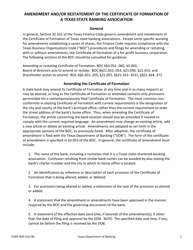

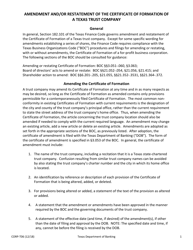

Form CORP-B21 Certificate of Correction - Texas

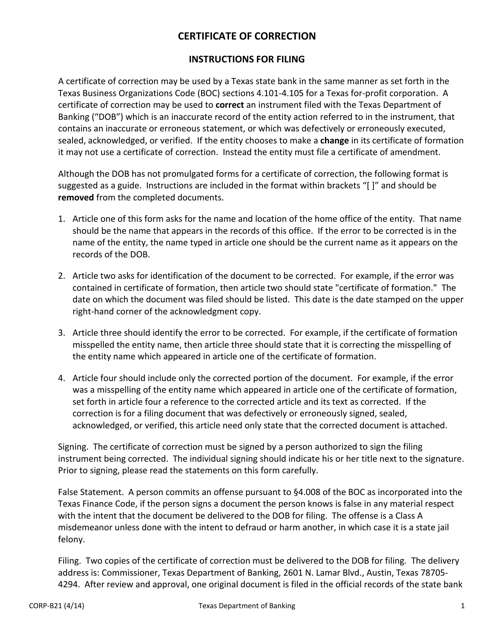

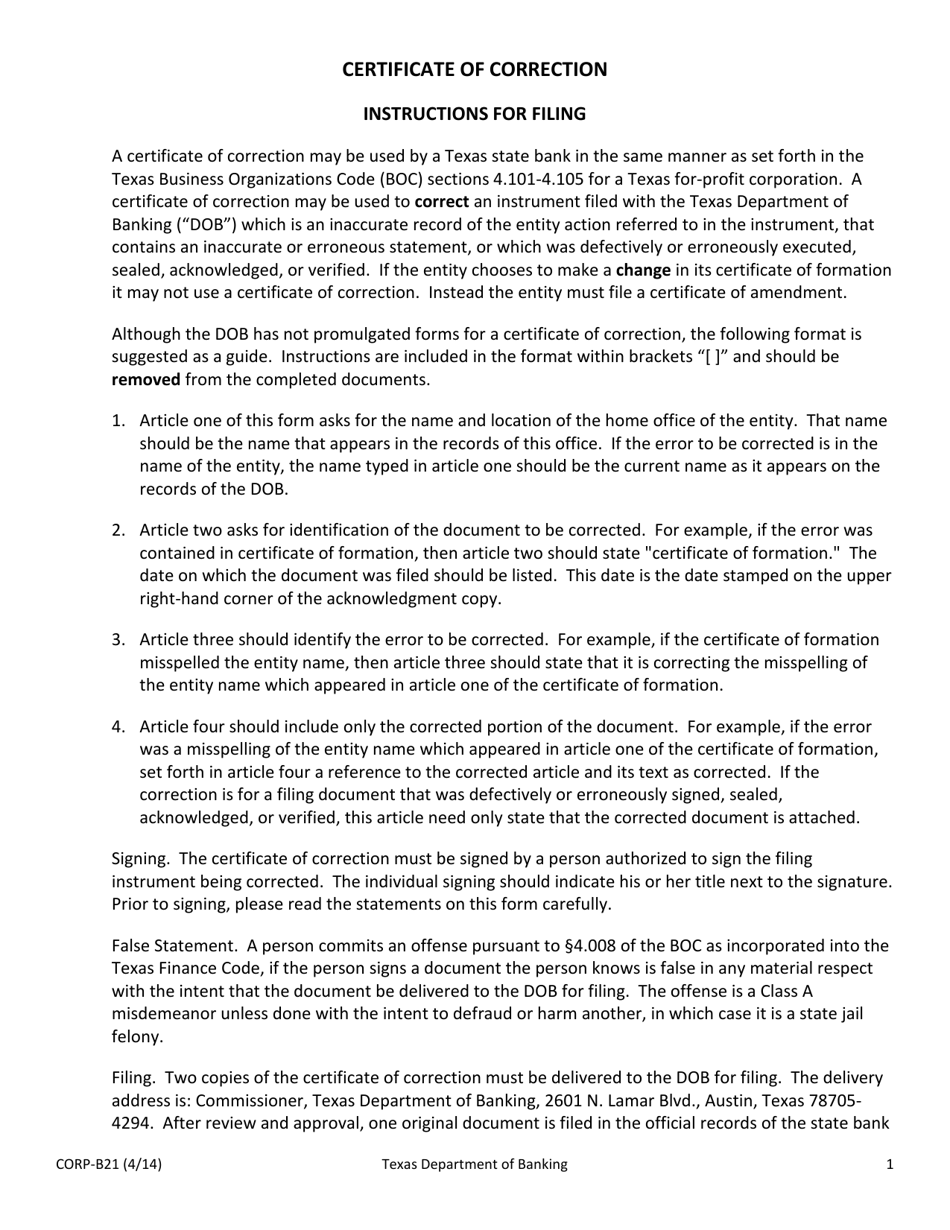

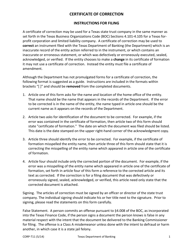

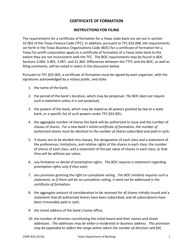

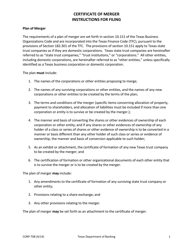

What Is Form CORP-B21?

