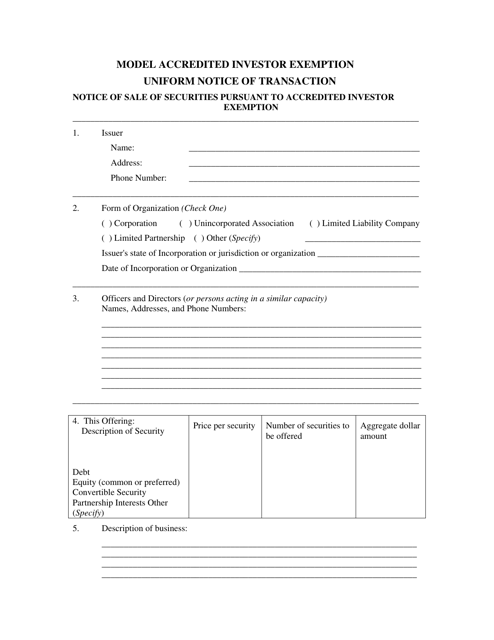

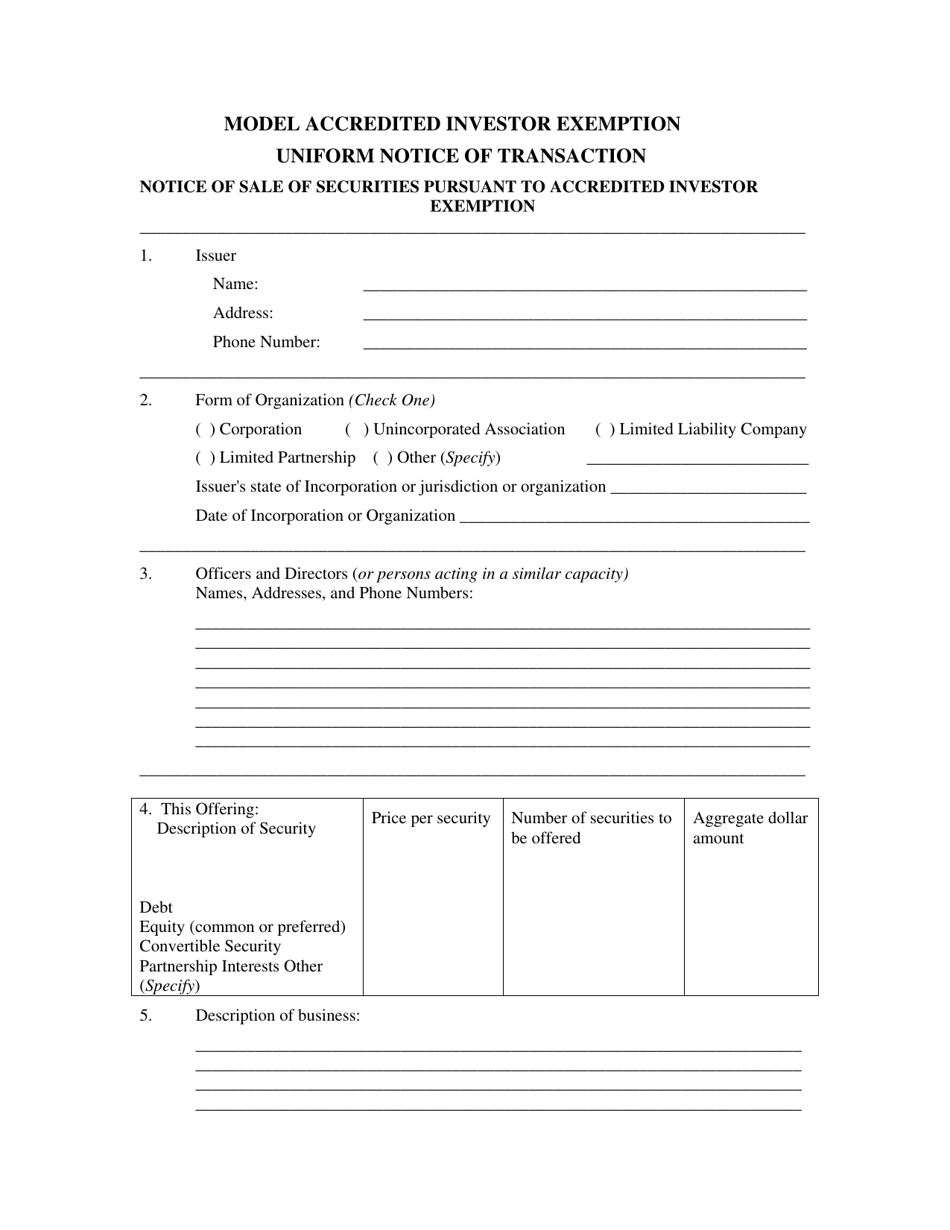

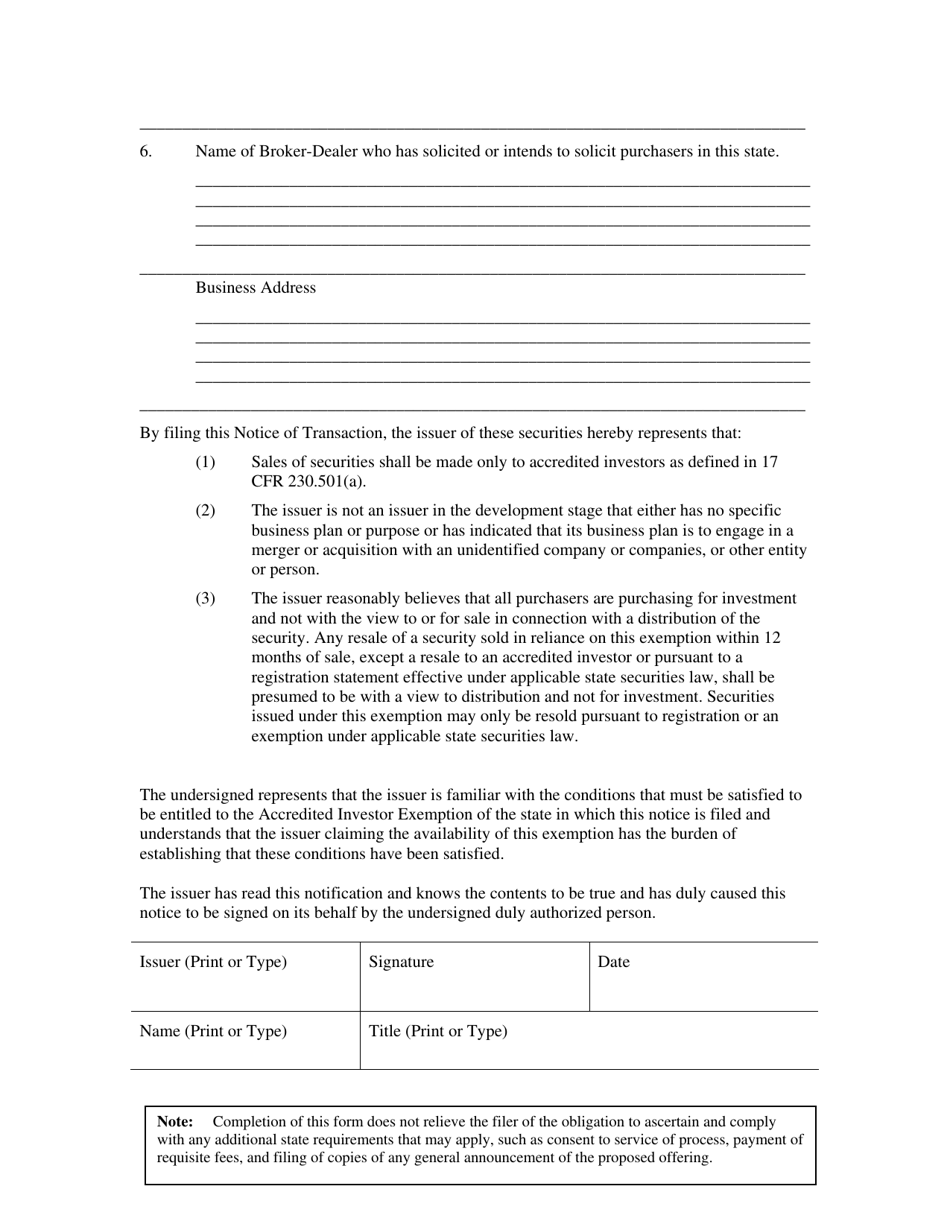

Model Accredited Investor Exemption Uniform Notice of Transaction

Model Accredited Investor Exemption Uniform Notice of Transaction is a 2-page legal document that was released by the North American Securities Administrators Association and used nation-wide.

FAQ

Q: What is the Model Accredited Investor Exemption?

A: The Model Accredited Investor Exemption is a framework created by the North American Securities Administrators Association (NASAA) to exempt certain offerings from registration requirements if sold to accredited investors.

Q: What is an accredited investor?

A: An accredited investor is an individual or entity that meets certain income or net worth thresholds set by the Securities and Exchange Commission (SEC).

Q: What is the Uniform Notice of Transaction?

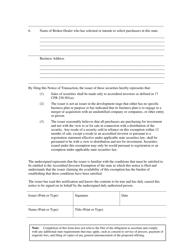

A: The Uniform Notice of Transaction is a form that must be filed by the issuer of securities to notify the appropriate securities regulator of certain exempt offerings under the Model Accredited Investor Exemption.

Q: What information does the Uniform Notice of Transaction require?

A: The Uniform Notice of Transaction requires information about the issuer, the securities being offered, the exempt offering being conducted, and the accredited investors involved.

Q: Why is the Model Accredited Investor Exemption important?

A: The Model Accredited Investor Exemption provides a streamlined process for issuers to raise capital from accredited investors without having to comply with the full registration requirements of securities laws.

Form Details:

- The latest edition currently provided by the North American Securities Administrators Association;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.