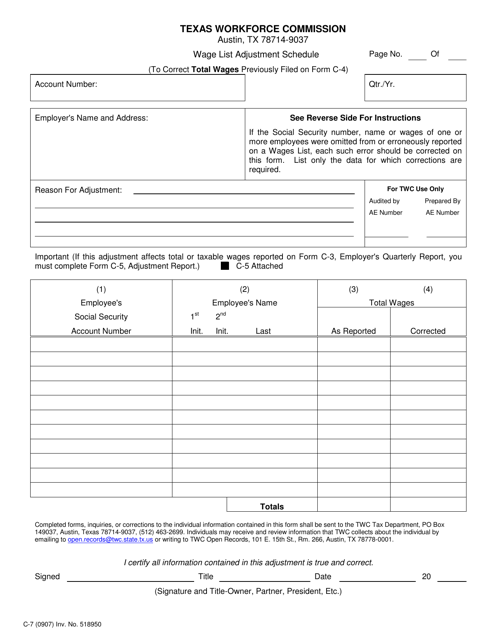

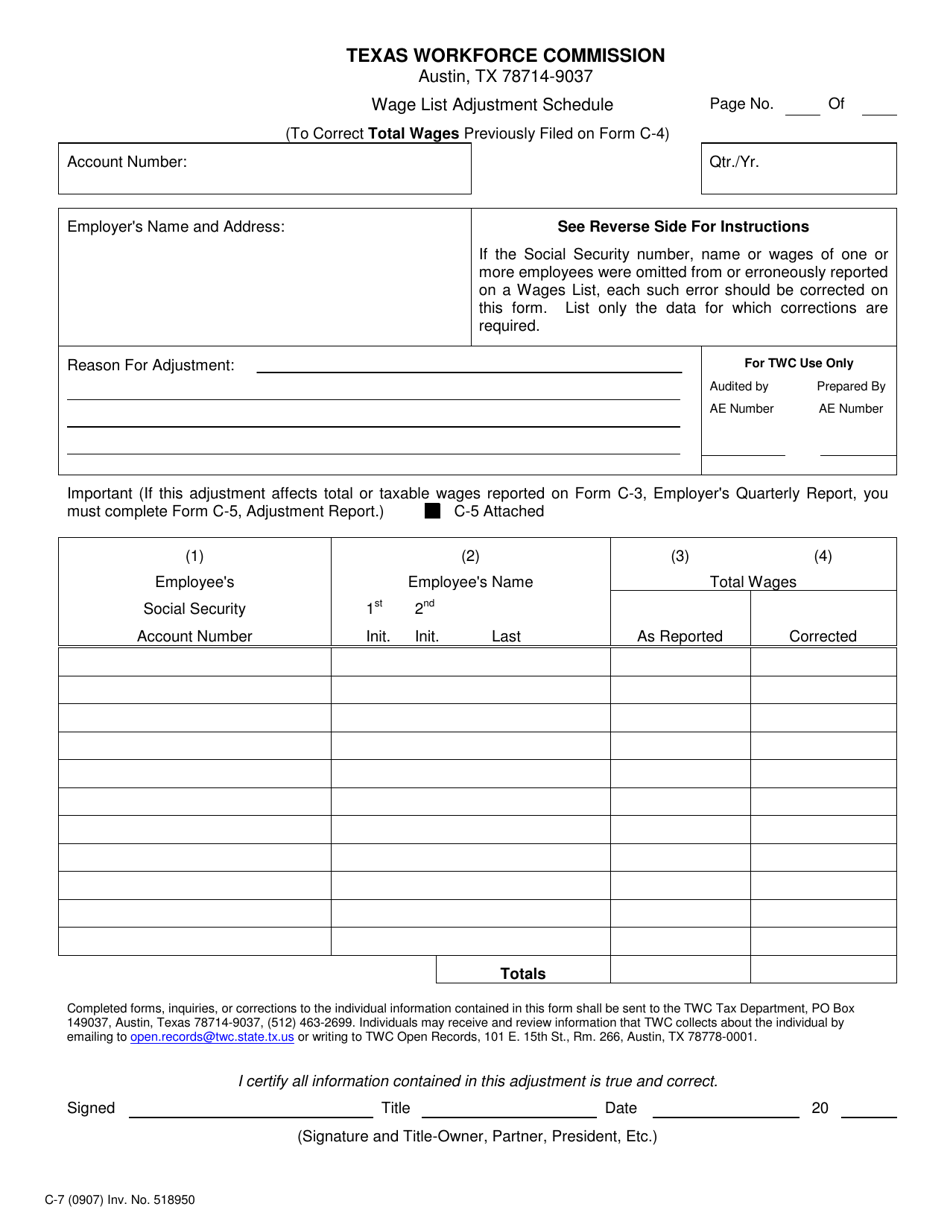

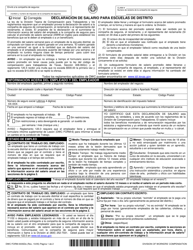

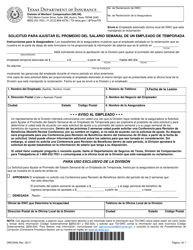

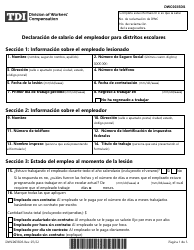

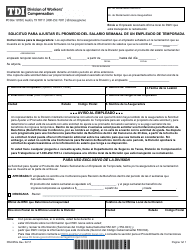

Form C-7 Wage List Adjustment Schedule - Texas

What Is Form C-7?