This is a legal form that was released by the Texas Department of Banking - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

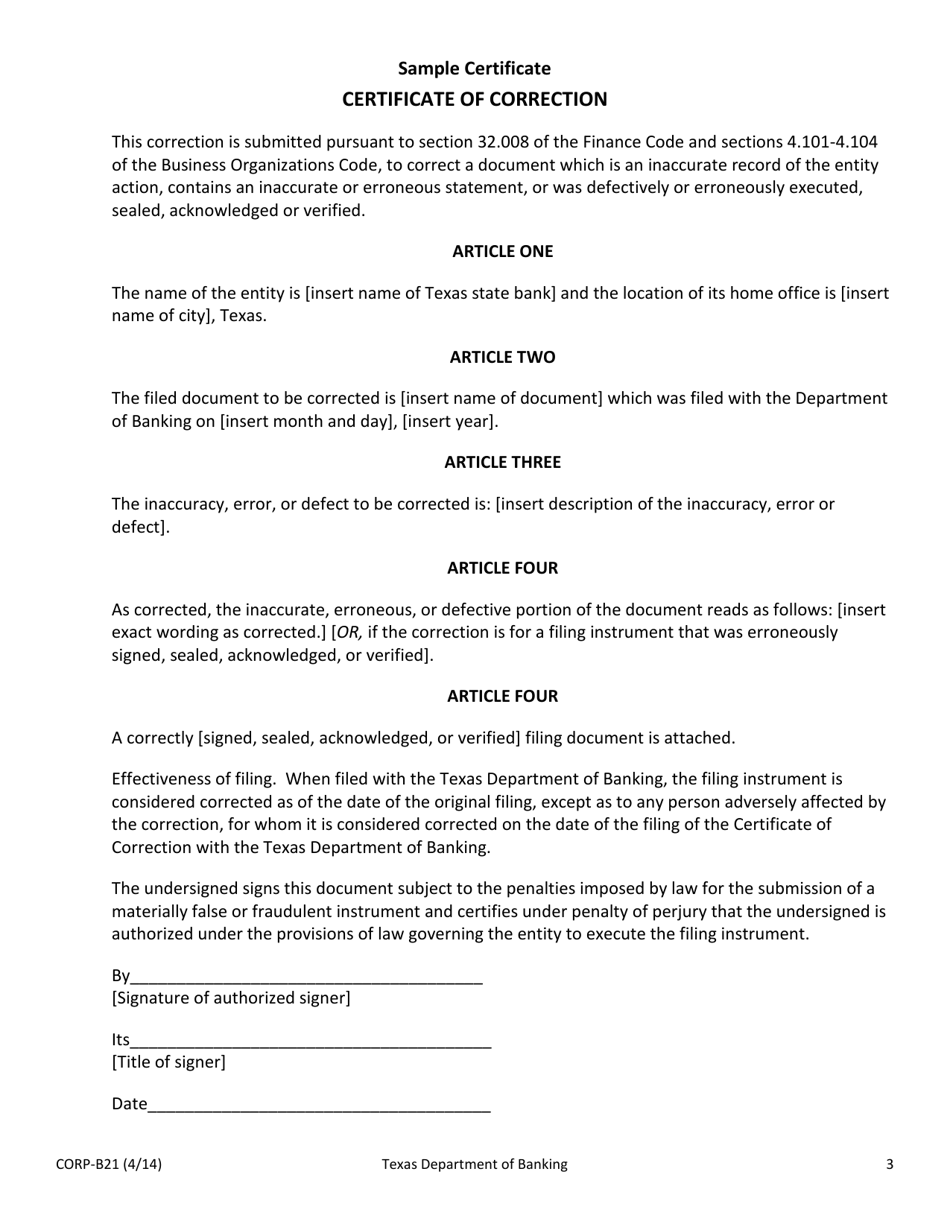

Q: What is a CORP-B21 Certificate of Correction?

A: A CORP-B21 Certificate of Correction is a document used in Texas to correct errors or omissions in previously filed corporate documents.

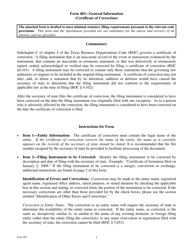

Q: What can I use the CORP-B21 Certificate of Correction for?

A: You can use the CORP-B21 Certificate of Correction to correct errors or omissions in previously filed corporate documents, such as Articles of Incorporation or Amendments.

Q: Who can file a CORP-B21 Certificate of Correction?

A: The CORP-B21 Certificate of Correction can be filed by the corporation or its authorized representative.

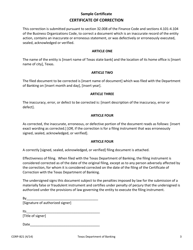

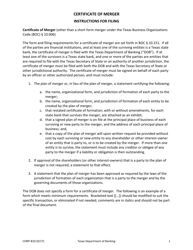

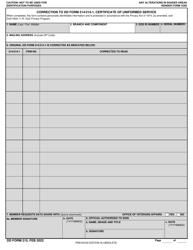

Q: What information do I need to provide on the CORP-B21 Certificate of Correction?

A: You will need to provide the name of the corporation, the file number assigned by the Secretary of State, a description of the error or omission, and the corrected information.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Texas Department of Banking;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CORP-B21 by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.