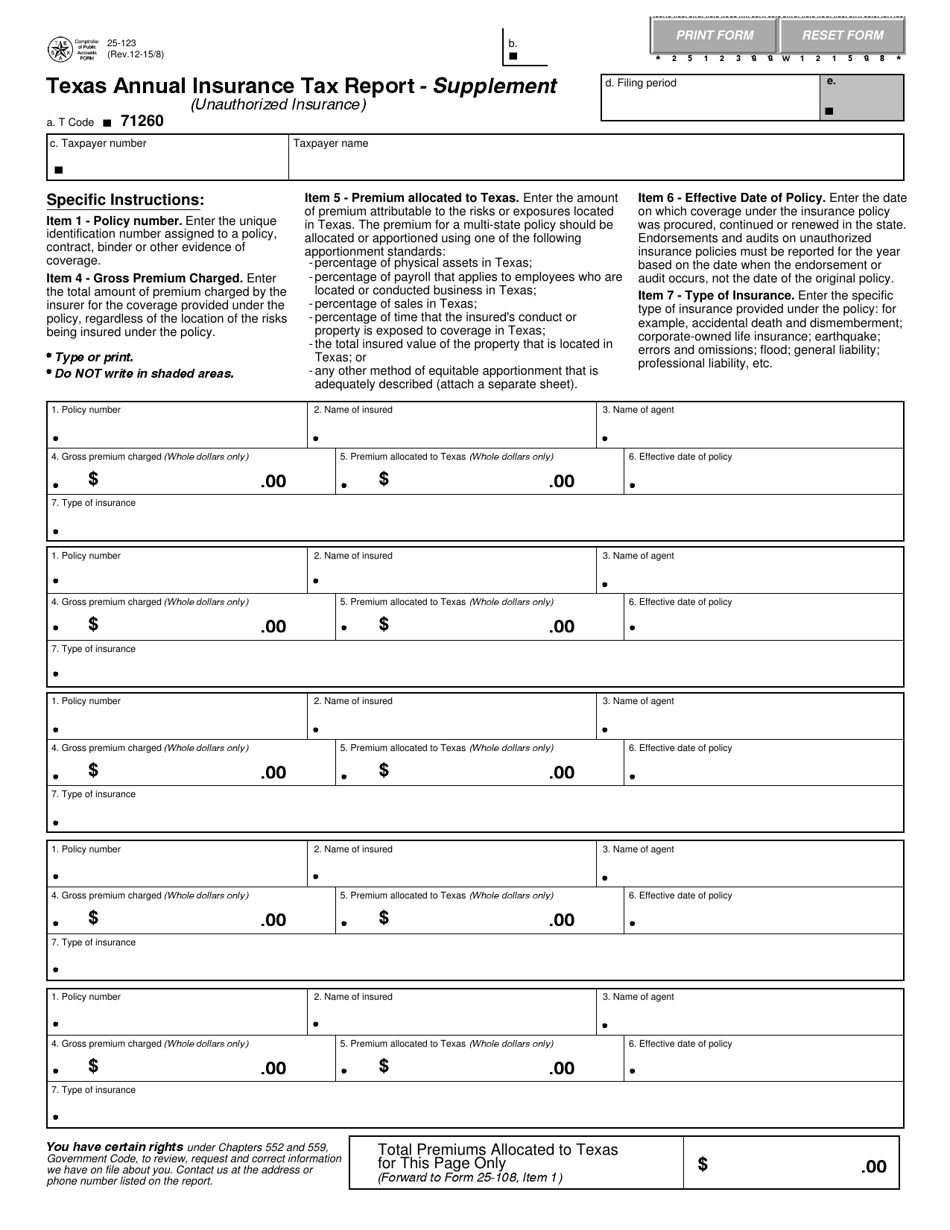

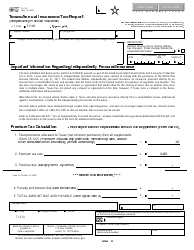

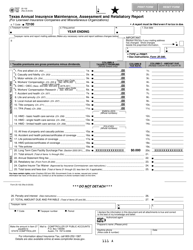

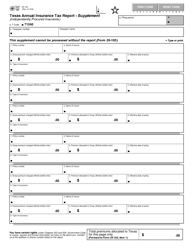

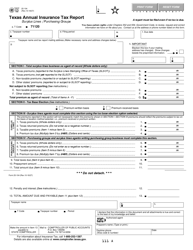

Form 25-123 Annual Insurance Tax Report - Supplement (Unauthorized Insurance) - Texas

What Is Form 25-123?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25-123?

A: Form 25-123 is the Annual Insurance Tax Report - Supplement (Unauthorized Insurance) specifically for the state of Texas.

Q: What is the purpose of Form 25-123?

A: The purpose of Form 25-123 is to report unauthorized insurance policies to the state of Texas.

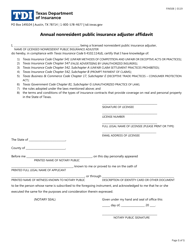

Q: Who needs to file Form 25-123?

A: Insurance companies operating in Texas that have unauthorized insurance policies need to file Form 25-123.

Q: What is unauthorized insurance?

A: Unauthorized insurance refers to policies that are sold without being properly licensed by the state.

Q: What information is required on Form 25-123?

A: Form 25-123 requires information about the unauthorized insurance policies, such as policy numbers and premium amounts.

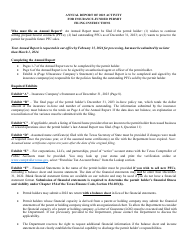

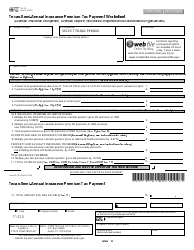

Q: When is Form 25-123 due?

A: Form 25-123 is typically due by March 1st of each year.

Q: Are there any penalties for not filing Form 25-123?

A: Yes, there may be penalties for not filing Form 25-123, including fines and potential loss of license to operate in Texas.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-123 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.