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-7?

A: Form C-7 is the Wage List Adjustment Schedule.

Q: What is the purpose of Form C-7?

A: The purpose of Form C-7 is to report adjustments to the wage list for workers' compensation purposes in Texas.

Q: Who needs to fill out Form C-7?

A: Employers in Texas who need to report adjustments to the wage list for workers' compensation purposes.

Q: Is there a deadline for submitting Form C-7?

A: Yes, employers must submit Form C-7 within 30 days of the effective date of the adjustment.

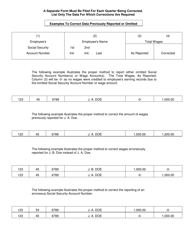

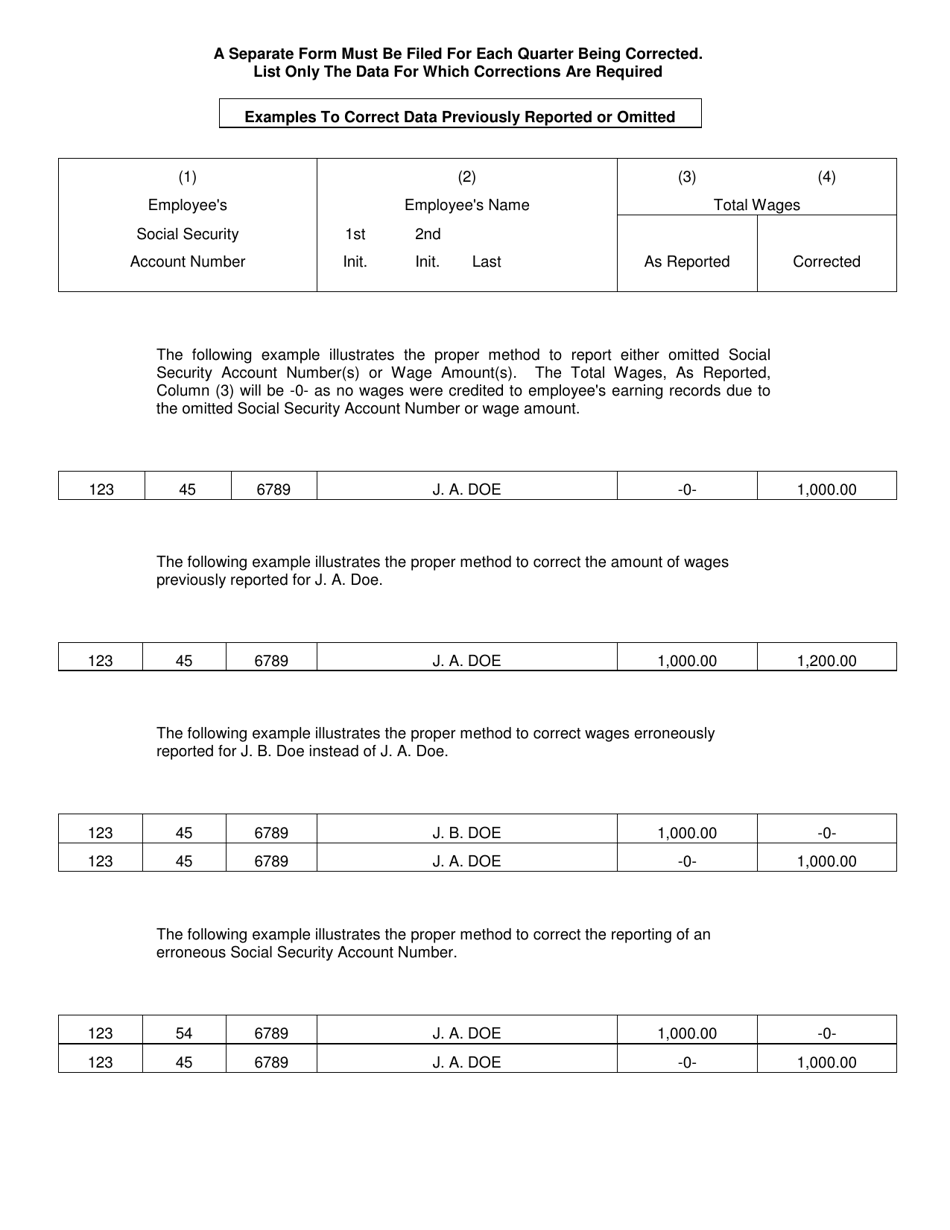

Q: What information is required on Form C-7?

A: Form C-7 requires information such as the employee's name, Social Security number, current wage, effective date of the adjustment, and reason for the adjustment.

Q: Are there any fees associated with filing Form C-7?

A: No, there are no fees associated with filing Form C-7. It is a free form.

Q: What should I do if I made an error on Form C-7?

A: If you made an error on Form C-7, you should contact the Texas Department of Insurance to correct the mistake.

Q: Is Form C-7 specific to Texas?

A: Yes, Form C-7 is specific to Texas and is used for reporting wage list adjustments for workers' compensation purposes in the state.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-7 by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.