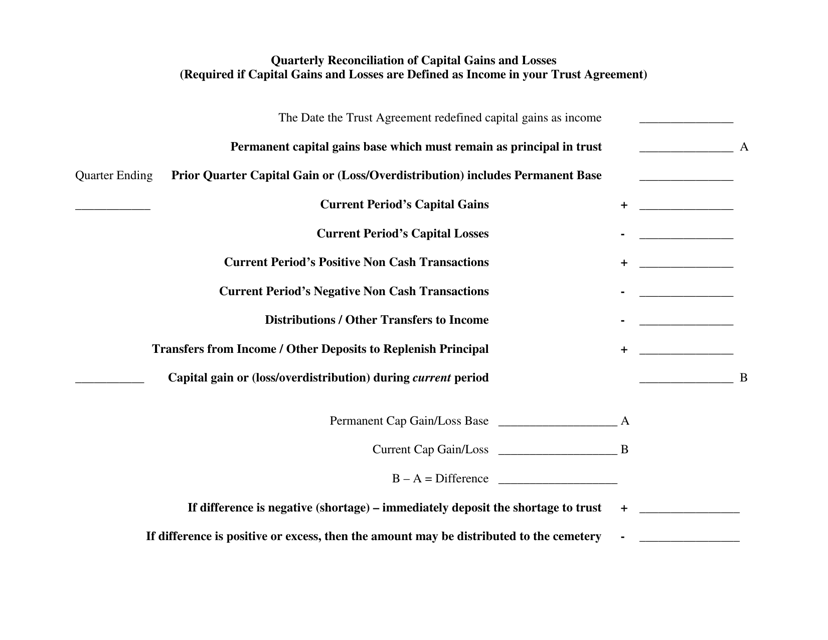

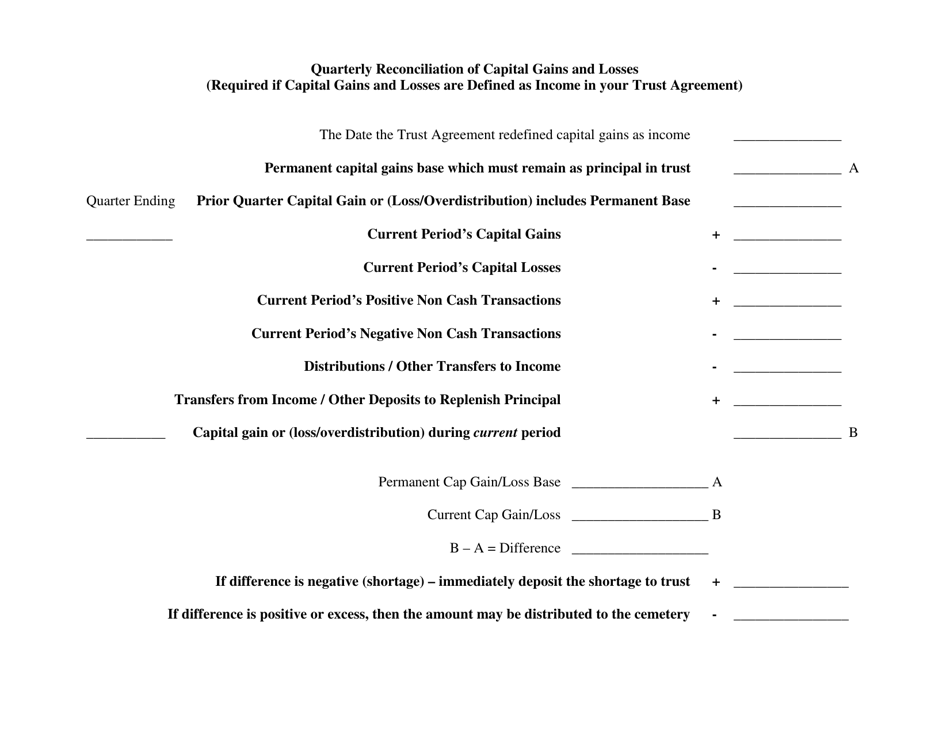

Quarterly Reconciliation of Capital Gains and Losses - Texas

Quarterly Reconciliation of Capital Gains and Losses is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: What is quarterly reconciliation of capital gains and losses?

A: Quarterly reconciliation of capital gains and losses refers to the process of reviewing and balancing the gains and losses from investments made during a specific quarter.

Q: Why is quarterly reconciliation of capital gains and losses important?

A: Quarterly reconciliation of capital gains and losses is important for accurately calculating and reporting taxable income from investments.

Q: Who is required to do quarterly reconciliation of capital gains and losses?

A: Individuals and businesses that have capital gains or losses from investments are required to do quarterly reconciliation.

Q: Do I need to do quarterly reconciliation of capital gains and losses in Texas?

A: Yes, if you have capital gains or losses from investments and you reside in Texas, you are required to do quarterly reconciliation.

Q: How do I do quarterly reconciliation of capital gains and losses in Texas?

A: To do quarterly reconciliation in Texas, you need to gather all relevant investment information, calculate gains and losses, and report them on the appropriate tax forms.

Form Details:

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.