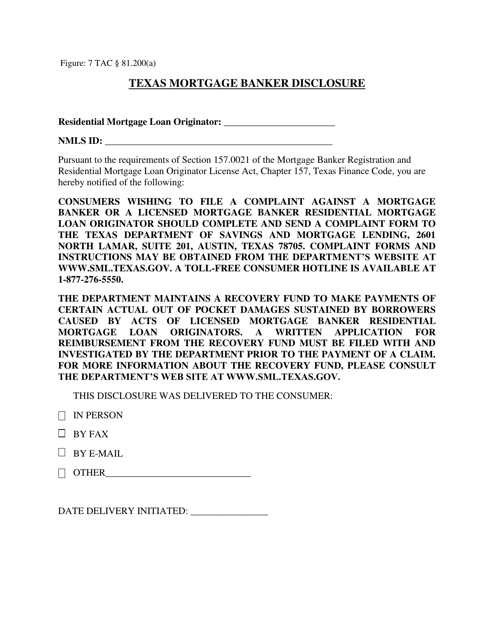

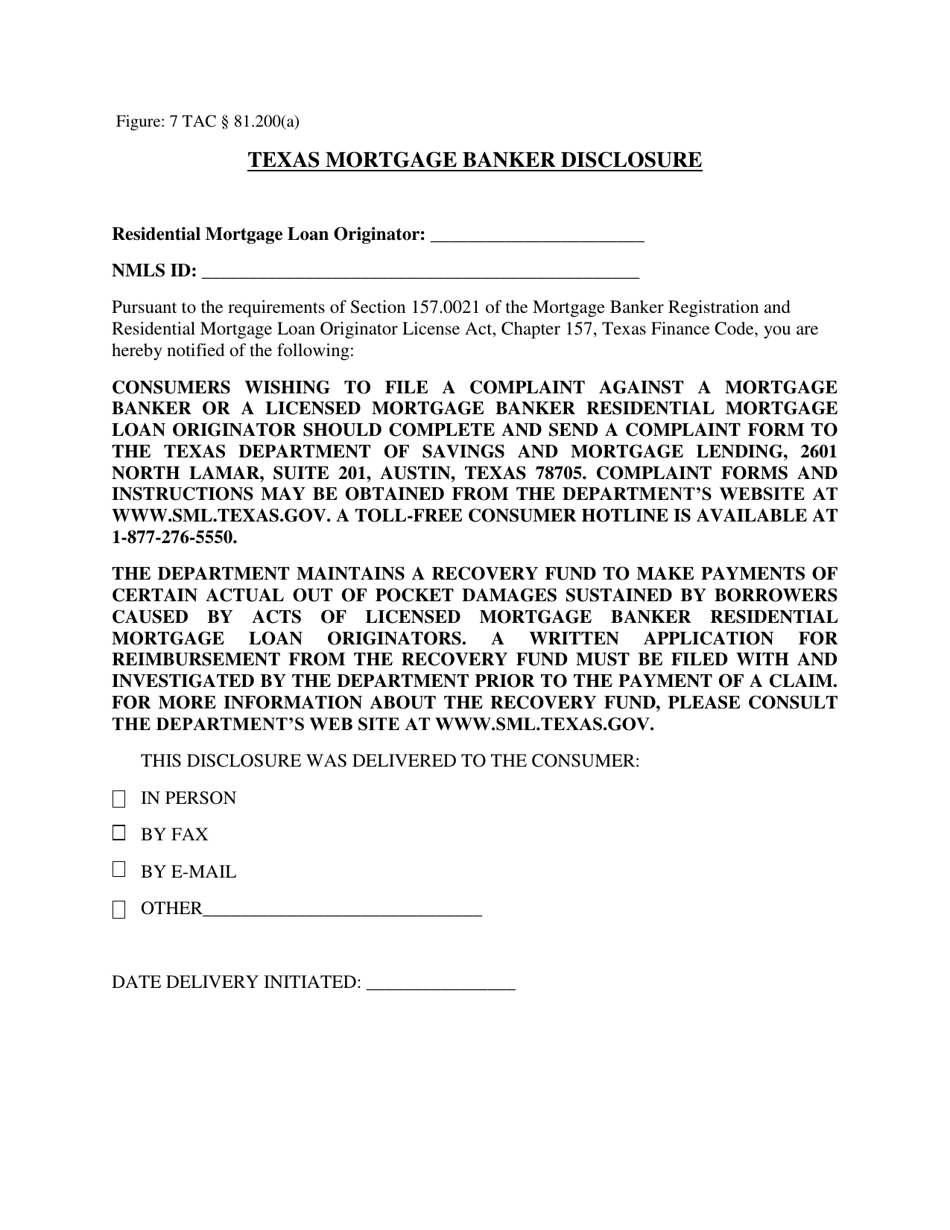

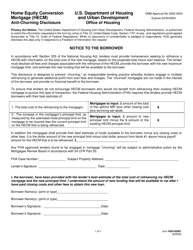

Texas Mortgage Banker Disclosure - Texas

Texas Mortgage Banker Disclosure is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What is the Texas Mortgage Banker Disclosure?

A: The Texas Mortgage Banker Disclosure is a legal document required by the state of Texas for mortgage bankers.

Q: Who needs to provide the Texas Mortgage Banker Disclosure?

A: Mortgage bankers in Texas are required to provide the Texas Mortgage Banker Disclosure.

Q: What is the purpose of the Texas Mortgage Banker Disclosure?

A: The purpose of the Texas Mortgage Banker Disclosure is to inform borrowers about the nature of the relationship with the mortgage banker.

Q: What information is included in the Texas Mortgage Banker Disclosure?

A: The Texas Mortgage Banker Disclosure includes information about the mortgage banker's licensing, fees, and potential conflicts of interest.

Q: Is the Texas Mortgage Banker Disclosure required for all types of mortgage loans?

A: Yes, the Texas Mortgage Banker Disclosure is required for all types of mortgage loans in Texas.

Q: Can I waive or opt-out of receiving the Texas Mortgage Banker Disclosure?

A: No, the Texas Mortgage Banker Disclosure is a mandatory document and cannot be waived or opted-out.

Q: What should I do if I did not receive the Texas Mortgage Banker Disclosure?

A: If you did not receive the Texas Mortgage Banker Disclosure, you should contact your mortgage banker and request a copy.

Q: Are there any penalties for not providing the Texas Mortgage Banker Disclosure?

A: Yes, mortgage bankers who fail to provide the Texas Mortgage Banker Disclosure may be subject to penalties and fines.

Q: Is the Texas Mortgage Banker Disclosure only applicable in Texas?

A: Yes, the Texas Mortgage Banker Disclosure is specific to mortgage bankers operating in the state of Texas.

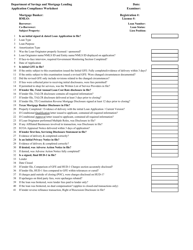

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.