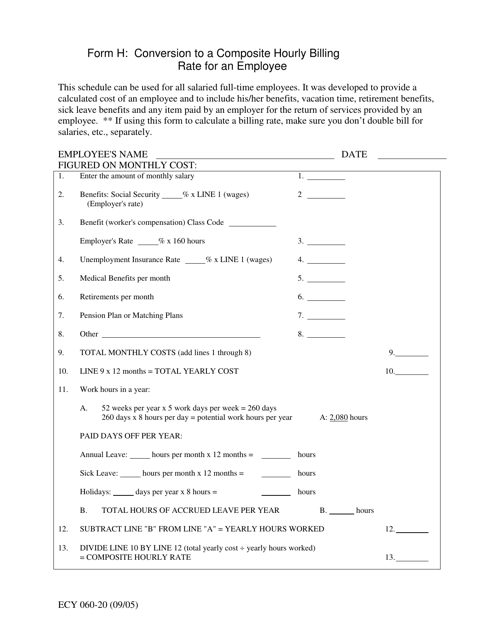

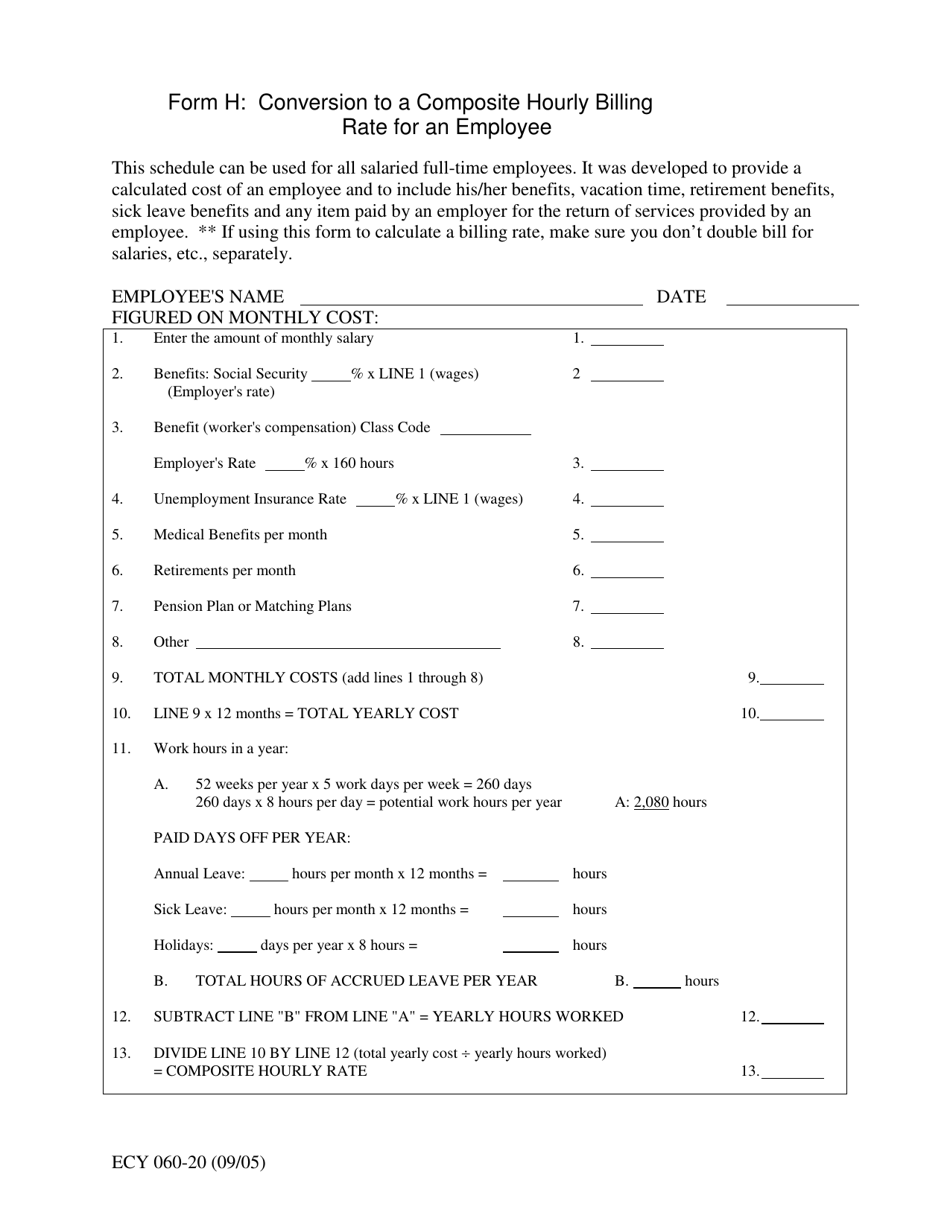

Form H (ECY060-20) Conversion to a Composite Hourly Billing Rate for an Employee - Washington

What Is Form H (ECY060-20)?

This is a legal form that was released by the Washington State Department of Ecology - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H (ECY060-20)?

A: Form H (ECY060-20) is a document used for converting an employee's hourly billing rate.

Q: What is the purpose of Form H (ECY060-20)?

A: The purpose of Form H (ECY060-20) is to convert an employee's hourly billing rate to a composite hourly billing rate.

Q: Who uses Form H (ECY060-20)?

A: Form H (ECY060-20) is used by employers in Washington.

Q: How does Form H (ECY060-20) work?

A: Form H (ECY060-20) calculates a composite hourly billing rate by factoring in various costs associated with employing the individual.

Q: What information is required on Form H (ECY060-20)?

A: Form H (ECY060-20) requires information such as the employee's hourly wage, benefits costs, overhead expenses, and other related costs.

Q: Are there any guidelines for completing Form H (ECY060-20)?

A: Yes, the Washington State Department of Ecology provides instructions and guidelines for completing Form H (ECY060-20).

Q: What is a composite hourly billing rate?

A: A composite hourly billing rate is the total cost an employer charges for an employee's hourly work, including wages, benefits, overhead, and other expenses.

Q: Why is Form H (ECY060-20) important?

A: Form H (ECY060-20) is important for employers to accurately calculate the cost of an employee's hourly work and ensure they are charging the appropriate amount.

Form Details:

- Released on September 1, 2005;

- The latest edition provided by the Washington State Department of Ecology;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H (ECY060-20) by clicking the link below or browse more documents and templates provided by the Washington State Department of Ecology.