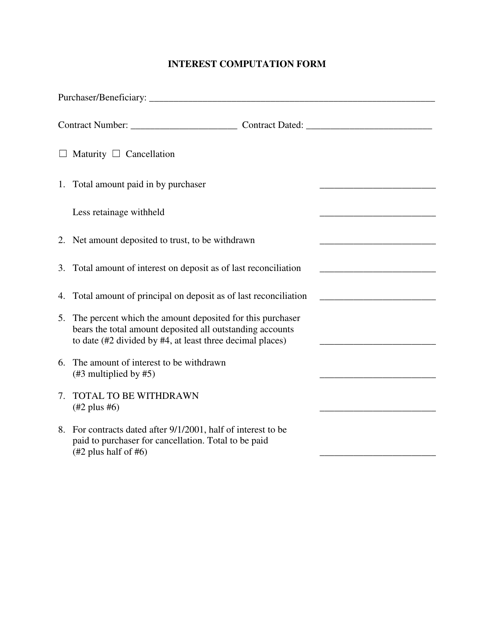

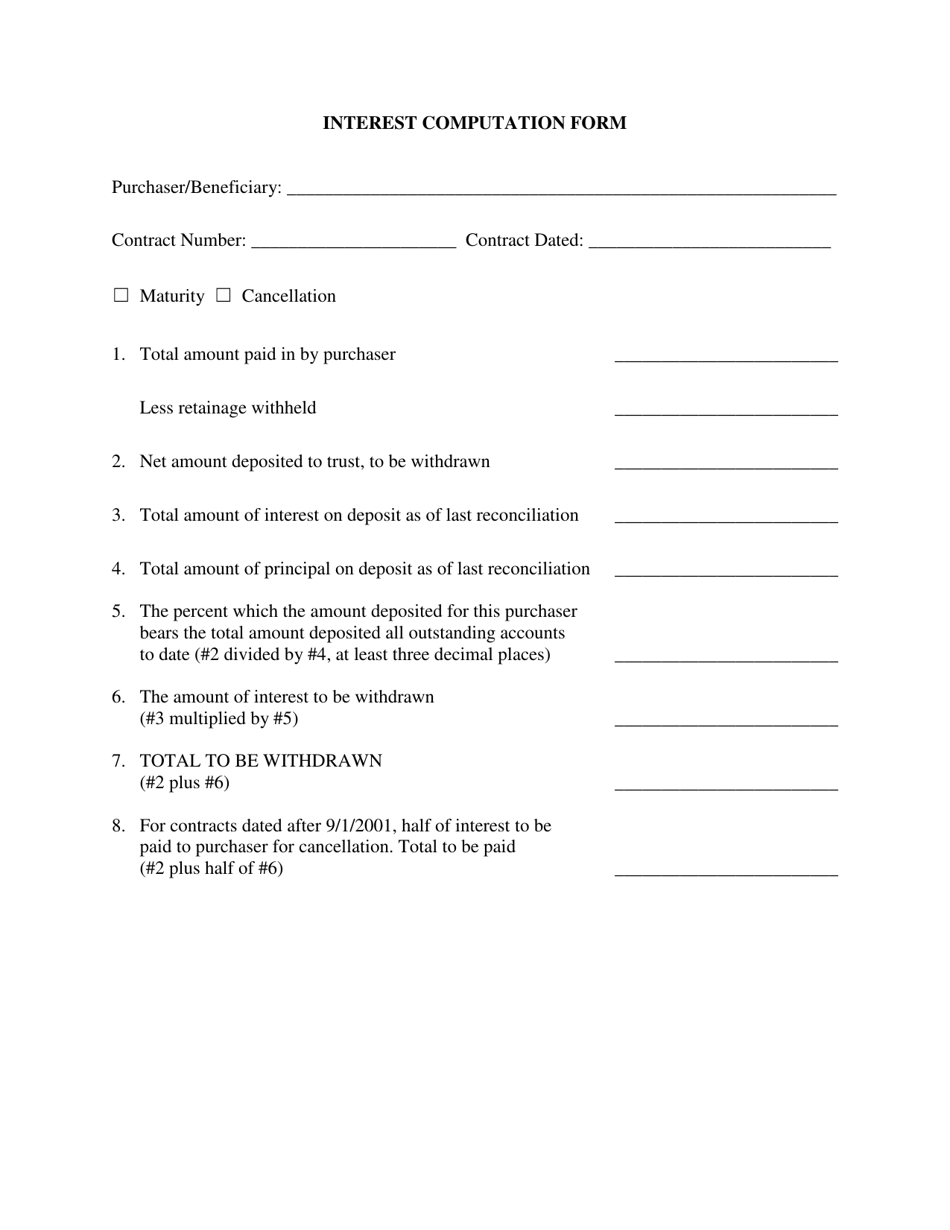

Interest Computation Form - Texas

Interest Computation Form is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: What is an Interest Computation Form?

A: An Interest Computation Form is a document used in Texas to calculate the interest due on a debt.

Q: Who uses an Interest Computation Form?

A: Lenders and borrowers in Texas use an Interest Computation Form to determine the amount of interest to be paid on a loan.

Q: How is interest calculated on the Interest Computation Form?

A: Interest is typically calculated using a specific formula that takes into account the principal amount, interest rate, and duration of the loan.

Q: Why is an Interest Computation Form important?

A: The form ensures that both parties involved in a loan agreement have a clear understanding of how interest will be calculated and how much is owed.

Q: Are there any legal requirements for using an Interest Computation Form in Texas?

A: Yes, using an Interest Computation Form is a legal requirement in Texas for certain types of loans, such as those covered by the Texas Finance Code.

Form Details:

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.